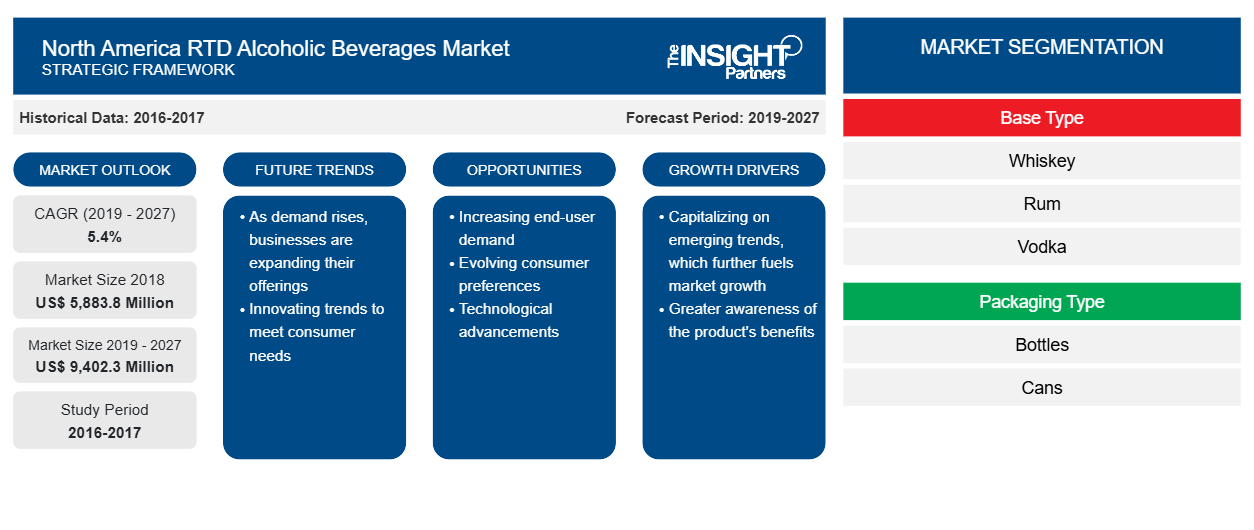

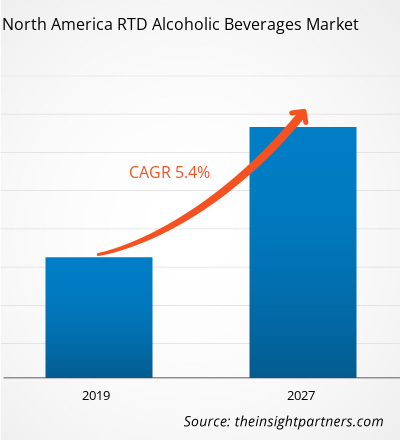

The North America RTD alcoholic beverages market accounted to US$ 5,883.8 Mn in 2018 and is expected to grow at a CAGR of 5.4% during the forecast period 2019-2027, to account to US$ 9,402.3 Mn by 2027.

US is dominating the North America RTD alcoholic beverages market followed by Canada. The market for RTD alcoholic beverages is growing in US owing to increased consumer awareness related to health benefits associated with the beverages. RTD alcoholic beverages has low alcoholic content owing to which it is gaining more acceptance by a larger customer base. The shift in consumer lifestyle along with inclination towards luxury is also expected the growth of market in US region. Manufacturers in the region are focusing more towards innovation and development of new product to boost the growth of North America RTD alcoholic beverages market

North America RTD Alcoholic Beverages Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Rising preference towards low-content alcoholic beverages has led to the growth of North America RTD alcoholic beverages market

The customers in developed and developing countries in North America have become more aware of the adverse impact of excessive alcohol consumption and are moving towards low alcohol content beverages. RTD alcoholic beverages are a good substitute for full-strength alcoholic drinks. The consumers looking for cutting down alcohol consumption prefer these beverages as they have very low alcohol level. Moreover, a wide range of low alcohol beverages with innovative flavors are available in the market. Low alcohol beverages have had most of the alcohol removed by osmosis (many still contain up to 0.5 percent alcohol). These beverages prove to be a better choice for anyone who should avoid alcohol altogether or want to reduce their alcohol intake. RTD alcoholic beverage is ideal for moderate drinkers without health problems. These factors are fuelling the growth of the North America RTD alcoholic beverages market.

Upsurge in the consumption of premium RTD alcoholic beverages will create growth opportunities for the North America RTD alcoholic beverages market

The North America RTD alcoholic beverage consumption is continuously growing with the rise in disposable income and increasing the buying power of the consumer. Millennial are looking forward to high-end and super-premium products, which are also surpassing the growth of premium RTD alcoholic beverage products. The modern trends in premiumization and growing demand from consumers are fostering the need for more innovative RTD alcoholic beverage, which further boosts the North America RTD alcoholic beverages market growth.

