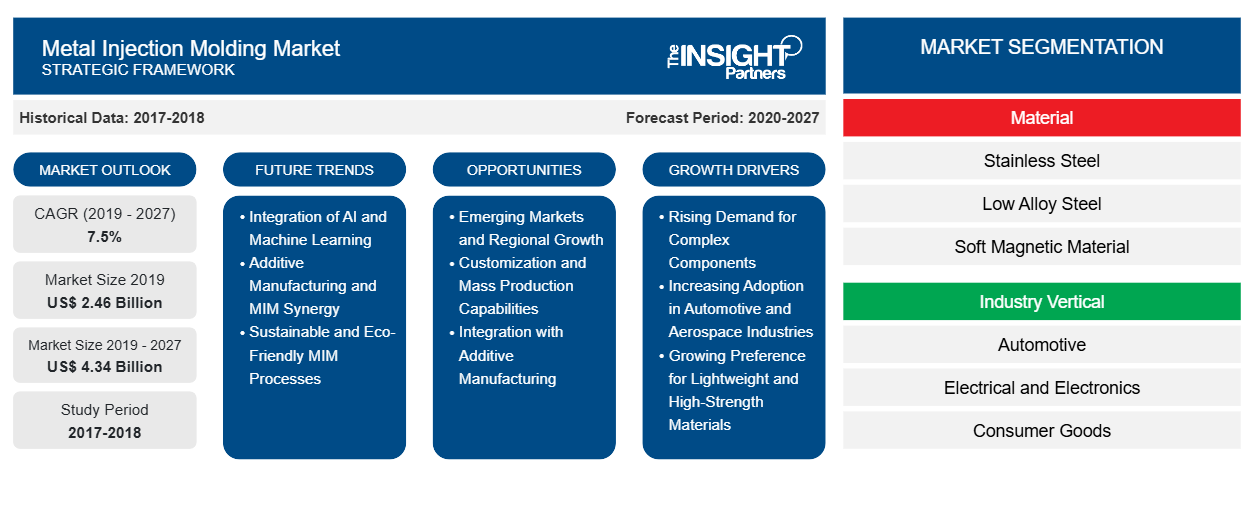

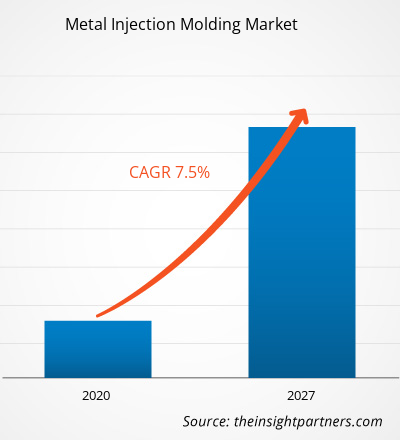

[Research Report] The metal injection molding market was valued at US$ 2,458.68 million in 2019 and is projected to reach US$ 4,338.52 million by 2027; it is expected to grow at a CAGR of 7.5% from 2019 to 2027.

Metal injection molding is a flexible, cost-effective, and innovative process that provides versatility to product designers and production engineers while using metal alloys. Metal acts as a good substitute for plastic and ceramic components that are incapable of performing as per requirement. Metal injection molding focuses on quality and precision, and the process is closely monitored to meet the requirements. When a metal alloy is chosen for a specific application, the component's geometry gets limited by the cost of shaping operations. The metal injection molding helps in overcoming this issue with the formation of the net shape parts in the tool. The metal injection molding offer benefits such as resistance to wear & corrosion, thermal stability, high mechanical strength, and dimensional stability.

