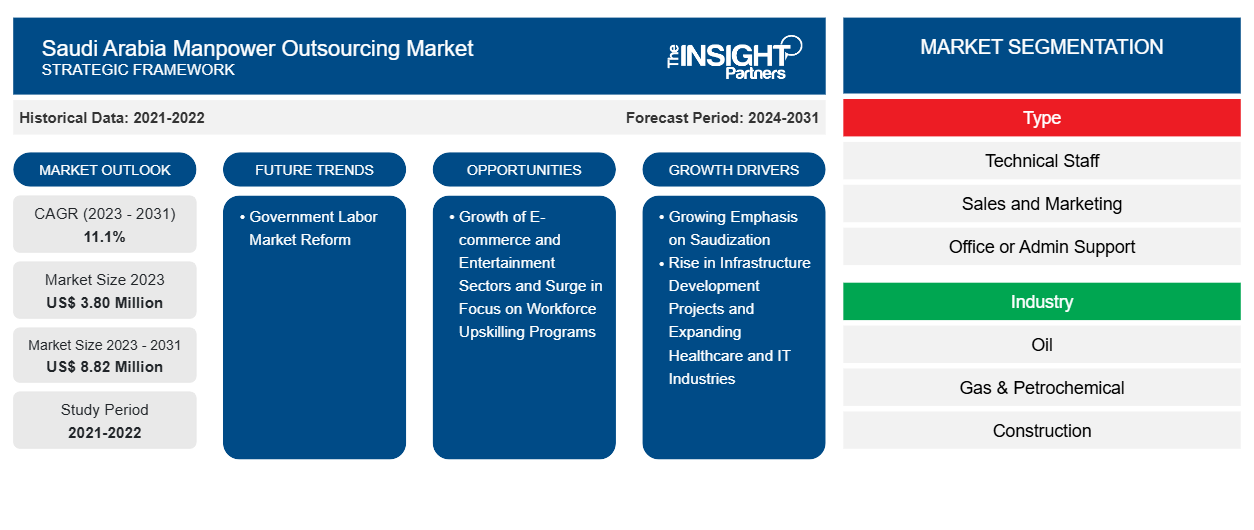

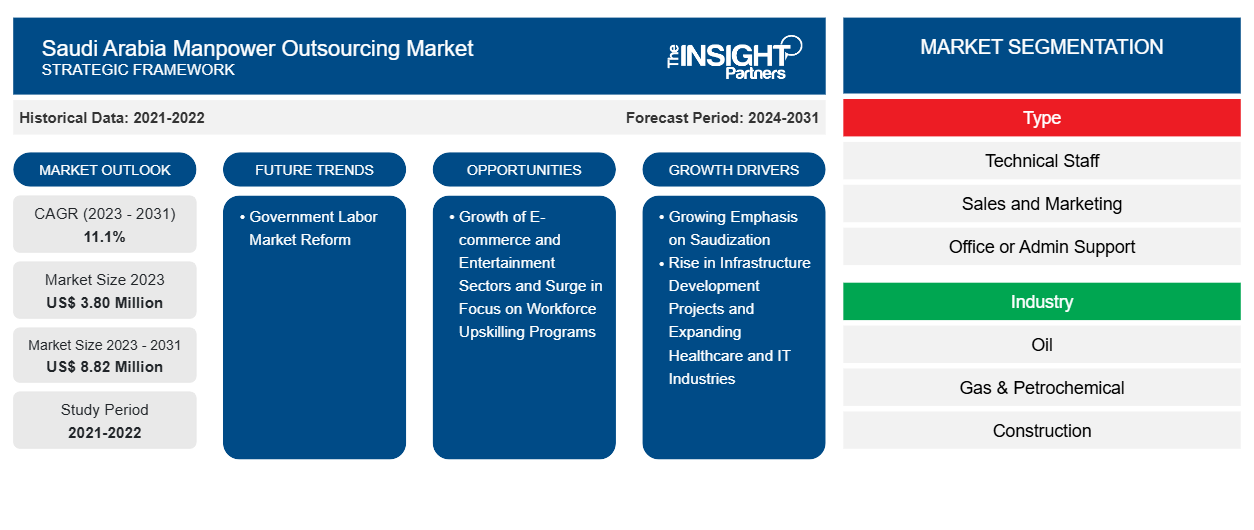

The Saudi Arabia manpower outsourcing market size was valued at US$ 3.80 million in 2023 and is expected to reach US$ 8.82 million by 2031; it is estimated to record a CAGR of 11.1% during 2023–2031. The rise of government labor market reforms is likely to bring new trends to the Saudi Arabia manpower outsourcing market during the forecast period.

