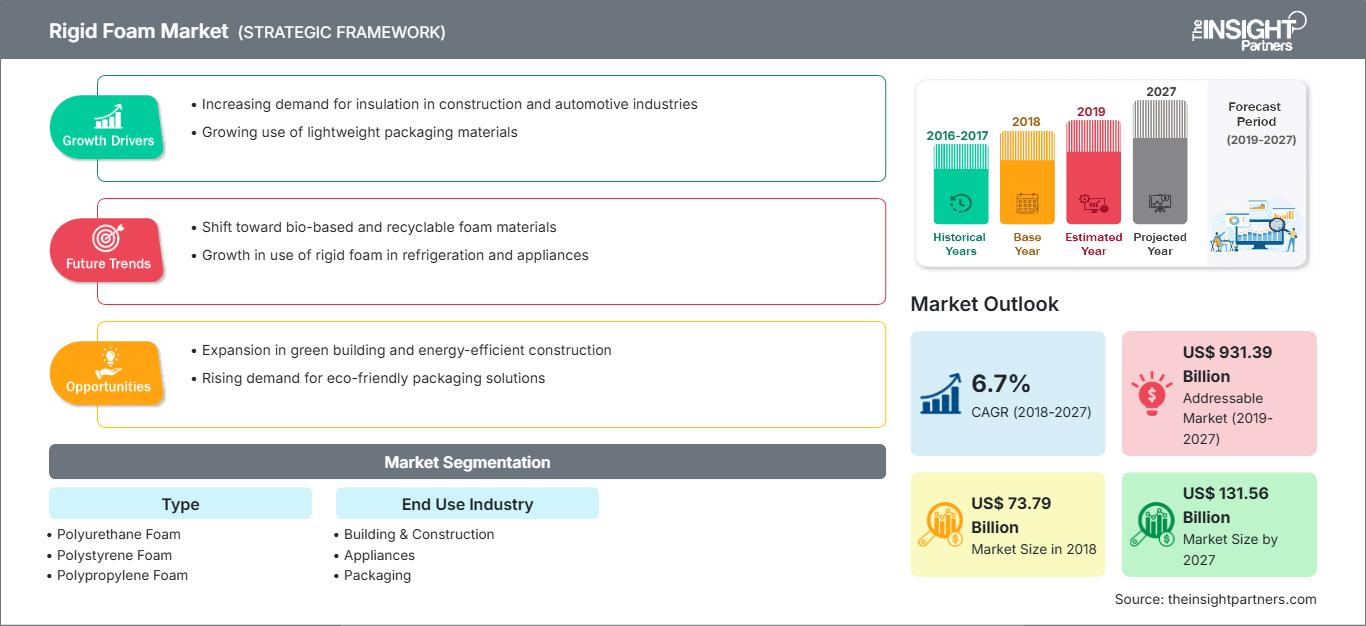

Rigid Foam Market Dynamics and Trends by 2027

Rigid Foam Market to 2027 - Industry Analysis and Forecasts By Type (Polyurethane Foam, Polystyrene Foam, Polypropylene Foam, Polyethylene Foam, Polyvinyl Chloride Foam, and Others), End Use Industry (Building & Construction, Appliances, Packaging, Automotive, and Others)

Historic Data: 2016-2017 | Base Year: 2018 | Forecast Period: 2019-2027- Report Date : Dec 2019

- Report Code : TIPRE00005351

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 144

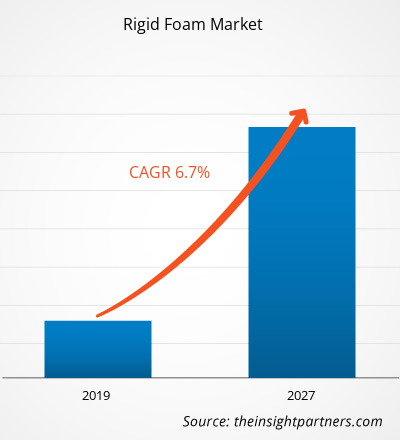

[Research Report] The rigid foam market accounted to US$ 73,786.7 Mn in 2018 and is expected to grow at a CAGR of 6.7% during the forecast period 2019 - 2027, to account to US$ 131,558.9 Mn by 2027.

Rigid foams are known to possess various properties such as waterproofing, anti-static, anti-vibration, and anti-skid, which makes them ideal material to be used across many industrial, as well as construction industries. Rigid foam protects the concrete surfaces onto which they are applied and are responsible for extending the life of the underlying concrete floors. They are inert to oils, detergents and cleaners, transmission fluids, water, hail, snow, and corrosive chemicals. Rigid foam is also used to improve the aesthetic appeal of the floor. They are available in a number of colors, shades, and textures. Metallic pigments, and vinyl color flakes are added to the rigid foam systems to produce surfaces with iridescent colors. The aesthetic appeal of colorful rigid foam is expected to drive the market for rigid foam and is increasingly being used in new housing projects and renovation of old houses.

