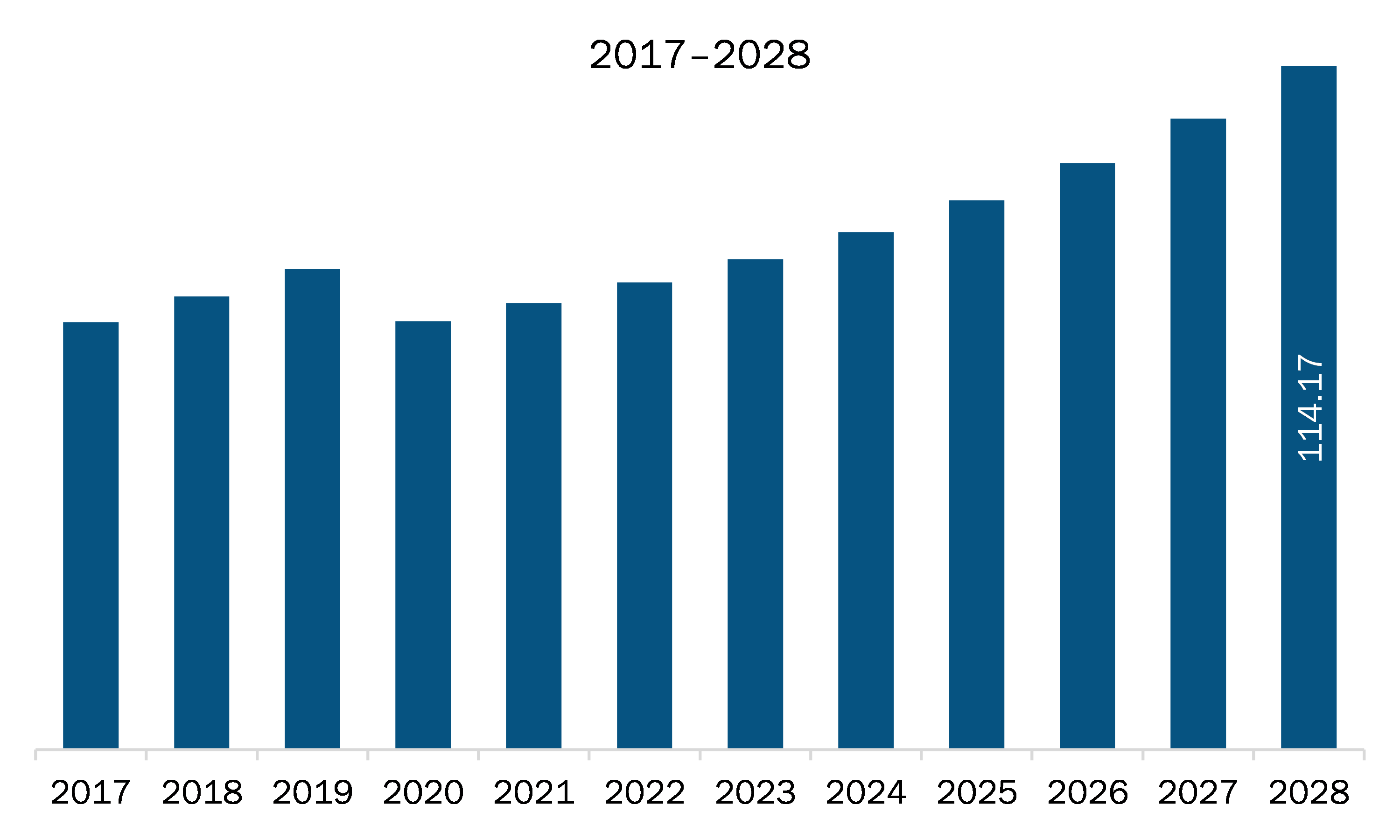

The machine vision lighting market in SAM is expected to grow from US$ 74.56 million in 2021 to US$ 114.17 million by 2028; it is estimated to grow at a CAGR of 6.3% from 2021 to 2028.

Brazil and Argentina are major economies in SAM. Non-industrial sector implementing machine vision is the major factor driving the growth of the SAM machine vision lighting market. Lower costs and ongoing improvements in vision components, such as 3D color cameras and machine learning techniques, is expected to further expand the machine vision sector into non-industrial niche applications, such as driverless car systems, IP video surveillance, intelligent traffic systems, logistics, agriculture, and guided surgery. Once considered too delicate for use anywhere but in environmentally controlled indoor areas, machine vision components today have been hardened for highly demanding outdoor applications. One real-world instance is the implementation of 3D color cameras to inspect the undercarriage and sides of railcars as a train passes by, thus eliminating the need for the cars to be taken out of service and removed to a maintenance center for inspection. By being contained within rugged scannerboxs, the 3D cameras are protected against dirt, dust, and water. This innovative system provides maintenance crews with precise stereoscopic 3D images, detecting various potential faults on couplings, hoses, pressure tanks and wheels, as well as locating loose screws that would otherwise remain unnoticed on a standard 2D-image. Another example is the use of machine vision aided drones that would allow farmers to visually evaluate crop issues like pests, disease, and weather without the need to visit far-off fields.

Brazil has the highest number of COVID-19 confirmed cases in SAM, followed by Ecuador, Chile, Peru, and Argentina. The COVID-19 pandemic has led to the closure of all economic activities across the region to combat the spread of the virus. The closure of manufacturing activities across major SAM countries, such as Brazil and Argentina, to combat the spread is adversely affecting the new adoption of technology. The COVID-19 crisis hindered the manufacturing industry across Argentina, which was already weakened by the recession of previous years. This has influenced government bodies to take necessary steps to boost the sector across the country over the years. Though the machine vision lighting market is adversely affected due to the outbreak, but the government initiative to attract investors in the sector is expected to influence the adoption of the technology across various industries in SAM in the coming years

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM machine vision lighting market. The SAM machine vision lighting market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Machine Vision Lighting Market Segmentation

SAM Machine Vision Lighting Market – By Lighting Type

- LEDs

- Fiber Optic Lights (Halogen)

- Florescent Lighting

- Xenon

- Others

SAM Machine Vision Lighting Market – By Spectrum of Light

- Visible spectrum

- UV Spectrum

- IR spectrum

SAM Machine Vision Lighting Market – By Application

- Automotive

- Consumer Electronics

- Food & Beverage

- Pharmaceuticals

- Logistics

- Others

SAM Machine Vision Lighting Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Machine Vision Lighting Market - Companies Mentioned

- Advanced Illumination Inc

- EFFILUX

- Moritex Corporation

- National Instruments Corporation

- Omron Microscan System, Inc.

- Smart Vision Lights

- Spectrum Illumination

- TPL Vision

South America Machine Vision Lighting Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 74.56 Million |

| Market Size by 2028 | US$ 114.17 Million |

| CAGR (2021 - 2028) | 6.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Lighting Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For