Maternity Wear Market Share, Size & Demand by 2034

Maternity Wear Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Top Wear, Bottom Wear, Dresses and Gowns, and Innerwear) and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

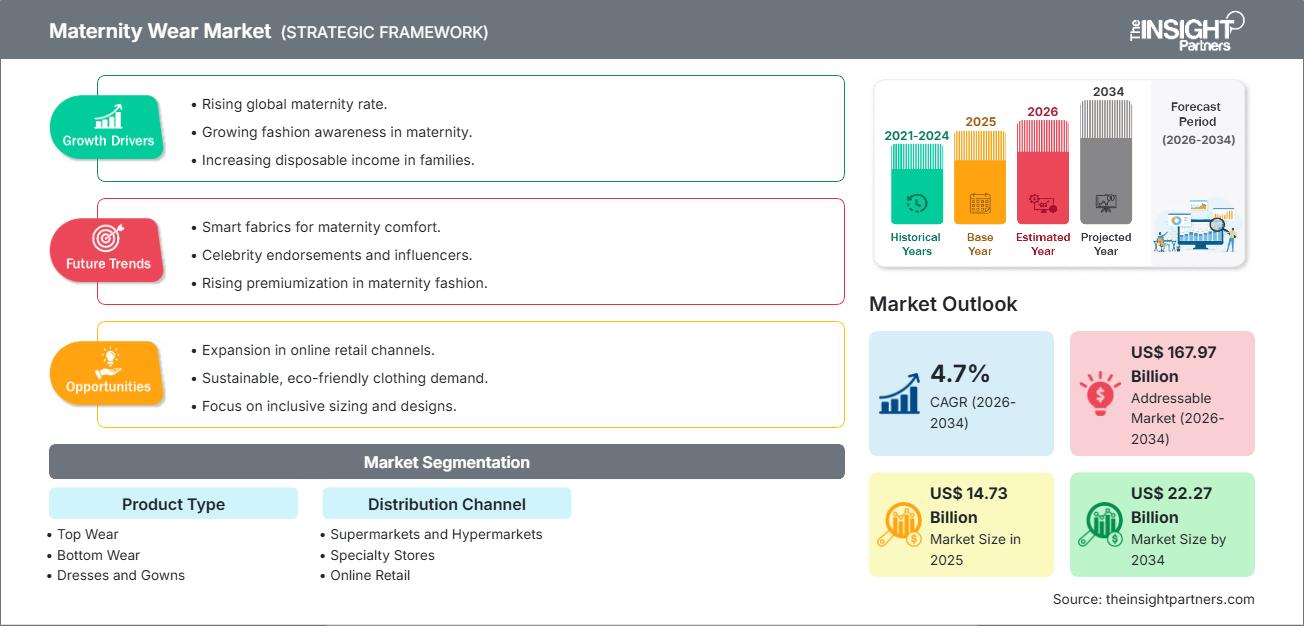

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Apr 2026

- Report Code : TIPRE00025401

- Category : Consumer Goods

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

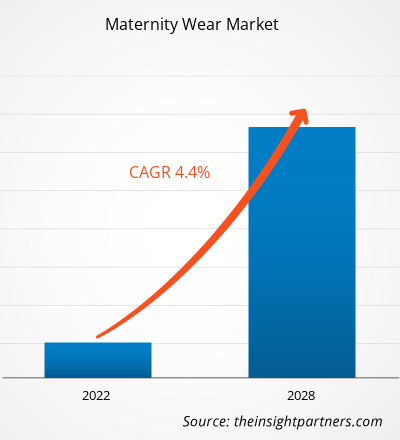

The global maternity wear market size is projected to reach US$ 22.27 billion by 2034 from US$ 14.73 billion in 2025. The market is anticipated to register a CAGR of 4.7% during the forecast period 2026–2034. Key market dynamics include a heightening global focus on maternal comfort and ergonomics, rising participation of women in the professional workforce, and a significant shift toward fashion-forward, bump-friendly apparel. Additionally, the market is expected to benefit from the growing popularity of sustainable and organic fabrics, expansion in organized e-commerce channels across emerging economies, and the increasing inclusion of maternity lines in high-value premium and luxury fashion segments.

Maternity Wear Market Analysis

The maternity wear market analysis shows a shift toward high-value functional apparel as consumers prioritize fabric performance and multi-stage longevity. Procurement trends indicate the market is splitting into traditional fast-fashion retail and high-growth, eco-conscious niche brands. Strategic opportunities are emerging in specialized activewear and innerwear, where seamless technology and moisture-wicking properties compared to standard apparel offer a clear competitive advantage. The analysis also notes that market expansion depends on digital sizing accuracy and size inclusivity for diverse body types. Competitive differentiation now stands out depending on branding that tells a story and highlights organic materials, ethical manufacturing, and transitional designs that work for both pregnancy and postpartum. This approach helps premium brands charge higher prices in a market with many budget-tier suppliers.

