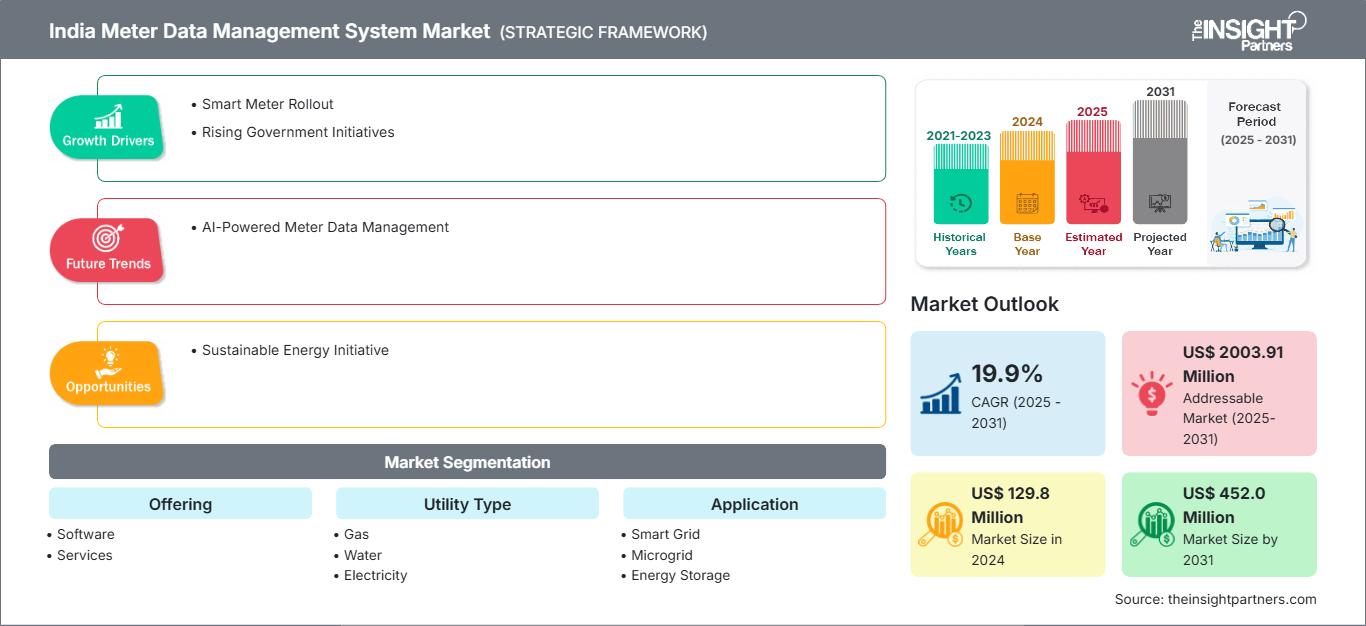

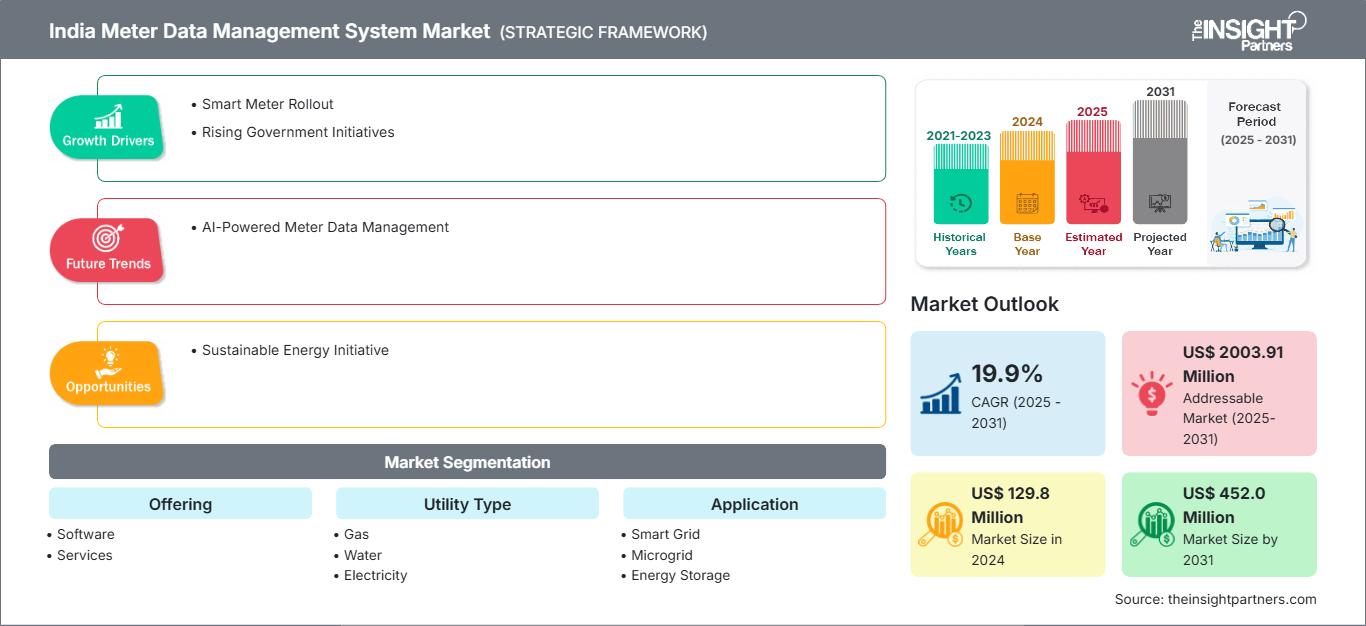

The India Meter Data Management System Market size is expected to reach US$ 452.0 million by 2031 from US$ 129.8 million in 2024. The market is anticipated to register a CAGR of 19.9% during 2025–2031.

India Meter Data Management System Market Analysis

The India meter data management system market is poised for significant expansion over the coming years. With strong government initiatives and mandatory smart meter rollouts, the demand for robust meter data management platforms, especially those offering cloud, AI, IoT, and multi‑utility integration, is set to rise. With the continued constraints posed by costs, interoperability, and capacity issues, India holds persisting opportunities for global and local software, services, and system integration vendors as it moves toward a digital, efficient electricity ecosystem. India's transition toward smart metering represents a pivotal advancement in the modernization of its power distribution sector.

With active government support and structured financing mechanisms, these initiatives are expected to enhance operational efficiency, reduce losses, and improve the consumer experience. The increasing adoption of meter data management systems, which serve as the digital backbone for capturing, validating, and managing the vast influx of data from smart meters, forms a cornerstone of this transformation.

India Meter Data Management System Market Overview

India Meter Data Management System (EDR) is a cybersecurity solution designed to monitor, detect, Meter data management systems are critical for utility providers across electricity, gas, water, and thermal energy sectors. These systems enable collecting, validating, and managing meter usage data from customer premises. The information obtained from this data supports a wide