Next Generation Data Storage Market Key Players and Opportunities by 2030

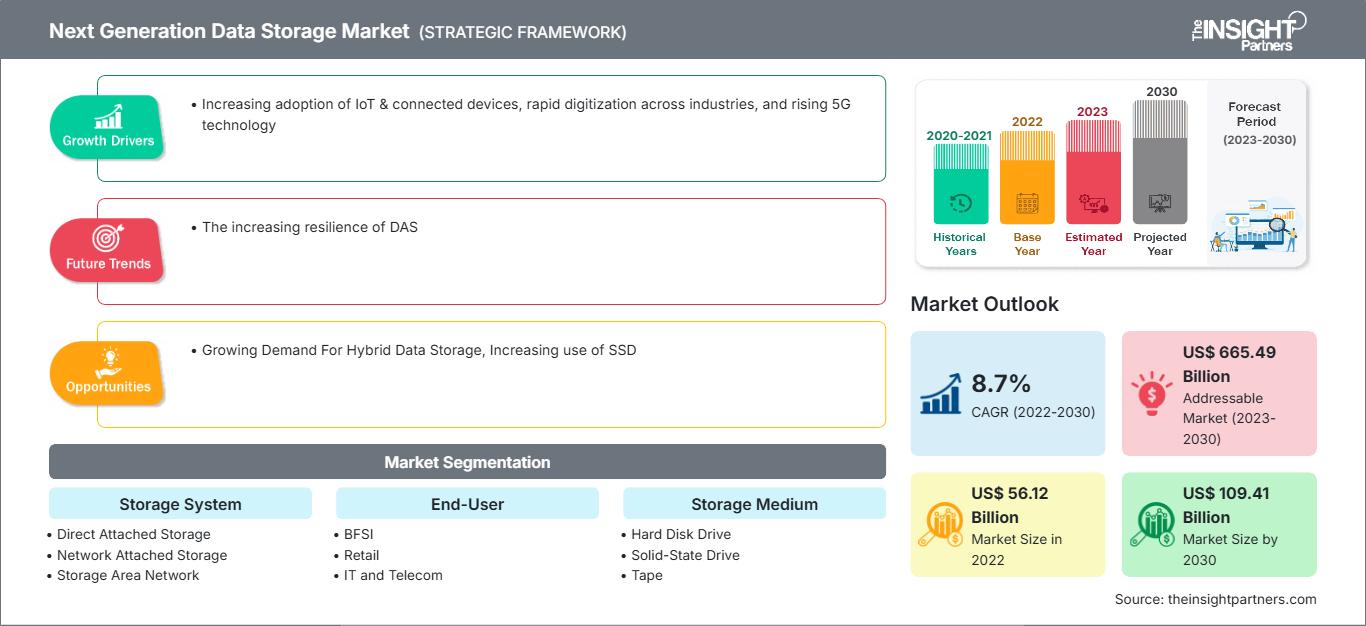

Next Generation Data Storage Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Storage System (Direct Attached Storage (DAS), Network Attached Storage (NAS), and Storage Area Network (SAN)), End-User (BFSI, Retail, IT and Telecom, Healthcare, Media and Entertainment, and Others), Storage Medium (Hard Disk Drive, Solid-State Drive, and Tape), Storage Architecture (File-Object based Storage and Block Storage), and Deployment (On-premise, Cloud-based, and Hybrid) and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Mar 2024

- Report Code : TIPRE00004286

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 161

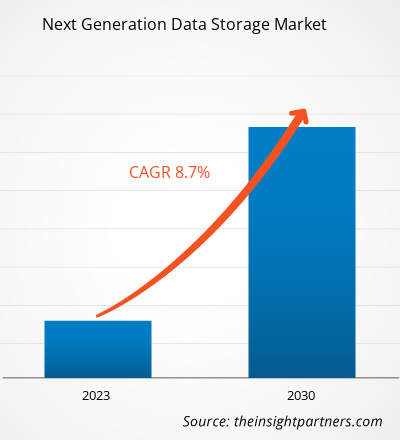

The next-generation data storage market size is projected to reach from US$ 56.12 billion in 2022 to US$ 109.41 billion by 2030; it is estimated to record a CAGR of 8.7% from 2022 to 2030. The increasing resilience of DAS is likely to remain a key trend in the market.

