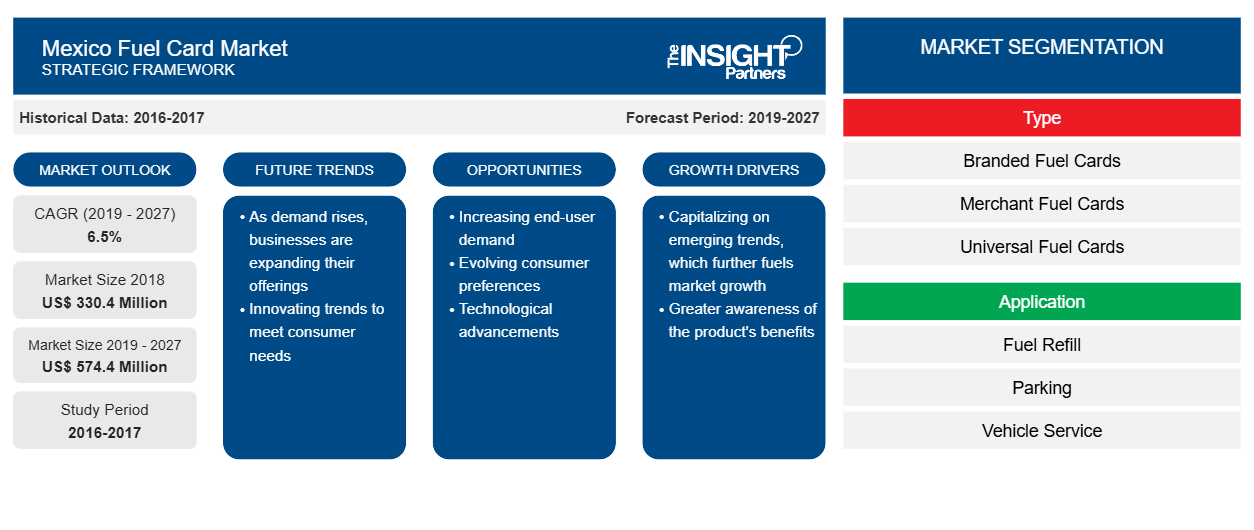

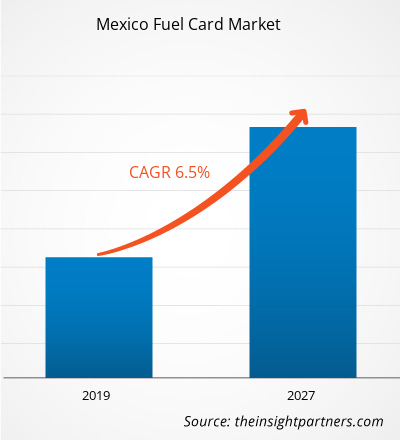

Mexico fuel card market was valued at US$ 330.4 Mn in 2018, is expected to reach US$ 574.4 Mn by 2027, growing at a CAGR of 6.5% from 2019 – 2027.

Fuel card market operates in a highly-competitive marketplace. As leading companies in Mexico fuel card market continues to broaden their addressable market, by expanding their current product portfolio, diversifying their client base, and developing new applications and markets, all the prominent players faces an increasing level of competition, both from regional as well the leading global technology and industrial companies in the world. Mexico fuel card market is fragmented at higher level with major eight to ten players comprising 30% of the Mexico fuel card market share, whereas at the regional level it is highly fragmented with several local players. Rise in fleet sizes around the world is pushing the market for fuel card as it helps a fleet owner to streamline the process of tracking driver behavior and fuel consumption per vehicle.

Fuel cards enable enhanced tracking of fleet expenses and efficiency of the fleet by tracking real-time mileage and fuel usage by vehicles in a fleet. Fleet operators use fuel cards for costs such as truck maintenance, truck repairs, fuel, truck cleaning, and replacement vehicle rental, among others. Data captured by a fuel card include odometer reading, fuel grades, fuel product, and quantity of fuel, vehicle ID, driver ID and tax information along with transaction details such as time, location, spend amount and date support rich repowering for fleet managers. These features of fuel card are significantly driving the Mexico fuel card market.