Maternity Wear Market Overview

Maternity wear is shifting from a temporary necessity to a global premium commodity. While historically focused on loose-fitting basics, maternity wear is expanding into value-added products like specialized denim, professional office wear, and nursing-integrated tops. Both global retail giants and boutique artisanal labels are part of this market, making use of advanced stretch textiles like spandex and modal. More style-conscious consumers in North America and Asia-Pacific are looking for clothing that mirrors their pre-pregnancy aesthetic, which has helped maternity wear gain popularity as a lifestyle choice. North America is still the main revenue generator; however, Asia-Pacific has become a leader in innovation and growth, especially through mobile-first shopping platforms in China and India.

For instance, in the US, the maternity wear market is characterized by high disposable income and a strong preference for fashion-forward apparel. The sector thrives on a well-established e-commerce infrastructure, enabling easy access to premium, branded collections that emphasize style, comfort, and the integration of high-performance, sustainable materials.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMaternity Wear Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Maternity Wear Market Drivers and Opportunities

Market Drivers:

- Surging Number of Pregnant Working Women: As more women continue their professional careers throughout pregnancy, there is a consistent demand for formal and business-casual maternity wear that balances style with physical ease.

- Influencer Culture and Social Media Visibility: The expansion of maternity fashion photography and celebrity influence has sustained high demand for trendy inputs. As consumers trade up for Instagrammable maternity experiences, premium dresses and gowns continue to see stable volume gains.

- Advancements in Textile Technology: Modern maternity wear has integrated high-performance fabrics that offer better breathability and support. This is particularly evident in the rapid adoption of specialized maternity activewear and supportive innerwear.

Market Opportunities:

- Expansion into Sustainable and Ethical Lines: Beyond standard cotton, there are significant opportunities in GOTS-certified organic and recycled fabrics for eco-conscious Gen Z and Millennial parents.

- Growth in Postpartum and Transitional Wear: Forming strategic designs that function as both maternity and nursing wear facilitates longer product lifecycles and appeals to value-driven consumers.

- Diversification into Smart Textiles: There is a growing opportunity for producers to target tech-savvy demographics through garments with integrated support panels or health-tracking sensors, as seen in recent high-end retail expansions.

Maternity Wear Market Report Segmentation Analysis

The Maternity Wear Market share is analyzed across various segments to provide a clearer understanding of its structure, growth potential, and emerging trends. Below is the standard segmentation approach used in the industry:

By Product Type:

- Top Wear: The dominant volume driver, including blouses, tunics, and t-shirts, benefiting from high daily replacement rates and versatile styling options.

- Bottom Wear: A fast-growing segment focusing on leggings, jeans, and trousers with specialized waistbands designed for maximum support.

- Dresses and Gowns: A high-margin niche preferred for social events and professional settings, increasingly aligning with global fashion trends.

- Innerwear: Includes nursing bras and supportive intimates; this segment is increasingly preferred by consumers who prioritize comfort and functionality.

By Distribution Channel:

- Supermarkets and Hypermarkets: Remain a primary channel for budget-friendly basics and multi-pack essentials, benefiting from high foot traffic and one-stop shopping convenience.

- Specialty Stores: Offers a curated and personalized shopping experience, particularly for high-end brands and specialized fitting requirements.

- Online Retail: The fastest-rising channel, especially for D2C (Direct-to-Consumer) brands, enabling cross-border access to a wider variety of sizes and styles.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Maternity Wear Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 14.73 Billion |

| Market Size by 2034 | US$ 22.27 Billion |

| Global CAGR (2026 - 2034) | 4.7% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Maternity Wear Market Players Density: Understanding Its Impact on Business Dynamics

The Maternity Wear Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Maternity Wear Market Share Analysis by Geography

Asia-Pacific is expected to grow fastest in the coming years. Emerging markets in South & Central America, the Middle East, and Africa also have many untapped opportunities for global apparel brands and specialty retailers to expand.

The maternity wear market is undergoing a significant transformation, moving from traditional loose clothing to a global high-value fashion category. Growth is driven by rising disposable incomes, a surge in body-positive fashion demand, and the expansion of the luxury maternity sector. Below is a summary of market share and trends by region:

North America

- Market Share: Holds the largest share, driven by high consumer spending and the presence of major maternity-specific brands.