Next Generation Data Storage Market Analysis

The next-generation data storage market in Asia Pacific is experiencing significant growth owing to constant technological advancements, rapid urbanization, and increased investments in research and development by data storage solution providers. One notable development is the launch of the Asia Pacific Data Centre Association (APDCA), which marks the first association of its kind in the region. The APDCA aims to consolidate the shared interests of the data center industry across the Asia Pacific, bringing together data center operators, suppliers, and stakeholders. This association supports advocacies for policies that encourage the sustainable growth of the data center industry. The launch of the APDCA signifies a unified effort to represent the collective interests of the data center industry in Asia Pacific. This association, along with the advancements in technology and the growing market demand, demonstrates the region's commitment to shaping the future of next-generation data storage. The economic development of countries such as Japan and China has also surged the adoption of cutting-edge technologies in enterprises that aim to enhance operational efficiency and maintain competitiveness. Additionally, the presence of a large number of IT industries in the region drives the next-generation data storage market

Next Generation Data Storage Market Overview

5G's significantly faster speeds and lower latency are projected to enable a surge in data generation. The demand for the Internet of Things (IoT) will increase with more smart devices generating real-time data. In addition, with faster downloads and uploads, users will consume and create more data, from 4K/8K video streaming to AR/VR experiences. Also, remote work, cloud applications, and data-driven decision-making will increase enterprise data volumes. This massive data flood necessitates next-gen storage solutions that can handle high volume and velocity with low latency. Efficiently storing and processing real-time data streams requires advanced technologies such as flash storage and in-memory computing.

In November 2023, several companies implemented 5G technologies. For instance, the Port of Tyne, one of the UK's biggest and most important ports, went live with 5G private network connectivity. Together with partners BT and Ericsson, the Port deployed a private network with coverage across the entire estate, making it the UK's first site-wide deployment of 5G standalone connectivity for smart port applications. In addition, in January 2024, Ataya, one of the leaders of unified connectivity for Industry 4.0 and beyond, announced the launch of Chorus, a standalone 5G Access Point (AP) that brings unparalleled simplicity and low-cost benefits to enterprises needing to deploy Private 5G networks rapidly. This will increase the data generation volume. Moreover, partnerships and collaborations between technology giants, telecommunications companies, and storage solution providers will be crucial for driving innovation and delivering integrated solutions. Therefore, 5G technology is acting as a catalyst for the next-generation data storage market, pushing the boundaries of data management and paving the way for faster, more efficient, and scalable storage solutions.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONNext Generation Data Storage Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Next Generation Data Storage Market Drivers and Opportunities

Rapid Digitization Across Industries to Favor Market

Digitization across industries, from healthcare and finance to retail and manufacturing, is creating an explosion in data generation. This includes everything, including sensor data from connected devices and AI-generated insights. Traditional storage solutions struggle with this volume and require constant upgrades or scaling, making next-gen technologies more attractive. Digitized processes and decision-making rely on real-time data access and analysis. Next-gen technologies, including flash storage, NVMe, and software-defined storage, offer significantly faster performance compared to traditional disk drives, enabling smoother operations and faster insights.

Rapidly evolving business needs have further surged the demand for storage solutions that can easily scale up or down as data volumes and access demands fluctuate. Next-gen solutions such as cloud storage and object storage offer on-demand scalability and flexibility, eliminating the need for upfront infrastructure investments and catering to dynamic workloads. Further, new technologies such as AI, IoT, and machine learning generate unstructured and complex data types that require specialized storage solutions. Next-gen technologies such as data lakes and data fabrics offer specialized tools and frameworks for managing and analyzing these diverse data types, unlocking potential value. Thus, rapid digitization is acting as a powerful catalyst for the next-generation data storage market by creating demand for scalable, performant, and secure solutions that can handle the ever-growing volume and complexity of data.