Saudi Arabia Manpower Outsourcing Market Analysis

Saudi Arabia has experienced significant progress in industrialization and commercialization in recent years. Despite the economic challenges caused by disruptions in the oil industry, the country has successfully diversified its economy by attracting a range of industries. The establishment of international companies in the country has played a pivotal role in its economic recovery. With the rising establishment of industries, there is a corresponding increase in demand for skilled labor to ensure smooth operations and enhanced production. However, a growing reluctance among Saudi youth to pursue private-sector employment at lower wage levels has created a gap in the domestic workforce. This shortage has been largely addressed by the influx of expatriates, who currently dominate many sectors in the country.

Saudi Arabia Manpower Outsourcing Market Overview

Manpower outsourcing allows organizations to focus on their core competencies while leveraging specialized expertise in staffing and workforce management. By outsourcing manpower, companies can significantly reduce operational costs related to recruitment, training, and employee benefits. This enables businesses to allocate resources more effectively. Outsourcing firms possess industry-specific knowledge and experience, providing access to a wider talent pool. This ensures that businesses can find qualified candidates who meet their specific skill requirements quickly. The Saudi government has implemented the Saudization initiative as part of its Vision 2030 strategy. This initiative aims to create new employment opportunities for Saudi citizens by encouraging the hiring of skilled local talent across various industries. The Saudization program is expected to generate significant job opportunities in the coming years, with a particular focus on sectors such as retail, where demand for labor remains high. Moreover, the increasing consumer demand across multiple industries is driving companies to invest considerable time and resources into recruiting professionals with specialized expertise. However, considering the complexity and time-intensive nature of recruitment, many organizations are outsourcing their hiring processes. This trend is fueling the growth of the manpower outsourcing industry in Saudi Arabia as companies seek external recruitment agencies to streamline the hiring of qualified personnel and meet the evolving demands of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Manpower Outsourcing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Saudi Arabia Manpower Outsourcing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Saudi Arabia Manpower Outsourcing Market Drivers and Opportunities

Rise in Infrastructure Development Projects to Favor Market

In recent years, Saudi Arabia has unveiled a series of ambitious large-scale projects designed to transform the country into a leading global economic powerhouse. These initiatives, supported by multi-billion-dollar investments, aim to diversify the national economy beyond oil, create significant employment opportunities, and elevate Saudi Arabia's status as a prime hub for trade and tourism. For instance, in 2017, NEOM, a transformative development initiative, was introduced to create approximately 460,000 jobs and contribute an estimated US$ 48 billion to Saudi Arabia's GDP; it is projected to be completed by 2025. Similarly, in November 2024, the Saudi Roads General Authority (RGA) announced that the road sector in the Riyadh region is undergoing a major transformation, with ongoing work on projects worth SAR 3 billion (US$ 798 million). The total length of roads in the region is approximately 15,000 km, and significant efforts are being made to implement new road projects and carry out maintenance across all of the region's governorates. According to the RGA, 23 road projects have been completed in the Riyadh region, including 20 preventive maintenance projects covering a total of 215 km. Therefore, the rise in infrastructure development projects drives the Saudi Arabia manpower outsourcing market.

Growth of E-commerce and Entertainment Sectors

The Saudi government aims to attract foreign direct investments from various countries to help international companies establish their satellite offices to boost economic growth as well as create job opportunities. A few of the sectors being majorly focused on development are e-commerce, retail, and entertainment, among others. The interest in catalyzing the retail industry facilitates manpower outsourcing companies to generate substantial revenue.

In the recent past, the e-commerce industry has flourished significantly in Saudi Arabia. The increasing penetration of the Internet and smartphones has led Saudi youths to continue opting for online retail in the future. The e-commerce industry possesses substantial job opportunities in the Saudi market. In addition, Saudi Arabia's commitment to the entertainment sector is clearly demonstrated by its major giga-projects, alongside numerous initiatives such as the establishment of key public entities, including the General Entertainment Authority (GEA), the Saudi Commission for Tourism and National Heritage (SCTH), the General Culture Authority, and the General Commission for Audiovisual Media (GCAM). The country aims for the entertainment sector to contribute 4.2% to the national GDP and generate 450,000 job opportunities by 2030. Thus, the growth of e-commerce and entertainment sectors is likely to fuel the Saudi Arabia manpower outsourcing market growth during the forecast period.

Saudi Arabia Manpower Outsourcing Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Saudi Arabia manpower outsourcing market analysis are type and industry.

- Based on type, the Saudi Arabia manpower outsourcing market is segmented into technical staff, sales and marketing, office/admin support, and others. The technical staff segment dominated the market in 2023.

