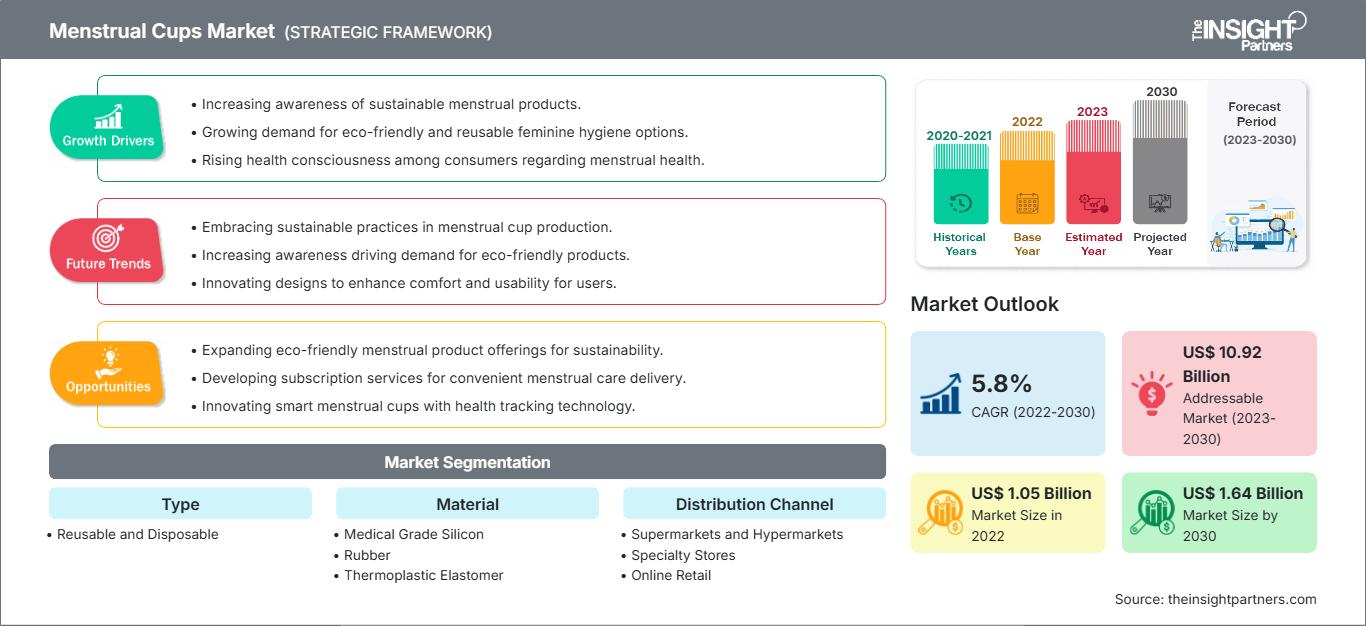

Menstrual Cups Market Analysis, Size, and Share by 2030

Menstrual Cups Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Reusable and Disposable), Material (Medical Grade Silicon, Rubber, and Thermoplastic Elastomer), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPHE100001400

- Category : Consumer Goods

- No. of Pages : 150

- Available Report Formats :

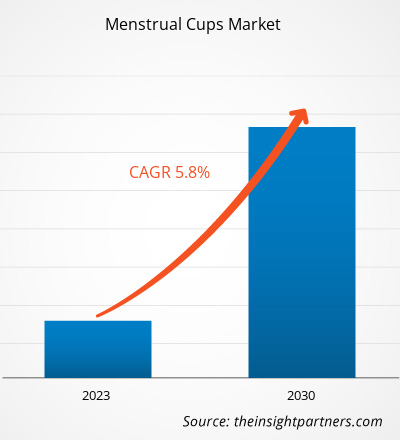

[Research Report] The menstrual cups market size was valued at US$ 1,050.81 million in 2022 and is expected to reach US$ 1,644.06 million by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Market Insights and Analyst View:

Menstrual cups are reusable, bell-shaped devices designed for feminine hygiene during menstruation. Typically made of medical-grade silicone or rubber, these cups are inserted into the vagina to collect menstrual fluid rather than absorbing it like traditional tampons or pads. They create a seal to prevent leaks and can be worn for up to 12 hours before needing to be emptied, offering a sustainable and cost-effective alternative to disposable products. Menstrual cups are gaining popularity for their environmental benefits and long-term cost savings compared to traditional menstrual hygiene options.

