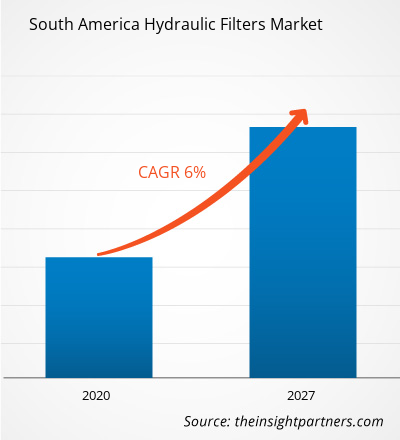

The hydraulic filters market in SAM is expected to grow from US$ 243.25 million in 2019 to US$ 383.22 million by 2027; it is estimated to grow at a CAGR of 6.0% from 2020 to 2027.

Brazil and Argentina are major economies in SAM. Technological and digital advancements are providing surge in demand for hydraulic filter. Digitization has paved the way for manufacturers of hydraulic filters to introduce new business models based on equipment utilization or performance. Also, integrating digital electronics with hydraulic systems provides one of the best solutions in modern control architectures in terms of high power density and hydraulic system flexibility. Moreover, with just few modifications, such electro-hydraulic components can be easily integrated with conventional systems. Similarly, hydraulic hose failure or connector leakage of hydraulic systems can be predicted using IoT technology. Digitization has increased the efficiency of existing machines and is expected to boost the demand for hydraulic filter in SAM hydraulic filters market in 2019 because of reliable and high quality offerings. The emergence of new market players is a new challenge for established leaders in the market. The idea of digital machinery has transformed manufacturers from 'hardware-only' providers into 'providers of' hardware, software, and services, which in turn has led to the development of new business models. These new models are used by hydraulic filter manufacturers to generate a steady stream of revenues and build a loyal client base. Also, growing production of vehicles in this region is likely to boost the growth of the SAM hydraulic filters market. For example, according to the Brazil Nation Association of Automobile Manufacturers Anfavea, car production in Brazil increased by 14.6% compared to 2017 in the first three months of 2018, as manufacturers increased output to meet growing domestic demand. Therefore, increasing production of vehicles is boosting the demand for hydraulic filters in this region proportionately, thereby boosting the market's growth in SAM region. Thus, growing digitization is one of the major factors driving the growth of SAM hydraulic filters market during the forecast period.

Further, the ongoing COVID-19 pandemic is adversely impacting the SAM region. In the SAM, Brazil has the highest number of COVID-19 confirmed cases, followed by other countries such as Ecuador, Peru, Chile, and Argentina. The governments of various countries in SAM are taking several initiatives to protect people and control COVID-19's spread in the region through lockdowns, trade bans, and travel restrictions. These measures are expected to affect the region's economic growth as the region directly will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to major trading partners. The outbreak has also resulted in the shutdown of production plants, which has impacted the growth of the automotive, manufacturing, and construction industry, among others and has limited the growth of the hydraulic filters market in the region. Additionally, the sales of passenger vehicles in the region has declined which has resulted in the lower demand of the hydraulic filters market. Therefore, the COVID-19 pandemic outbreak has suppressed the hydraulic filters market in the SAM region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging hydraulic filters market. This factor is likely to drive the SAM hydraulic filters market. The SAM hydraulic filters market is expected to grow at a good CAGR during the forecast period.SAM Hydraulic Filters Market

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Hydraulic Filters Market Segmentation

SAM Hydraulic Filters Market – By Product

- Suction Filter

- Pressure Filter

- Return Line Filter

- Off-Line Filter

- Breather Filter

- Others

SAM Hydraulic Filters Market – By End-User

- Manufacturing

- Marine

- Automotive

- Chemical and Petrochemical

- Power Generation

- Agriculture

- Construction

- Metal and Mining

- Others

SAM Hydraulic Filters Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Hydraulic Filters Market - Companies Mentioned

- Bosch Rexroth Corporation

- Donaldson Company, Inc.

- Eaton Corporation Plc.

- Filtration Group Industrial

- HYDAC Technology Ltd.

- MANN+HUMMEL Group

- MP Filtri S.p.A.

- Pall Corporation

- Parker-Hannifin Corporation

- YAMASHIN-FILTER CORP.

South America Hydraulic Filters Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 243.25 Million |

| Market Size by 2027 | US$ 383.22 Million |

| Global CAGR (2020 - 2027) | 6.0% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Compounding Pharmacies Market

- Occupational Health Market

- Adaptive Traffic Control System Market

- Hair Wig Market

- Clinical Trial Supplies Market

- Employment Screening Services Market

- Nuclear Waste Management System Market

- Electronic Health Record Market

- Industrial Valves Market

- Foot Orthotic Insoles Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, and End-user

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Brazil, Argentina

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

- Bosch Rexroth Corporation

- Donaldson Company, Inc.

- Eaton Corporation Plc.

- Filtration Group Industrial

- HYDAC Technology Ltd.

- MANN+HUMMEL Group

- MP Filtri S.p.A.

- Pall Corporation

- Parker-Hannifin Corporation

- YAMASHIN-FILTER CORP.

Get Free Sample For

Get Free Sample For