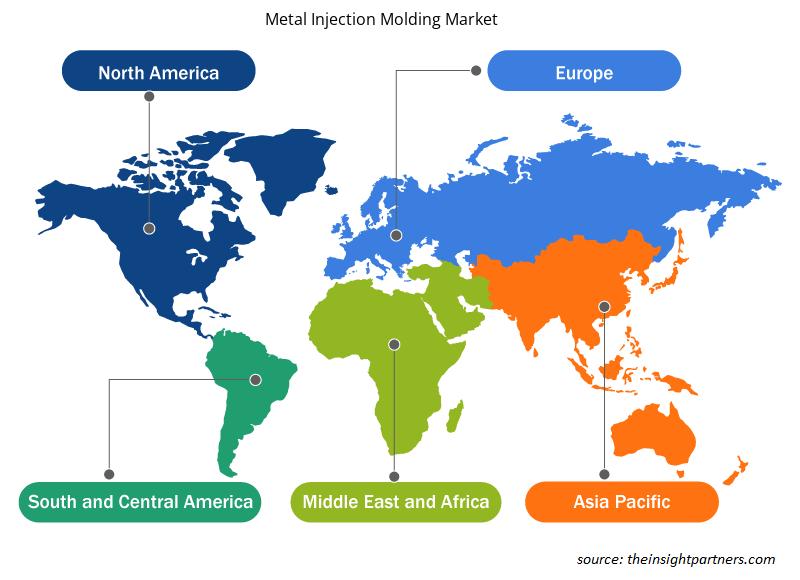

In 2019, Asia Pacific held the largest share of the global metal injection molding market. The rise in urbanization, increase in manufacturing industries, and upsurge in the demand for automobiles and electronics is expected to drive the market growth in Asia Pacific. Rising demand for smart vehicles, and medical and consumer goods in the region favors the growth of the metal injection molding market. Metal injection molding provide benefits such as fast production, high efficiency, design flexibility, and large material choice. The rise in awareness about the benefits offered by metal injection molding and the growing safety concerns in electronic vehicles supports the growth of the market. Asia Pacific is estimated to register the highest CAGR in the market over the forecast period.

The COVID-19 outbreak was first reported in Wuhan (China) during December 2019. As of December 2020, the US, India, Brazil, Russia, France, the UK, Italy, Spain, Germany, Colombia, Argentina, and Mexico are among the most affected countries in terms of confirmed cases and reported deaths. According to the latest WHO figures, there are ~106,008,943 confirmed cases and 2,316,389 total deaths globally. The crisis is hindering various industries across the globe due to lockdowns, travel bans, and business shutdowns. The global manufacturing industry is one of the major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, office shutdowns. The lockdown of various plants and factories in leading regions such as North America, Europe, Asia Pacific, South America, and the Middle East and Africa is restricting the global supply chains and hindering manufacturing activities, delivery schedules, and various goods sales. In addition, global travel bans imposed by countries in Europe, Asia, and North America are adversely affecting business collaborations and partnership opportunities. All these factors are disrupting the manufacturing of automotive, medical, defense, and electronics goods, which is restraining the growth of the metal injection molding market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Metal Injection Molding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Metal Injection Molding Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising Utilization of Technology by Automotive and Electronics Industry

Metal injection molding is highly exploited by industries such as automotive, electrical, and electronics. It is highly utilized in the production of consumer electronics. Metal injection molding is gaining momentum in the electronics industry due to the rising demand for small and complex parts in the industry coupled with the increasing demand for the miniaturization of electronics devices. Metal injection molding is utilized to manufacture Apple's Lightning Connector, a component that is produced in huge numbers. Metal injection molding is also used to produce fiber-optic parts, cold plates, heat sinks, and mobile phone parts. For the past few years, the production of portable computing devices, cellular phones, and other personal electronic devices has increased exponentially. The proliferating international smartphone market offers immense possibilities for metal injection molding. Hence, the rise in the adoption of these products drives the metal injection molding industry's expansion. Currently, the automotive sector is a significant consumer of metal injection molded parts. High complexity, high strength parts are used in engines, turbochargers, gearboxes, steering systems, locking mechanisms, and electronic systems. The demand for molded miniature products is escalating in the automotive sector, attributed to their high strength and complexity in their structures. The exponential growth of the automotive industry, especially in emerging economies such as India and China, is fueling the growth of the global metal injection molding market.

Material Insights

Based on material, the global metal injection molding market is segmented into stainless steel, low alloy steel, soft magnetic material, and others. In 2019, the stainless steel segment led the market. Stainless steel has good stiffness, wear, and corrosion resistance properties. It is a widely used injection molding material. Stainless steel components that are employed in metal injection molding possess high wear & corrosion stability. The metal injection molding help in enhancing the strength, achieving high densities, corrosion resistance, and flexibility of stainless steels. These materials are produced from elementally blended or pre-alloyed stainless steels, including ferritic, austenitic, and precipitation hardening grades. The utilization of metal injection molding for stainless steel is steadily increasing in the automotive and medical instruments sector. The initial use and overall success of the metal-injection-molded orthodontic brackets demonstrated the corrosion resistance and biocompatibility of injection-molded stainless steel applications.

