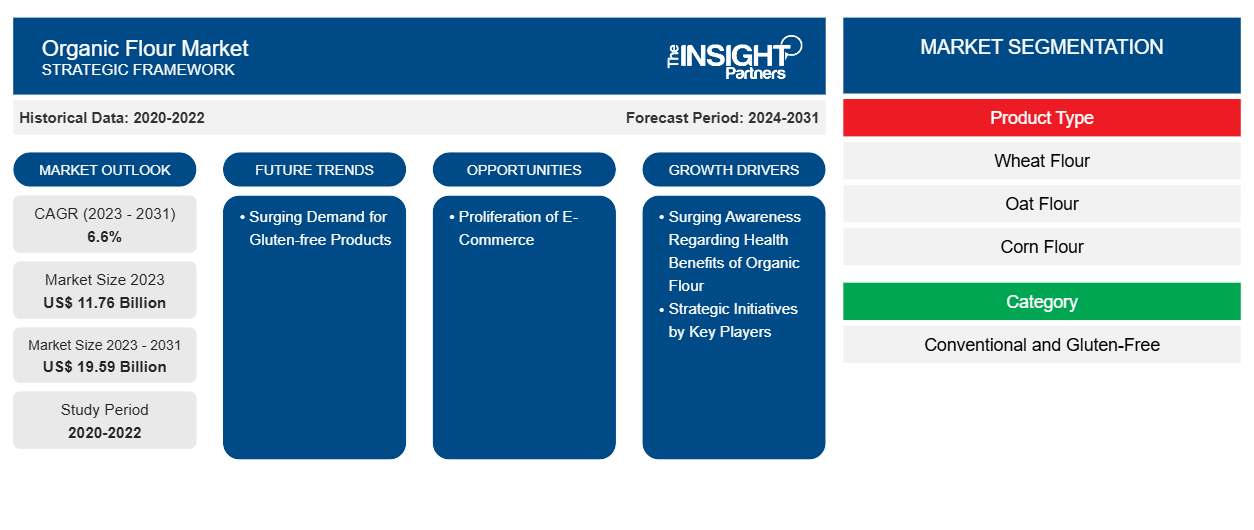

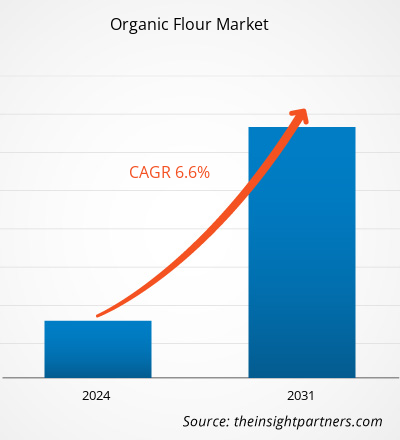

The organic flour market size is expected to grow from US$ 11.76 billion in 2023 to US$ 19.59 billion by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031.

Market Insights and Analyst View:

The demand for organic flour has surged as consumers are becoming more health-conscious and seeking organic products. Organic flour is produced from grains grown without toxic pesticides, synthetic fertilizers, or genetic engineering techniques. Its demand has surged due to increasing consumer preferences for healthier, environmentally friendly, and ethically produced food products. Additionally, the rich nutritional value and potential health benefits of organic foods have contributed to the increase in demand. This surge is part of the larger trend in the organic food industry, which has seen significant growth in recent years. In addition, owing to a growing awareness of environmental sustainability, many consumers are opting for organic products to support more eco-friendly farming practices that prioritize soil health and biodiversity. Further, the desire to support local farmers and small-scale producers and offer transparency in food production contributes to the rising demand for organic flour.

Growth Drivers and Challenges:

Strategic initiatives such as mergers and acquisitions, partnerships, campaign launches, and product launches undertaken by various market players to strengthen their positions and capitalize on emerging opportunities are expected to contribute to the growing organic flour market size. For instance, in 2020, ADM acquired the remaining 50% stake in the UK-based organic flour milling company Gleadell Agriculture Ltd. This acquisition enabled ADM to expand its presence in the organic flour market and strengthen its supply chain capabilities. Campaign launches aimed at raising awareness and educating consumers about the benefits of organic flour also play a vital role in driving market growth. Key players often invest in marketing campaigns highlighting organic flour's nutritional advantages, environmental sustainability, and quality standards. These campaigns help create demand, shape consumer preferences, and differentiate organic flour products from conventional alternatives. These campaigns include digital advertising, social media promotions, and educational content to raise consumers' awareness about the advantages of using organic flour in their baking and cooking.