range of functions, including billing, customer service, consumption forecasting, operational monitoring (such as outage detection and loss analysis), and financial reporting. In addition to utilities, meter data management systems solutions are adopted by energy service companies for audits and energy efficiency initiatives; energy management firms for usage reporting and analysis; independent and local energy providers for production planning and engineering; and commercial and industrial enterprises for internal accounting and financial management. Municipalities and government agencies also rely on these systems to support public infrastructure initiatives and ensure regulatory compliance.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Meter Data Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

India Meter Data Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

India Meter Data Management System Market Drivers and Opportunities

Market Drivers:

- Smart Meter Rollout: India is rapidly advancing its energy sector through one of the most ambitious smart meter rollout initiatives globally, positioning itself at the forefront of digital utility transformation. The government plans to install 250 million smart meters, in a move projected to unlock a US$20 billion market opportunity, according to the report by Avener Capital.

- Rising Government Initiaitves: One of the primary drivers propelling the growth of the meter data management system market in India is the increasing focus of the government on modernizing the power distribution sector through ambitious policy initiatives and targeted investments. In July 2022, the Prime Minister of India launched the Ministry of Power’s flagship Revamped Distribution Sector Scheme (RDSS), aimed at enhancing the operational efficiency and financial sustainability of power distribution companies (DISCOMs).

