Lab Automation Market Growth, Demand & Top Players Analysis 2025-2031

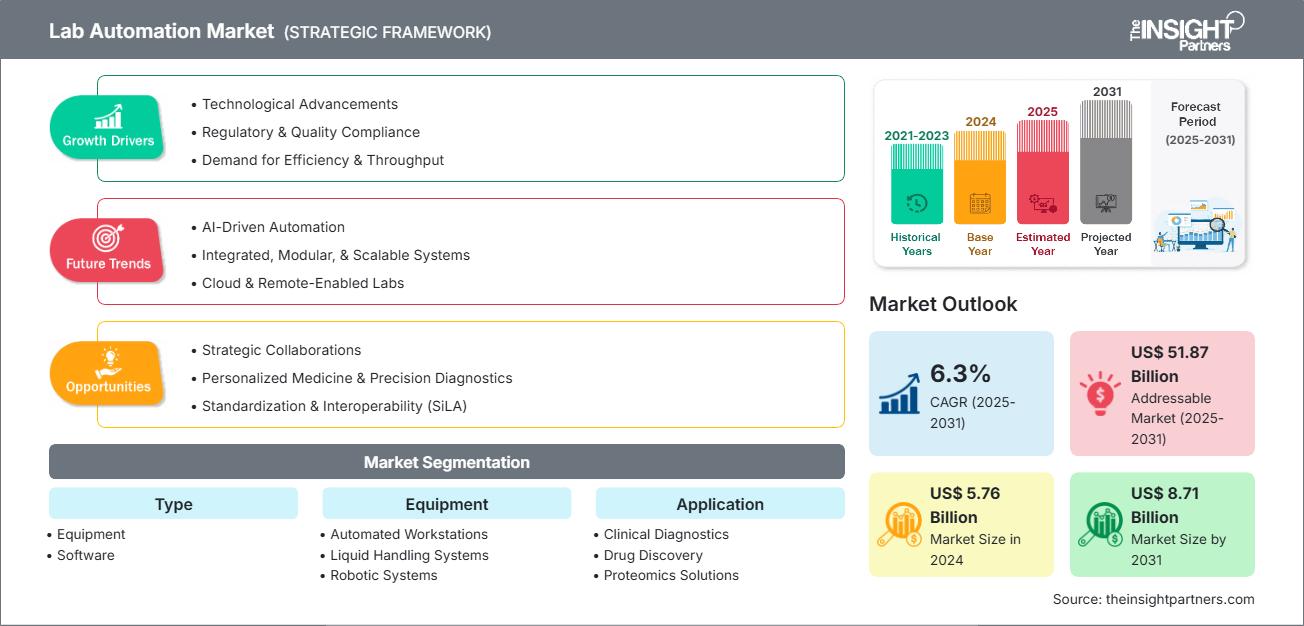

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031Lab Automation Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Equipment and Software), Equipment (Automated Workstations, Liquid Handling Systems, Robotic Systems, Microplate Readers, Automated Storage and Retrieval Systems (ASRS), and Others), Application (Clinical Diagnostics, Drug Discovery, Proteomics Solutions, Genomics Solutions, and Others), End User (Hospitals and Diagnostic Centers, Pharmaceutical Companies, Contract Research Organizations (CROs), and Educational and Research Institutions) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South and Central America)

- Report Date : Sep 2025

- Report Code : TIPHE100001249

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 285

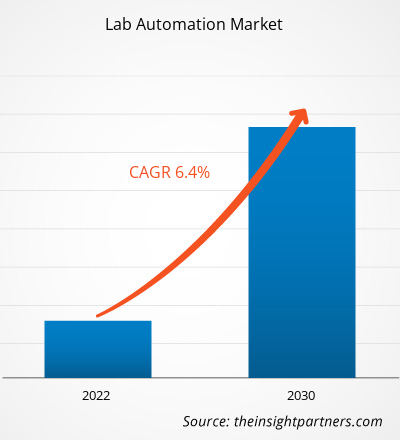

The Lab Automation Market size is expected to reach US$ 8.71 billion by 2031 from US$ 5.76 billion in 2024. The market is anticipated to register a CAGR of 6.3% during 2025–2031.

