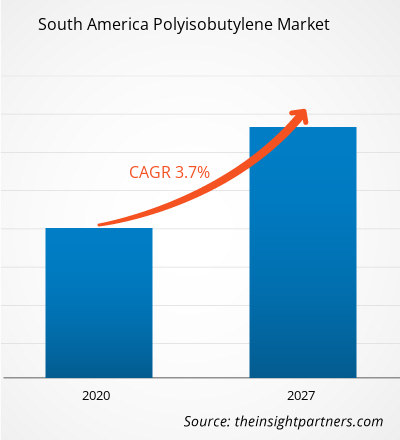

The Polyisobutylene market in SAM is expected to grow from US$ 154.9 Million in 2019 to US$ 207.7 Million by 2027; it is estimated to grow at a CAGR of 3.7% from 2020 to 2027.

Brazil, Argentina, and Rest of SAM are the major economies in SAM. The rise in demand for Polyisobutylene from construction industry. The world-wide changes in construction industry associated with use of material is changing faster than ever before. Urbanization, is considered as just one of the international megatrends shaking up the construction industry. The population of the urban zones is raising by 200,000 people per day, all of whom need reasonably priced housing as well as transportation, social and utility infrastructure. In such challenges, the construction industry is practically under a moral compulsion to transform. Its transformation is impacting elsewhere on the wider society, by reducing construction costs and by enlightening the use of scarce materials or by making buildings more eco-efficient and boosting economic development and by narrowing the infrastructure gap. Utilization of polyisobutylene in owing to demand for material with high melt flow rates, greater elongation, as well as enhanced impact strength. Increasing infrastructure demand in the evolving economies of the South America on account of developing road infrastructure, increase in per capita ownership of houses and rising spending capacity is expected to affect the construction sector in the region, which in turn will drive the demand for polyisobutylene in SAM region. Thus, the growth in the construction sector is expected to create a significant demand for polyisobutylene (PIB) in the coming years, which is further anticipated to drive the market in SAM.Brazil has the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina, among others. The government of South America has taken an array of actions to protect their citizens and contain COVID-19’s spread. It is anticipated that South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe, and the United States, which are important trade partners. Containment measures in several countries of South America will reduce economic activity in the manufacturing and service sectors for at least the next quarter, with a rebound once the epidemic is contained.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. Considering these factors is likely to drive the South America polyisobutylene market is expected to grow at a good CAGR during the forecast period.

SAM Polyisobutylene Market Revenue and Forecast to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SAM Polyisobutylene Market Segmentation

SAM Polyisobutylene Market – by Molecular Weight

- Low

- Medium

- High

SAM Polyisobutylene Market – by Product

- Conventional PIB

- Highly Reactive PIB

SAM Polyisobutylene Market – by Application

- Tires

- Industrial Lubes and Lube Additives

- Fuel Additives

- Adhesives and Sealants

SAM Polyisobutylene Market – by End Use Industry

- Industrial

- Food

- Others

SAM Polyisobutylene Market, by Country

- Brazil

- Argentina

- Rest of SAM

SAM Polyisobutylene Market-Companies Mentioned

- BASF SE

- Braskem SA

- Ineos AG

- Infineum International Limited

- TPC Group

South America Polyisobutylene Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 154.9 Million |

| Market Size by 2027 | US$ 207.7 Million |

| Global CAGR (2020 - 2027) | 3.7% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Molecular Weight

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Molecular Weight, Product, Application, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Brazil, Argentina

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - South America Polyisobutylene Market

- TPC Group

- Infineum International Limited

- Ineos AG

- Braskem SA

- BASF SE

Get Free Sample For

Get Free Sample For