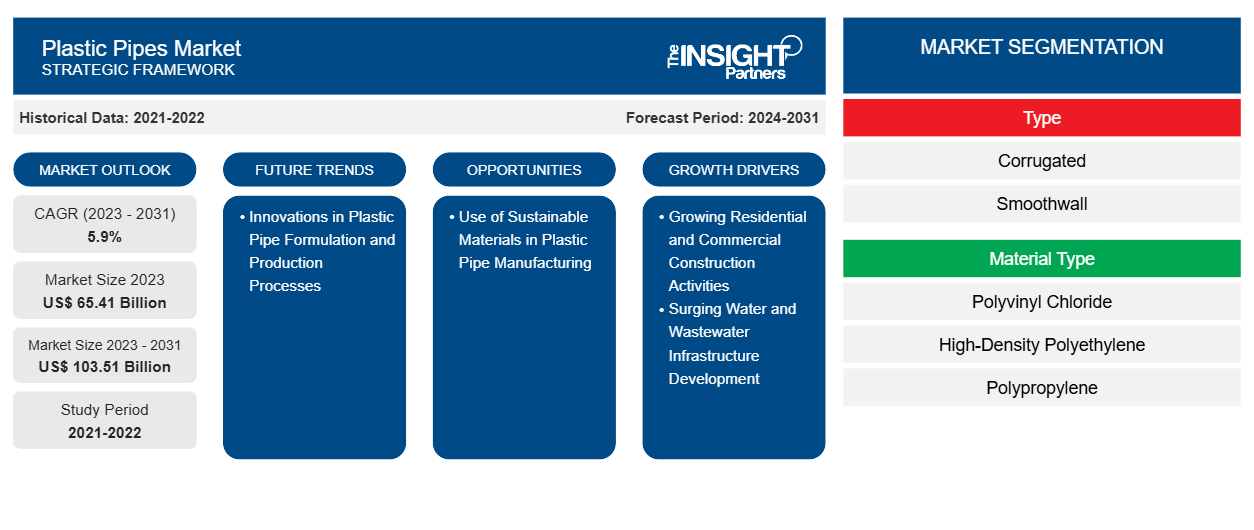

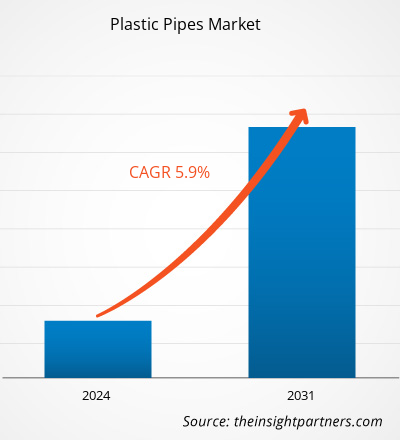

The plastic pipes market size is projected to reach US$ 103.51 billion by 2031 from US$ 65.41 billion in 2023; the market is expected to register a CAGR of 5.9% during 2023–2031. The use of sustainable materials in plastic pipe manufacturing is expected to be a key trend in the market.

Plastic Pipes Market Analysis

The growing residential and commercial construction activities are driving the plastic pipes market growth. The housing market growth is attributed to factors such as population increase, urbanization, and favorable economic conditions. According to Redfin, the number of houses sold in January 2024 was 284,121; 1.8% higher than the number sold in January 2023 in the US. Residential construction is a crucial component of the private sector. It witnessed a noteworthy increase to a seasonally adjusted annual rate of US$ 856.3 billion in June 2023, marking a 0.9% rise from the revised May estimate of US$ 848.6 billion. In March 2023, the government launched the Housing Accelerator Fund worth US$ 2.96 billion to aid in the building of at least 100,000 homes across Canada. In construction, plastic pipes are used in water supply, plumbing, HVAC systems, and fire suppression systems. Plastic pipes are used in residential plumbing for both hot and cold water lines.

Plastic Pipes Market Overview

The global plastic pipes market has been experiencing significant growth, driven by the growing construction industry and rising water and wastewater management initiatives worldwide. The market growth is attributed to rapid industrialization and urbanization, particularly in emerging economies. In addition, the global transition toward sustainability initiatives has influenced the plastic pipes market, with manufacturers increasingly focused on incorporating eco-friendly formulations.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastic Pipes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Plastic Pipes Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Plastic Pipes Market Drivers and Opportunities

Surging Water and Wastewater Infrastructure Development

Urban wastewater treatment plants that integrate resource recovery and energy production processes with clean water production contribute significantly to the sustainable development of any country. Over the past two decades, the demand for wastewater treatment has increased due to the trend of recovering water from energy generation processes. A report published by the United Nations Department of Economic and Social Affairs in 2022 highlights the rising interdependency of water and energy generation, with the increasing demand for each of these resources in many regions. According to the current policy scenario of the International Energy Agency, energy consumption is projected to increase by 50% by 2035, boosting water consumption of the energy sector by 85%.