Growth Drivers and Challenges:

The surging demand for sustainable menstrual products is a primary driver propelling the menstrual cup market. In recent years, there has been a global shift toward sustainability, with consumers becoming increasingly aware of the environmental impact of traditional disposable menstrual products. Traditional pads and tampons contribute significantly to plastic waste, and their production involves consuming resources and energy. Every year, an average woman trashes nearly 150 kilograms of nonbiodegradable waste. In India alone, roughly 121 million women and girls use an average of eight disposable and non-compostable pads per month, generating 1.021 billion pads waste monthly, 12.3 billion pads waste annually, and 113,000 metric ton of annual menstrual waste. Menstrual cups have emerged as a leading choice as individuals seek eco-friendly alternatives due to their reusable nature. This heightened environmental consciousness drives consumers to opt for products that minimize their ecological footprint, boosting the demand for menstrual cups.

The increased demand for sustainable menstrual products is closely tied to a broader movement advocating women's health and well-being. Consumers are increasingly prioritizing products that are not only good for the environment but also safe and beneficial for their health. Menstrual cups, typically made from medical-grade silicone, rubber, or thermoplastic elastomers, are considered safe and hygienic, reducing the risk of irritation and allergic reactions often associated with traditional products. The alignment of menstrual cups with environmental sustainability and women's health contributes to their appeal, acting as a driver for their rising popularity.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMenstrual Cups Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The call for sustainability in menstrual products has been amplified by various advocacy groups, NGOs, and government initiatives that aim to raise awareness about the environmental impact of disposable options. Campaigns promoting sustainable menstruation have been crucial in educating the public about the benefits of reusable alternatives like menstrual cups. The growing visibility and endorsement of sustainable menstrual practices contribute to a positive shift in consumer attitudes, fostering greater acceptance and adoption of menstrual cups.

The demand for sustainable menstrual products is also fueled by a younger generation of consumers prioritizing eco-conscious choices. Millennials and Generation Z, in particular, drive the demand for sustainable and ethical products across various industries, including personal care. These demographics' awareness and preferences influence market trends, and menstrual cups, being a sustainable and forward-thinking option, align well with their values. As this demographic continues to grow in purchasing power, the demand for menstrual cups will also grow, reinforcing their position in the market as a leading sustainable menstrual product.

However, consumer perception and unawareness represent significant restraints in the menstrual cup market, impacting adoption rates globally. Many individuals remain uninformed about the benefits of menstrual cups due to a lack of comprehensive education and awareness campaigns. The unfamiliarity with the product and its advantages, such as cost-effectiveness, reduced environmental impact, and extended wear time, contributes to potential users' reluctance to switch from traditional menstrual products. This lack of knowledge can lead to misconceptions and inhibitions, hindering the broader acceptance of menstrual cups as a viable and practical alternative.

The hesitation to use menstrual cups is often rooted in concerns about difficulty in insertion and removal. Several consumers perceive the learning curve associated with using menstrual cups as a barrier, assuming it requires a level of skill or comfort that they may not possess. The lack of understanding about menstrual cups' straightforward application and potential health benefits contributes to this apprehension. Overcoming these preconceived notions and misconceptions requires targeted educational efforts to highlight menstrual cups' ease of use, comfort, and positive environmental impact. By addressing these concerns and fostering awareness, the market can work toward dispelling myths and encouraging a more positive perception of menstrual cups among potential users.