- On the basis of industry, the Saudi Arabia manpower outsourcing market is segmented into oil, gas, and petrochemical; construction; IT and telecom; retail; healthcare; real estate; education; tourism; agriculture; and others. The oil, gas, and petrochemical segment dominated the market in 2023.

Saudi Arabia Manpower Outsourcing Market Share Analysis

- The construction industry is one of the key industries of outsourced labor. Massive infrastructure projects such as NEOM, the Red Sea Project, and the expansion of the Riyadh Metro have had a significant impact on the country's manpower outsourcing market. These projects are expected to drive the demand for outsourced labor in various sectors, from construction to high-tech services. For instance, Saudi giga-project NEOM's workforce is expected to surpass 200,000 by 2025 from 140,000 workers in April 2024, according to the CEO of the project. Moreover, information technology and digital services have emerged as a rapidly growing industry for manpower outsourcing. With the country’s aggressive digital transformation initiatives, there is an increasing demand for skilled professionals in software development, cybersecurity, and cloud computing.

Thus, the Saudi Arabia manpower outsourcing market has experienced significant growth over the past few years, driven by the country's economic diversification, government reforms, ongoing development initiatives under the Vision 2030 plan, and the demand for specialized skills across various sectors.

Saudi Arabia Manpower Outsourcing Market Report Scope

Report Attribute

Details

Market size in 2023

US$ 3.80 Million

Market Size by 2031

US$ 8.82 Million

CAGR (2023 - 2031) 11.1%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type - Technical Staff

- Sales and Marketing

- Office or Admin Support

By Industry - Oil

- Gas & Petrochemical

- Construction

- IT and Telecom

- Retail

- Healthcare

- Real Estate

- Education

- Tourism

- Agriculture

Regions and Countries Covered

Saudi Arabia- Saudi Arabia

Market leaders and key company profiles

- Ajeets Management and HR Consultancy

- ADAM RECRUITMENT

- PROVEN SA

- TASC OUTSOURCING

- Knowledge Group

- Serco Group plc

- NES Fircroft

- Esad for Human Resources Solutions and Management

- Tamkeen Talents

- JawaHR

Saudi Arabia Manpower Outsourcing Market Players Density: Understanding Its Impact on Business Dynamics

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.80 Million |

| Market Size by 2031 | US$ 8.82 Million |

| CAGR (2023 - 2031) | 11.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Saudi Arabia

|

| Market leaders and key company profiles |

|

The Saudi Arabia Manpower Outsourcing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Saudi Arabia Manpower Outsourcing Market top key players overview

Saudi Arabia Manpower Outsourcing Market News and Recent Developments

The Saudi Arabia manpower outsourcing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Saudi Arabia manpower outsourcing market are listed below:

- SMASCO and Urban Company, Asia's largest technology marketplace for home services, announced the establishment of their joint venture and the launch of a new cutting-edge home service platform in Saudi Arabia. The new joint venture will leverage Urban Company's advanced technology capabilities and consumer centricity with SMASCO's vast manpower resource network to offer exceptional home service solutions to the Saudi market, redefining the way home services are delivered for over 36 million citizens and residents across the country. (Source: SMASCO, Press Release, October 2024)

- TASC Outsourcing, a leading HR consultancy in the GCC, introduced TASC360, a groundbreaking HR platform designed specifically for the region. The platform has been specifically designed with three powerful modules: Incorpify, Onboardify, and Governify, the company announced in a media release. By harnessing AI technology, TASC360 streamlines labor-intensive tasks, boosts efficiency, and cuts costs. This solution addresses key HR challenges, including expatriate employee onboarding, government relations (GRO), and company formation. (Source: TASC Outsourcing, Press Release, October 2024)

Saudi Arabia Manpower Outsourcing Market Report Coverage and Deliverables

The "Saudi Arabia Manpower Outsourcing Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Saudi Arabia manpower outsourcing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Saudi Arabia manpower outsourcing market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Saudi Arabia manpower outsourcing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Saudi Arabia manpower outsourcing market

- Detailed company profiles

Frequently Asked Questions

What will be the market size for Saudi Arabia manpower outsourcing market by 2031?

Which are the key players holding the major market share of Saudi Arabia manpower outsourcing market?

Which is the leading type segment in the Saudi Arabia manpower outsourcing market?

What is the estimated market size for the Saudi Arabia manpower outsourcing market in 2023?

What are the future trends of the Saudi Arabia manpower outsourcing market?

What are the driving factors impacting the Saudi Arabia manpower outsourcing market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For