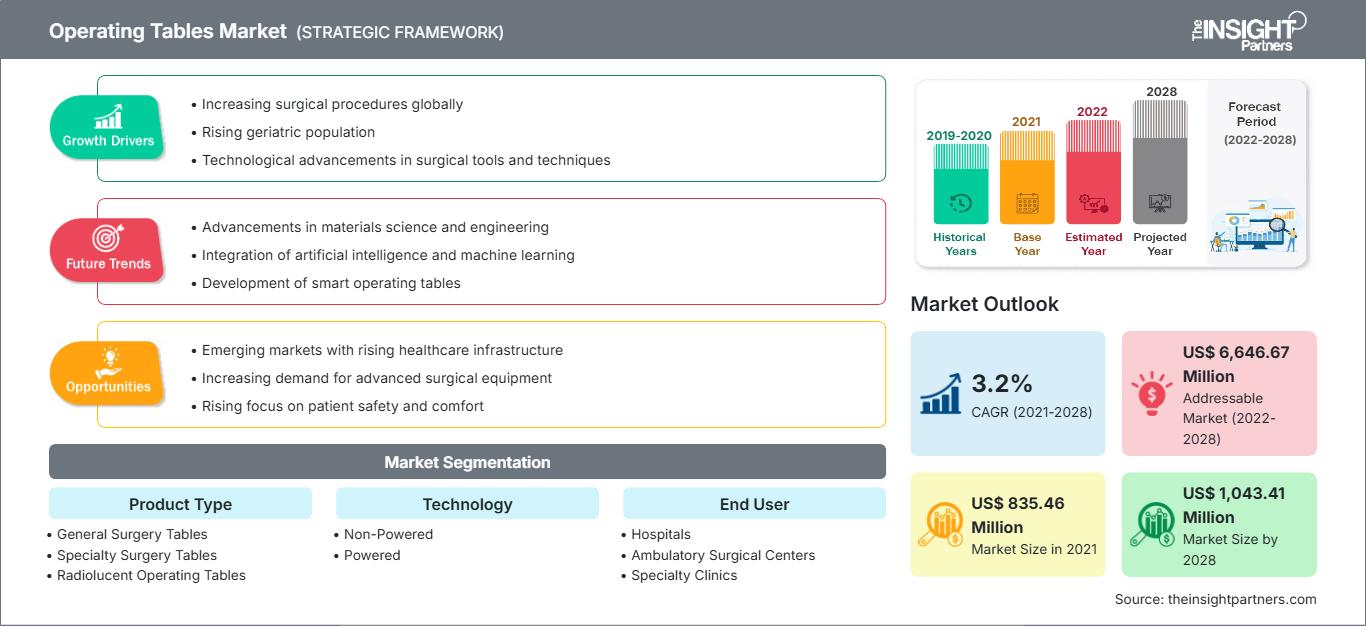

Operating Tables Market Share and Forecast by 2028

Operating Tables Market Forecast to 2028 - Analysis By Product Type (General Surgery Tables, Specialty Surgery Tables, Radiolucent Operating Tables, Pediatric Operating Tables); Technology (Non-Powered, Powered); End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics); and Geography

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Aug 2021

- Report Code : TIPRE00008980

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 177

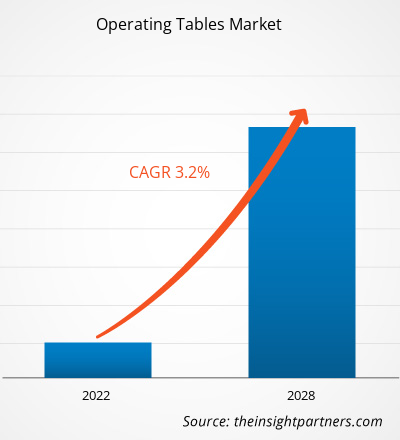

The operating tables market is projected to reach US$ 1,043.41 million by 2028 from US$ 835.46 million in 2021; it is estimated to grow at a CAGR of 3.2% from 2021 to 2028.

Operating tables are typically used within an operating room or surgical suite of a hospital, ambulatory surgery center, or other healthcare facilities, where surgeries are performed. Stationary or mobile operating tables are available in the market.

