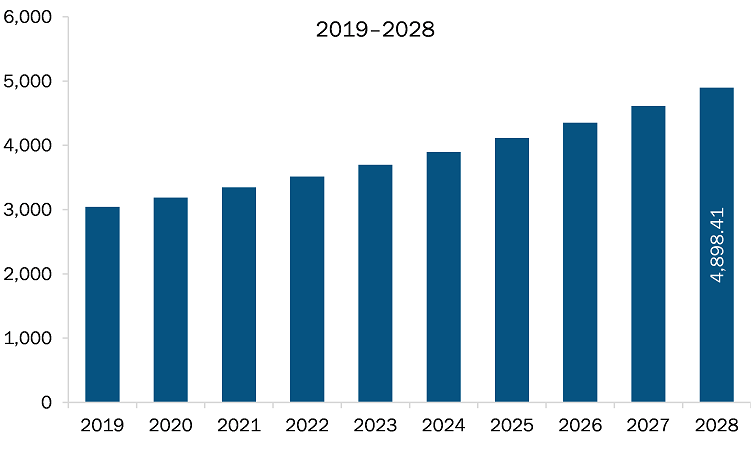

The food inclusions market in North America is expected to grow from US$ 3,345.79 million in 2021 to US$ 4,898.41 million by 2028; it is estimated to grow at a CAGR of 5.6% from 2021 to 2028.

Food inclusions are ingredients or variegates incorporated in different food products and beverages to impart unique properties such as color, flavor, and texture. Several food inclusions are also known for their nutritional benefits. They have a wide application scope, including baked products, confectioneries, sweet and savory snacks, frozen desserts, beverages, breakfast cereals, and dairy products. The ingredients are available in forms such as freeze-dried, infused, case-frozen, micro-dried, individually quick frozen (IQF), spray-dried, and whole foods, and are selected depending on their application. Consumer buying behavior and consumption pattern, as well as eating experience are highly influenced by the texture and flavor of a food product. Thus, it is necessary to select the most suitable format of a food inclusions for a particular application. For instance, infused blueberries are used to render a complete mouth-feel and chewiness, whereas freeze-dried blueberries are used to achieve crispiness. Furthermore, dehydrated blueberries are used in foodstuffs or beverages requiring standout presence of blueberries. In the bakery segment, food inclusions have been in use for a long period to enhance the sensory properties, texture, aesthetics, and provide indulgence. Further, many of food inclusions are rich in proteins, essential fatty acids, vitamins, and fiber. Tree nuts, dried fruits, spices, herbs, exotics fruits, cocoa nibs, chocolate, etc., are the majorly used inclusions in bakery products. Further, fruits, nuts, and chocolates are the major food inclusions types used in dairy products and frozen desserts such as ice cream, yogurt, and cheese. For instance, in cultured yogurts, sweet fruits are mainly used as an inclusions to balance the tangy flavor of the cultured yogurt. Food inclusions are mainly added as individually quick-frozen ingredients in dairy products and frozen desserts. The frozen desserts and dairy products application of food inclusions is challenging as they highly influence the overall texture, flavor profile, and shelf life of the final product. Further, beverage manufacturers are highly focusing on food inclusions to cater the rising consumer demand for natural beverages. Exotic fruits, vegetables, tree nuts, and chocolate are the majorly consumed inclusions in various beverages. Beverages in which these ingredients are being incorporated include functional water, flavored water, tea, beer, energy drinks, wine, and milk. Such a wide application scope of food inclusions is a major factor driving the market growth.

The US has the highest number of confirmed cases of coronavirus, as, compared to Canada and Mexico. This has negatively affected the food & beverages industry in the region as the COVID-19 outbreak has negatively affected the supply and distribution chain. The unavailability of raw materials due to lockdown in many raw material supplying countries has halted the production. The food inclusions market has had a major impact on its product trends. The pandemic has propelled consumers to opt for healthy food products with various functional properties. Additionally, to break through the regular routine imposed due to the lockdown, the consumer’s desire for new and innovative products to experience different culinary adventure is also influencing the market trends for food inclusions. Fruits and nuts are expected to witness an increasing demand during the upcoming years owing to the health benefits offered by them. Travel restrictions are influencing the flavor trends in food. Thus, though the COVID-19 pandemic has had a negative impact on the production and supply of food inclusions, it has positively influenced the product trends in the market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the North America food inclusions market. The North America food inclusions market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Food Inclusions Market Segmentation

North America Food Inclusions Market – By Type

- Chocolates

- Fruit and Nuts

- Flavored Sugar and Caramels

- Others

North America Food Inclusions Market – By Form

- Solid

- Semi-Solid

North America Food Inclusions Market – By Application

- Dairy and Frozen Desserts

- Bakery Products

- Breakfast Cereals

- Chocolate and Confectionery Products

- Others

North America Food Inclusions Market – By Country

- US

- Canada

- Mexico

North America Food Inclusions Market – Companies Mentioned

- ADM

- AGRANA Beteiligungs-AG

- Puratos

- Barry Callebaut

- Cargill, Incorporated.

- Kerry Group

- Georgia Nut Company

- Taura Natural Ingredients Ltd

- Sensient Technologies

North America Food Inclusions Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,345.79 Million |

| Market Size by 2028 | US$ 4,898.41 Million |

| Global CAGR (2021 - 2028) | 5.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For