Industrial Refrigeration System Market Outlook and Strategic Insights by 2025

Industrial Refrigeration System Market to 2025 - Global Analysis and Forecasts by Refrigerant Type (CO2, HFC, and Ammonia); Equipment (Compressor, Condenser, Evaporator, and Others); and Application (Food Processing, Chemicals & Pharmaceuticals and Refrigerated Logistics)

Historic Data: 2015-2016 | Base Year: 2017 | Forecast Period: 2018-2025- Report Date : Sep 2018

- Report Code : TIPTE100001045

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 145

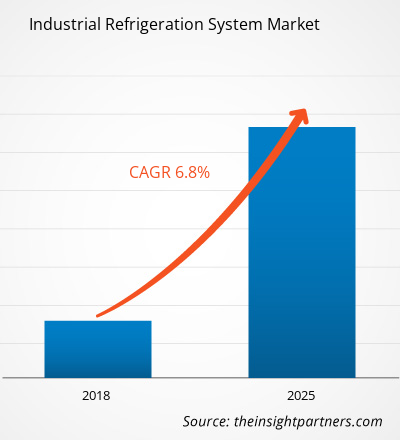

The industrial refrigeration system market was valued at US$ 20.02 billion in 2017 and is projected to reach US$ 33.66 billion by 2025; it is expected to grow at a CAGR of 6.8% during 2018–2025.

The importance of refrigerant systems in industries such as food processing and storing, chemicals and pharmaceuticals, oil & gas and transportation industry globally has gained prominence over the years. This has led the manufacturers to continuously innovate and design technologically advanced refrigeration systems which marked a significant influence on the end users. Innovations in the field of refrigerants have witnessed several alternatives and up gradations like HFC to Ammonia and then Ammonia to CO2 and again Ammonia (NH3) and CO2 cascade. The HFC used to be the most prominent refrigerant, however, owing to the disadvantages like high ODP (Ozone Depletion Potential) and high GWP (Global Warming Potential), highly inflammable characteristics and toxic nature compelled the manufacturers to replace the refrigerant with Ammonia (NH3). The refrigeration system with Ammonia has gained substantial popularity in the market owing to three distinctive advantages such as natural occurrence and thus is an environment-friendly gas, possesses extreme thermodynamic capabilities and require minimum heat transfer areas which facilitates the manufacturers to use smaller pipelines. In addition, NH3 gas is 15% - 20% more efficient than the traditional HFC refrigerants. However, due to the hygroscopic nature of the gas, it evaporates easily and migrates to the environment which causes hazardous consequences to human as well as machinery in the vicinity due to the toxicity of the gas. Another disadvantage of Ammonia vapors is the inflammable capability when contaminated with lubricating oil from the machinery. In the current scenario, the manufacturers of Industrial Refrigeration System are using carbon dioxide CO2 individually as well as cascading CO2 and NH3 as the refrigerants. The CO2 is easily available and is much cheaper as compared to its counterparts, which helps the manufacturers to reduce the upfront cost of the final product and also increase the operational efficiency of the system. In addition, the cascade of CO2 and NH3 possesses much more efficiency in refrigeration, and also saves huge amounts of energy, thereby helping the end user to reduce their operating costs. These trends are being observed among the global industrial refrigeration system manufacturers, which is heavily impacting on the growth of the system presently.

The future of market for industrial refrigeration system market is promising, as the research centers are continually innovating new technologies and researching on replacing traditional refrigerants in order to enhance the technicalities of the machinery and to reduce environmental hazards. As a result, technologically enriched sensors systems are being developed and integrated, which is expected to attract the significant number of industries in the coming years.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONIndustrial Refrigeration System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights–Industrial Refrigeration System Market