The operating tables market is segmented on the basis of product type, technology, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers insights and in-depth analysis of the market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the globally leading market players.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOperating Tables Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increasing Number of Hospitals and Clinics Drives Operating Tables Market Growth

The hospital industry across the world is growing at a rapid pace. Although the average hospital stays for a single patient has been slightly decreased from 7 days to 5–6 days in the last couple of decades, the total number of hospital admissions has increased in the last 5–6 years. Moreover, according to the American Hospital Association, the total number of all hospitals in the US in 2019 was 6,090.

According to the Department of Industrial Policy and Promotion (DIPP), the hospital and diagnostic centers in India have attracted Foreign Direct Investments (FDIs) worth US$ 6 billion in the last couple of decades. According to the Ministry of Health and Family Welfare, the Government of India, India and Cuba signed a Memorandum of Understanding (MoU) to increase cooperation in the areas of health and medicine. Furthermore, a de-merger between Fortis Healthcare and Manipal Hospitals Enterprises has been carried out to raise US$ 602.41 million, which can be further invested to expand hospital infrastructure in Manipal Hospital Enterprise. The operating tables industry in India is booming owing to a few factors such as rising government and private sector investments, increasing geriatric population, and surging hospital count.

Hospitals are known to amplify the effectiveness and quality of healthcare. Moreover, the World Health Organization (WHO) states that hospitals are an essential part of health system development. This has drawn the attention of Health Ministries in multiple countries to focus on improving the healthcare infrastructure and establish a hospital and clinical facilities in rural and urban areas. For instance, in November 2017, Japan’s Health Ministry made free access to healthcare centers available in the country through the establishment of new hospitals. Thus, the rising number of hospitals and clinics across the world boosts the growth of the operating tables market.

Surging Number of Surgical Procedures Contribute Significantly to Operating Tables Market Growth

There is a rise in the number of cardiovascular surgeries and general surgeries performed across the world. The incidence of cardiovascular diseases has increased in European countries over the last 25 years. In the region, conditions and symptoms, such as a rise in diabetic cases and lifestyle changes, are leading to an increasing number of cardiovascular surgeries and general surgeries. According to a longtime voluntary registry founded by the German Society for Thoracic and Cardiovascular Surgery (GSTCVS), in 2018, overall, 174,902 cardiac, thoracic, and vascular surgical procedures were reported to the registry among them. In addition, the number of isolated heart transplantations grew to 312 in 2018, an increase of 23% compared to the previous year. Along with cardiovascular surgeries, the number of general surgeries is also increasing, which fuels the growth of the operating tables market.

Cancer and diabetes are the leading cause of mortality across the globe. For instance, as per a study carried out by the American Cancer Society (ACS), in 2018, ~1,735,350 new cancer cases were diagnosed in the US. Furthermore, according to the International Diabetes Federation (IDF), in 2017, an estimated 46 million Americans were suffering from diabetes. The number is expected to reach 62 million by 2045. The same study also mentioned that ~425 million people worldwide were suffering from diabetes in 2017, and the number is likely to reach ~629 million by 2045. Such a high prevalence of chronic conditions increases the number of surgical procedures. Moreover, according to the data published by the Obesity and Metabolic Surgery Society of India in 2020, the number of bariatric surgeries in India increased by around 86.7% during 2014–2018 in India. In addition, according to the study published by the American Society for Metabolic and Bariatric Surgery, in 2019, around 252,000 weight loss surgeries were performed in the US.

In 2018, according to Globocan, around 16,209 new breast cancer cases were registered in the Netherlands. The number is large in comparison to other types of cancers. According to an article published in 2017 by Elsevier ltd, around 1 to 3% of the female population carry breast implants in the Netherlands. Breast surgeries are among the most common procedures in plastic surgeries performed in the country. The increasing number of surgical procedures is creating a need for operating tables. Therefore, the staggering prevalence of chronic conditions and rising surgical procedures generate the demand for operating tables, which fuels the growth of the operating table market.

The number of road accidents is increasing across the world. For instance, according to the National Inter-ministerial Observatory of Road Safety (ONISR), in France, 6,520 people were injured in road accidents in May 2018. The surging number of road accidents eventually leads to the rise in the number of orthopedic procedures and treatments, which, in turn, is boosting the growth of the operating table market.

