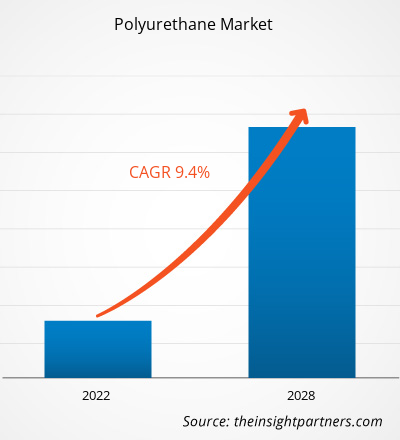

[Research Report] The Polyurethane market was valued at US$ 54,917.09 million in 2021 and is projected to reach US$ 1,02,916.80 million by 2028; it is expected to grow at a CAGR of 9.4% from 2020 to 2028.

MARKET ANALYSIS

Polyurethane is a material synthesized by copolymerizing an isocyanate and a polyhydric alcohol. Polyurethane composites and blends have wider applications in electronics and optoelectronics. The uses of polyurethane are broad ranged, including sensors, electrolytes, actuators, EMI shielding for supercapacitors and batteries, electrostatic dissipation, also shape memory applications. The potential market for printed electronics is huge. PU and its composites-based adhesives have discovered applications in flexible and printed electronics. Polyurethane potting compounds are particularly formulated by developers to meet a diverse range of physical, thermal as well as electrical properties. They can protect electronics by providing excellent insulating and adhesive properties, exceptional flexible foam, water, and temperature resistance.

GROWTH DRIVERS AND CHALLENGES

The rising government support for infrastructure development and growing use of polyurethane as insulation material across the globe has aided the market growth of industrial polyurethane products. Governments of various countries across the world are focusing on the nation's infrastructure development. Infrastructure advancement comprises projects related to roads, ports, railways, and airports; projects in agriculture and renewable energy; and industrial and social infrastructure. According to TATA Capital, Budget 2020 also presented a thrust to infrastructure development to encourage spending in roads, railways, airports, highways, and ports infrastructure projects. Allocating more than US$ 1.25 trillion for infra projects, the Indian Government identified over 6,500 projects under the National Infrastructure Pipeline (NIP) to build a $5 trillion economy by 2025. Such activities are supporting the construction sector, mainly in developing countries, and would create ample opportunities for the polyurethane market in coming years. Volatility of prices of raw material used in polyurethane manufacturing pose a challenge to the polyurethane market. Manufacturers make polyurethane foam mainly by reacting polyols and diisocyanates, and both these products are derived from crude oil. Hence, the volatility of crude oil prices eventually affects polyurethane production cost. International crude oil prices witnessed uncertainty in 2020, and it is continuing in 2021 also. Both crude oil demand and prices fell sharply in the starting months of the year 2020 due to lockdowns and travel restrictions in various countries across the world. Oil prices also crashed to such an extent that the price for WTI crude and the benchmark for US crude oil had turned negative in April 2020.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polyurethane Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Polyurethane Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Polyurethane Market Analysis to 2030" is a specialized and in-depth study with a major focus on the global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation by raw material, product, application, and geography. The global polyurethane market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of polyurethane worldwide along with their demand in major regions and countries. In addition, the report provides the qualitative assessment of various factors affecting the polyurethane market performance in major regions and countries. The report also includes a comprehensive analysis of the leading players in the polyurethane market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global polyurethane market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global polyurethane market is segmented on the basis of raw material, product and application. Based on raw material, the polyurethane market is segmented as, polyol, MDI, TDI, and others. On the basis of product, the market is classified as, rigid foam, flexible foam, coatings, adhesives, sealants & binders, elastomers, and others. The polyurethane market is categorized on the basis of application into furniture and interiors, construction, electronics & appliances, automotive, footwear, packaging, and others. Based on raw material, polyols accounted for significant share. Polyols are organic compounds with multiple hydroxyl groups. They are amongst key raw materials used in the production of polyurethanes. Methylene diphenyl diisocyanate (MDI) is an aromatic compound used in the production of polyurethane. It is reacted with polyols to form polyurethane. Toluene diisocyanate (TDI) is a chemical compound which is transparent pale yellow or colourless liquid. It is used to make flexible polyurethane foams that are largely utilized in applications such as beds and furniture, carpet underlay, and packaging materials. Raw materials used for the production of polyurethanes other than polyols and diisocynates are stabilizers and additives. Based on product, the flexible foam accounted for highest market share. Flexible polyurethane foam is characterized by a cellular structure that allows for some degree of compression also resilience which provides a cushioning effect. Due to this property, it is a favored material in furniture, athletic equipment, packaging, footwear, bedding, automotive seating, and carpet cushion. It further plays a valuable role in soundproofing as well as filtration. Rigid polyurethane foam is known as one of the most efficient, high performance insulation materials; also, it enables very effective energy savings along with the minimal occupation of space.

REGIONAL ANALYSIS

The report provides a detailed overview of the global polyurethane market with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Asia Pacific accounted for a significant share of the market and valued at more than US$ 9,500 million in 2022. Emerging countries of Asia Pacific are further witnessing an upsurge in urbanization and industrialization, which offers ample opportunities for the key market players in the polyurethane market. Countries like Australia, Japan, India, China, South Korea, Singapore, Taiwan, and Indonesia have large manufacturing industries in a diverse sector, which chemical, textile, automotive, electronics, and other industries. The manufacturing sector in these countries has experienced a huge shift over the years. North America valued at more US$ 3,500 million in 2022. The polyurethane market in this region is growing owing to its increasing demand from the furniture and interiors, construction, electronics and appliances, automotive, footwear, packaging, and other industries located in North America.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

The report provides a detailed overview of the global polyurethane market with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America.

