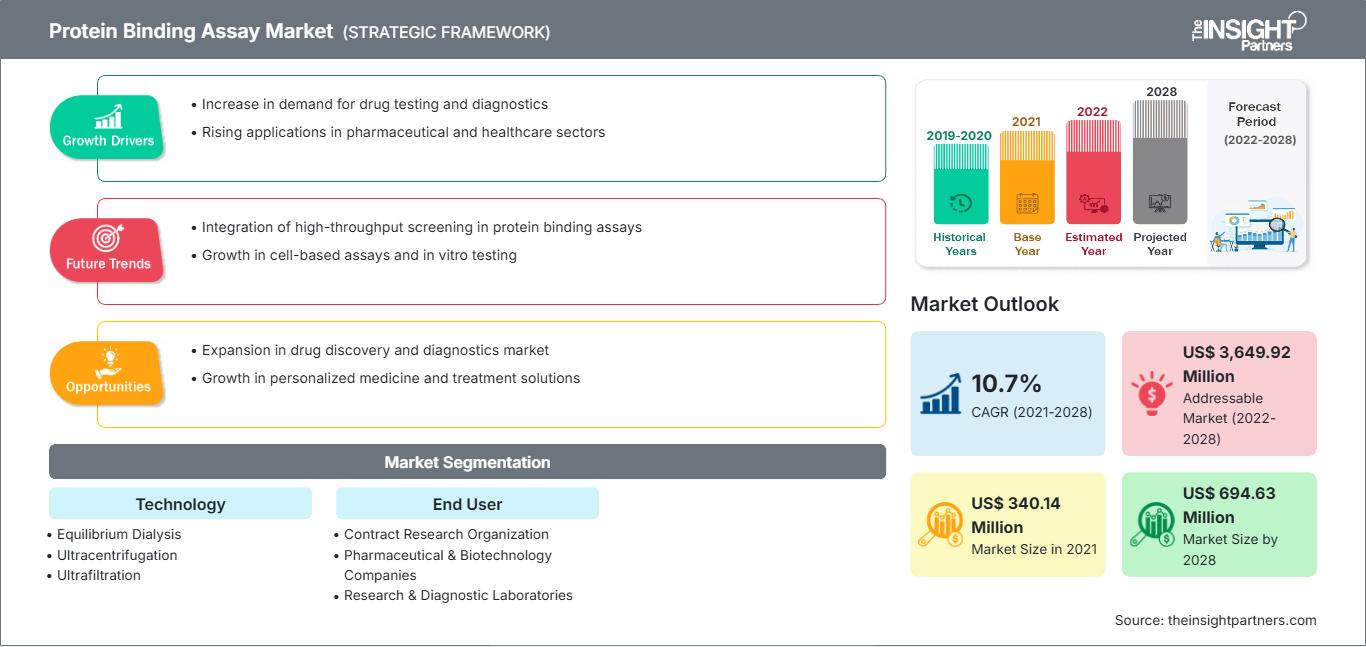

Protein Binding Assay Market Overview and Growth by 2028

Protein Binding Assay Market Forecast to 2028 - Analysis By Technology (Equilibrium Dialysis, Ultracentrifugation, Ultrafiltration, Surface Plasmon, and Others); End User (Contract Research Organization, Pharmaceutical & Biotechnology Companies, and Research & Diagnostic Laboratories), and Geography.

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Aug 2021

- Report Code : TIPRE00004168

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 145

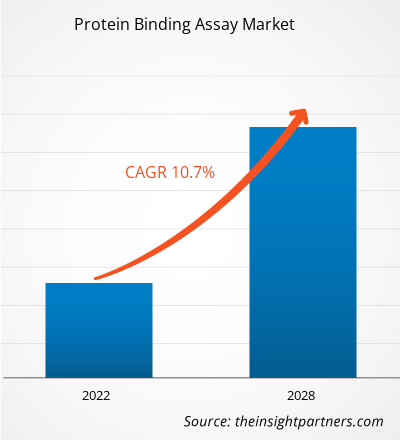

The protein binding assay market is projected to reach US$ 694.63 million by 2028 from US$ 340.14 million in 2021; it is estimated to grow at a CAGR of 10.7% from 2021 to 2028.

