Mobile Card Reader Market Analysis, Growth, Trends, and Forecast by 2031

Mobile Card Reader Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis By Component [Hardware (Integrated Card Reader and Accessories), Software and Services], by Technology (EMV Chip & Pin, Hybrid Readers, Magnetic Stripe, and Near Field Communication & Biometrics), by End Use (Arenas & Entertainment, Healthcare, HoReCa, Retail Stores, and Others)

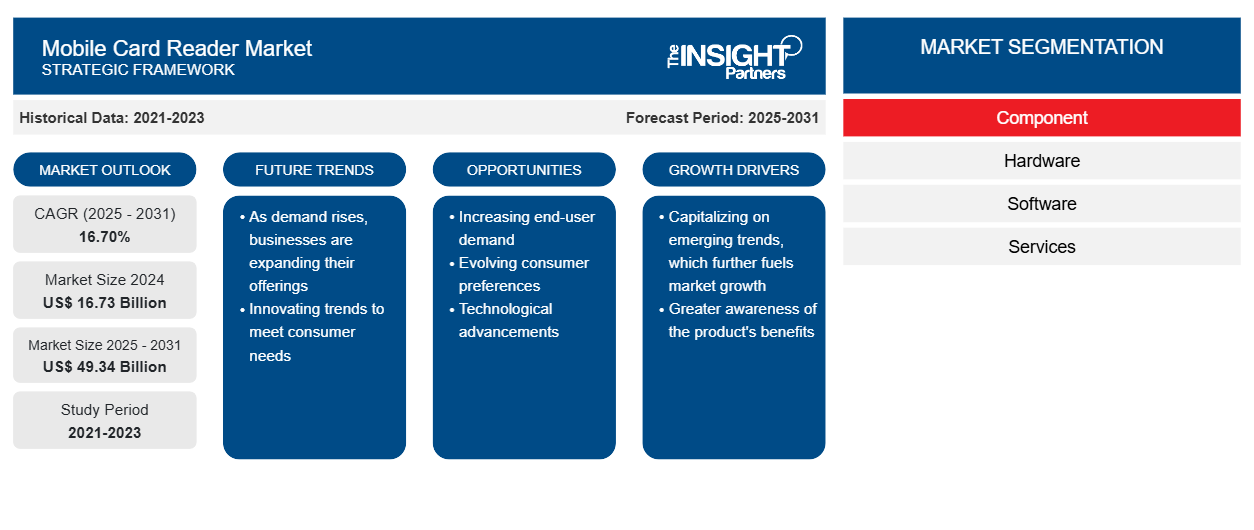

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Mar 2026

- Report Code : TIPRE00031434

- Category : Electronics and Semiconductor

- Status : Upcoming

- Available Report Formats :

- No. of Pages : 150

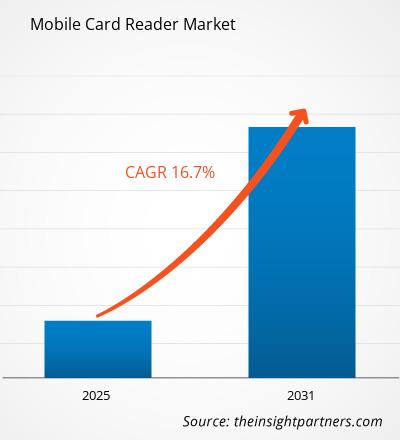

[Research Report] The mobile card reader market is anticipated to grow from US$ 12.29 billion in 2022 to US$ 42.33 billion by 2031, estimated at a CAGR of 16.7 % from 2022 to 2031.

Analyst Perspective:

A mobile card reader is an apparatus that connects to your tablet, laptop, or smartphone and accepts credit and debit card payments. It is small and allows transactions to be carried out using a variety of methods, such as card payments, contactless payments, and tip payments. Mobile card readers also have various functions, such as invoices, receipts, and tax calculations. These devices are cost-effective and charge users a small fee for each transaction. Such instances propel the growth of the market.

Increasing usage of debit cards, credit cards, and smart cards among consumers is the key factor driving the growth of the global mobile card reader market. Increasing digitalization and increasing preference for cashless payments around the world are key trends thrusting the growth of the target market. Mobile card reader reduces paperwork and eliminates the need to stand in line at checkout. This process also tracks transactions that result in the loss of funds for which you are not responsible. Moreover, it is affordable and easy to use. Increasing usage of mobile card readers by businesses to expand their consumer base is also a factor expected to drive the expansion of the market in the future.

Additionally, the development of the e-commerce sector in emerging markets is another factor expected to drive the expansion of the global mobile card reader market. However, security concerns in mobile card readers and instances of identity theft may hinder the growth of the global mobile card reader market. The existence of a cash-based economy is a challenging factor that can affect the growth of the global market.

The acceptance rate of payment gateways among large enterprises is very high as many transactions take place. The largest contributors to this segment are companies from the BFSI, IT, and manufacturing sectors. There are also some extensions of BFSI companies. Intra-regional cross-border banking is also increasing around the world. For instance, as of October 2021, JP Morgan released its card payment provider, QuickAccept, which is a mobile contactless card reader. This will offer same-day deposits without any fee to those with Chase bank accounts.

Thus, the increase in the need for payment gateways will increase the adoption of payment gateways and drive the growth of the mobile card reader market segment during the forecast period.

Mobile Card Reader Market Overview:

A mobile card reader is a small device that connects to a phone or tablet to collect payments from a cardholder's credit card. The versatility of this device allows for card swipe, chip card, and contactless payment transactions. These helps speed up and simplify the payment process.

