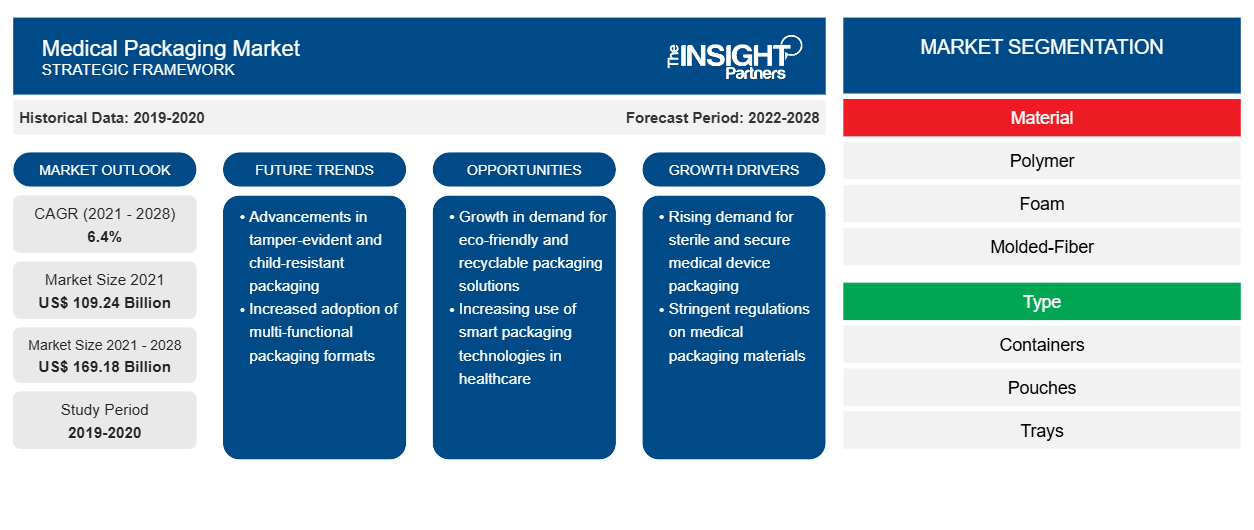

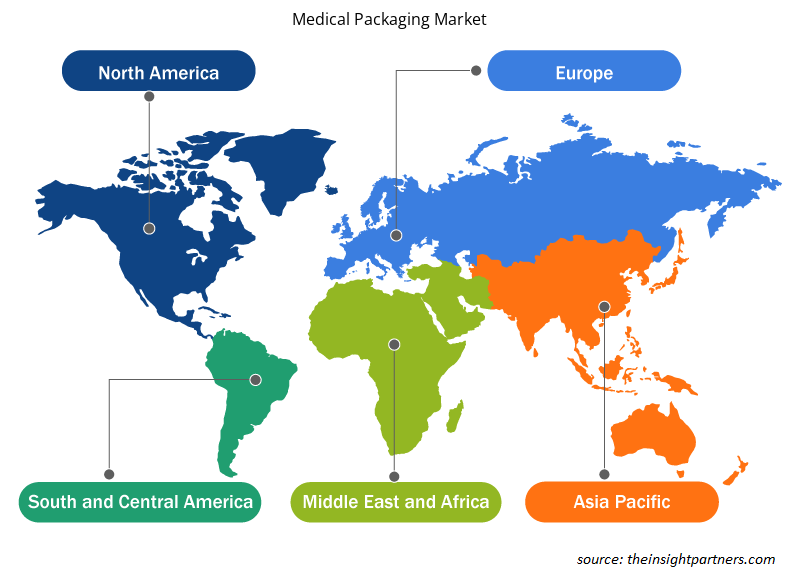

The medical packaging market is projected to reach US$ 169,183.91 million by 2028 from US$ 109,238.35 million in 2021; it is expected to grow at a CAGR of 6.4% from 2021 to 2028.