Industry Vertical Insights

Based on industry vertical, the metal injection molding market is segmented into automotive, electrical and electronics, consumer goods, firearms and defense, medical and orthodontics, and others. The electrical and electronics segment accounted for the largest share in the market in 2019. Metal injection molding focuses on precision and quality, and the process is a closely monitored to meet the requirements. The low cost and complex designing capacities of metal injection molding technology reduce manufacturing time and offer high economies of scale. Metal injection molding has diversified electrical and electronics applications such as fiber-optic parts, lightning connector, cold plates and heatsinks, PCB terminal blocks, high-voltage power connectors, solenoids, and smartphone components, micro switches, heat sinks, filter, and switching components, and mobile phone parts. Furthermore, the low cost and complex designing capacities of metal injection molding are expected to boost the market growth in the near future.

Players operating in the metal injection molding market are implementing the mergers and acquisitions and research & development strategies to enlarge their customer base and gain significant market share across the world, which also permits them to maintain their brand name globally.

Report Spotlights

- Progressive industry trends in the global metal injection molding market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global metal injection molding market from 2017 to 2027

- Estimation of global metal injection molding demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict the market growth

- Recent developments to understand the competitive market scenario and global metal injection molding demand

- Market trends and outlook coupled with factors driving and restraining the growth of the global metal injection molding market

- Decision-making process by understanding strategies that underpin commercial interest with regard to global metal injection molding market growth

- Global metal injection molding market size at various nodes of market

- Detailed overview and segmentation of the global metal injection molding market, as well as its dynamics in the industry

- Global metal injection molding market size in various regions with promising growth opportunities

Metal Injection Molding Market Regional Insights

The regional trends and factors influencing the Metal Injection Molding Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Metal Injection Molding Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Metal Injection Molding Market

Metal Injection Molding Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 2.46 Billion |

| Market Size by 2027 | US$ 4.34 Billion |

| Global CAGR (2019 - 2027) | 7.5% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Metal Injection Molding Market Players Density: Understanding Its Impact on Business Dynamics

The Metal Injection Molding Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Metal Injection Molding Market are:

- Arc Group Worldwide

- CMG Technologies

- Dean Group International

- Molex, LLC

- INDO-MIM

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Metal Injection Molding Market top key players overview

Metal Injection Molding Market – by Material

- Stainless Steel

- Low Alloy Steel

- Soft Magnetic Material

- Others

Metal Injection Molding Market – by Industry Vertical

- Automotive

- Electrical and Electronics

- Consumer Goods

- Firearms and Defense

- Medical and Orthodontics

- Others

Company Profiles

- Arc Group Worldwide

- CMG Technologies

- Dean Group International

- Molex, LLC

- INDO-MIM

- MPP

- Sintex A/S

- Smith Metal Products

- Shanghai Future Group

- Form Technologies

Frequently Asked Questions

Based on material, why stainless steel segment accounted for the largest share in the global metal injection molding market?

The stainless steel segment had a significant market share, and this trend is expected to continue over the forecast period. Metal injection molding makes use of metal powders like stainless steel. Stainless steel has good stiffness, wear, and corrosion resistance properties. Stainless steel is widely used injection molding materials. The stainless steel components that are employed in metal injection molding possess high wear & corrosion stability. The metal injection molding (MIM) process enhancing the strength, achieves high densities, corrosion resistance, and flexibility of stainless steels. These materials are produced from elementally blended or pre-alloyed stainless steels, including ferritic, austenitic, and precipitation hardening grades.

Can you list some of the major players operating in the global metal injection molding market?

The major players operating in the global metal injection molding market are Arc Group Worldwide, CMG Technologies, Dean Group International, Molex, LLC, INDO-MIM, MPP, Sintex A/S, Smith Metal Products, Shanghai Future Group, and Form Technologies, among others.

Which region held the largest share of the global metal injection molding market?

In 2019, Europe contributed to the largest share in the Global Metal Injection Molding market. Attributed to the Europe’s flourishing economic conditions, there has been a spur in the region's industrial activities. The exponential growth in the industrial sector, including electrical and electronics, automotive, consumer good, medical and orthodontics and others, has influenced the metal injection molding demand. Europe has matured the automotive, aerospace, medical, and consumer electronics sector, and it is further supported by high technology connectivity environment. Along with the advancing technology, the trend of using advanced products boosts the demand for metal materials and further influences the market growth for the metal injection molding market. Additionally, the consumers' rising personal disposable income has led to increasing demand for consumer electronic products. These factors boost the metal injection molding market in Europe.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Global Metal Injection Molding Market

- Arc Group Worldwide

- CMG Technologies

- Dean Group International

- Molex, LLC

- INDO-MIM

- MPP

- Sintex A/S

- Smith Metal Products

- Shanghai Future Group

- Form Technologies

Get Free Sample For

Get Free Sample For