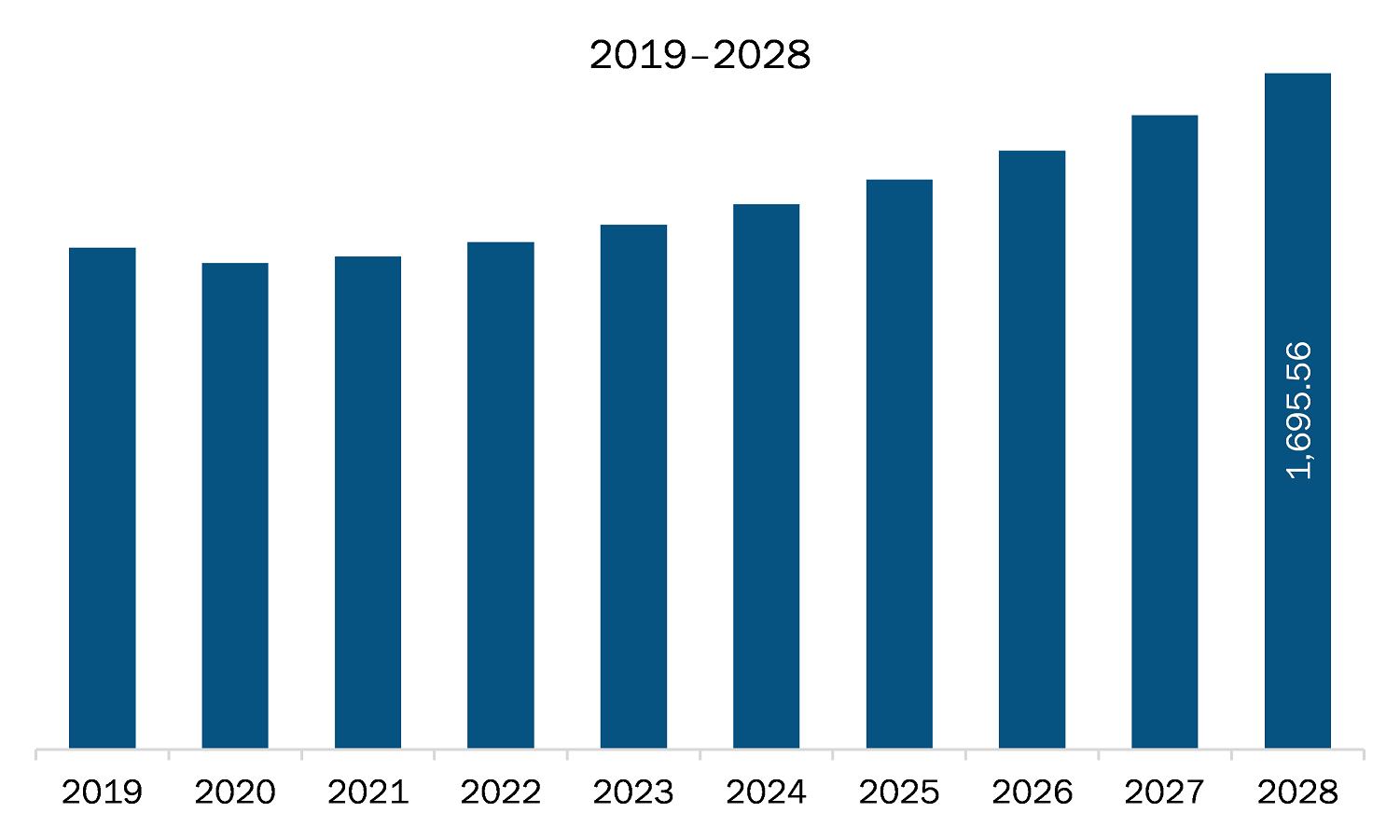

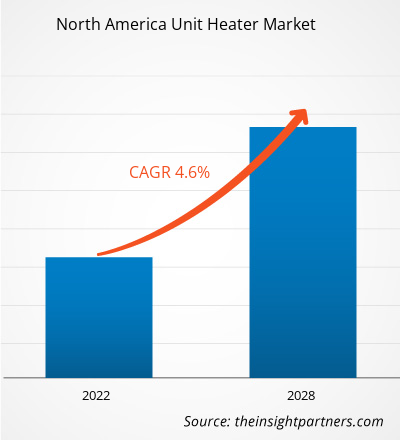

The unit heater market in North America is expected to grow from US$ 1,236.18 million in 2021 to US$ 1,695.56 million by 2028; it is estimated to grow at a CAGR of 4.6% from 2021 to 2028.

