Military Aircraft Rubber Tanks Market Share & Demand Insights by 2034

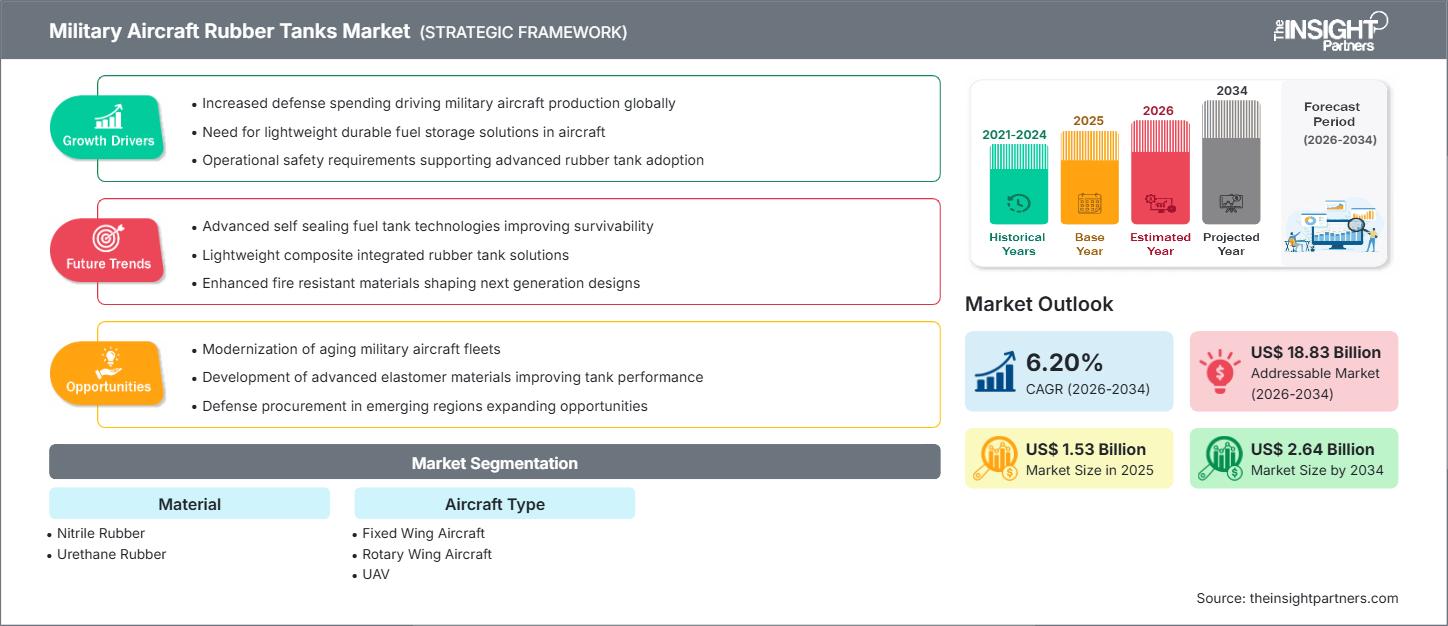

Military Aircraft Rubber Tanks Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Nitrile Rubber and Urethane Rubber) and Aircraft Type (Fixed Wing Aircraft, Rotary Wing Aircraft, and UAV)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Report Date : Mar 2026

- Report Code : TIPRE00017947

- Category : Aerospace and Defense

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

The military aircraft rubber tanks market size is expected to reach US$2.64 billion by 2034 from US$1.53 billion in 2025. The market is anticipated to register a CAGR of 6.20% during 2026–2034.

Military Aircraft Rubber Tanks Market Analysis

The military aircraft rubber tanks market forecast indicates steady growth, driven by rising defense budgets, modernization of air fleets, and increasing demand for lightweight, durable fuel storage solutions. The market expansion is supported by technological advancements in elastomer materials, stringent safety standards, and the growing need for extended mission endurance. Additionally, the integration of self-sealing technologies, improved puncture resistance, and compatibility with advanced fuels further accelerate adoption. Strategic opportunities lie in developing tanks for UAVs and next-generation fighter jets, as well as expanding into emerging defense markets.