In 2021, Covestro successfully completed acquisition of Resins & Functional Materials business from DSM.

In 2020, Huntsman Corporation announced that it has branded its world leading spray polyurethane foam (SPF) Business as Huntsman Building Solutions (HBS). HBS is a global platform within Huntsman's Polyurethanes division.

Polyurethane Market Regional Insights

The regional trends and factors influencing the Polyurethane Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Polyurethane Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Polyurethane Market

Polyurethane Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 54.92 Billion |

| Market Size by 2028 | US$ 102.92 Billion |

| Global CAGR (2021 - 2028) | 9.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Polyurethane Market Players Density: Understanding Its Impact on Business Dynamics

The Polyurethane Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Polyurethane Market are:

- Covestro AG

- FXI

- Huntsman Corporation

- Lubrizol Corporation

- Mitsui Chemicals, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Polyurethane Market top key players overview

IMPACT OF COVID/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

The report provides a detailed overview of the global polyurethane market with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. Industries such as construction, automotive, electronics, and furniture have been the major consumers of polyurethane. In 2020, these industries had to slow down their operations due to disruptions in the value chain caused by the shutdown of national and international boundaries. Moreover, lockdowns imposed by different countries hampered the ability of industries to maintain inventory levels in the same year. The shortage of manpower resulted in the deceleration of polyurethane production and distribution operations. Additionally, government restrictions and other COVID-19 precautions reduced the production capacities of stakeholders in the polyurethane ecosystem. In 2021, the global marketplace began recovering from the losses incurred in 2020 as governments of different countries announced relaxations in social restrictions. Moreover, the previously postponed construction projects are anticipated to resume, which would further provide an opportunity for the polyurethane market players to regain normalcy. Expansion in production capacities in the chemicals & materials industry in different regions of the world resulted in a rise in demand for polyurethane in 2021.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Some of the key players and top polyurethane manufacturers, operating in the polyurethane market include, Covestro AG, FXI, Huntsman Corporation, Lubrizol Corporation, Mitsui Chemicals Inc, BASF SE, The Dow Chemical Company, DIC Corporation, Recticel NV, and Tosoh Corporation, among others.

Frequently Asked Questions

Based on raw material, which segment accounted for the largest share in the global market?

The polyols segment held the largest share of the market during the forecast period. Polyols are organic compounds with multiple hydroxyl groups. They are amongst key raw materials used in the production of polyurethanes. Polyurethanes are made by reacting a polyol with a diisocyanate or a polymeric isocyanate in the presence of appropriate catalysts and additives. A wide range of polyols are used to produce polyurethanes that meet the requirements of different applications including cushioning and insulation, coatings, apparel, and electronics.

Which region held the largest share of the global polyurethane market in 2021?

In 2021, Asia Pacific accounted for the largest share of the global polyurethane market. The region also held the largest CAGR during the forecast period. The polyurethane market in the region comprises several economies such as China, India, Japan, South Korea, Australia, and Rest of APAC. These countries are witnessing an upsurge due to growth in urbanization, increasing manufacturing industries coupled with growing industrialization which offers ample opportunities for key market players in the polyurethane market.

Based on application, which segment emerged as the fastest in the global market?

The electronics and appliances segment held the largest share of the market during the forecast period. Non-foam polyurethanes also called potting compounds, are frequently utilized in the electrical & electronics industries to encapsulate, seal & insulate fragile microelectronic components, pressure-sensitive underwater cables, and printed circuit boards. Polyurethane potting compounds are particularly formulated by developers to meet a diverse range of thermal, physical, and electrical properties. They can protect electronics by providing excellent dielectric as well as adhesive properties, exceptional solvent, water, and extreme temperature resistance. Polyurethanes are important in major appliances that consumers utilize every day.

Based on application, which segment accounted for the largest share in the global market?

In 2021, furniture and interiors accounted for the largest share of the global polyurethane market. Polyurethane in the form of flexible foam is the most popular material utilized in home furnishings, including furniture, bedding, and carpet underlay. As a cushioning material for upholstered furniture, flexible polyurethane foam acts to make furniture more durable, comfortable also supportive.

Based on product, why flexible foam segment accounted for the largest share in the global market?

The flexible foam segment held the largest share of the market during the forecast period. Flexible polyurethane foam is characterized by a cellular structure that allows for some degree of compression also resilience which provides a cushioning effect. Due to this property, it is a favored material in furniture, athletic equipment, packaging, footwear, bedding, automotive seating, and carpet cushion. It further plays a valuable role in soundproofing as well as filtration

Can you list some of the major players operating in the global polyurethane market?

The key players operating in the polyurethane market are Covestro AG, The Dow Chemical Company, BASF SE, Mitsui Chemicals, Inc., and Huntsman Corporation.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Polyurethane Market

- Covestro AG

- FXI

- Huntsman Corporation

- Lubrizol Corporation

- Mitsui Chemicals, Inc.

- BASF SE

- The Dow Chemical Company

- DIC CORPORATION

- Recticel NV

- Tosoh Corporation

Get Free Sample For

Get Free Sample For