Lab Automation Market Analysis

Technological advancements, regulatory & quality compliance, and demand for efficiency & throughput drive the demand for lab automation. The market growth is driven by strategic collaborations, personalized medicine & precision diagnostics, and standardization & interoperability (SiLA). AI-driven automation, cloud & remote-enabled labs, and integrated, modular, & scalable systems are expected to emerge as future trends in the market. However, the high capital and maintenance costs, integration and workflow complexity, and skills gap hamper market growth.

Lab Automation Market Overview

Laboratory automation refers to deploying advanced technologies—including robotics, software platforms, and integrated data systems—to perform laboratory operations with minimal human intervention. These operations range from routine tasks such as pipetting and sample labeling to more complex procedures like high-throughput screening, diagnostic assays, data interpretation, and report generation. The overarching goal of automation in laboratory environments is to enhance operational efficiency, accuracy, and scalability, while simultaneously reducing human error, lowering operational expenditures, and accelerating turnaround times. Automation solutions are applicable across various laboratory domains, including clinical diagnostics, pharmaceutical R&D, biotechnology, environmental analysis, and academic research. Depending on the scope of integration, laboratory automation can be classified into two categories: partial automation, which targets specific tasks, and full automation, which encompasses comprehensive end-to-end workflow automation.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Lab Automation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Lab Automation Market Drivers and Opportunities

Market Drivers:

- Technological Advancement: Laboratory automation has been undergoing rapid growth due to technological innovations. One of the latest innovations types of evidence how integrated and intelligent systems are revolutionizing traditional workflows. The significant improvement in this field is the introducing of the Sapio Scientific Data Cloud by Sapio Sciences on October 2, 2023. This state-of-the-art platform allows researchers and organizations to extend the use of their research, development, and clinical datasets to the maximum--in fact, these are the new scientific assets that are being acknowledged. In line with the strategy of Sapio, this debut turns out to be a game-changer by presenting a single, no-code interface that allows for the smooth integration of Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), and Scientific Data Management Systems (SDMS). This complete "lab triple-play" not only imparts the features of versatility, scalability, and higher operational efficiency to the labs as the driving factors of the performance but also is basically the key to success objects from the perspective of the scientific automated environments which are progressively being established internationally.

- Regulatory & Quality Compliance: One of the main factors that drives growth in the laboratory automation market is the increasing need for systems that simplify regulatory and quality compliance, especially in such domains as biotechnology, pharmaceuticals, diagnostics, and clinical research, which are highly regulated. These sectors are subject to strict regulations such as Good Laboratory Practice (GLP), Good Manufacturing Practice (GMP), FDA 21 CFR Part 11, and different ISO standards, which require absolute data integrity, traceability, and reproducibility standards. Traditional manual or partly automated workflows are often unable to comply with such standards, leading to the inefficient operation of the organization, the high risk of audits, and even possible penalties. On the other hand, automated laboratory systems are a revolutionary solution as they incorporate compliance protocols at the very core of laboratory workflows, thus increasing trust, lowering risk, and easing regulatory compliance.

Market Opportunities:

- StrategicCollaborations: The laboratory automation industry is opening significant growth opportunities, the main reason being that different companies are coming together to provide integrated solutions to the customers. A most illustrative example is the cooperation signed on January 24, 2025, between ABB Robotics and Agilent Technologies, a global leader in analytical instrumentation and laboratory informatics. The core of this work-sharing project is the common harnessing of the next-generation automated laboratory systems, which combine ABB’s state-of-the-art robotic technology with Agilent’s extremely precise analytical instruments. Their common know-how and skills put the partnership in a position to renew laboratory activities in many sectors, for example, pharmaceuticals, biotechnology, energy, and so on. The integrated solutions have been widely used for speeding up, simplifying standardization, and diagnostic functions in the laboratories, with the quality of research, diagnostic testing, and other areas required by the laboratory functions, to name a few.

Lab Automation Market Report Segmentation Analysis

The lab automation market is categorized into distinct segments to comprehensively understand its structure, growth prospects, and emerging trends. Below is the standard segmentation approach used in industry reports:

By Type:

- Equipment: The equipment segment represents the basic hardware and machines that have enabled the automation of laboratory tasks that have been traditionally done manually. Some of the sophisticated devices that come under this category are robotic arms, automation liquid handling systems, analyzers, centrifuges, plate handlers, incubators, and sample storage units. These machines are designed to carry out operations such as pipetting, sample preparation, mixing, and transport within the laboratory with greatly increased speed, accuracy, and uniformity as compared to the manual methods. This category accounted for the highest share of the lab automation market in 2024.

