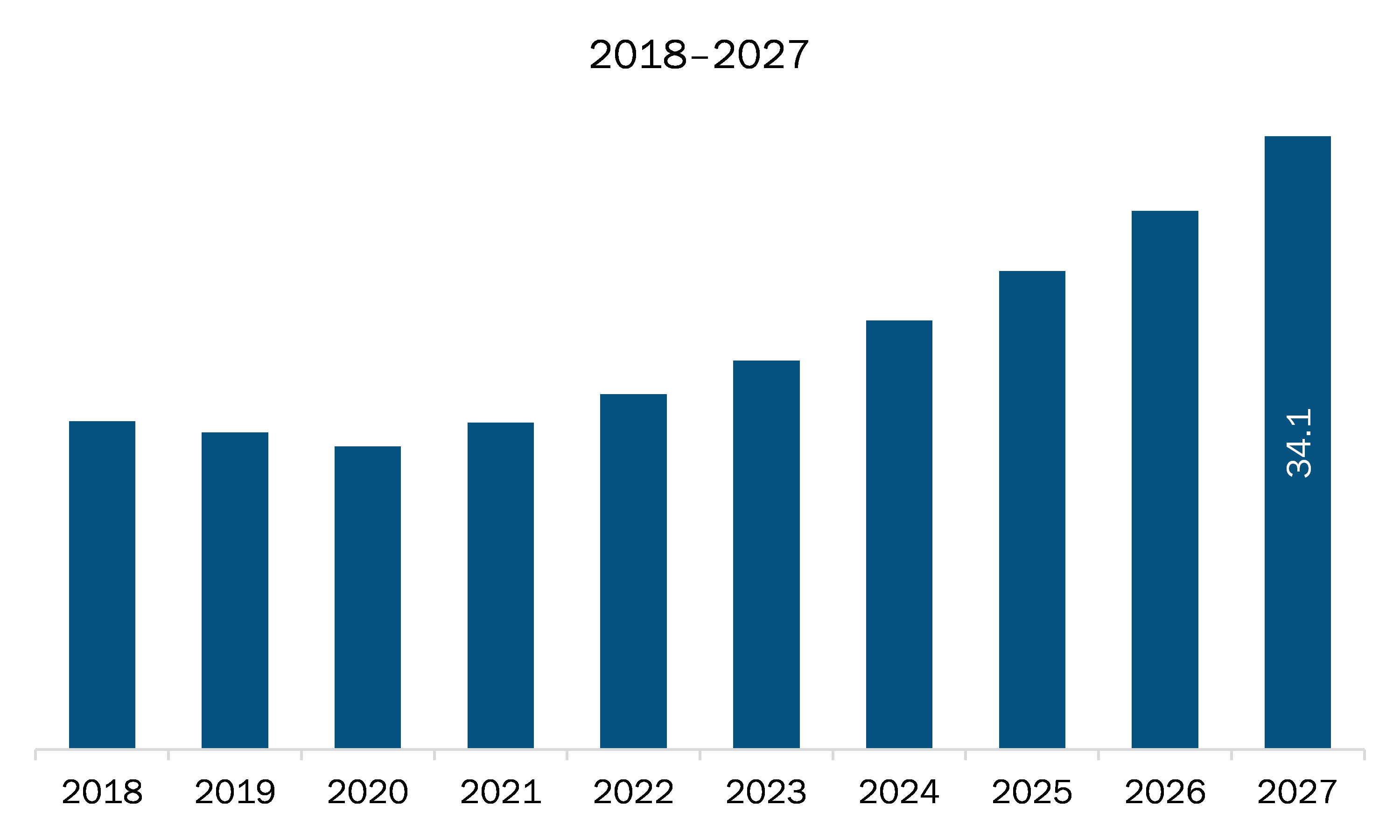

The autonomous navigation market in MEA is expected to grow from US$ 17.7 million in 2019 to US$ 34.1 million by 2027; it is estimated to grow at a CAGR of 10.6% from 2020 to 2027.

Saudi Arabia, South Africa, and UAE are major economies in MEA. Vessel navigation and unmanned ship getting deployed with autonomous navigation technology is driving the MEA autonomous navigation market in a positive way. Maritime trade has increased drastically in recent years owing to the growth of industrial economies. The unmanned ship is gaining attention as a next-generation transportation vessel owing to its enhanced efficiency, safety, and connectivity during maritime trade. As the shipping industry still stands at a transient state, tech giants and shipping companies are focusing on integrating the autonomous navigation technology in shipping. Considering the risk associated with assessing the safety of autonomous ships and human life, it is identified that autonomous unmanned ships are reliable and secure compared to conventional ship. In light of the technological adequacy of pilot applications and navigation systems, there is a magnificent development taking place in autonomous shipping, which is anticipated to build a lucrative future for autonomous vessels. In the context of advanced technologies, tug owners are investing a huge amount in autonomous technology, CCTV, AI, and digitalization for monitoring and vessel navigation. The aspect of deploying autonomous technology in vessels and unmanned ships will propel the market growth. Moreover, with respect to the application of autonomous navigation in unmanned ships, companies such as Wheelhouse technology is introducing autonomous tug navigation with better performance and effective hazard avoidance. KOTUG International, a towage services provider, has passed a new landmark in autonomous vessel navigation by demonstrating Rotortug-designed training harbour tug RT Borkum in Rotterdam, the Netherlands. Under this demonstration, the KOTUG International has used software that autonomously pilots an unmanned vessel in a busy port. Such technological advancements for the development of vessel navigation will help in fueling the growth of autonomous navigation during the coming years.

The ongoing COVID-19 pandemic is impacting the MEA severely. Iran, Saudi Arabia, Qatar, South Africa, and the UAE are among the countries with high number of COVID-19 confirmed cases and reported deaths.

The economic and industrial growth of these countries has been affected negatively in the last few months. Due to lesser maritime trade and limited business in shipping industry in the first quarter of 2020, the trend of unmanned ships and vessel navigation has been disturbed. This factor has affected the scope of autonomous navigation systems.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the MEA autonomous navigation market. The MEA autonomous navigation market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

MEA Autonomous Navigation Market Segmentation

MEA Autonomous Navigation Market – By Solution

- Sensing System

- Navigation System

- Processing Unit

- Software

MEA Autonomous Navigation Market – By Application

- Commercial

- Defense

MEA Autonomous Navigation Market – By Vehicle Type

- AGVs

- Mobile Robots

- UUVs

- Drones

- Others

MEA Autonomous Navigation Market – By Platform

- Land

- Marine

- Space

MEA Autonomous Navigation Market, by Country

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

MEA Autonomous Navigation Market - Companies Mentioned

- Collins Aerospace, a Raytheon Technologies Corporation Company

- FURUNO ELECTRIC CO., LTD

- Kollmorgen

- KONGSBERG

- Trimble Inc.

Middle East and Africa Autonomous Navigation Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 17.7 Million |

| Market Size by 2027 | US$ 34.1 Million |

| CAGR (2020 - 2027) | 10.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For