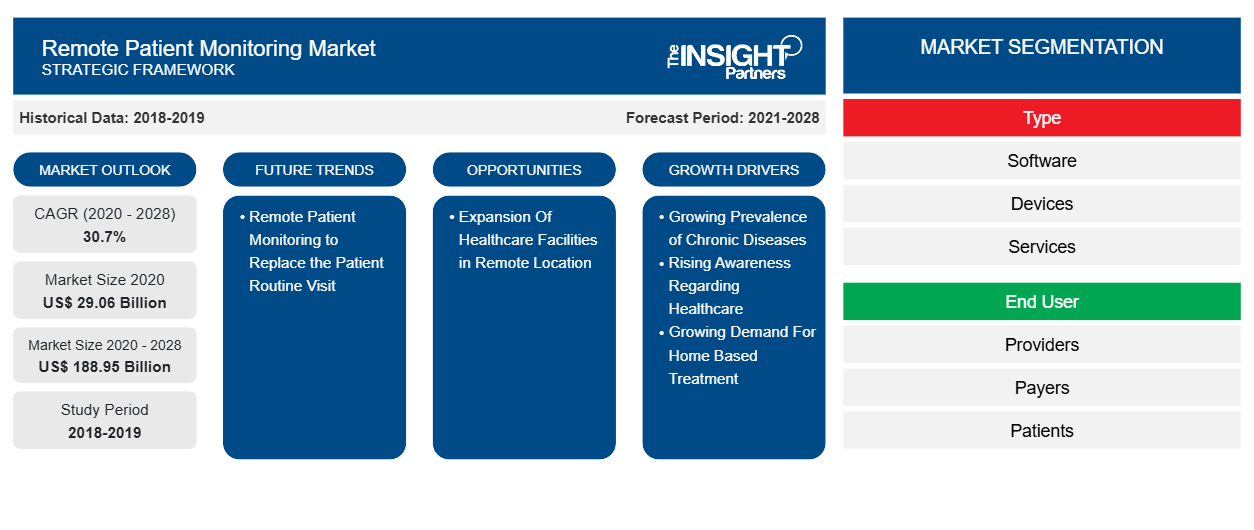

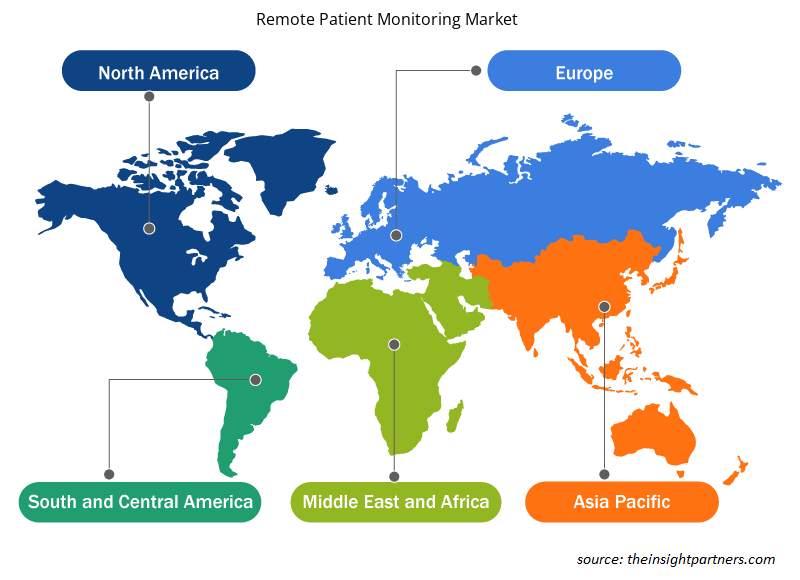

[Research Report] The remote patient monitoring market is expected to reach US$ 188,952.22 million by 2028 from US$ 29,062.30 million in 2021. The market is estimated to grow at a CAGR of 30.7% from 2021 to 2028.

Market Insights and Analyst View:

Remote patient monitoring system, a technology used to collect patients medical and health information from health monitoring and diagnostic devices at one location and transfer it to the physician or doctor at another location. The most used remote patient monitoring technologies are accelerometers that can evaluate both measures of activity and sleep. Other remote patient monitoring technologies include mobile apps that track disease activity, electronic peak flow meters, continuous glucose monitoring, blood pressure and heart rhythm monitoring, and remote cough measurement devices. Due to which, it helps to reduce the patient hospitalization time and reduces hospital visits. This further improves patient's care and quality of life.

