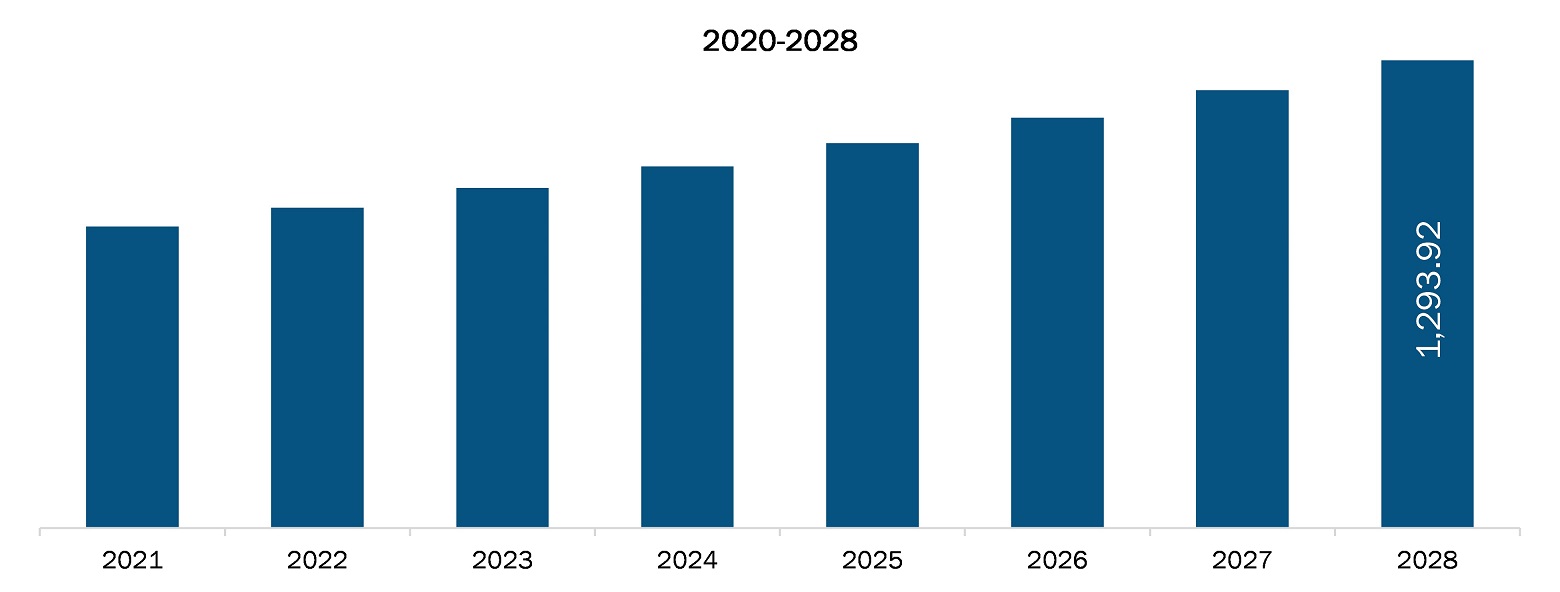

The South and Central America laboratory developed test market is expected to reach US$ 1,293.92 million by 2028 from US$ 834.55 million in 2021; it is estimated to grow at a CAGR of 6.5% from 2021 to 2028.

The key factors driving the market's growth are the increasing incidence of cancer and genetic disorders and the growing number of product launches for laboratory developed tests. However, the changing regulatory landscape is hampering the growth of the South and Central America laboratory development test market.Cancer is one of the leading causes of death worldwide. As per the WHO, cancer was a cause of ~9.6 million deaths in 2018. Clinical diagnostics helps in detecting early signs and risk factors, paving the way for early intervention. The laboratory developed tests (LDTs) have a decisive impact on each step of diagnosis, from screening to the prevention of certain diseases and early diagnosis at the onset of illness. For instance, the Oncotype DX lab test is used to determine if chemotherapy would benefit patients with early-stage breast cancer. It also helps evaluate the likelihood of disease recurrence; the test is performed on a small tissue sample removed during breast cancer surgery. In addition, the increasing incidence of genetic disorders is also driving the demand for LDTs. Many LDTs are available for genetic testing due to a lack of availability of genetic tests in the market. As per the Association for Molecular Pathology 2018 assessment, ~70,000 genetic tests are available in the medical market, and most of these are LDTs. Therefore, the rising incidence of cancer and growing awareness regarding the importance of early diagnostics are boosting the adoption of LDTs. Also, LDTs are developed and used within laboratories and are not distributed or sold to other laboratories or healthcare facilities. Thus, the frequency of development and introduction of new LDTs is high. Additionally, the increasing emergence of SARS-CoV-2 variants has highlighted the need to identify, trace, and track mutations across the complete viral genome. Hence, increasing research on developing LDTs to detect cancer and autoimmune diseases is driving the market growth.

The COVID‐ 19 pandemic is a critical test for the already overburdened and underfunded public healthcare systems of South and Central America. State-run hospitals and clinics are already overstressed by the treatment of vector‐borne diseases, community‐acquired infections, and high rates of non‐communicable diseases (NCDs). As per the Pan American Health Organization (PAHO), the prevention and treatment of NCDs have been critically affected since the onset of the COVID-19 in the region. Moreover, in South and Central America, the gross domestic product (GDP) and central government healthcare expenditure are significantly lower in developed countries. The increasing COVID-19 cases have severely disrupted the care for many chronic diseases, thereby hindering market growth in the region.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

SOUTH AND CENTRAL AMERICA LABORATORY DEVELOPED TEST MARKET SEGMENTATION

By Type

- Clinical Biochemistry

- Critical Care

- Haematology

-

- Coagulation and Hemostasis,

- Hemoglobin Testing

- Blood Count Testing

- Others

- Immunology

- Microbiology

- Molecular Diagnostics

- Other Test Types

By Application

- Academic Institutes

- Clinical Research organizations

- Hospitals laboratory

- Specialty Diagnostic Centers

- Others

By Country

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Quest Diagnostics Incorporated

- F. HOFFMANN-LA ROCHE LTD

- QIAGEN

- Illumina, Inc.

- Guardant Health

South and Central America Laboratory Developed Test Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 834.55 Million |

| Market Size by 2028 | US$ 1,293.92 Million |

| CAGR (2021 - 2028) | 6.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For