Report Segmentation and Scope:

The global menstrual cups market is segmented on the basis of type, material, distribution channel, and geography. Based on type, the market is categorized into reusable and disposable. By material, the market is categorized into medical grade silicon, rubber, and thermoplastic elastomer. By distribution channel, the market is categorized into supermarkets and hypermarkets, specialty stores, online retail, and others. By geography, the global menstrual cups market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Segmental Analysis:

Based on type, the menstrual cups market is categorized into reusable and disposable. The reusable segment is expected to register the highest CAGR during 2022–2030. Reusable menstrual cups represent a sustainable and cost-effective revolution in menstrual hygiene. Typically crafted from medical-grade silicone, rubber, or thermoplastic elastomers, these bell-shaped cups are inserted into the vagina to collect menstrual flow rather than absorbing it like traditional tampons or pads. The flexibility and softness of the material ensure comfort and ease of use, adapting to the user's anatomy. Reusable menstrual cups can be worn for up to 12 hours, providing leak-free protection and allowing users greater flexibility in managing their periods. One of their most significant advantages is their environmental impact, as they can be reused. The cups significantly reduce the amount of menstrual waste produced, contributing to an eco-friendly menstrual care routine. In addition, the long-term cost savings and the convenience of not needing to purchase disposable products regularly make reusable menstrual cups an increasingly popular choice for users looking for sustainable and practical alternatives in menstrual hygiene.

Regional Analysis:

The menstrual cups market is segmented into five key regions: North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. North America dominated the global menstrual cups market in 2022, as the market in this region was valued at US$ 395.41 million. Europe is a second major contributor, holding more than 30% share of the global market. Asia Pacific is expected to register a considerable CAGR of over 5% during 2022–2030. The surge in demand for menstrual cups in Asia Pacific can be attributed to various factors, including rising cultural shifts, increasing awareness, and the growing importance of women's health. There has been a rising movement toward breaking taboos surrounding menstruation in many Asian countries.

COVID-19 Pandemic Impact:

The COVID-19 pandemic initially hindered the global menstrual cups market due to the shutdown of manufacturing units, shortage of labor, disruption of supply chains, and financial instability. The disruption of operations in various industries due to the economic slowdown caused by the COVID-19 outbreak restrained the menstrual cups supply. Moreover, various stores were closed, which limited the sales of menstrual cups. Nevertheless, businesses started gaining ground as previously imposed limitations were revoked across various countries in 2021. Moreover, the implementation of COVID-19 vaccination drives by governments of different countries eased the situation, leading to a rise in business activities worldwide. Several markets, including the menstrual cups market, reported growth after the ease of lockdowns and movement restrictions.

Menstrual Cups Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.05 Billion |

| Market Size by 2030 | US$ 1.64 Billion |

| Global CAGR (2022 - 2030) | 5.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Menstrual Cups Market Players Density: Understanding Its Impact on Business Dynamics

The Menstrual Cups Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

Nixit, Lunette Global, Lena Cup LLC, Diva International Inc., Saalt, Pixie Cup, June Cup, Cora, The Flex Company, and Blossom Cup are among the prominent players operating in the global menstrual cups market.

Frequently Asked Questions

The convenience provided by menstrual cups is also a significant factor influencing market growth. Menstrual cups can be worn for up to 12 hours, depending on the flow, before emptying and cleaning. This extended wear time makes them particularly appealing to women with active lifestyles, as they do not require as much attention and change as traditional products. The convenience of not having to carry multiple pads or tampons, especially in situations where restroom facilities may be limited, adds to the appeal of menstrual cups. This aspect resonates with individuals seeking a hassle-free and practical approach to managing their menstrual hygiene.

Manufacturers opt for TPE in menstrual cup production because of its hypoallergenic and biocompatible nature. TPE is known for being safe for prolonged skin contact, making it suitable for intimate and sensitive applications like menstrual hygiene products. This characteristic is crucial for ensuring the comfort and well-being of users, reducing the risk of irritation or adverse reactions. The hypoallergenic properties of TPE enhance the overall user experience, positioning menstrual cups made from this material as a reliable and health-conscious choice in the market.

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For