Impact of COVID-19 on Mexico Fuel Card Market

COVID-19 is one of the most impactful disruptions till today. It has adversely impacted the transportation and logistics sector. Corona virus has forced transportation and logistics companies to delay resuming work. Overall, vehicle movement nationwide was suspended for almost a month due to the outbreak, but there is still a chance that lost output can be made up for later. These factors are hindering the Mexico fuel card market.

Mexico Fuel Card Market, By Revenue

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Mexico Fuel Card Market Insights

Efficient fleet administration is one of the key factor boosting Mexico fuel card market

Fuel cards enable enhanced tracking of fleet expenses and efficiency of the fleet by tracking real-time mileage and fuel usage by vehicles in a fleet. Fleet operators use fuel cards for costs such as truck maintenance, truck repairs, fuel, truck cleaning, and replacement vehicle rental, among others. Data captured by a fuel card include odometer reading, fuel grades, fuel product, and quantity of fuel, vehicle ID, driver ID and tax information along with transaction details such as time, location, spend amount and date support rich repowering for fleet managers. All of these enhanced data permits richer reporting, which can be used by fleet operators to identify problem zones such as fraudulent transaction by truck drivers or truck with lower fuel efficiency. Thus, fuel cards provide complete insight into vehicle operating cost and driver behavior that provides fleet managers with a complete oversight and trends required to analyze shortcomings in the fleet. Above mentioned metrics are expected to drive the adoption of fuel card by fleet operators and to contribute to the Mexico fuel card market growth.

Leveraging telematics with the adoption of fuel card is a key trend in Mexico fuel card market

Certain fuel card providers have started implanting the telematics interface as well as robust reporting abilities as a natural product offering to enhance fleet management efficiency. This comprises of GPS data integration along with purchase data with a purpose to track fleet or driver performance. It further helps in determining whether the vehicle is refueling at an appropriate location. Moreover, integrating fuel cards with telematics helps in receiving accurate Miles/Gallon reports for each vehicle. The recorded data enables the business or users to effortlessly identify any inadequacies or pinpoint drivers who may need further training. Truck driver’s behavior can be tracked using telematics. Metrics related to driving speed, the route taken, harsh braking and trip schedule can be used to keep track of driver efficiency, habits and any anomalies such as deviation from the planned route, unscheduled stoppage refueling at non-partner fuel stations and driving behavior among others.

Mexico Fuel Card Market By Type

The Mexico fuel card market is segmented into three type by their function as branded fuel card, merchant fuel card, and universal fuel card. The Mexico fuel card market by type was led by universal fuel cards. Universal card are most convenient fuel card type, the providers of these cards usually partners with several fuel companies and offer great flexibility. Certain fuel card companies merely operate in some countries or regions. While others may only be accepted at particular fuel stations. Users with less options in their region may need to be cautious regarding limiting them to just a few fuel stations.

Mexico Fuel Card Market, by Type (2019 & 2027)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mexico Fuel Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Mexico Fuel Card Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Merger & acquisition strategy is commonly adopted by companies to expand their footprint worldwide and meet the growing demand in Mexico fuel card market. Few of the recent developments in Mexico fuel card market are listed below;

2018:

Edenred, the world leader in transactional solutions for companies, employees and merchants, today announced the signing of an agreement to acquire 80% of the share capital of The Right Fuelcard Company (TRFC) group, the number four fuel card program manager in the United Kingdom.2018:

Mastercard unveiled a new service to automatically integrate fuel and maintenance data from a connected car’s dashboard into the payment process. The service will streamline the process, providing fleet managers greater transparency and control.Mexico Fuel Market – By Type

- Branded Fuel Cards

- Merchant Branded Fuel Cards

- Universal Fuel Cards

Mexico Fuel Market- By Application

- Fuel Refill

- Parking

- Vehicle Service

- Toll Charge

- Others

Mexico Fuel Card Market- Companies Profiles

- BP PLC

- Edenred SA

- Exxon Mobil

- FleetCor Technologies Inc.