- Software: Software is the brain that controls, powers, and coordinates automated processes. This segment includes solutions such as ELN, LIMS, SDMS, instrument control software, and more.

By Equipment:

- Automated Workstations: The automated workstations carry out various laboratory processes - such as sample preparation, nucleic acid extraction, PCR setup, and assay execution - in a combined system. This segment captured the largest market share of lab automation in 2024.

- Liquid Handling Systems: Liquid handling systems are the means to the accurate and repeatable transfer of liquids - a process that is almost always carried out in laboratory workflows, e.g., genomics, proteomics, drug screening, and cell culture.

- Robotic Systems: Robotic systems in laboratory automation automating the physical movement of the samples, labware, and reagents, which are intermixed with various instruments and workstations.

- Microplate Readers: Microplate readers are the devices that perform the analysis of biological, chemical, or physical reactions in microtiter plates, which are the plates that are used in drug discovery, diagnostics, and molecular biology.

- Automated Storage and Retrieval Systems (ASRS): Storage and Retrieval Systems (ASRS): The ASRS is the answer to one of the major logistics problems of contemporary laboratories: the storage of samples and reagents in large quantities in a safe, organized, and traceable way.

- Others: The "others" category comprises specialized and emerging technologies that are designed to solve niche applications or to simplify the existing workflows. It also includes colony pickers, automated microscopy, real-time PCR platforms, sample barcoding systems, and AI-powered imaging platforms.

By Application:

- Clinical Diagnostics

- Drug Discovery

- Proteomics Solutions

- Genomics Solutions

- Others

By End User:

- Hospitals and Diagnostic Centers

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Educational and Research Institutions

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The lab automation market in the Asia Pacific is witnessing the fastest growth, driven by demographic shifts, rising healthcare demand, growing biotechnology sectors, and government-led digitization initiatives.

Lab Automation Market Regional InsightsThe regional trends and factors influencing the Lab Automation Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Lab Automation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Lab Automation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 5.76 Billion |

| Market Size by 2031 | US$ 8.71 Billion |

| Global CAGR (2025 - 2031) | 6.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Lab Automation Market Players Density: Understanding Its Impact on Business Dynamics

The Lab Automation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Lab Automation Market top key players overview

Lab Automation Market Share Analysis by Geography

North America still positions itself at the top of the global automated laboratory market. At the same time, the US and Canada take the lead in the adoption of the technology in clinical diagnostics, life sciences research, and pharmaceutical applications. The area mentioned above is benefiting from a stable healthcare infrastructure, a proactive regulatory framework, and a significant expenditure on research and development—these being the factors that, individually, position North America as a center of innovation and deployment of automated laboratory technologies. The need for the rapid processing of the samples, the accuracy of the analytical determinations, and keeping the costs under control are the main drivers behind an accelerated implementation of the total solutions for automatic handling of samples in the North American laboratories.

Europe is described as a market with a very rigorous and quality-oriented approach to laboratory automation. The region requires the establishment of standardized healthcare methods and practices to ensure the traceability of all data recorded and compliance with regulations. The mentioned key markets, which include Germany, the UK, France, Italy, and the Nordic countries, are the major players in the European advanced automation ecosystem. With predominantly publicly financed healthcare systems, European laboratories are turning to technology, particularly computerization, to realize the promise of testing efficiency, error minimization, and the smooth flow of operational activities in both clinical and research domains.

The lab automation market growth differs in each region due to technological advancement, regulatory & quality compliance, and demand for efficiency & throughput. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a large portion of the global market share

-

Key Drivers:

- High demand for advanced diagnostics and personalized medicine.

- Strong investment in R&D by pharmaceutical and biotech firms.

- Labor shortages in clinical and research labs are pushing automation adoption.

- Stringent regulatory compliance is driving standardization and digitalization.

- Trends: Integrated Automation in Clinical Laboratories.

2. Europe

- Market Share: Substantial share owing to early, stringent EU regulations

-

Key Drivers:

- Substantial public funding for academic and life sciences research.

- Emphasis on data integrity and compliance with regulations such as GDPR.

- Growing need for cost-effective research infrastructure.

- Rising focus on pharmaceutical innovation and biotech startups.

- Trends: AI-Powered Automation in Research Labs.

3. Asia Pacific

- Market Share: Fastest-growing region

-

Key Drivers:

- Rising healthcare expenditure in China, India, and Southeast Asia.