The increasing adoption of smartphones in digital payments is expected to drive the growth of the mobile card reader market. According to the phone Pay, as of 2021, more than 300 million Indian smartphone users now use digital payments. Also, in North America, 32% of customers use smartphones for the transaction. A smartphone is a mobile phone that is connected to the Internet and has software similar to a laptop. Digital payments are operations that take place online or through digital channels without any physical interchange of funds. This implies that both the payer and the payee exchange money electronically.

The integration of physical card functionality and smartphone functionality will drive the future of card payments and increase the demand for mobile card readers in the retail shopping experience. For example, according to US-based media company Comscore, as of June 2021, nearly 50% of internet transactions worldwide are conducted on mobile devices. It reached 28.6% of transactions or more than US $13.3. Trillion. Therefore, the increasing penetration of smartphones for digital payments is increasing the demand for the market.

As payments become increasingly electronic, NFC payments using contactless IC cards and mobile phones are rapidly becoming popular, and there is a growing need to equip POS terminals with NFC readers. However, it has always been difficult to find additional space for an NFC card reader inside the device housing, as the NFC card reader must maintain the functionality of traditional magnetic cards or contact IC cards. To solve this problem, several players across the globe are launching mobile card readers. For instance, in May 2023, Nidec Instruments developed this new NFC-integrated card reader. Thus, such instances propel the growth of the mobile card reader market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMobile Card Reader Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Increasing Need for Portable and Cheaper Devices for Payment Driving the Mobile Card Reader Market Growth

For small and medium-sized businesses (SMBs) wanting to accept credit and debit card payments, mobile card readers are an effective and low-cost choice. A little card reader that connects to your mobile device either directly or remotely. Customers use this attachment when swiping, dipping, or waving their plastic, just like they would with a regular POS machine. The hardware costs are minimal for mobile card readers (especially if one already has a phone). Moreover, the advancement of mobile credit card processing technology provides users with new payment options. Whether one uses a mobile card reader with their phone or a terminal, using mobile readers for business transactions can help streamline the payment process.

The majority of mobile card readers are user-friendly and may be combined with an organization's current point-of-sale (POS) system to create mobile POS solutions. They can be paired over Bluetooth or a conventional headphone socket with a smartphone, tablet, or other mobile device. The merchant uses a portable card reader to receive payment from the buyer after a few easy steps are followed. The growing need for portable and cheaper payment devices is driving the growth of the mobile card reader market.

Segmental Analysis:

The mobile card reader market is segmented into components, technology, and end-use. Based on the component, the mobile card reader market is segmented into hardware and software & services. The hardware segment is further bifurcated into integrated card readers and accessories. Additionally, the hardware segment held the largest share of the mobile card reader market. In contrast, the software & services segment is anticipated to register the highest CAGR in the mobile card reader market during the forecast period. The technology segment of the market is segmented into EMV chip & pin, hybrid readers, magnetic Stripe, and near field communication & biometrics. The end-user segment of the mobile card reader market is segmented into arenas & entertainment, healthcare, HoReCa, retail stores, and others.

Regional Analysis:

The North American mobile card reader market is expected to grow at a CAGR of xx during the forecast period. North America dominated the global market. The mobile card reader market in this region is anticipated to have the highest growth potential, mainly due to Internet penetration. Additionally, the strong presence and penetration of key market players boost the overall market growth in this region. Additionally, the integration of physical card and smartphone functionality is driving the future of card payments. This factor will increase the demand for mobile card readers in the retail shopping experience. Therefore, the increasing use of smartphones for digital payments is expected to increase the demand for mobile card readers and drive the growth of the North American mobile card reader market during the forecast period.

Additionally, US multinational retail companies and operators of hypermarkets, discount department stores, and grocery stores have entered into partnerships with market participants in the regional market. These collaborations have enabled retailers to offer better digital payment services. Such factors are expected to drive the growth of the mobile card reader market in this region during the forecast period.

Key Player Analysis:

The mobile card reader market analysis consists of players such as Fujian Newland Payment Technology Co Ltd, Ingenico, Intuit Inc., Mswipe Technologies, PAX Technology, PayPal Holdings Inc., Revolut Ltd, SumUp Inc, Verifone Systems Inc., and Wuhan Tianyu Information Industry Co Ltd are among the players in mobile card reader market. Fujian Newland Payment Technology Co Ltd and PAX Technology are the top two players owing to the diversified product portfolio offered.

Recent Developments:

Inorganic and organic growth strategies such as product launches and mergers and acquisitions are highly adopted by mobile card reader market players. A few recent key market developments are listed below:

- In January 2023, Advanced Card Systems Ltd. (ACS) launched the ACR40T USB contact smart card reader in SIM format. The reader is compact and effortless to use via a sliding smart card input slot.

- In May 2023, Nidec Instruments Corporation launched the industry's first card reader with integrated NFC (near-field communication) functionality.

- In May 2023, Stripe, the enterprise financial infrastructure platform, introduced the Stripe Reader S700 to help businesses connect online and in-person payment experiences more closely than ever before. The new Android-based smart reader is part of Stripe Terminal, a variety of developer interfaces, pre-qualified card readers, and logistics management tools. The Stripe Reader S700 is the latest demonstration of Stripe's commitment to personal payments.

Mobile Card Reader Market Regional Insights

The regional trends and factors influencing the Mobile Card Reader Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Mobile Card Reader Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Mobile Card Reader Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 16.73 Billion |

| Market Size by 2031 | US$ 49.34 Billion |

| Global CAGR (2025 - 2031) | 16.70% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Mobile Card Reader Market Players Density: Understanding Its Impact on Business Dynamics

The Mobile Card Reader Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Mobile Card Reader Market top key players overview

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For