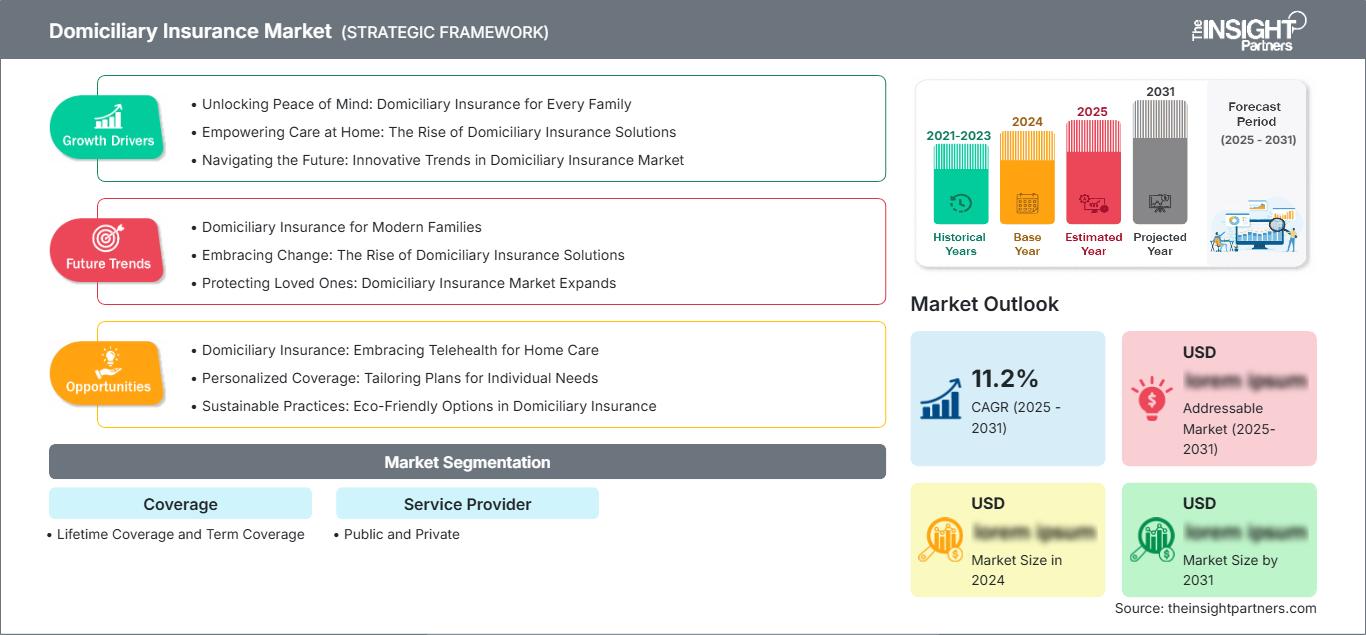

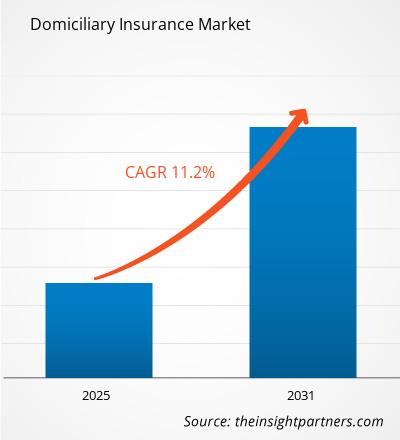

The Domiciliary Insurance Market is expected to register a CAGR of 11.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX million by 2031.

The report is categorized by Coverage (Lifetime Coverage and Term Coverage) and further analyzes the market based on Service Provider (Public and Private). A comprehensive breakdown is provided at global, regional, and country levels for each of these key segments.

The report includes market size and forecasts across all segments, presenting values in USD. It also delivers key statistics on the current market status of leading players, along with insights into prevailing market trends and emerging opportunities.

Purpose of the Report

The report Domiciliary Insurance Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Domiciliary Insurance Market Segmentation

Coverage

- Lifetime Coverage and Term Coverage

Service Provider

- Public and Private

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDomiciliary Insurance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Domiciliary Insurance Market Growth Drivers

- Unlocking Peace of Mind: Domiciliary Insurance for Every Family

- Empowering Care at Home: The Rise of Domiciliary Insurance Solutions

- Navigating the Future: Innovative Trends in Domiciliary Insurance Market

Domiciliary Insurance Market Future Trends

- Domiciliary Insurance for Modern Families

- Embracing Change: The Rise of Domiciliary Insurance Solutions

- Protecting Loved Ones: Domiciliary Insurance Market Expands

Domiciliary Insurance Market Opportunities

- Domiciliary Insurance: Embracing Telehealth for Home Care

- Personalized Coverage: Tailoring Plans for Individual Needs

- Sustainable Practices: Eco-Friendly Options in Domiciliary Insurance

Domiciliary Insurance Market Regional Insights

The regional trends and factors influencing the Domiciliary Insurance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Domiciliary Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Domiciliary Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX million |

| Global CAGR (2025 - 2031) | 11.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Coverage

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Domiciliary Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Domiciliary Insurance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Domiciliary Insurance Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Domiciliary Insurance Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Domiciliary Insurance Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For