- Expanding pharmaceutical manufacturing and clinical trial activities.

- Government-backed initiatives for healthcare modernization and smart labs.

- Increasing demand for rapid diagnostics in large population centers.

- Trends: Mass Automation in Clinical Diagnostics.

4. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Government funding for public health, genomics, and disease surveillance.

- Emerging medical hubs in the UAE and Saudi Arabia.

- Need for improved lab turnaround times and efficiency.

- Rising interest in precision medicine and national health strategies.

- Trends: Automation in National Genomics and Public Health Labs.

5. South & Central America

- Market Share: Growing Market with steady progress

-

Key Drivers:

- Growing private investment in clinical and pathology labs.

- Rising awareness of laboratory quality standards.

- Need to reduce operational inefficiencies and manual errors.

- Gradual improvement in healthcare infrastructure.

- Trends: Adoption of Modular Automation in the Private Sector.

Lab Automation Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of major global players such as Thermo Fisher Scientific Inc., Siemens AG, Danaher Corp, Honeywell International Inc, Revvity Inc, and Analytik Jena GmbH+Co. KG, Abbott Laboratories, and bioMérieux SA. Regional and specialized providers such as Eppendorf (Germany), Horiba (Japan), Agilent Technologies (US), and Bioneer (South Korea) bring innovation and domain-specific focus, further intensifying the competitive landscape.

This high level of competition urges companies to stand out by offering:

- End-to-end lab automation solutions (e.g., sample prep, analysis, data integration)

- Investments in robotics, AI, and smart lab technologies

- Customization for niche sectors such as genomics, clinical diagnostics, drug discovery, and food testing

- Cloud-based software platforms with real-time data capture, compliance tracking, and analytics.

Opportunities and Strategic Moves

- Adoption of AI, IoT, and Smart Automation.

- Cloud & Data Integration Platforms.

- Personalized Medicine & Genomics Boom

- Strategic Partnerships and M&A

Major Companies operating in the Lab Automation Market are:

- Thermo Fisher Scientific Inc. (US)

- Siemens AG (Germany)

- Danaher Corp (Germany)

- Honeywell International Inc (US)

- Agilent Technologies Inc (US)

- Revvity Inc (US)

- Analytik Jena GmbH+Co. KG (Germany)

- Abbott Laboratories (US)

- Eppendorf SE (Germany)

- bioMerieux SA (France)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- PerkinElmer, Inc.

- Tecan Group Ltd.

- Hamilton Company

- Becton Dickinson (BD)

- Bio-Rad Laboratories

- Roche Diagnostics

- Sartorius AG

- Mettler-Toledo

- Labcyte (Echo)

- Synchron Lab Automation

- Aurora Biomed

- Opentrons

- Gilson, Inc.

- LabVantage Solutions

- LabWare

- BMG LABTECH

- Andrew Alliance (Waters)

- Hudson Robotics

- Peak Analysis & Automation

- Systech Illinois

- Integra Biosciences

- SPT Labtech

- QIAGEN

- Formulatrix

- Integra Biosciences

Lab Automation Market News and Recent Developments

- Danaher Corporation announced the launch of two new Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP)-certified labs, July 2024 - Danaher Corporation, a global science and technology innovator, announced the launch of two new Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP)-certified labs to accelerate the development of Companion Diagnostics (CDx) and Complementary Diagnostics (CoDx).

- Revvity, Inc. announced the launch of the Auto-Pure 2400 liquid handler, April 2025 - Revvity, Inc. announced the launch of the Auto-Pure 2400 liquid handler from Allsheng for use with the T-SPOT TB test. The Auto-Pure 2400 platform is easy to use and designed to provide efficient lab workflows. When the accuracy of the T-SPOT TB test is combined with the efficiency of the Auto-Pure 2400 system, labs, clinicians, and ultimately patients benefit from the resultant powerful solution.

Lab Automation Market Report Coverage and Deliverables

The "Lab Automation Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Lab automation market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Lab automation market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Lab automation market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the lab automation market

- Detailed company profiles

Frequently Asked Questions

What is the current size of the global lab automation market?

What are the leading companies in the lab automation market?

What regions show the fastest growth in the lab automation market?

What are the emerging trends in the lab automation industry?

What are the challenges faced by the lab automation market?

How are advancements in AI and ML influencing lab automation?

Which end user is gaining traction in the lab automation market?

What are the key drivers of growth in the lab automation market?

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For