Rising Demand for Packaged Food Storage Capabilities

The trend of consuming packaged foods has increased significantly in the recent years globally, with special marks in North America, and Asia Pacific regions. The consumption of packaged food or frozen food products have grown 50% over the past decade in the US. The consumers in the North American countries are more concerned about the changing lifestyle, consumption convenience, and also health awareness. These factors are catalyzing the demand for packaged foods globally. Packaged foods industry has outperformed in the North America region in recent years, owing to the rapid increase in consumption of savoury and dairy products, confectionery products and others products. Another food product that is catalyzing the demand for packaged food is the meat. The Food and Drug Administration (FDA), the United States under the act Federal Food, Drug and Cosmetic Act (FFDCA) work closely with these food packaging companies in order to deliver the best quality packages. The FDA also implements several rules to omit the unhygienic or unhealthy substances from packaging. Pertaining to the benefit of permission from the US Government, the procurement of packaged foods have increased in the region. The increase in consumption of packaged foods has also grown in the recent times attributing to the substantial increase in retail stores and departmental stores in the region. Owing to the increasing trend of packaged food consumption, several companies are emerging along with well-established companies in the region. The growth of food packaging companies in the region has simultaneously led the region to witness the growth of industrial refrigerators. This is due to the fact that, these industrial refrigerators are capable of maintaining temperatures that vary widely. In addition to temperature variation, these industrial refrigerators use Ammonia and CO2 in their volatile form or cascade form as the cooling agent or refrigerants, which is energy efficient and combination enhances the safety of the food production as well as food packaging and storing areas. Moreover, these packaged foods are also stored in cold storages for longer times with an objective to maintain the freshness of the packaging, which also demands industrial refrigerators in order to maintain the desired temperature for respective food items. Thus, the packaged processing and packaging, as well as storage capabilities, are the major factors triggering the growth of the market for industrial refrigerators in the current scenario.

Refrigerant Type Segment Insights

Based on refrigerant type, the industrial refrigeration system market is segmented into CO2, HFC, and ammonia. Global warming and the changing environmental conditions and the allied governing body regulations play a significant role in the functioning of the industrial refrigeration system market. The refrigerant choice has witnessed gradual changes in the adoptions over the years owing to various compliance demands across the world. Ammonia, and Hydrocarbons were the first choice refrigerant used in this industry until few years back.

Equipment Segment Insights

Based on equipment, the industrial refrigeration system market is bifurcated into compressor, condenser, evaporator, and others. The industrial refrigeration system market is consisting of vital components that are critical for their smooth functioning. Compressors, Condensers, Evaporators, and other smaller components comprise of the industrial refrigeration system.

Application Segment Insights

Based on application, the industrial refrigeration system market is bifurcated into food processing, chemicals & pharmaceuticals and refrigerated logistics. The food processing industries contributed the maximum revenue shares in 2017 in the region, pertaining to the rapid surging demand for frozen foods, chilled-ready meats, confectioneries, breweries, and liquid milk processing among the North American mass. The US is one of the largest consumers of packaged foods and frozen food followed by developed countries in the Europe. Also, other regions of the world such as Middle East, and the developing economies of APAC exhibit changing patterns in the demand of packaged food and food products.

The market players focus on new product innovations and developments by integrating advanced technologies and features in their products to compete with the competitors.

2018: GEA Group signed a EUR 150 million loan agreement running until 2025 with the European Investment Bank (EIB) to finance its research, development and innovation spending.

2018: Carnot Refrigeration entered into a distribution agreement with Emergent Cold Technologies. Under this agreement Emergent Cold will deliver Carnot Refrigeration's CO2 systems to its customers present in several US regions.

2017: EVAPCO, Inc. announced its plan to expand its manufacturing facility in Taneytown by investing US$ 15 Mn.

The regional trends and factors influencing the Industrial Refrigeration System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Industrial Refrigeration System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Industrial Refrigeration System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 20.02 Billion |

| Market Size by 2025 | US$ 33.66 Billion |

| Global CAGR (2017 - 2025) | 6.8% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Refrigerant Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Industrial Refrigeration System Market Players Density: Understanding Its Impact on Business Dynamics

The Industrial Refrigeration System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Industrial Refrigeration System Market top key players overview

Industrial Refrigeration System Market – By Refrigerant Type

- CO2

- HFC

- Ammonia (NH3)

Industrial Refrigeration System Market – By Equipment

- Compressor

- Condenser

- Evaporator

- Others

Industrial Refrigeration System Market – By Application

- Food Processing

- Chemicals & Pharmaceuticals

- Oil & Gas

- Refrigerated Logistics

Industrial Refrigeration System Market – by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Rest of APAC

-

Middle East & Africa (MEA)

- South Africa

- Rest of MEA

-

South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Industrial Refrigeration System Market – Companies Profiles

- Carnot Refrigeration

- Emerson Electric Co.

- United Technologies Corporation

- Innovative Refrigeration Systems, Inc.

- Johnson Controls, International Plc.

- Ingersoll-Rand PLC

- Evapco, Inc.

- GEA Group AG

- Hussmann Corporation

- Dover Corporation

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For