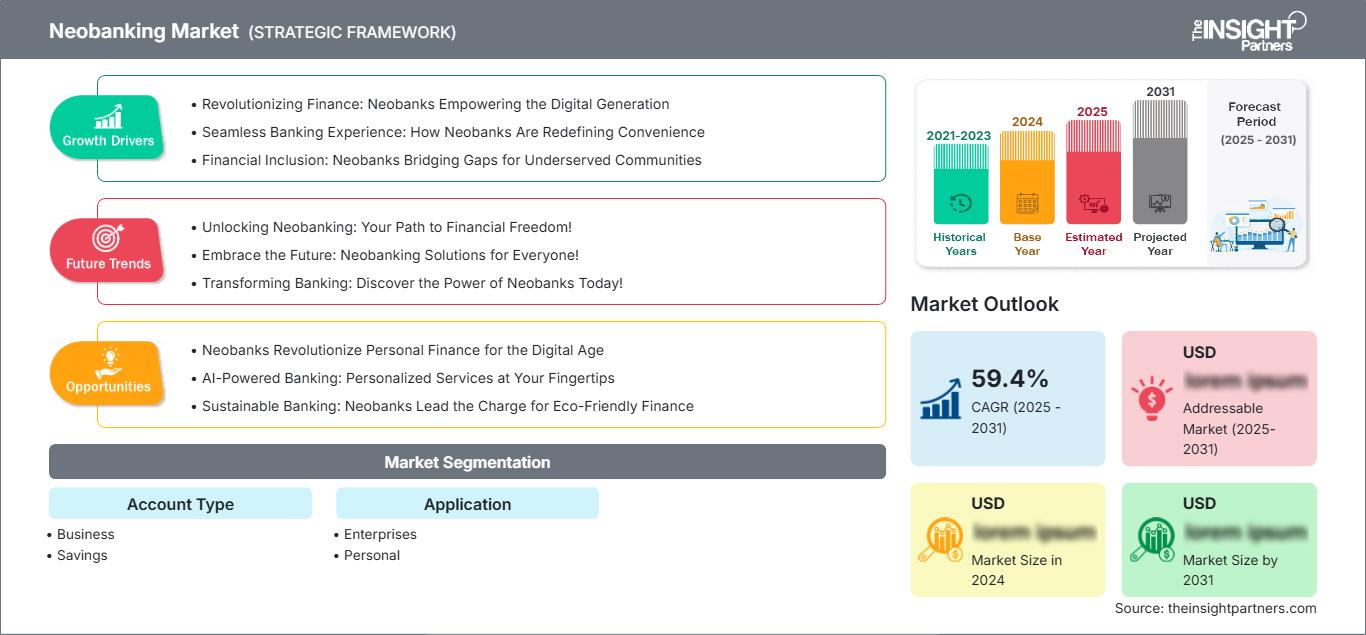

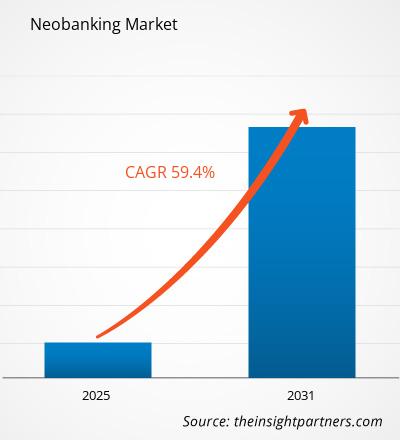

The Neobanking Market is expected to register a CAGR of 59.4% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Billion by 2031.

The report is categorized by Account Type (Business, Savings) and further analyzes the market based on Application (Enterprises, Personal). A comprehensive breakdown is provided at global, regional, and country levels for each of these key segments.

The report includes market size and forecasts across all segments, presenting values in USD. It also delivers key statistics on the current market status of leading players, along with insights into prevailing market trends and emerging opportunities.

Purpose of the Report

The report Neobanking Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Neobanking Market Segmentation

Account Type

- Business

- Savings

Application

- Enterprises

- Personal

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNeobanking Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Neobanking Market Growth Drivers

- Revolutionizing Finance: Neobanks Empowering the Digital Generation

- Seamless Banking Experience: How Neobanks Are Redefining Convenience

- Financial Inclusion: Neobanks Bridging Gaps for Underserved Communities

Neobanking Market Future Trends

- Unlocking Neobanking: Your Path to Financial Freedom!

- Embrace the Future: Neobanking Solutions for Everyone!

- Transforming Banking: Discover the Power of Neobanks Today!

Neobanking Market Opportunities

- Neobanks Revolutionize Personal Finance for the Digital Age

- AI-Powered Banking: Personalized Services at Your Fingertips

- Sustainable Banking: Neobanks Lead the Charge for Eco-Friendly Finance

Neobanking Market Regional Insights

The regional trends and factors influencing the Neobanking Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Neobanking Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Neobanking Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Billion |

| Global CAGR (2025 - 2031) | 59.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Account Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Neobanking Market Players Density: Understanding Its Impact on Business Dynamics

The Neobanking Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Neobanking Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Neobanking Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Neobanking Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For