Stringent government regulations regarding wastewater management, such as the treatment of industrial effluents prior to releasing them in waterbodies, have prompted the development of wastewater infrastructure. The Environmental Protection Agency (EPA), US, issued the National Pollutant Discharge Elimination System memorandum in December 2022. This memorandum involves the authorization of states and municipalities to administer the National Pollutant Discharge Elimination System and pretreatment programs. This extended version aimed to improve the older version of the system (rolled out in April 2022) to incorporate supplemental permitting mechanisms and recommendations and accelerate efforts to reduce PFAS discharges to water bodies. Thus, the surge in water and wastewater infrastructure development fuels the plastic pipes market growth.

Innovations in Plastic Pipe Formulation and Production Processes

The plastic pipes market is witnessing several innovations in plastic formulations and production processes. These advancements are aimed at improving the performance, sustainability, and cost-efficiency of plastic pipes. The recent developments in technology and material science have paved the way for nanotechnology, integration of smart sensors, and additive manufacturing in the plastic pipes market. The integration of nanotechnology in plastic pipe manufacturing involves the utilization of nanocomposites for the improvement of the mechanical properties of materials. Researches are aimed at exploring the potential for incorporating nanomaterials in PVC pipes to improve their properties while preserving their inherent characteristics. This application of nanotechnology represents an advancement as it addresses critical performance aspects of plastic pipes and diversifies their applications.

Plastic Pipes Market Report Segmentation Analysis

Key segments that contributed to the derivation of the plastic pipes market analysis are type, material type, application, and end-use industry.

- By type, the market is segmented into corrugated and smoothwall. The corrugated segment is further categorized into single-wall and multi-wall. The smoothwall segment dominated the market in 2023.

- By material type, the market is segmented into polyvinyl chloride, high-density polyethylene, polypropylene, and others. The polyvinyl chloride segment dominated the market in 2023.

- By application, the market is segmented into water supply, sewage and drainage, irrigation, gas distribution, and others. The water supply segment dominated the market in 2023.

- By end-use industry, the market is segmented into construction and infrastructure, water and wastewater management, oil and gas, and others. The construction and infrastructure segment dominated the market in 2023.