Protein binding assays assist in analyzing the interaction between two types of proteins. These assays are widely used in the new drug development process.

The protein binding assay market is segmented on the bases of technology, end user, and geography. By geography, the market is broadly segmented into North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. The report offers insights and in-depth analysis of the market, emphasizing on parameters such as market trends, technological advancements, and market dynamics, along with the analysis of competitive landscape of the globally leading market players.

Market Insights

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONProtein Binding Assay Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growing Drug Discovery Activities Drive Protein Binding Assay Market Growth

A clinical trial is a crucial and significant step in the determination of the safety and effectiveness of a medical strategy, treatment, and device for commercial usage. These studies also help understand and determine the best medical approaches for a particular therapeutic area. Before the approval of drug molecules or medical devices by the regulatory authorities, a series of clinical studies are conducted. The increasing prevalence of communicable and non-communicable diseases is triggering the demand for the development of new drugs and medical devices, which, in turn, propels the demand for the protein binding assay. As per the data from the US National Library of Medicine, in 2018, there were ~280,801 clinical studies ongoing in 50 states and 204 countries. The following figure shows the rise in the number of studies registered in period of year 2015 to 2020.

- Number of Registered Studies for Clinical Trials

|

Year First Posted |

Studies at Start of Year |

Studies During Year |

Studies at End of Year |

|

2015 |

181,304 |

24,130 |

205,434 |

|

2016 |

205,434 |

27,809 |

233,243 |

|

2017 |

233,243 |

29,198 |

262,441 |

|

2018 |

262,441 |

17,836 |

280,277 |

|

2019 |

293,275 |

32,519 |

325,794 |

|

2020 |

325,794 |

36,740 |

362,534 |

Furthermore, pharmaceutical, medical device, and biotechnology companies focus on research and development (R&D) activities to develop new molecules for therapeutic applications with the greatest medical and commercial potential. The companies invest majorly in the R&Ds intending to deliver high quality and innovative products to the market.

- Top 10 Pharmaceutical R&D Spenders, 2019

|

Name of Company (R&D Budget as % of Revenue) |

Name of Company (R&D Budget as % of Revenue) |

|

1. F. Hoffmann La-Roche Ltd. (19.0%) |

2. Johnson & Johnson Services, Inc. (13.8%) |

|

3. Merck KGaA (21.1%) |

4. Novartis AG (19.8%) |

|

5. Pfizer, Inc. (16.7%) |

6. Sanofi S.A (16.7%) |

|

7. AbbVie, Inc. (19.0%) |

8. Bristol Myers Squibb Company Limited (23.6%) |

|

9. AstraZeneca Plc. (24.8%) |

10. GlaxoSmithKline Plc (13.8%) |

In the early stages of the drug development process, protein binding assays are being developed. Because unbound circulating drugs have the best access to targets and excretion pathways, drug candidate binding to plasma proteins is crucial for drug distribution, efficacy, and safety margin definition. According to Statista, around 7,493 drugs entered the preclinical stage in 2017, and the number is estimated to reach 8,040 in 2018. As a result, the total number of drug candidates being screened each year is increasing. Protein binding studies, which are conducted early in the drug development process, are an important aspect of the preclinical phase. Hence, the rising drug discovery activities coupled with increasing pharmaceutical R&D expenditure drives the growth of the protein binding assay market.

Rising Need of Reducing Drug Discovery and Development Costs Contributes Significantly to Protein Binding Assay Market Growth

The cost of developing new drugs remains high at an inflation-busting rate, and returns and profits on investments are declining, placing pressure on the entire innovative medicine system. Many pharmaceutical and biopharmaceutical research companies are re-evaluating old R&D policies and focusing their efforts on improving efficiency, increasing output, and satisfying unmet patient requirements due to current economic and political pressures to reduce the healthcare cost. The changing focus on drug discovery and development, and the rising use of new technologies for identifying and screening drug candidates are allowing research personnel to tap into various chronic, degenerative, and life-threatening disease segments that were previously untargeted.