- LeasePlan Corporation

- Royal Dutch Shell PLC

- Total SA

- US bank

- Wex, Inc.

- World Fuel Corporation

Mexico Fuel Card Market Regional Insights

The regional trends and factors influencing the Mexico Fuel Card Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Mexico Fuel Card Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Mexico Fuel Card Market

Mexico Fuel Card Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 330.4 Million |

| Market Size by 2027 | US$ 574.4 Million |

| Global CAGR (2019 - 2027) | 6.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Mexico

|

| Market leaders and key company profiles |

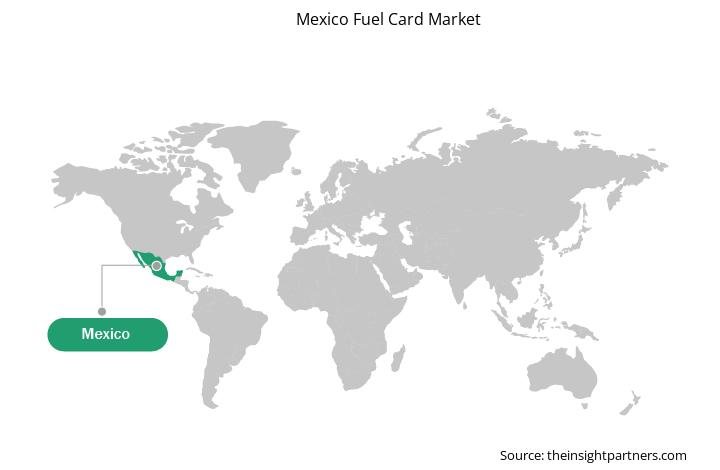

Mexico Fuel Card Market Players Density: Understanding Its Impact on Business Dynamics

The Mexico Fuel Card Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Mexico Fuel Card Market are:

- BP p.l.c.

- Exxon Mobil

- Fleetcor Technologies Inc.

- Royal Dutch Shell Plc

- U.S. Bank

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Mexico Fuel Card Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What is the key trend in Mexico fuel card market?

Certain fuel card providers have started implanting the telematics interface as well as robust reporting abilities as a natural product offering to enhance fleet management efficiency. This comprises of GPS data integration along with purchase data with a purpose to track fleet or driver performance. It further helps in determining whether the vehicle is refueling at an appropriate location.

Which factor is driving the Mexico fuel card market?

Efficient fleet administration with the help of enhanced data capture is the key factor driving the Mexico fuel card market. Fuel cards enable enhanced tracking of fleet expenses and efficiency of the fleet by tracking real-time mileage and fuel usage by vehicles in a fleet. Fleet operators use fuel cards for costs such as truck maintenance, truck repairs, fuel, truck cleaning, and replacement vehicle rental, among others. Data captured by a fuel card include odometer reading, fuel grades, fuel product, and quantity of fuel, vehicle ID, driver ID and tax information along with transaction details such as time, location, spend amount and date support rich repowering for fleet managers.

Which type led the Mexico fuel card market?

The Mexico fuel card market by type was led by universal fuel cards. Universal card are most convenient fuel card type, the providers of these cards usually partners with several fuel companies and offer great flexibility. Certain fuel card companies merely operate in some countries or regions. While others may only be accepted at particular fuel stations. Users with less options in their region may need to be cautious regarding limiting them to just a few fuel stations.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Mexico Fuel Card Market

- BP p.l.c.

- Exxon Mobil

- Fleetcor Technologies Inc.

- Royal Dutch Shell Plc

- U.S. Bank

- WEX Inc

- U.S. Bank

- LeasePlan México, S.A. De C.V

- Edenred Mexico S.A. De C.V.

- Total SA

Get Free Sample For

Get Free Sample For