Military Aircraft Rubber Tanks Market Overview

Military aircraft rubber tanks are specialized fuel storage systems designed for combat and tactical aircraft. These tanks are constructed using advanced elastomers such as nitrile and urethane rubber, offering flexibility, puncture resistance, and self-sealing capabilities to prevent fuel leakage during combat damage. They play a critical role in enhancing aircraft survivability and operational efficiency. Rubber tanks are widely used in fixed-wing aircraft, rotary-wing helicopters, and increasingly in UAVs for reconnaissance and combat missions. The market is influenced by global defense modernization programs, rising geopolitical tensions, and the need for lightweight, high-performance fuel systems.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMilitary Aircraft Rubber Tanks Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Aircraft Rubber Tanks Market Drivers and Opportunities

Market Drivers

- Increasing Defense Expenditure and Fleet Modernization: Global defense budgets are rising significantly due to geopolitical tensions and the need for advanced military capabilities. Countries like the U.S., China, and India are investing heavily in upgrading their air fleets, including fighter jets, transport aircraft, and helicopters. Rubber tanks are integral to these modernization programs because they offer enhanced survivability through self-sealing properties, reducing the risk of fuel leakage during combat damage. Additionally, retrofitting older aircraft with advanced rubber tanks ensures compliance with modern safety standards, creating sustained demand.

- Demand for Lightweight and High-Durability Fuel Systems: Modern military aircraft prioritize weight reduction to improve fuel efficiency and extend mission range. Rubber tanks, made from advanced elastomers like nitrile and urethane, provide a lightweight yet highly durable solution. These tanks withstand extreme temperatures, high altitudes, and exposure to aggressive fuels, making them ideal for combat environments. Their flexibility also allows for custom shapes to fit complex aircraft designs, further enhancing operational efficiency.

- Rise in UAV Deployment for Tactical Missions: Unmanned Aerial Vehicles (UAVs) are increasingly deployed for reconnaissance, surveillance, and combat missions. These platforms require compact, lightweight fuel tanks with high reliability to support extended flight durations. Rubber tanks meet these requirements by offering superior puncture resistance and adaptability to small airframes. As UAV adoption accelerates globally, especially in border surveillance and precision strike operations, the demand for specialized rubber tanks tailored for UAVs is expected to surge.

Market Opportunities

- Integration of Smart Monitoring Systems: The next frontier in military aviation involves digitization and predictive maintenance. Rubber tanks integrated with IoT-enabled sensors can monitor fuel levels, detect leaks, and predict wear and tear in real time. This capability enhances mission readiness and reduces downtime, offering defense agencies a strong value proposition. Manufacturers that invest in smart tank technologies will gain a competitive edge in securing long-term defense contracts.

- Expansion into Emerging Defense Markets: Developing regions such as the Asia Pacific, Latin America, and the Middle East are witnessing rapid defense modernization programs. These markets present significant opportunities for rubber tank manufacturers to establish localized production facilities or form strategic partnerships with regional defense contractors. Tailoring products to meet local requirements—such as compatibility with indigenous aircraft platforms—can unlock substantial growth potential.

- Development of Advanced Self-Sealing and Fire-Resistant Technologies: Combat survivability is a top priority for defense forces. Innovations in elastomer chemistry to enhance self-sealing capabilities and fire resistance will attract defense agencies seeking superior safety standards. Tanks that can automatically seal bullet punctures and resist ignition during high-temperature exposure will become indispensable in next-generation fighter jets and rotary-wing aircraft. Manufacturers focusing on these advanced features can position themselves as leaders in military aviation safety.

Military Aircraft Rubber Tanks Market Report Segmentation Analysis

By Material

- Nitrile Rubber : Known for excellent fuel resistance and flexibility, nitrile rubber is widely used in tanks for fixed-wing and rotary aircraft. It offers durability under extreme temperatures and chemical exposure.

- Urethane Rubber: Provides superior abrasion resistance and structural integrity, making it suitable for high-performance aircraft and UAV applications.

By Aircraft Type

- Fixed Wing Aircraft: Includes fighter jets, transport aircraft, and bombers. These platforms require large-capacity tanks with advanced sealing technologies.

- Rotary Wing Aircraft: Helicopters used in combat and rescue missions demand compact, puncture-resistant tanks for operational safety.

- UAV: Lightweight tanks designed for endurance and reliability in unmanned aerial systems, supporting long-range missions.

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

Military Aircraft Rubber Tanks Market Regional Insights

The regional trends and factors influencing the Military Aircraft Rubber Tanks Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Military Aircraft Rubber Tanks Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Military Aircraft Rubber Tanks Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1.53 Billion |

| Market Size by 2034 | US$ 2.64 Billion |

| Global CAGR (2026 - 2034) | 6.20% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Military Aircraft Rubber Tanks Market Players Density: Understanding Its Impact on Business Dynamics

The Military Aircraft Rubber Tanks Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Military Aircraft Rubber Tanks Market top key players overview

Military Aircraft Rubber Tanks Market Share Analysis by Geography

North America

- Market Share: Largest share due to strong defense budgets and the advanced aerospace industry.