- Key Drivers:

- Strong presence of major players like Gap Inc. and Destination Maternity.

- Mainstreaming of bump-friendly professional attire in corporate environments.

- Rising popularity of rental services for high-end maternity event wear.

- Trends: Scaling of premium activewear and the successful adoption of rental models for high-end maternity gowns.

Europe

- Market Share: Holds a significant global share, anchored by a strong focus on sustainable and ethically produced fashion in countries like the UK, France, and Germany.

- Key Drivers:

- Increased demand for ethically sourced and organic materials (e.g., GOTS-certified cotton).

- Government support for maternity rights, encouraging high workforce participation.

- Expansion of premium brands like Seraphine into new retail hubs.

- Trends: A strategic shift toward slow fashion and minimalist transitional pieces that can be worn well into the postpartum period.

Asia-Pacific

- Market Share: The fastest-growing region, with China and India acting as the primary engines for volume and value growth.

- Key Drivers:

- Massive consumer base seeking trendy, affordable maternity wear through e-commerce.

- Rising female labor force participation, particularly in urban centers like Bengaluru and Shanghai.

- Emergence of domestic startups focusing on culturally tailored maternity designs.

- Trends: Heavy reliance on social commerce and B2C platforms for localized and international maternity brands.

South and Central America

- Market Share: Emerging market with a growing fashion sector in countries like Brazil and Argentina.

- Key Drivers:

- Increasing modernization of the retail landscape and rising interest in specialized mom-and-baby boutique stores.

- Increasing awareness of specialized maternity comfort as a health priority.

- Expansion of global fast-fashion brands (e.g., H&M) into local shopping malls.

- Trends: Growth of affordable yet stylish fast-fashion maternity wear to cater to the burgeoning middle class.

Middle East and Africa

- Market Share: Developing market with a transition toward formalized commercial fashion retail.

- Key Drivers:

- High birth rates and a growing middle-to-high income demographic in the GCC.

- Modernization of retail infrastructure to include dedicated maternity and baby sections.

- Trends: Implementation of modern e-commerce logistics to improve accessibility to global maternity brands in urban centers.

High Market Density and Competition

Competition is intensifying due to the presence of established leaders such as Gap Inc., H&M Hennes & Mauritz AB, and Mothercare. Specialized experts like Seraphine and Destination Maternity, alongside innovators like PinkBlush and Hatch Collection, also contribute to a diverse and rapidly expanding landscape.

This competitive environment pushes vendors to differentiate through:

- Functional Branding: Positioning maternity wear as essential for physical health by emphasizing belly support and ergonomic fits.

- Product Diversification: Offering everything from waterproof maternity outerwear to high-performance yoga gear.

- Vertical Integration: Managing the supply chain from organic cotton sourcing to local retail distribution to ensure quality and transparency.

- Technology Adoption: Using AI-driven sizing tools and virtual try-ons to reduce return rates in the online segment.

Opportunities and Strategic Moves

- Incorporate Sustainable and High-Performance Textiles: Utilizing regenerative fibers like bamboo and Lenzing™ Modal to appeal to environmentally conscious Millennial and Gen Z consumers who prioritize non-toxic, antimicrobial fabrics for sensitive skin.

- Focus on Multi-Stage Transitional Clothing: Developing garments that feature discreet nursing access and adaptive waistbands to extend the product’s lifecycle, effectively addressing the short shelf-life restraint of traditional maternity wear.

Major Companies operating in the Maternity Wear Market are:

- Gap Inc

- Seraphine

- Isabella Oliver

- H & M Hennes and Maurits

- Brunelli & Co. S.R.L

- Mothercare

- Boob Design

- Shaico Design Pvt. Ltd.

- Pinkblush Maternity

- Organic & More

Disclaimer: The companies listed above are not ranked in any particular order.

Maternity Wear Market News and Recent Developments

- In July 2025, NEXT plc announced that it had entered into an agreement to acquire certain assets of the maternity brand Seraphine for £0.6 million ($0.8 million).

- In October 2024, Mothercare plc and Reliance Brands Holding UK Limited announced the formation of a new joint venture that will own the Mothercare brand and its intellectual property assets related to the regions of India, Nepal, Sri Lanka, Bhutan, and Bangladesh.

Maternity Wear Market Report Coverage and Deliverables

The Maternity Wear Market Size and Forecast (2021–2034) report provides a detailed analysis of the market covering below areas:

- Maternity Wear Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Maternity Wear Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Maternity Wear Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Maternity Wear Market.

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For