Drug discovery and development is a costly process as it requires investments in funding, human resources, and technologies. Before launching a new drug in the market, strict adherence to regulations on testing and manufacturing standards is required. Furthermore, the failure of drug candidate during the development stage results in the wastage of entire investment. Protein binding studies assist in assessing binding and absorption capabilities in preclinical phases, resulting in lower drug attrition in the later stages of development, which helps optimize drug discovery expenses. Thus, rising need of reducing the cost of drug discovery and development process is fueling the protein binding assay market growth.

Technology Insights

Based on technology, the global protein binding assay market is segmented into ultracentrifugation ultrafiltration, equilibrium dialysis, surface plasmon, and others. In 2020, the equilibrium dialysis segment held the largest share of the market. However, the ultrafiltration segment is expected to register the highest CAGR in the market during 2021–2028. Equilibrium dialysis is among the most widely accepted methods for evaluating protein binding, and it can be performed with the help of rapid equilibrium dialysis (RED) devices. Researchers prefer this method as it has fewer binding effects to extraneous and unintended factors affecting research results.

End User Insights

Based on end user, the protein binding assay market is segmented into contract research organization, pharmaceutical and biotechnology companies, and research and diagnostic laboratories. The pharmaceutical and biotechnology companies segment is expected to hold the largest market share in 2021. It is also expected to be the largest shareholder in the market by 2028. These companies are the major adopters of CRO services; they approach CROs for outsourcing drug and molecule research and development. Protein binding is a fundamental biochemical process that is used to study the mechanism of drugs along with their pharmacological effects in subjects. These aspects are propelling the protein binding assay market for the market for the pharmaceutical and biotechnology companies segment.

Product launches, and mergers and acquisitions are highly adopted strategies by the players operating in the global protein binding assay market. A few of the recent key product developments are listed below:

In November 2020, Pharmaron Beijing Co., Limited acquired 100% assets of Absorption Systems, US, for up to US$ 137.5 million in cash. Absorption Systems is a leading scientific, non-clinical contract research organization (CRO) that provides small and large molecules, cell and gene therapies, and ocular and medical device products, among others, to pharmaceutical, biotechnology, and medical device companies; regulatory agencies; and research and testing organizations.

In April 2020, Sartorius acquired selected assets of Danaher Life Sciences successfully. The transaction was completed after obtaining the required regulatory approvals.

The pace of research and development of drugs and vaccines against the disease has increased during the COVID-19 pandemic. Protein binding is one of the key biochemical phenomena studied during the drug development process, as the cell receptors to which antigens on the infectious agents or drug molecules attach are mostly proteinic in nature. Thus, the pharmaceutical and biotechnological companies investing in product innovations frequently need protein binding assay materials and equipment.

Protein Binding Assay

Protein Binding Assay Market Regional InsightsThe regional trends and factors influencing the Protein Binding Assay Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Protein Binding Assay Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Protein Binding Assay Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 340.14 Million |

| Market Size by 2028 | US$ 694.63 Million |

| Global CAGR (2021 - 2028) | 10.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Protein Binding Assay Market Players Density: Understanding Its Impact on Business Dynamics

The Protein Binding Assay Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Protein Binding Assay – Market Segmentation

The global protein binding assay market is segmented on the bases of technology, end user, and geography. The market, by technology, is segmented into ultracentrifugation ultrafiltration, equilibrium dialysis, surface plasmon, and others. Based on end user, the protein binding assay market is segmented into contract research organizations, pharmaceutical and biotechnology companies, and research and diagnostic laboratories. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America.

Company Profiles

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Eurofins Scientific

- General Electric Company

- Sovicell GmbH

- Pharmaron Beijing Co., Ltd.

- Biotium, Inc.

- MicroConstants, Inc.

- Sartorius AG

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For