The increasing product launch in remote patient monitoring technologies is the major driving factor for the growth of the market. For instance, in March 2021, Medtronic officially confirmed its Medtronic Care Management Services (MCMS)(opens new window) business has released two new solutions created to assist, monitor, and triage support for patients who may be concerned about COVID-19 and their respiratory symptoms. This factor is bolstering the healthcare monitoring devices growth.

Growth Drivers and Challenges:

Chronic diseases such as heart disease, diabetes, stroke, and obesity are the leading causes of death across the world and these diseases account for the largest share of the country's health care cost. According to CDC, in 2018, ~9% of the total population had diabetes, and it is the major cause of lower-limb amputation and kidney failure in the US. Further, the report also suggests that more than 1.5 million American population are diagnosed with diabetes in the US every year. Similar scenario of higher prevalence of diabetes persists in other regions such as Europe, Asia Pacific, and Middle East and Africa. According to International Diabetes Federation's published IDF Diabetes Atlas, in 2017, south-east part of Asia had ~19% of the total diabetes population globally.

According to the American College of Cardiology Foundation, in 2018, CHD was the major cause of death, owing to cardiovascular disease (CVD), followed by stroke, high BP, heart failure, and other CVDs contribution share of 16.8%, 9.4%, 9.0%, and 17.9% respectively. By 2035, nearly 130 million adults in the US are feared to have CVD. Thus, rising geriatric population and related chronic disorders are expected to push the sales of cardiac monitoring devices and other vital sign monitoring devices market, thus propelling the growth of global remote patient monitoring devices market during the forecast period.

The regulatory requirements for medical devices are well established worldwide, but advanced remotely monitored devices need some different guidelines to control and avoid the malpractices. Remote patient monitoring devices are designed to record patient’s data and transmit it to physician or doctor for diagnosis and also saved for analysis, but little has been established with respect to responsibility for when that information lands in the wrong hands. There has been rapid transformation in the technology during the recent years, leading to a greater need for the formation of regulatory guidelines ensuring proper use of the medical devices. Concerns regarding issues such as, privacy, security, data ownership, and consent are expected to offer obstacle to the adoption of remotely monitored medical devices, during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Remote Patient Monitoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Remote Patient Monitoring Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “Global Remote Patient Monitoring Market” is segmented based on type, end user, and geography. Based on type, the remote patient monitoring market is segmented into software, devices and services. The remote patient monitoring software segment is further bifurcated into on premises software and Cloud based software’s. The remote patient monitoring software device type segment is classified into cardiac monitoring devices, neurological monitoring devices, respiratory monitoring devices, multiparameter monitoring devices, fetal and neonatal monitoring devices, weight monitoring devices and other monitoring devices. Based on End user, the remote patient monitoring market is segmented into providers, payers, patients and others. The remote patient monitoring service provider segment of end users are further classified into hospitals, homecare settings, ambulatory care centers and others. The remote patient monitoring service market based on geography is segmented into North America (US, Canada, and Mexico), Europe (Germany, France, Italy, UK, Russia, and Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America)

Segmental Analysis:

Based on type, the remote patient monitoring market is segmented software, devices, and services. The remote patient monitoring devices segment held the largest share of the market in 2021, whereas the remote patient monitoring devices software segment is anticipated to register the highest CAGR of 31.9% in the market during the forecast period. Cloud computing refers to an application-based software infrastructure that stores the data on a remote server that can be accessed through internet. The front-end part of the interface enables the user to access the data stored in the cloud with the help of an internet browser or a cloud computing software. Cloud based remote patient monitoring software integrated in remote patient monitoring solutions enables virtual care through various real time data solutions. These solutions help to keep the patients connected with their healthcare providers allowing doctors to give more time to treat critical patients. These solutions further help in utilizing medical resources in an effective way. The cloud based remote patient monitoring software have advantages such as high-speed accessibility, cost-effectivity, reliability, mobility, and a significant data storage capability. Thus, the advantages offered by these solutions are likely responsible for the growth of the segment in the remote patient monitoring market during the forecast years.

