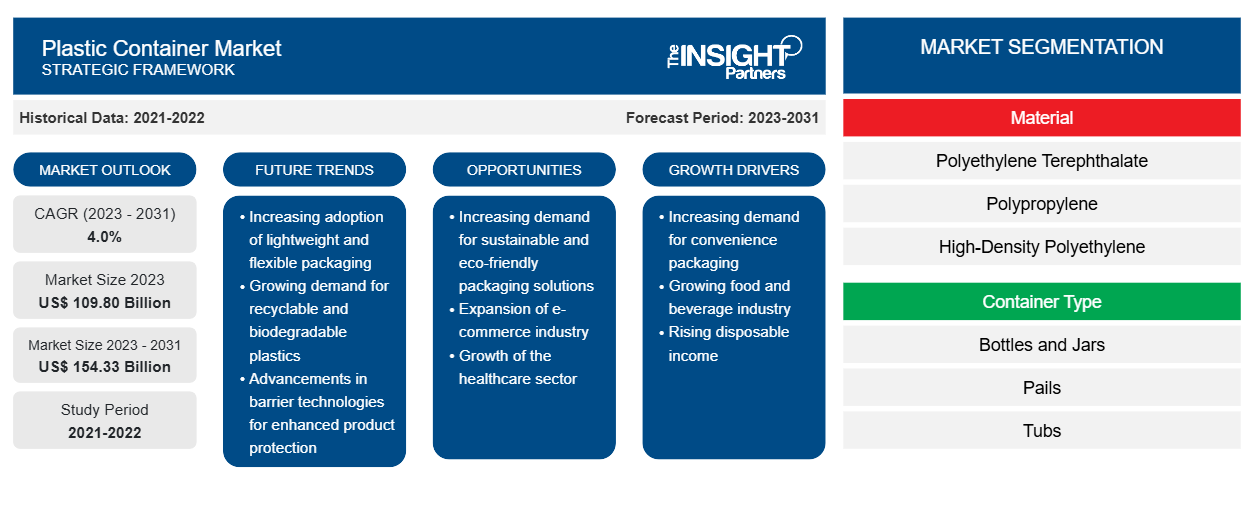

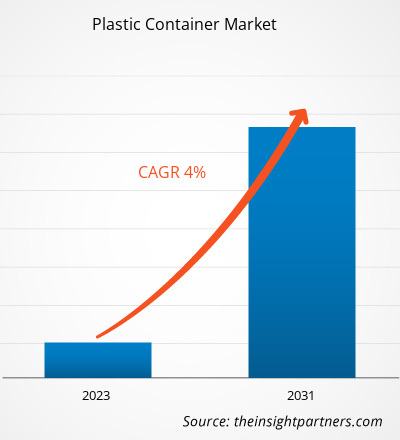

The Plastic Container Market size is projected to reach US$ 154.33 billion by 2031 from US$ 109.80 billion in 2023. The market is expected to register a CAGR of 4.0% in 2023–2031. The growing demand from end-use industries, including food, beverage, and cosmetics industries, is likely to remain a key plastic container market trends.

Plastic Container Market Analysis

Plastic containers are multipurpose and are available in various sizes, shapes, and designs. They are widely used in various applications, including food storage, transportation, organizing household items, and packaging industrial goods. Plastic container's flexibility makes them a popular choice for diverse needs, driving demand across multiple sectors. Additionally, plastic containers have effective airtight and moisture-resistance, making them an ideal choice for fresh food packaging to preserve food freshness. In addition to these qualities, their easy sealing mechanisms are vital for upholding, preventing spoilage, and maintaining hygiene. In addition, plastic containers offer a cost-effective alternative to other packaging materials such as metal packaging, which extends to consumers. The lightweight nature of the plastic containers helps in reducing shipping costs, making them an ideal choice for end users. Thus, they often prefer plastic containers for packaging goods and products, bolstering the demand for plastic food storage containers in households and the food industry.

Plastic Container Market Overview

Manufacturers of personal care & cosmetics products often require unique and aesthetically pleasing packaging materials to attract consumers. Plastic containers can be molded into various shapes, sizes, and designs, which helps manufacturers to produce aesthetic and distinctive packaging. The availability of plastic packaging in different shapes and sizes is vital in the personal care & cosmetics industry, where product presentation and branding are important.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastic Container Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastic Container Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Plastic Container Market Drivers and Opportunities

Surging Demand from Beverage Industry Bolsters Plastic Container Market Growth

Plastic containers provide a lightweight and durable packaging solution, which makes them ideal for transporting beverages, which helps to reduce shipping costs and minimize the risk of breakage during transit. This ensures the product's integrity till delivery. Moreover, plastic containers are encouraging innovative packaging designs. Manufacturers of plastic containers use different shapes, colors, and labeling to improve the visual appeal of the products. Standing out on store shelves and attracting customers is important in a highly competitive beverage industrial landscape. Additionally, plastic containers are often made of recyclable materials, with various end users promoting sustainability by applying recycled plastics for product packaging. Growing awareness about the negative impact of microplastics on the environment and human health encourages beverage manufacturers to adopt eco-friendly packaging solutions.

