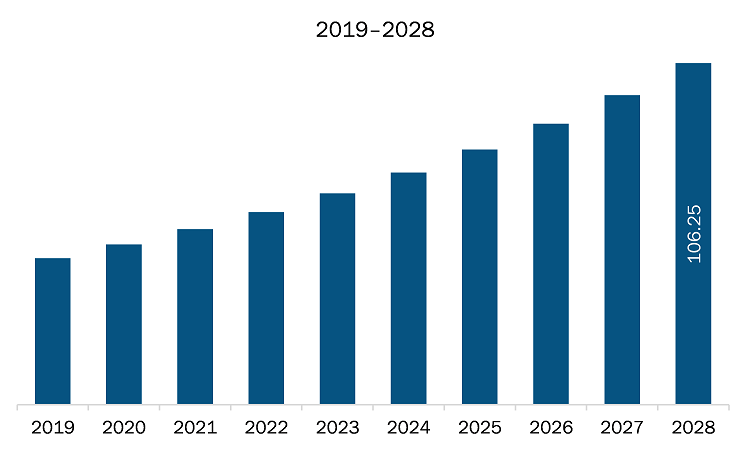

The protective cultures market in North America is expected to grow from US$ 54.62 million in 2021 to US$ 106.25 million by 2028; it is estimated to grow at a CAGR of 10.0% from 2021 to 2028.

The US, Canada, and Mexico are major economies in North America. Growing demand for natural preservatives are the major factor driving the growth of the North America protective cultures market. Consumer preference is shifting toward food and beverages with natural preservatives. Upsurge in the consumption of convenience and ready-to-eat food products propels the demand for foods with longer shelf life, which boosts the need for natural preservatives. Protective cultures are considered a promising alternative in comparison to lactic acid bacteria. The use of protective culture ensures the safety and quality of minimally processed foods items without chemical preservatives. It also extends the shelf life of ready-to-eat products with fresh-tasting. Rise in consumption of ready-to-eat food products coupled with increase in consumption of healthy food, specifically with clean label ingredients, are the major drivers projected to fuel the natural preservatives market growth. In addition, the consumer preference toward clean-label products is surging, owing to the use of bacterial cultures. For instance, in 2017, DSM launched the Delvo Guard range of clean-label dairy cultures designed to inhibit mold and yeast in fresh dairy products without affecting food quality or safety. The company stated that these protective cultures are an addition to DSM’s clean-label range. It delivers an entirely clean-label and natural solution to image-conscious brands looking to contribute to a more sustainable world and rise to the challenge of changing consumer trends and preferences. Moreover, before consumption, health-conscious consumers understand the ingredients used in products through transparent product labeling. Thus, the demand for clean label products comprising natural preservatives is increasing. According to the Food & Health Survey 2016, over 70% of consumers check expiry dates in supermarkets and hypermarkets. This shows that, while consumers value clean labels and natural products, shelf life is also a key driver of purchasing behavior. In addition, recent research has exhibited that consumers are willing to pay more for clean label products, with 1 in 2 people ready to pay at least 10% more for these products, such as yogurt free from artificial preservatives. All such factors drive the demand for the natural preservatives, which is further anticipated to drive the market in North America.North America is one of the worst-affected economies due to the COVID-19 pandemic. The US reported the highest number of confirmed cases of COVID-19, followed by Canada and Mexico. However, the COVID-19 pandemic has had a relatively positive impact on the protective cultures market. The pandemic helped to develop more awareness and interest in the microbial cultures. It has been a disagreeable and a stressful time for most of the population across the world, and therefore the people have started consuming clean label products. The COVID-19 pathophysiology has changed the consumer’s perception of clean beyond labels or products. They continue to maintain their focus on clean label for at-home as well as out-of-home purchases.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Protective Cultures Market Segmentation

North America Protective Cultures Market – By Target Microorganism

- Bacteria

- Yeasts & Molds

North America Protective Cultures Market – By Application

- Food Processing

- Dairy Products

- Beverages

- Meat, Poultry, & Seafood Products

- Others

- Animal Feed

North America Protective Cultures Market– By Country

- US

- Canada

- Mexico

North America Protective Cultures Market-Companies Mentioned

- Bioprox

- Chr. Hansen Holding A/S

- DSM

- International Flavors & Fragrances Inc.

- Kerry Group

- Lallemand Inc.

- Sacco Systems

North America Protective Cultures Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 54.62 Million |

| Market Size by 2028 | US$ 106.25 Million |

| CAGR (2021 - 2028) | 10.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Target Microorganism

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For