Market Opportunities:

- Sustainable Energy Initiative: India has made remarkable strides in strengthening its energy sector over recent years, effectively balancing the critical dual objectives of meeting rapidly growing electricity demand while advancing its sustainability goals. India, one of the world’s fastest-growing economies, is positioned at the forefront of the global energy transition, with its energy consumption projected to grow at most rapidly among large economies. In February 2025, the International Energy Agency (IEA) forecasted that emerging and developing economies will account for 85% of the global increase in electricity demand throughout 2026-2029, with India playing a central role in this dynamic landscape. India’s share in global primary energy consumption is expected to double by 2035, underscoring the nation’s expanding influence on the global energy stage.

India Meter Data Management System Market Report Segmentation Analysis

The India Meter Data Management System market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Offering:

- Software: The software component of meter data management systems is the technological core that enables smart utilities to collect, store, process, and analyze the vast volumes of data generated by smart meters.

- Services: Services associated with meter data management systems encompass various offerings necessary to ensure their successful deployment and lifecycle management. These include pre-deployment activities such as requirement analysis, consulting, and architecture design, followed by system integration, testing, and deployment.

By Utility Type:

- Electricity: Electricity utilities dominate the meter data management system market primarily because of the massive rollout of smart electric meters.

- Water: The water utility segment of the meter data management system is experiencing growth as utilities seek to modernize their aging infrastructure and address pressing challenges such as water scarcity, leakage, and non-revenue water (NRW).

- Gas: In gas utilities, meter data management systems aid safety, billing accuracy, and regulatory compliance. Smart gas meters provide consumption data, flow rates, and pressure levels, which are crucial for system integrity and efficient operation.

By Application:

- Smart Grid: The smart grid application segment is the primary and most mature use case of meter data management systems.

- Microgrid: Microgrids are localized grids that operate independently or in conjunction with the primary utility grid.

- Energy Storage: Meter data management systems facilitate precise tracking of battery charge/discharge cycles, energy throughput, state of health (SoH), and grid signal integration.

- EV Charging: Electric vehicle (EV) charging presents new challenges and opportunities for grid operators.

- Others: Other applications of meter data management systems are emerging in areas such as building energy management, district heating, peer-to-peer energy trading, and energy efficiency programs.

By End-User Industry:

- Residential

- Commerical

- Industrial

Each sector has specific meter data management system requirements. It influences data management and analysis.

India Meter Data Management System Market Report Scope

Report Attribute

Details

Market size in 2024

US$ 129.8 Million

Market Size by 2031

US$ 452.0 Million

CAGR (2025 - 2031) 19.9%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Offering - Software

- Services

By Utility Type - Gas

- Water

- Electricity

By Application - Smart Grid

- Microgrid

- Energy Storage

- EV Charging

- Others

By End User - Residential

- Commerical

- Industrial

Regions and Countries Covered

India- India

Market leaders and key company profiles

- Itron Inc.

- Oracle Corp

- Gentrack Group

- Fluentgrid Limited

- Siemens AG

- EnergiSpeak

- BCITS, Esyasoft

- Landis+Gyr Group AG

- Genus Power Infrastructures Ltd

India Meter Data Management System Market Players Density: Understanding Its Impact on Business Dynamics

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 129.8 Million |

| Market Size by 2031 | US$ 452.0 Million |

| CAGR (2025 - 2031) | 19.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | India

|

| Market leaders and key company profiles |

|

The India Meter Data Management System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the India Meter Data Management System Market top key players overview

India Meter Data Management System Market Share Analysis

Smart meter rollout and rising government initiatives are the important factors driving the India meter data management system market. The market would continue to grow during the forecast period owing to sustainable energy initiatives. Rise in AI-powered meter data management is one of the key trends in the market. However, the inconsistent metering data may hamper the market growth:

1. India

- Market Share: Holds a significant portion of the global market

- Key Drivers:

- Smart Meter Rollout:

- Rising Government Initiaitves.