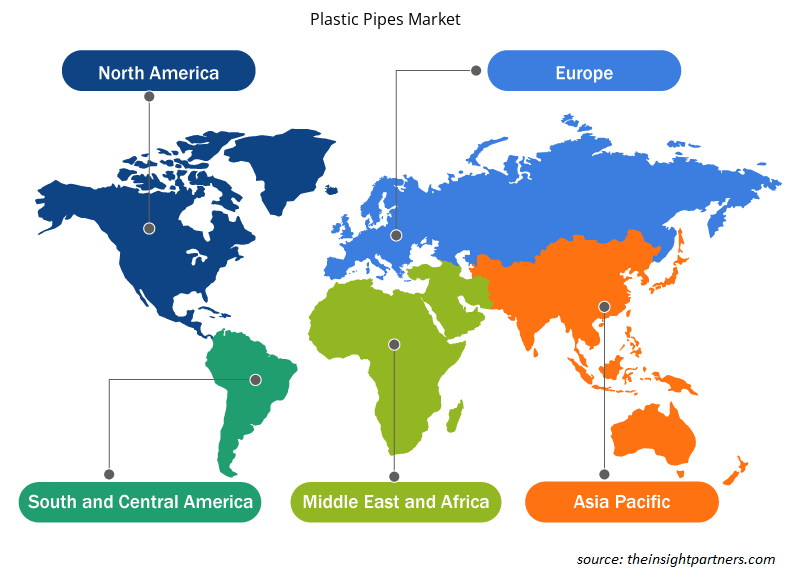

Plastic Pipes Market Share Analysis by Geography

The geographic scope of the plastic pipes market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific held the largest market share in 2023 and is expected to register the highest CAGR during the forecast period. Europe held the second-largest plastic pipes market share in 2023. Asia Pacific is a prominent market for plastic pipes owing to growth in the construction industry, wastewater treatment facilities, and oil & gas sector. The rise in foreign direct investments in emerging economies also leads to regional economic growth, further bolstering industrialization in the region. The demand for oil and gas is increasing in Asia Pacific. According to the International Energy Agency, the global oil demand rebounded in 2021, and Asia is expected to account for 77% of oil demand by 2025. Asian oil import requirements are expected to surpass 31 million barrels per day by 2025. All major Asian economies heavily depend on oil imports from the Middle East & Africa. Various countries in the region have initiated projects to cater to the growing demand for oil and gas. For instance, in April 2023, Asia's largest underwater hydro-carbon pipeline, below the river Brahmaputra connecting Jorhat and Majuli in Assam, India, was completed by the Indradhanush Gas Grid Limited (IGGL). Further, the growing investment in infrastructure projects in Asia Pacific is expected to bolster the plastic pipes market during the forecast period.

Plastic Pipes Market Regional Insights

The regional trends and factors influencing the Plastic Pipes Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Plastic Pipes Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Plastic Pipes Market

Plastic Pipes Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 65.41 Billion |

| Market Size by 2031 | US$ 103.51 Billion |

| Global CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Plastic Pipes Market Players Density: Understanding Its Impact on Business Dynamics

The Plastic Pipes Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Plastic Pipes Market are:

- JM Eagle Inc

- Georg Fischer Ltd

- Sekisui Chemical Co Ltd

- China Lesso Group Holdings Ltd

- Finolex Industries Ltd

- Genuit Group Plc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Plastic Pipes Market top key players overview

Plastic Pipes Market News and Recent Developments

The plastic pipes market is evaluated by gathering qualitative and quantitative data post-post-primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the plastic pipes market are listed below:

- Advanced Drainage Systems (ADS) announced its plans to build a new manufacturing facility in Lake Wales, Florida. ADS produces large quantities of corrugated plastic pipe. The project is expected to break ground in 2024 on a 100-acre site. (Plastics Technology, Company website/ News/ 2023)

- Uponor has produced the world's first circular Uponor PEX pipe based on 100% chemically recycled raw material derived from the company's own PEX pipe production waste, using an ISCC PLUS-certified mass-balancing approach. This groundbreaking solution was enabled by cooperation between Uponor, Wastewise, Neste, and Borealis, which have successfully managed to chemically recycle PEX pipe manufacturing waste on an industrial scale back to plastic raw material. (Uponor Corporation, Company website/ 2023)

Plastic Pipes Market Report Coverage and Deliverables

The "Plastic Pipes Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Plastic pipes market size and forecast for all the key market segments covered under the scope

- Plastic pipes market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Plastic pipes market analysis covering key market trends, country framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the plastic pipes market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the plastic pipes market?

The market is expected to register a CAGR of 5.9% during 2023–2031.

Which are the leading players operating in the plastic pipes market?

Key players in the plastic pipes market include JM Eagle Inc, Uponor Corp, Georg Fischer Ltd, Sekisui Chemical Co Ltd, China Lesso Group Holdings Ltd, Astral Poly Technik Limited, Finolex Industries Ltd, Genuit Group Plc, Formosa Plastics Corp, Vasen Europe, Luna Plast, Orbia, Aliaxis Holdings SA, and Advanced Drainage Systems Inc.

What are the factors driving the plastic pipes market?

Growing residential and commercial construction activities and surging water and wastewater infrastructure development are driving the market.

Which region held the largest share of the global plastic pipes market?

In 2023, Asia Pacific held the largest share of the global plastic pipes market. The rise in government initiatives for water and wastewater management across emerging economies of Asia Pacific drives market growth.

Based on material type, which segment held the largest share in the global plastic pipes market?

The polyvinyl chloride segment held the largest share of the global plastic pipes market in 2023. Polyvinyl chloride pipes offer several advantages, such as durability, cost-effectiveness, chemical resistance, and versatility.

What are the future trends in the plastic pipes market?

The use of sustainable materials in plastic pipe manufacturing is expected to emerge as a future trend in the market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Plastic Pipes Market

- JM Eagle Inc

- Georg Fischer Ltd

- Sekisui Chemical Co Ltd

- China Lesso Group Holdings Ltd

- Finolex Industries Ltd

- Genuit Group Plc

- Vasen Europe

- Luna Plast

- Orbia

- Aliaxis Holdings SA

- Advanced Drainage Systems Inc.

- ASTRAL PIPES

- Wienerberger AG

- NAN YA PLASTICS CORPORATION

- Reboca

Get Free Sample For

Get Free Sample For