- Key Drivers:

- Modernization of the U.S. Air Force and Navy fleets

- High adoption of UAVs for tactical missions

- Strong R&D investments in advanced elastomers

- Trends: Integration of smart sensors and IoT-enabled fuel monitoring systems.

Europe

- Market Share: Significant share driven by NATO defense programs and cross-border collaborations.

- Key Drivers:

- Fleet upgrades under European Defense Fund initiatives

- Growing demand for lightweight fuel systems in fighter jets

- Emphasis on self-sealing technologies for combat survivability

- Trends: Development of eco-friendly elastomers and compliance with stringent safety standards.

Asia Pacific

- Market Share: Fastest-growing region due to rising defense budgets and indigenous aircraft programs.

- Key Drivers:

- Expansion of air forces in China and India

- Increasing UAV deployment for border surveillance

- Government-led defense modernization initiatives

- Trends: Localization of production and partnerships with global suppliers.

Central & South America

- Market Share: Emerging region with growing procurement of military aircraft.

- Key Drivers:

- Defense modernization in Brazil and Argentina

- Rising focus on rotary-wing aircraft for jungle operations

- Investments in UAV programs for surveillance

- Trends: Adoption of cost-effective rubber tank solutions.

Middle East & Africa

- Market Share: Developing market with high growth potential.

- Key Drivers:

- Increased defense spending in Gulf countries

- Demand for advanced fuel systems in combat aircraft

- Rising UAV usage for reconnaissance missions

- Trends: Integration of fire-resistant and self-sealing technologies.

Military Aircraft Rubber Tanks Market Players Density: Understanding Its Impact on Business Dynamics

The market is moderately concentrated, with global players focusing on innovation, material science, and compliance with military standards. Differentiation strategies include:

- Advanced self-sealing and fire-resistant technologies

- Lightweight designs for UAV applications

- Integration of smart monitoring systems

Opportunities and Strategic Moves:

- Partnerships with defense OEMs and government agencies

- Expansion into emerging markets with localized production

- Investment in elastomer R&D for enhanced durability

Major Companies Operating in the Military Aircraft Rubber Tanks Market Are:

- Aero Tec Laboratories, Inc.

- Aircraft Rubber Manufacturing (Fuel Safe Systems)

- Amfuel FFC, Inc.

- Magam Safety Ltd.

- Meggitt PLC

- M.E.RIN

- Musthane

- PFW Aerospace GmbH

Disclaimer: The companies listed above are not ranked in any particular order

Military Aircraft Rubber Tanks Market News and Recent Developments

- In November 2025, Parker Hannifin Corporation, the global leader in motion and control technologies, announced that it had entered into a definitive agreement to acquire Filtration Group Corporation on a cash-free, debt-free basis for a cash purchase price of $9.25 billion, which represented 19.6x Filtration Group's calendar year 2025 estimated adjusted EBITDA, or 13.4x including expected cost synergies. The purchase price was expected to be financed with new debt and cash on hand. The transaction was subject to customary closing conditions, including receipt of applicable regulatory approvals, and was expected to close within six to twelve months. This acquisition strengthened Parker Hannifin's aerospace division, enabling the company to integrate advanced filtration technologies into its fuel containment systems, including Military Aircraft Rubber Tanks, to enhance durability, safety, and performance for next-generation defense platforms.

- In August 2025, Aero Tec Laboratories Ltd (ATL), a global leader in advanced liquid containment technology, exhibited its world-class range of fuel systems and bladder solutions at DSEI 2025 in London, highlighting cutting-edge capabilities for the defense, UAV, marine, and aerospace sectors. With decades of innovation drawn from the extreme demands of motorsport and defense, ATL had designed and manufactured flexible, fabricated, and molded fuel systems that delivered unmatched performance, safety, and reliability in the harshest environments. These solutions included advanced Military Aircraft Rubber Tanks, engineered to provide superior durability and self-sealing properties for combat and tactical aircraft.

Military Aircraft Rubber Tanks Market Report Coverage and Deliverables

The "Military Aircraft Rubber Tanks Market Size and Forecast (2021–2034)" report provides a detailed analysis of the market covering below areas:

- Military Aircraft Rubber Tanks Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Military Aircraft Rubber Tanks Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Military Aircraft Rubber Tanks Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Military Aircraft Rubber Tanks Market

- Detailed company profiles

Frequently Asked Questions

2. Integration of IoT-enabled fuel monitoring systems

3. Lightweight designs for UAV applications

2. Asia Pacific is the fastest-growing region, driven by indigenous aircraft programs and rising UAV deployment.

1. Increasing defense expenditure and fleet modernization

2. Demand for lightweight and high-durability fuel systems

3. Rise in UAV deployment for tactical missions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For