Product launches are integral for maintaining competitiveness and meeting evolving consumer preferences in the organic flour market. Key players continuously innovate and introduce new organic flour products tailored to specific dietary needs, taste preferences, and occasions. For instance, gluten-free organic flour variants cater to consumers with gluten intolerance or sensitivity, while specialty flours such as almond flour or coconut flour appeal to health-conscious consumers seeking alternative baking ingredients. For example, in 2021, Hodgson Mill introduced a new line of organic flour, including organic whole wheat flour, organic all-purpose flour, and organic pastry flour, to cater to consumers seeking organic alternatives for their baking needs and demonstrate Hodgson Mill's commitment to meeting the growing demand for organic flour options. Also, several companies are entering the organic market by launching products such as organic flour.

Regulatory compliances associated with organic flour such as stringent standards and certification processes mandated by regulatory authorities, including the USDA and the EU Organic Regulation, are expected to restrain the global organic flour market growth. Acquiring organic certification entails comprehensive inspections, documentation, and adherence to specific organic farming practices, all of which demand significant time and financial investment from producers. This exhaustive process can act as a deterrent for smaller producers or those with limited resources, hampering the ability to enter or expand within the organic flour market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Organic Flour Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Organic Flour Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

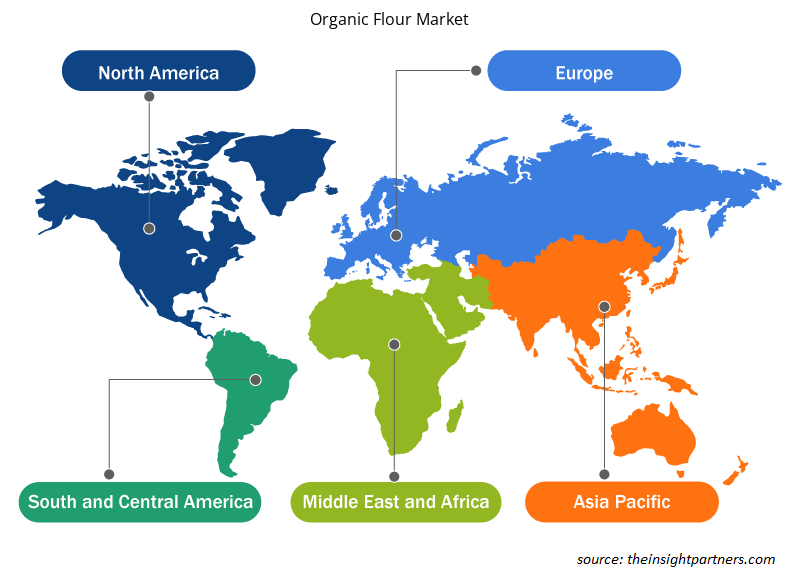

The "Global Organic Flour Market Analysis" has been performed by considering the following segments: product type, category, distribution channel, and geography. Based on product type, the organic flour market is segmented into wheat flour, oat flour, corn flour, rice flour, and others. Based on category, the market is segmented into conventional and gluten-free. By distribution channel, the market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The geographic scope of the organic flour market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on product type, the market is segmented into wheat flour, oat flour, corn flour, rice flour, and others. Based on type, the gluten-free segment is anticipated to hold a significant organic flour market share by 2030. Gluten-free flour is designed for individuals affected by celiac disease or gluten sensitivity and those opting for a gluten-free diet. The demand for gluten-free claims products has upsurged significantly due to the increasing prevalence of gluten-related disorders and a broader health-conscious trend. According to Beyond Celiac, 1 in 133 Americans, or ~1% of the population, suffer from celiac disease in the US. Celiac disease awareness has led many consumers to seek gluten-free alternatives, creating a substantial market for products that cater to dietary restrictions. Moreover, the perception that gluten-free options may be healthier has expanded the consumer base beyond those suffering from medical conditions, contributing to the sustained growth of the organic flour market for the gluten-free segment.

Regional Analysis:

Based on geography, the market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the global organic flour market share. The market in North America accounted for ~US$ 2,900 million in 2023. The Asia Pacific organic flour market is expected to grow at a highest CAGR during the forecast period. Asia Pacific is experiencing rapid urbanization and changing consumer lifestyles. Urban consumers seek organic flour as a critical ingredient for homemade bread, pastries, and other baked goods. Also, the shift toward home baking has been accelerated by factors such as the COVID-19 pandemic, which prompted more consumers to explore cooking and baking at home. As a result, the demand for organic flour as a versatile and nutritious baking ingredient has grown substantially in Asia Pacific, supporting the market expansion.

Asia Pacific is home to diverse agricultural landscapes and traditional farming practices, providing ample opportunities for organic flour production. Countries such as India, China, and Australia have witnessed a rise in organic farming initiatives supported by government policies promoting sustainable agriculture and organic certification programs. This growing interest in organic farming has increased the availability of organic grains and flour produced in the region. The increasing awareness of health and wellness is driving the organic flour market growth in Asia Pacific.