Based on end use, the remote patient monitoring market has been segmented into providers, payers, patients, and others. The providers segment held the largest share of the market in 2021, whereas the patient segment is estimated to register the highest CAGR of 31.8% in the market during the forecast period. A Patient is a person who required medical health care or treatment under the physician's care for a particular disease or condition. A patient receives the medical services that are directed by a licensed physician of the healing arts towards improvement, maintenance or protection of health or decreasing of disability, illness, or pain. The remote patient monitoring service provides self-management and caregiver support for patients that includes public health and health care services. Remote patient monitoring help to assist in the diagnosis, treatment, care management, education, and self-management of a patient. The remote patient monitoring system supports long-distance clinical health care, patient & professional health-related education and public health & health administration by using the information and communication technologies. The remote patient monitoring platform is designed depending on the variability of the patient’s adherence and activity.

Moreover, increasing number of hospitals and growing accessibility in emerging nations are also estimated to offer lucrative opportunity for growth of the remote patient monitoring market in hospital segment during the forecast period.

Regional Analysis:

Based on geography, the remote patient monitoring market is divided into five key regions: North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa. In 2021, North America remote patient monitoring market is the largest market with the US holding the largest market share followed by Canada. The growth in North America remote patient monitoring market is characterized by increase in the demand of remote patient monitoring devices and services from hospitals & clinics and home healthcare in the US, the rise in the geriatric population in U.S., rising adoption of vital signs monitoring devices due to COVID-19 pandemic. In addition, the increasing prevalence of the cardiovascular disease population in U.S. and Mexico are likely to boost the growth of the remote patient monitoring devices in the region during the forecast period. In addition, the recently published report by the American Heart Association in 2018 states that one of every three deaths are caused due to cardiovascular diseases. Approximately 2,300 Americans die of cardiovascular disease per year and an average of one death is recorded in every 38 seconds. In US nearly 92.1 million adults are suffering from some form of the cardiovascular disease. The indirect and direct cost associated with the total cardiovascular diseases and stroke are anticipated to entire more than US$ 329.7 billion which includes both health expenditures and productivity loss.

Whereas Asia Pacific remote patient monitoring market is fastest growing market for in a global scenario. China, India and Japan are three major contributors to the growth of the market that is driven by growing emphasis on cost optimization, focus on streamlining of clinical processes, supportive government policies, and increasing number of clinical trials. During the COVID-19 outbreak, the China’s National Health Commission (NHC) encouraged people to use internet-based medical services to limit population movement and infection risk. As a result, the number of users and participation on China's online medical platforms has skyrocketed.

Industry Developments and Future Opportunities:

Various initiatives taken by global remote patient monitoring product providers are listed below:

- In May 2021, CareGuidePro is a new mobile app and online platform from Medtronic that helps patients navigate their spinal cord stimulation journey.

- In Feb 2021, BioTelemetry, Inc., a leading provider of remote cardiac diagnostics and monitoring in the United States, was acquired by Philips. As of February 9, 2021, BioTelemetry's financial results will be consolidated as part of Philips' Connected Care business segment.

- In May 2021, Medtronic has released a new pediatric monitor that alerts doctors about potential airway obstructions during ventilation.

- In Nov 2020, VitalConnect, a leader in remote and in-hospital wearable biosensor technology, announced today that its VitalPatch RTM cardiac monitoring solution is now available for patients who need extended Holter monitoring.

- In June 2020, Philips launched the Avalon CL Fetal and Maternal Pod and Patch in the US, Europe, Australia, New Zealand, and Singapore for remote monitoring.

- In March 2020, Medtronic officially confirmed its Medtronic Care Management Services (MCMS)(opens new window) business has released two new solutions created to assist, monitor, and triage support for patients who may be concerned about COVID-19 and their respiratory symptoms.