The US, Canada, and Mexico are economies in North America. Major unit heater manufacturers are focusing on offering energy-efficient products that offer optimal heating, exhibit low maintenance and operational costs, and operate with decreased emission levels. For instance, Modine Manufacturing Company launched a new unit heater named Affinity, which features a dual heat exchanger, power exhauster, and separated combustion chamber, thereby emitting less CO2 levels and increases the overall heating efficiency.Rising demand for low-noise operations, integration of electric heaters with solar panels, growing use of sensors to automatically adjust the temperature, and elevated efficiency at lower costs are the factors driving the growth of the unit heaters market. The manufacturers are focusing on the implementation of new motor designs with low-noise fans, and the integration of thermostat, remote control option, and screen display in unit heaters. According to the US Department of Energy, several states in the country are adopting the state efficiency standards for unit heaters, which would further encourage the production of energy-efficient unit heaters. Hazloc Heaters developed an explosion-proof electric air heater for operations in hazardous conditions to meet the US and Canadian certification standards. The heater features spark-resistant fan assembly, which is in the quality standard of AMCA 99-10. Further, increase in demand for energy-efficient equipment in the food & beverages, manufacturing, chemicals, pharmaceutical, oil & gas, and other sectors is boosting the unit heater market growth. According to the US Energy Information Administration (EIA), the manufacturing sector accounted for ~77% of the industrial energy consumption. In addition, the growing replacement and maintenance of unit heaters are driving the demand for energy-efficient unit heaters.During late Q1 and entire Q2, the majority of the manufacturing facilities in North America operated with minimum staff or halted their manufacturing momentarily; the supply chain of components and parts were disrupted. According to the American Institute of Architects (AIA), the outbreak of COVID-19 has significantly impacted the construction industry in US. The construction activity declined in 2020 and the trend is likely to prevail in 2021. The construction activities in terms of hospitality industry are declined by approximately 20%, by 11% in commercial offices and approximately 8% in the retail sector. However, the construction of healthcare facilities and public safety have surged in 2020. The industries that install higher volumes of HVAC systems have been hit at various levels of degree by the COVID-19 pandemic. Hotels, hospitality, and restaurants have been struggling due to concerns over contracting the virus, even after they could reopen. The Canadian and Mexican unit heaters market also witnessed and are experiencing similar tremors owing the widespread of COVID-19 virus. The commercial sector in the two countries have been witnessing significant shocks. Apart from commercial sector, the residential HVAC systems industry in Canada and Mexico also observed decline in sales. Moreover, as the economies reponed and restriction measures were relaxed along with vaccine drive augment the growth of unit heaters market from 2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the unit heater market. The North America unit heater market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

North America Unit Heater Market Segmentation

North America Unit Heater Market – By Installation

- Horizontal Unit Heater

- Vertical Unit Heater

Suspended Unit Heater

North America Unit Heater Market – By Application

- Commercial

- Industrial

- Residential

North America Unit Heater Market -By Product Type

- Gas Fired

- Hydronic

- Electric

- Others

North America Unit Heater Market- By Country

- US

- Canada

- Mexico

North America Unit Heater Market-Companies Mentioned

- Airtherm

- Armstrong International Inc.

- Beacon Morris

- Dunham-Bush Limited

- KING ELECTRICAL MFG. CO.

- Kroll Energy GmbH

- Reznor HVAC

- Thermon Industries, Inc.

- Trane

- Turbonics, Inc.

North America Unit Heater Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,236.18 Million |

| Market Size by 2028 | US$ 1,695.56 Million |

| Global CAGR (2021 - 2028) | 4.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Installation

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Sleep Apnea Diagnostics Market

- Predictive Maintenance Market

- Sweet Potato Market

- Toothpaste Market

- Electronic Health Record Market

- Artificial Intelligence in Healthcare Diagnosis Market

- Lyophilization Services for Biopharmaceuticals Market

- Smart Grid Sensors Market

- Space Situational Awareness (SSA) Market

- Human Microbiome Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

- Airtherm

- Armstrong International Inc.

- Beacon Morris

- Dunham-Bush Limited

- KING ELECTRICAL MFG. CO.

- Kroll Energy GmbH

- Reznor HVAC

- Thermon Industries, Inc.

- Trane

- Turbonics, Inc.

Get Free Sample For

Get Free Sample For