Europe is another major contributor, holding more than 30% of the global market share. Consumers across Europe are increasingly concerned about food safety, environmental sustainability, and the impact of agricultural practices on public health. This has led to a growing preference for organic products, including flour. Consumers in Europe actively seek organic flour produced without synthetic pesticides, herbicides, or GMOs, viewing it as a much safer and more environmentally friendly option than conventional flour. This shift toward organic flour is also driven by changing consumer lifestyles and dietary preferences, with many Europeans opting for healthier and more natural food choices.

Organic Flour Market Regional Insights

The regional trends and factors influencing the Organic Flour Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Organic Flour Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Organic Flour Market

Organic Flour Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 11.76 Billion |

| Market Size by 2031 | US$ 19.59 Billion |

| Global CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Organic Flour Market Players Density: Understanding Its Impact on Business Dynamics

The Organic Flour Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Organic Flour Market are:

- Hometown Food Company

- Bob's Red Mill Natural Foods

- King Arthur Baking Company

- koRo

- Betterbody Foods C/O

- FWP Matthews Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Organic Flour Market top key players overview

Industry Developments and Future Opportunities:

The organic flour market forecast can help stakeholders plan their growth strategies. The following are initiatives taken by the key players operating in the organic flour market:

- In 2022, Dairy major GCMMF, which markets its products under the Amul brand, announced entry into the organic food market with the launch of organic wheat flour. The first product launched in this portfolio is "Amul Organic Whole Wheat Atta."

Competitive Landscape and Key Companies:

Hometown Food Company, Bob's Red Mill Natural Foods, Betterbody Foods C/O, FWP Matthews Ltd, Shipton Mill Ltd, W and H Marriage and Sons Limited, Gilchesters Organics, and Anita's Organic Grain & Flour Mill Ltd. are among the prominent players profiled in the organic flour market report. Players operating in the global market focus on providing high-quality products to fulfill customer demand. They are also adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations in order to stay competitive in the market.

Frequently Asked Questions

Can you list some of the major players operating in the global organic flour market?

The major players operating in the global organic flour market are are Hometown Food Company, Bob's Red Mill Natural Foods, King Arthur Baking Company, koRo, Betterbody Foods C/O, FWP Matthews Ltd, Shipton Mill Ltd, W and H Marriage and Sons Limited, Gilchesters Organics, and Anita's Organic Grain & Flour Mill Ltd.

What are the opportunities for organic flour in the global market?

The proliferation of e-commerce presents a significant opportunity for growth and expansion in the global organic flour market. With the increasing popularity and convenience of online shopping, e-commerce platforms provide organic flour producers with a direct channel to reach consumers worldwide. By leveraging e-commerce platforms, organic flour manufacturers can overcome traditional barriers to entry, such as geographic limitations and distribution challenges, and tap into new markets beyond their local regions. This expanded reach enables organic flour producers to access a broader customer base and capitalize on the growing demand for organic products globally.

Based on the product type, why is the wheat flour segment have the largest revenue share?

Based on product type, wheat flour segment mainly has the largest revenue share. The demand for organic wheat flour is increasing owing to the growing trend of home baking and cooking. In addition, as consumers become more health-conscious, they prefer to bake their bread and pastries using organic wheat flour, which they perceive as a healthier alternative to processed foods. The widespread availability and versatility have attributed to the demand for organic wheat flour.

What is the largest region of the global organic flour market?

North America accounted for the largest share of the global organic flour market. In North America, the demand for organic flour is rapidly growing as consumers are aware of the benefits of organic food products, including flour. Organic flour is produced without synthetic pesticides, herbicides, or genetically modified organisms (GMOs), making it a healthier and more environmentally friendly option. This increased awareness of health and sustainability issues encourages consumers to seek organic alternatives to conventional flour, contributing to the rising product demand in the market. In recent years, the markets for organic products have grown rapidly in North America. There are in total about 23,957 organic producers about 18,000 of whom are in the United States, and over 5,000 in Canada.

What are the key drivers for the growth of the global organic flour market?

Surging awareness regarding health benefits of organic flour and strategic initiatives by key players are key factors driving the growth of the global organic flour market.

Based on the distribution channel, which segment is projected to grow at the fastest CAGR over the forecast period?

Based on the application, online retail segment is hold a significant share in the market. The rise of online retail platforms has significantly impacted the distribution of organic flour, facilitated a global reach, and provided convenience to consumers. Consumers prefer to buy organic flour from online retail platforms due to the convenience, extensive variety, and ease of comparison offered by e-commerce sites. Online retailers allow consumers to browse a vast array of organic flour from the comfort of their homes, eliminating the need for physical store visits; the convenience of doorstep delivery saves time and effort for busy buyers.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Organic Flour Market

- Hometown Food Company

- Bob's Red Mill Natural Foods

- King Arthur Baking Company

- koRo

- Betterbody Foods C/O

- FWP Matthews Ltd

- Shipton Mill Ltd

- W and H Marriage and Sons Limited

- Gilchesters Organics

- Anita's Organic Grain & Flour Mill Ltd

Get Free Sample For

Get Free Sample For