Proliferation of E-Commerce Industry

Efficiency and security of packaging material are crucial for e-commerce businesses. Consumers rely on online platforms to purchase various products, and manufacturers and retailers require adequate packaging for storing, protecting, and delivering these products. The convenience of online shopping bolsters the growth of e-commerce, a significant driver of the rising demand for plastic containers. With their versatility and durability plastic containers have become a popular packaging material to ensure the safe transportation of products. The lightweight and availability of plastic containers in different sizes and shapes help to optimize shipping and storage space. This helps businesses to reduce the costs of shipping and helps to utilize space effectively.

Plastic Container Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Plastic Container Market analysis are material, container type, and end-use.

- Based on material, the market is segmented into polyethylene terephthalate, polypropylene, high-density polyethylene, low-density polyethylene, and others. The polyethylene terephthalate segment held a larger market share in 2023.

- In terms of container type, the plastic container market is bifurcated into bottles & jars, pails, tubs, cups & bowls, and others. The bottles & jars segment held a larger market share in 2023.

- On the basis of end-use, the market is bifurcated into beverages, food, pharmaceuticals, personal care & cosmetics, and others. The beverages segment held a larger market share in 2023.

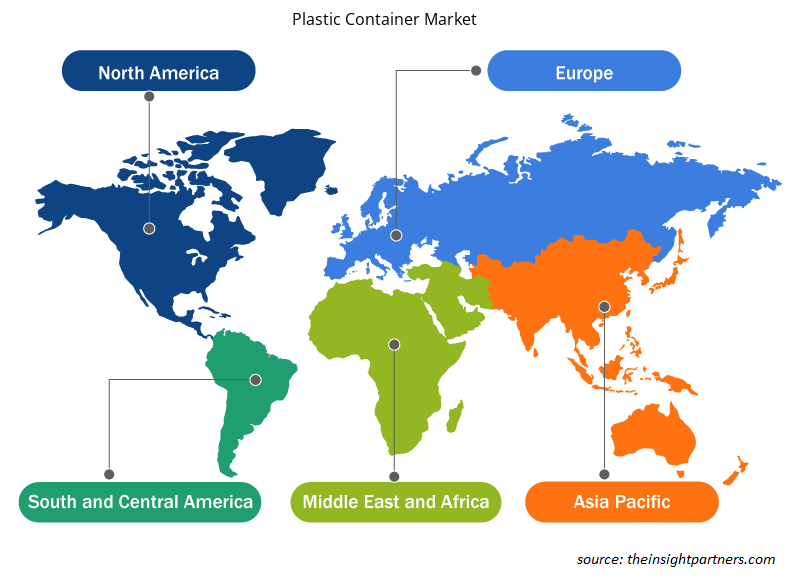

Plastic Container Market Share Analysis by Geography

The geographic scope of the Plastic Container Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The Asia Pacific's rapidly growing population and urbanization have led to increased packaged food & beverage consumption. As a result, there is a greater need for packaging materials, with plastic containers being a popular choice due to their convenience and affordability. In addition, economic growth in many Asia Pacific countries has boosted disposable incomes, leading to changes in consumer preferences. Consumers are now more inclined to purchase convenience foods and beverages. The convenience factor, such as resealable lids and lightweight packaging, drives the plastic container market. Furthermore, the Asia Pacific region is witnessing a surge in the e-commerce industry, which relies heavily on efficient packaging solutions. Plastic containers, such as PET bottles for beverages and various food containers, are well-suited for online retail because they are durable, lightweight, and reduce the risk of product damage during shipping.

Plastic Container Market Regional Insights

The regional trends and factors influencing the Plastic Container Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Plastic Container Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Plastic Container Market

Plastic Container Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 109.80 Billion |

| Market Size by 2031 | US$ 154.33 Billion |

| Global CAGR (2023 - 2031) | 4.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Plastic Container Market Players Density: Understanding Its Impact on Business Dynamics

The Plastic Container Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Plastic Container Market are:

- Amcor Plc

- Sonoco Products Company

- Berry Global Inc.

- Plastipak Holdings, Inc.

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Graham Packaging Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Plastic Container Market top key players overview

Plastic Container Market News and Recent Developments

The plastic container market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for plastic containers and strategies:

- Berry Global's technical and manufacturing skills have achieved a significant breakthrough in the packaging of hazardous liquids. The company has now launched the first 20 and 25 litre containers containing 35% recycled material, which have UN Approval for the transport of hazardous goods for five of the six model liquids in the UN assessment. In addition to the existing UN approval for water, the new containers also have approval for wetting solution, acetic acid, white spirit, and N-butyl acetate. The introduction of these new containers into the company's popular Optimum range will support companies both in meeting their sustainability goals and satisfying consumer demands for more sustainable packaging solutions. It will also help businesses comply with forthcoming legislation covering the required minimum amount of recycled material in a pack. (Source: Berry Global Inc, Press Release, 2023)

Plastic Container Market Report Coverage and Deliverables

The "Plastic Container Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies

1. Alpack Inc.

2. Alpha Packaging Holdings Inc.

3. Amcor Limited

4. Anchor Packaging Inc.

5. Constar International Inc.

6. Graham Packaging Company Inc.

7. Plastipak Holdings, Inc.

8. Rahway Steel Drum Company(U.S.)

9. The Plastic Bottles Company

10. Werke Alwin Lehner GmbH and Company KG

Get Free Sample For

Get Free Sample For