In 2018, APAC held the largest share of the global rigid foams market. This growth of the market in APAC is primarily attributable to the presence of major rigid foam manufacturers in the region. Also, the rising production activities of rigid foam is expected to fuel market growth during 2019–2027. In Asia Pacific, China accounted for the largest share of rigid foams in terms of revenue generated.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRigid Foam Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Adoption of New Poly(lactide-urethane-isocyanurate) Foams Based on Bio-Polylactide Waste

Rapid advancements in the field of polymer have been witnessed with increase in production of plastics and polymers in recent years. An upward trend in the polymer industry is expected to generate high proportion of polymer waste. Further, new rules and regulations have been formed in the wake of environmental protection, which are driving the scientists and entrepreneurs to look for alternative solutions to manage and treat plastic waste or adoption of biodegradable plastics which could decompose in the natural environment. Amongst, several types of biodegradable plastics produced across world, Polylactide (PLA) is perceived to be one of the preferred form of bioplastics. The waste generated from these plastics can easily be processed into a full-value product such as rigid polyurethane-polyisocyanurate (RPU/PIR) foams. Such foams produced from biodegradable polylactide are treated as sustainable solutions. According to a study presented by Europe PMC, polylactide can partially replace petrochemical polyol in formulation of polyisocyanurate. Also,the obtained PIR foams possess several characteristics such as minimal apparent density, brittleness, and water absorption capability. Therefore, the use of PLA polyol composed of plastic waste can be a great alternative to petrochemical polyols. Such developments help to manage the scarce resources and helps in effective utilization of wastes. Moreover, the products produced from such biomaterial are considered to be environment-friendly solutions.

Type Insights

Based on type, the rigid foam market is bifurcated based on polyurethane foam, polystyrene foam, polypropylene foam, polyethylene foam, polyvinyl chloride foam, and others. The polyurethane foam segment dominated the global rigid foam market. Rigid polyurethane foam is widely used in refrigeration, construction, and packaging industry owing to its superior insulation properties and good dimensional stability.

End-Use Industry Insights

The rigid foam market is bifurcated based on end-use industry into building & construction, appliances, packaging, automotive and others. The building & construction segment accounted for the largest share in the global rigid foam market. Their use in the construction of houses and buildings reduces the energy needed for heating and cooling the interior spaces of buildings, shops, and offices. The growing consumption of rigid foams by the construction & building sector is expected to support the growth of the global rigid foam market during the forecast period.

Several strategies are commonly adopted by companies to expand their footprint worldwide. Huntsman Corporation., Covestro, BASF SE. are among the key players in the global Rigid Foam market implementing these strategies to enlarge the customer base and gain significant share, which, in turn, allows them to maintain their brand name globally.

Rigid Foam Market Regional InsightsThe regional trends and factors influencing the Rigid Foam Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Rigid Foam Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Rigid Foam Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 73.79 Billion |

| Market Size by 2027 | US$ 131.56 Billion |

| Global CAGR (2018 - 2027) | 6.7% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Rigid Foam Market Players Density: Understanding Its Impact on Business Dynamics

The Rigid Foam Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Rigid Foam Market top key players overview

Report Spotlights

- Progressive industry trends in the rigid foam market help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the rigid foam market from 2017 to 2027

- Estimation of rigid foam demand across various industries

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry to predict market growth

- Recent developments to understand the competitive market scenario and rigid foam demand

- Market trends and outlook coupled with factors driving and restraining the growth of the rigid foam market

- Understanding of strategies that underpin commercial interest with regard to rigid foam market growth, which facilitates decision-making process for stakeholder’s rigid foam market size at various nodes of market

- Detailed overview and segmentation of the rigid foam market, as well as its dynamics in the industry

Global Rigid Foam Market – by Type

- Polyurethane foam

- Polystyrene foam

- Polypropylene foam

- Polyethylene foam

- Polyvinyl chloride foam

- Others

Global Rigid Foam Market – by End-Use Industry

- Building & Construction

- Appliances

- Packaging

- Automotive

- Others

Company Profiles

- Saint-Gobain

- Dow Chemical Corporation

- BASF SE

- Borealis AG

- Sekisui Chemical Co.,Ltd

- Covestro AG

- Armacell International S.A.

- Huntsman International LLC

- JSP

- Zotefoams Plc

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For