Medical packaging is essential in sustaining product quality and encouraging safe and effective use. Packaging is done for the safety of medical products for storage, distribution, sale, and use. The material used for packaging is a sterile barrier system that safeguards the drugs, equipment, and other medical products. Also, the medical packaging requires a high quality of sterility to ensure that the product is free from contamination. These medical packaging systems increase patient safety and enhance packaging performance. Factors such as increased emphasis on convenience and environmental issues and rise in demand for counterfeit prevention mechanisms are driving the medical packaging market. However, fluctuations in prices of raw materials are expected to restrict the market growth to a certain extent during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Medical Packaging Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rise in Demand for Counterfeit Prevention Mechanisms

Counterfeit medical products have been detected in most member states and all regions. Examples involved widely-used medicines such as atorvastatin or paracetamol; limited-use medicines such as growth hormone, paclitaxel, and filgastrim; and other kind of drugs such as sildenafil and tadalafil, as well as medical devices such as contact lenses, condoms, surgical mesh, and strips used by diabetic patients to monitor their blood glucose concentrations. Counterfeiting has affected both expensive and cheap products and generic and branded ones. Counterfeit products appear in community pharmacies, hospitals, and other less-regulated settings.

It is often assumed that high-income countries with solid regulatory systems can effectively exclude substandard and falsified medical products from their markets. However, the World Health Organization (WHO) analysis shows that this is not necessarily the case, as reports on these products have been submitted by countries in Western Europe and North America as well as other high-income settings. For example, a recent UK survey, carried out by Sapio Research and commissioned by a private company INCOPRO, concludes that almost one-third (32%) of those who have bought one or more counterfeit medicines have suffered a health issue as a result (INCOPRO, 2020). Numerous other documented cases in which patients have died or suffered harm due to an online purchase. As just one example, in 2013, people died after taking a counterfeit diet pill bought through an online drug seller. The pill, sold as a weight loss aid through many illicit online pharmacies, was actually a pesticide with lethal consequences for humans.

The threat that counterfeit medicines pose to the global pharmaceutical sector is immense. From fake formulations to issues in the manufacturing process, some industry figures believe we could be looking at revenue losses up to EUR 27 billion in Europe alone. The International Hologram Manufacturers Association (IHMA) is a good source of expertise in this field and highlights an industry report that indicates continued growth for anti-counterfeiting packaging technologies. According to the IHMA, the “Anti-counterfeiting, Authentication and Verification Technologies” report signals the added expertise holography brings to the authentication of packaging products. Technological innovation within the anti-counterfeiting, authentication, and verification technologies is a significant factor contributing to the market's growth.

The increasing demand for anti-counterfeiting techniques to protect the interests of patients has further strengthened the medical packaging's growth.

Type-Based Insights

Based on type, the medical packaging market is categorized into containers, pouches, trays, blister packets, vials, and others. In 2021, the containers segment held the largest share of the market, by type. The blister packets segment is estimated to grow at significant CAGR during the forecast period due to increasing product developments and product launches.

Material-Based Insights

Based on material, the medical packaging market has been segmented into polymer, foam, molded-fiber, non-woven fabric, films, paper & paperboard, and others. In 2021, the polymer segment held the largest share of the market, by material. Also, similar segment is expected to grow at the fastest rate during the coming years.

Application-Based Insights

Based on application, the medical packaging market has been segmented into medical devices, pharmaceutical and biotechnology, medical equipment & tools, and others. In 2021, the pharmaceutical and biotechnology segment held the largest share of the market. The same segment is estimated to grow at a significant CAGR during the forecast period due to the growing production of pharmaceutical and biotechnology product in the global markets because of the increasing prevalence of chronic diseases.

Various companies operating in the medical packaging market are adopting strategies such as product launches, mergers and acquisitions, collaborations, product innovations, and product portfolio expansions to expand their footprint worldwide, maintain brand name, and meet the growing demand from end users.