Product Type Insights

Based on product type, the global operating tables market is segmented into general surgery tables, specialty surgery tables, radiolucent operating tables, and pediatric operating tables. The market for the specialty surgery tables segment is sub segmented into orthopedic surgery, neurosurgical, laparoscopic, and bariatric surgery. In 2020, the general surgery tables segment held the largest market share. However, the specialty surgery tables segment is expected to register the highest CAGR in the market during 2021–2028. A general surgical table is designed for versatility and adaptability across a wide array of operations. The table can be adjusted for height and length as well as can be tilted to either side. The rising burden of chronic diseases is one of the major factors propelling the demand for operating tables across the world.

Technology Insights

Based on technology, the operating tables market is bifurcated into non-powered and powered. The non-powered segment is likely to hold a larger market share in 2021, and it is expected to dominate the market by 2028. Owing to the advancements in surgeries and other medical procedures, healthcare professionals across the world need adjustable equipment that can be precise, fast, and easy to control. In powered operating tables, there is a source of power control that operates various settings, such as the movement of the table, adjustment of height, and the inclination of the tabletop. These aspects are propelling the market growth for the technology segment.

End User Insights

Based on end user, the operating tables market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. The hospitals segment is likely to hold the largest market share, and it is expected to dominate the market by 2028. The ambulatory surgical centers segment is expected to lead the market as the centers offer cost-effective services and convenient environment, which is less stressful than hospitals. The increasing number of ASCs across the world is driving the market growth for the ambulatory surgical centers segment.

Product launches and mergers and acquisitions are highly adopted strategies by the players operating in the global operating tables market. A few of the recent key product developments are listed below:

In December 2020, Skytron launched the GS70 Salus surgical table, the first of the guardian series surgical table. The table offers unique and advanced features and technologies, and keeps the user informed. It facilitates research and continuous improvement by utilizing the captured performance data.

In July 2020, Hillrom launched the PST 500, a precision surgical table designed to be versatile and intuitive to provide the best care for patients. The PST 500 served as the foundation of surgical care during a wide range of positions across various surgical applications. The PST 500's safety features comprise a 454 kg weight capacity, ergonomic handling, collision monitoring, a self-leveling floor locking system, as well as a light-messaging system to help combat alarm fatigue, remote control, and easy setup and use. The company also introduced the PST 300, a versatile, intuitively designed multi-function surgical table suitable for handling general surgery, orthopedics, and neurosurgery. Furthermore, the highly advanced addition to the Yellofins Stirrups line provides enhanced safety, a dual-rod design that prevents medial leg drop, automatic position-locking technology to safely position the patient, along with enhanced infection control.

Healthcare systems are overburdened owing to the COVID-19 outbreak pandemic, and the delivery of medical care to all patients has become a challenge worldwide. In addition, the medical device industry is witnessing a negative impact of the pandemic. As the COVID-19 pandemic continues to unfold, medical device companies are finding difficulties in managing their operations. Many companies offering operating tables have their business operations in the US. The outbreak has adversely affected their businesses owing to the restriction on the distribution of products and the temporary closure of companies’ facilities. However, gradually hospitals have started resuming elective procedures as the COVID-19 recovery rate is increasing. This factor is propelling the demand for medical equipment, such as operating tables, which is expected to bolster the market growth in the coming years.

Operating Tables Market Regional InsightsThe regional trends and factors influencing the Operating Tables Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Operating Tables Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Operating Tables Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 835.46 Million |

| Market Size by 2028 | US$ 1,043.41 Million |

| Global CAGR (2021 - 2028) | 3.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Operating Tables Market Players Density: Understanding Its Impact on Business Dynamics

The Operating Tables Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Operating Tables Market top key players overview

Operating Tables – Market Segmentation

The global operating tables market is segmented on the basis of product type, technology, end user, and geography. In terms of product type, the market is segmented into general surgery tables, specialty surgery tables, radiolucent operating tables, and pediatric operating tables. Based on technology, the operating tables market is segmented into non-powered and powered.

Based on end user, the operating tables market is segmented into hospitals, ambulatory surgical centers, and specialty clinics. In terms of geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America.

Company Profiles

- Skytron, LLC.

- Steris, PLC.

- AGA Sanitätsartikel GmbH

- Alvo

- Denyers International

- Getinge AB

- Mizuho Medical

- Merivaara

- Stryker Corporation

- Hill Rom Holding Inc.

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For