Covid-19 Impact:

The COVID-19 pandemic affected economies and industries in various countries across the globe. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America (SAM), and the Middle East & Africa (MEA) hampered the growth of several industries, including the Healthcare IT industry. North America has experienced a rising number of cases of COVID-19 since its outbreak. The clinical and product development engine has experienced profound disruption as colleagues adjust to remote work environments and lab capacity is reduced. Clinical trials are also severely affected by disruptions in both new enrolment and in keeping existing patients on therapies. The impact of COVID-19 has placed many biomedical sensors companies under pressure. However, it also has had a positive impact on the medical device industry, wherein the demand for R&D activity is increasing, leading to a rise in medical device assistance for the detection of COVID-19. For instance, the researchers of the University of Illinois Grainger College of Engineering developed an ultrasensitive test using a paper-based electrochemical sensor that can detect the presence of the coronavirus in five minutes.

The pulse oximeter is among the essential medical devices used to monitor the patients' oxygen level and heart rate. During the pandemic, there has been a rise in the application of pulse oximeter devices at hospitals and homes. During this COVID-19 pandemic, the pulse oximeter has proven helpful to patients with chronic lung diseases to monitor blood oxygen levels. For instance, as per a press release on American Lung Association in April 2020, it was suggested to use an oximeter for at-home use in cases of a chronic lung or heart condition that regularly affect your oxygen saturation level.

Due to the pandemic international trade and supply chain are disrupted, it has affected the sales and manufacturing of remote patient monitoring products for a short period. However, overall prospects for market growth are considered positive.

Remote Patient Monitoring Market Regional Insights

The regional trends and factors influencing the Remote Patient Monitoring Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Remote Patient Monitoring Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Remote Patient Monitoring Market

Remote Patient Monitoring Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 29.06 Billion |

| Market Size by 2028 | US$ 188.95 Billion |

| Global CAGR (2020 - 2028) | 30.7% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Remote Patient Monitoring Market Players Density: Understanding Its Impact on Business Dynamics

The Remote Patient Monitoring Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Remote Patient Monitoring Market are:

- Cerner Corporation

- Medtronic

- Koninklijke Philips N.V.

- VitalConnect

- Boston Scientific Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Remote Patient Monitoring Market top key players overview

Competitive Landscape and Key Companies:

Some of the prominent players holding the global remote patient monitoring market share are Cerner Corporation, Medtronic, Koninklijke Philips N.V., VitalConnect, Boston Scientific Corporation, Siemens Healthineers , AGGE Healthcare, Abbott, Nihon Kohden Corporation, OMRON Corporation amongst others. These companies focus on new product launches and geographical expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. They have a widespread global presence, which provides them to serve a large set of customers and subsequently increases their market share.

Frequently Asked Questions

What are the driving factors for the remote patient monitoring market across the globe?

Key factors that are driving growth of the market are growing prevalence of chronic diseases, rising awareness regarding healthcare, and growing demand for home-based treatments. However, security and privacy issues and unaddressed regulatory concerns are expected to hamper the market during the forecast period.

What is remote patient monitoring?

Remote Patient Monitoring (RPM), a technology used to collect patients medical and health information from health monitoring and diagnostic devices at one location and transfer it to the physician or doctor at another location. Remote patient monitoring (RPM) remotely monitors and analyzes physiological parameters such as heart rate, pulse rate, blood pressure, blood oxygen levels, blood sugar, vital signs. Due to which, it helps to reduce the patient hospitalization time and reduces hospital visits. This further improves patient's care and quality of life.

What is the regional market scenario of remote patient monitoring?

Global remote patient monitoring market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is expected to hold a dominant share in the market for remote patient monitoring. This market is expected to reach to US$ 188,952.22 Million in 2028 from US$ 29,062.30 Mn in 2021. The remote patient monitoring market is estimated to have a larger share in the United States. The growth of the remote patient monitoring market in the United States is expected to grow due to well-developed healthcare facility centers equipped with modern-age equipment and instruments as well as rising adoption of telemedicine and telehealth services in the region. On the other hand, Asia-Pacific is expected to account for a significant rate of growth in the remote patient monitoring market. This attributes to huge patient population, and rising government investment in healthcare infrastructure.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Remote Patient Monitoring Market

- Cerner Corporation

- Medtronic

- Koninklijke Philips N.V.

- VitalConnect

- Boston Scientific Corporation

- Siemens Healthineers AG

- GE Healthcare

- Abbott

- Nihon Kohden Corporation

- OMRON Corporation

Get Free Sample For

Get Free Sample For