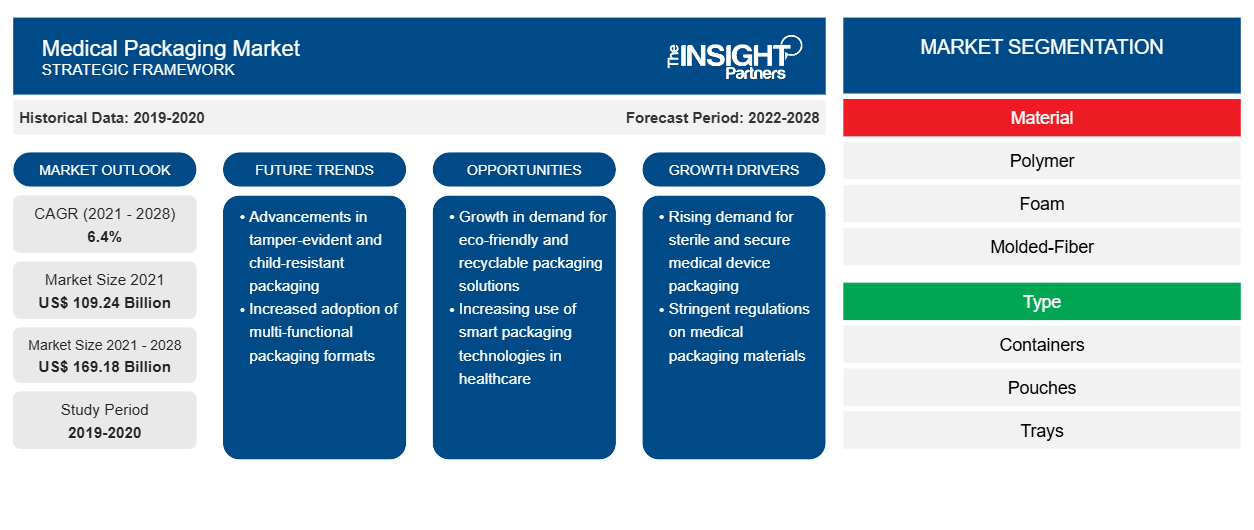

Medical Packaging Market Regional Insights

The regional trends and factors influencing the Medical Packaging Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Medical Packaging Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Medical Packaging Market

Medical Packaging Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 109.24 Billion |

| Market Size by 2028 | US$ 169.18 Billion |

| Global CAGR (2021 - 2028) | 6.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Medical Packaging Market Players Density: Understanding Its Impact on Business Dynamics

The Medical Packaging Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Medical Packaging Market are:

- Amcor plc

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Corporation

- SGD Pharma

- 3M

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Medical Packaging Market top key players overview

Medical Packaging Market – by Type

- Containers

- Pouches

- Trays

- Blister Packets

- Vials

- Others

Medical Packaging Market – by Material

- Polymer

- Foam

- Molded-Fiber

- Non-Woven Fabric

- Films

- Paper & Paperboard

- Others

Medical Packaging Market – by Application

- Medical Devices

- Pharmaceutical and Biotechnology

- Medical Equipment & Tools

- Others

Medical Packaging Market – by Geography

North America

- US

- Canada

- Mexico

Europe

- France

- Germany

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of Asia Pacific

Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

South America (SAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Amcor plc

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Corporation

- SGD Pharma

- 3M

- West Pharmaceutical Services, Inc

- Avery Dennison Corporation

- Sonoco Products Company

- CCL Industries Inc.

- WestRock Company

Frequently Asked Questions

What are the driving factors for the medical packaging market across the globe?

Key factors that are driving the growth of this market include increased emphasis on convenience and environmental issues, rise in demand for counterfeit prevention mechanisms drive the growth of the medical packaging market.

What is the regional market scenario of medical packaging?

Global medical packaging market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for medical packaging. The US is estimated to hold the largest share in the medical packaging market during the forecast period. The projected growth of the medical packaging market in the US is attributed to the rise in demand for counterfeit prevention mechanisms, increased emphasis on convenience and environmental issues. The Asia Pacific region is expected to account for the fastest growth in the medical packaging market. Rapid development of healthcare infrastructure along with pharmaceutical production hub is expected to impact the growth of the market in the region.

What is medical packaging?

Medical packaging is essential in sustaining product quality and encourage safe and effective use. Packaging is done for the safety of medical products for storage, distribution, sale, and use. The material used for packaging is sterile barrier systems that safeguard the drugs, equipment, and other medical products. Also, the medical packaging requires a high quality of sterility to ensure that the product is free from contamination. These medical packaging systems increase patient safety and enhance packaging performance.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Medical Packaging Market

- Amcor plc

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Corporation

- SGD Pharma

- 3M

- West Pharmaceutical Services, Inc

- Avery Dennison Corporation

- Sonoco Products Company

- CCL Industries Inc.

- WestRock Company

Get Free Sample For

Get Free Sample For