Growing Demand For Hybrid Data Storage

The demands on modern businesses are greater than ever. Companies need to be innovative, flexible, and efficient in order to stay competitive. Hybrid cloud storage, which combines the benefits of public and private cloud environments, including on-premises data centers or edge locations, has emerged as a crucial technology for promoting growth. An architecture framework for hybrid clouds gives businesses the ability to control where data is stored while also efficiently handling spikes in IT demand. It is anticipated that specialized hybrid cloud solutions designed for particular industries or niche requirements will become more popular. These solutions will meet the needs of businesses operating in highly regulated sectors and address their particular compliance requirements while also building greater trust.

Next Generation Data Storage Market Report Segmentation Analysis

Key segments that contributed to the derivation of the next-generation data storage market analysis are storage system, end user, storage medium, storage architecture, and deployment.

- Based on the storage system, the next-generation data storage market is divided into direct attached storage (DAS), network attached storage (NAS), and storage area network (SAN). The network attached storage (NAS) segment will hold a significant market share in 2022.

- By end user, the market is segmented into BFSI, retail, IT and telecom, healthcare, media and entertainment, and others. The BFSI segment held the largest market share in 2022.

- In terms of storage medium, the market is segmented into hard disk drives, solid-state drives, and tape. The hard disk drive segment held the largest market share in 2022.

- In terms of storage architecture, the market is segmented into file-object-based storage and block storage. The file-object-based storage segment held the largest market share in 2022.

- In terms of deployment, the market is segmented into on-premise, cloud-based, and hybrid. The on-premise segment held the largest market share in 2022.

Next Generation Data Storage Market Share Analysis by Geography

The geographic scope of the next-generation data storage market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The next-generation data storage market in Asia Pacific is experiencing significant growth, propelled by various factors. Firstly, there is a remarkable surge in the number of laptop and smartphone users, accompanied by rising disposable income and increasing consumer awareness. As a result, the region is witnessing strong demand for dependable, secure, and cost-effective storage infrastructure. Secondly, the presence of a substantial number of IT industries in countries such as China, Japan, and India plays an essential role in driving market expansion. Additionally, the adoption of technologies such as big data, IoT, and other digital platforms in economies including China, India, Japan, and South Korea amplifies the need for efficient data storage management solutions. The emergence of data hubs and commercial organizations in Asia Pacific also promotes its dominance in the next-generation data storage market.

Next Generation Data Storage Market Regional Insights

The regional trends and factors influencing the Next Generation Data Storage Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Next Generation Data Storage Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Next Generation Data Storage Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 56.12 Billion |

| Market Size by 2030 | US$ 109.41 Billion |

| Global CAGR (2022 - 2030) | 8.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Storage System

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Next Generation Data Storage Market Players Density: Understanding Its Impact on Business Dynamics

The Next Generation Data Storage Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Next Generation Data Storage Market top key players overview

Next Generation Data Storage Market News and Recent Developments

The next-generation data storage market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the next-generation data storage market are listed below:

- DDN, the global leader in artificial intelligence (AI) and multi-cloud data management solutions, announced the launch of DDN Infinia. This next-generation software-defined storage platform leverages two decades of DDN engineering in file systems, data orchestration, and AI-based optimization, all coming together to usher in the era of accelerated computing and generative AI. (Source: DDN, Press Release, November 2023)

- Hitachi, Ltd. announced the transformation of its existing data storage portfolio with the introduction of Hitachi Virtual Storage Platform One, a single hybrid cloud data platform. Having a common data plane across structured and unstructured data in block, file, and object storage allows businesses to run different types of applications anywhere—on-premises and in the public cloud—without any complexities. (Source: Hitachi, Ltd, Press Release, October 2023)

Next Generation Data Storage Market Report Coverage and Deliverables

The “Next Generation Data Storage Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Next-generation data storage market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Next-generation data storage market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Next-generation data storage market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the next-generation data storage market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For