- Trends: AI-powered meter data management system.

India Meter Data Management System Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is strong due to the presence of established players such as Siemens AG, Landis + GYR Group AG, and Itron. Regional and niche providers like FluentGrid (India), and Genus (India) are also adding to the competitive landscape across country.

This high level of competition urges companies to stand out by offering:

- Advanced security features

- Value-added services like analytics and meter data management

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Integration with Smart Grid, IoT & Analytics.

- Standardization and Interoperability Focusy.

Major Companies operating in the India Meter Data Management System Market are:

- Itron Inc. (US)

- Oracle Corp (US)

- Gentrack Group (New Zealand)

- Fluentgrid Limited (India)

- Siemens AG (Germany)

- EnergiSpeak (India)

- BCITS (India)

- Esyasoft (India)

- Landis+Gyr Group AG (Switzerland)

- Genus Power Infrastructures Ltd. (India)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analysed during the course of research:

- Cuculus ZONOS

- Smartflex

- Connexo Insight

- ATLAS Energy Monitoring System

- The PI System (AVEVA)

- Net@Suite (Engineering Ingegneria Informatica)

- Terranova TAMM MDM

- Ferranti MECOMS

- Energyworx

- SAP

- Medidata Solution

- Radix IoT

- EnergyCAP

- Honeywell EIServer

- Eaton

India Meter Data Management System Market News and Recent Developments

- Esyasoft announced that it has formed a joint venture with Adani Energy Esyasoft announced that it has formed a joint venture with Adani Energy Solutions to implement smart metering projects in India and other countries. This partnership involves Adani acquiring a 49% stake in Esyasoft's smart metering solutions arm.

- Landis+Gyr announced they have completed its MDUS certification Landis+Gyr announced they have completed its MDUS certification for the Landis+Gyr MDMS platform. Renewal of this certification allows utility customers using MDUS integration services to access new features for interval and time series billing. Landis+Gyr's MDUS (Meter Data Unification and Synchronization) is a unique solution that enables end-to-end business processes by connecting and synchronizing smart metering landscapes to utility back office systems.

India Meter Data Management System Market Report Coverage and Deliverables

The "India Meter Data Management System Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- India Meter Data Management System Market size and forecast at country levels for all the key market segments covered under the scope

- India Meter Data Management System Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- India Meter Data Management System Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the India Meter Data Management System Market

- Detailed company profiles

Frequently Asked Questions

What are some leading companies in the India Meter Data Management System market?

What is the current size of the India Meter Data Management System market?

What are the key drivers of growth in the India Meter Data Management System market?

1. Smart Meter Rollout: India is rapidly advancing its energy sector through one of the most ambitious smart meter rollout initiatives globally, positioning itself at the forefront of digital utility transformation.

2. Rising Government Initiatives: One of the primary drivers propelling the growth of the meter data management system market in India is the increasing focus of the government on modernizing the power distribution sector through ambitious policy initiatives and targeted investments.

How are advancements in AI influencing India Meter Data Management Systems?

Greater Speed and Accuracy With the integration of AI, utilities can now identify irregularities or anomalies in energy consumption data with far greater speed and accuracy. The speed and accuracy also enable them to automatically flag unusual patterns, reduce the occurrence of billing errors, and mitigate the need for manual intervention or physical inspections, commonly referred to as "truck rolls", which can be costly and time-consuming.

What are the challenges faced by the India Meter Data Management System market?

Inconsistent Metering Data: Inconsistency in data arises when meter readings deviate from expected or historical consumption patterns, leading to discrepancies that can undermine the accuracy and reliability of energy usage information.

Which industries are the primary end-users of India Meter Data Management Systems?

1. Residential: The residential sector forms the largest base of smart meter installations globally, making it a major driver of the adoption of meter data management systems.

2. Commercial: Commercial end users, including shopping centers, office complexes, hospitals, and educational institutions, have unique energy demands and are typically early adopters of data-driven energy management solutions.

3. Industrial: Industrial facilities have complex, high-load energy environments that require robust and reliable data management systems.

Which offering is gaining traction in the India Meter Data Management Systems market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For