Base Type Insights

Based on base type, the North America RTD alcoholic beverages market is bifurcated as whiskey, rum, vodka, gin, and others. The vodka segment dominated the North America RTD alcoholic beverages market. Vodka is called a neutral grain spirit because the standard method for making it is by fermenting and distilling grain. The gains used for vodka production are corn, rye, wheat, or any other grain. Vodka is the most commonly distilled spirit found in cocktails and mixed drinks. It has gained massive popularity due to its general characteristic that it has no distinct flavor or smell. The demand for vodka is continually expanding, and there are many brands available, such as Absolut, Grey Goose, and Ketel One.

Packaging Type Insights

The North America RTD alcoholic beverages market is bifurcated based on packaging type into bottles, cans, and others. The bottle segment accounted for the largest share in the North America RTD alcoholic beverages market. Bottle packaging has been one of the primary reasons that have been inclining the consumers and has helped in favoring the RTD alcoholic beverages across North America. Different types of bottle packaging are available in the market that creates an attractive appearance for the RTD alcoholic beverages. The three types of bottle packaging available are standard, premium, and super-premium. The standard bottle packaging is widely preferred in North America RTD alcoholic beverages marketowing to its low price and easy availability.

Mexico RTD alcoholic beverages market by Application

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America RTD Alcoholic Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

North America RTD Alcoholic Beverages Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

New product development, market initiatives and merger and acquisition were observed as the most adopted strategies in North America RTD alcoholic beverages market. Few of the recent developments in the North America RTD alcoholic beverages market are listed below:

2019:

Asahi Group opened a R&D Center, Asahi Quality and Innovations, Ltd. (AQI). This company is expected to carry out R&D activities, draft research strategies, and work to create new businesses.

2019:

Anheuser-Busch InBev acquired Ohio's Platform Beer Co., an American craft brewery. This acquisitions fills in another hole in AB InBev’s U.S. craft beer map, which further facilitates a path for regional dominance.

2018:

Bacardi Ltd. acquired Patrón Spirits International and its PATRÓN® brand, the world’s top-selling super-premium tequila. Through this acquisition, Bacardi can support Patrón Spirits to grow the PATRÓN brand outside the United States. Thus, the acquisition makes Bacardi the number one spirits company in the super-premium segment in the United States.NORTH AMERICA RTD ALCOHOLIC BEVERAGES MARKET SEGMENTATION

By Base Type

- Whiskey

- Rum

- Vodka

- Gin

- Others

By Packaging Type

- Bottles

- Cans

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Liquor Specialty Store

- Others

By Country

- US

- Canada

- Mexico

Company Profiles

- Anheuser Busch Inbev NV

- Asahi Group Holdings, Ltd

- The Boston Beer Company, Inc

- Bacardi Limited

- Carlsberg Breweries A/S

- Diageo plc

- Halewood Wines & Spirits

- Heineken N.V.

- Mike's Hard Lemonade Co.

- Pernod Ricard

North America RTD Alcoholic Beverages Market Regional Insights

The regional trends and factors influencing the North America RTD Alcoholic Beverages Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses North America RTD Alcoholic Beverages Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for North America RTD Alcoholic Beverages Market

North America RTD Alcoholic Beverages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 5,883.8 Million |

| Market Size by 2027 | US$ 9,402.3 Million |

| Global CAGR (2019 - 2027) | 5.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Base Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

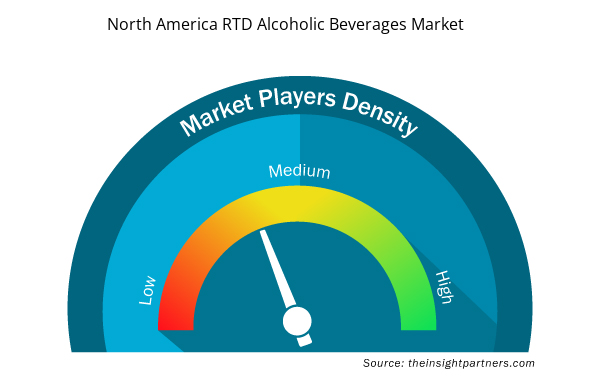

North America RTD Alcoholic Beverages Market Players Density: Understanding Its Impact on Business Dynamics

The North America RTD Alcoholic Beverages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the North America RTD Alcoholic Beverages Market are:

- Anheuser Busch Inbev NV

- Asahi Group Holdings, Ltd

- The Boston Beer Company, Inc

- Bacardi Limited

- Carlsberg Breweries A/S

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the North America RTD Alcoholic Beverages Market top key players overview

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Base Type, Packaging Type, Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies

- Anheuser Busch Inbev NV

- Asahi Group Holdings, Ltd

- The Boston Beer Company, Inc

- Bacardi Limited

- Carlsberg Breweries A/S

- Diageo plc

- Halewood Wines & Spirits

- Heineken N.V.

- Mike's Hard Lemonade Co.

- Pernod Ricard

Get Free Sample For

Get Free Sample For