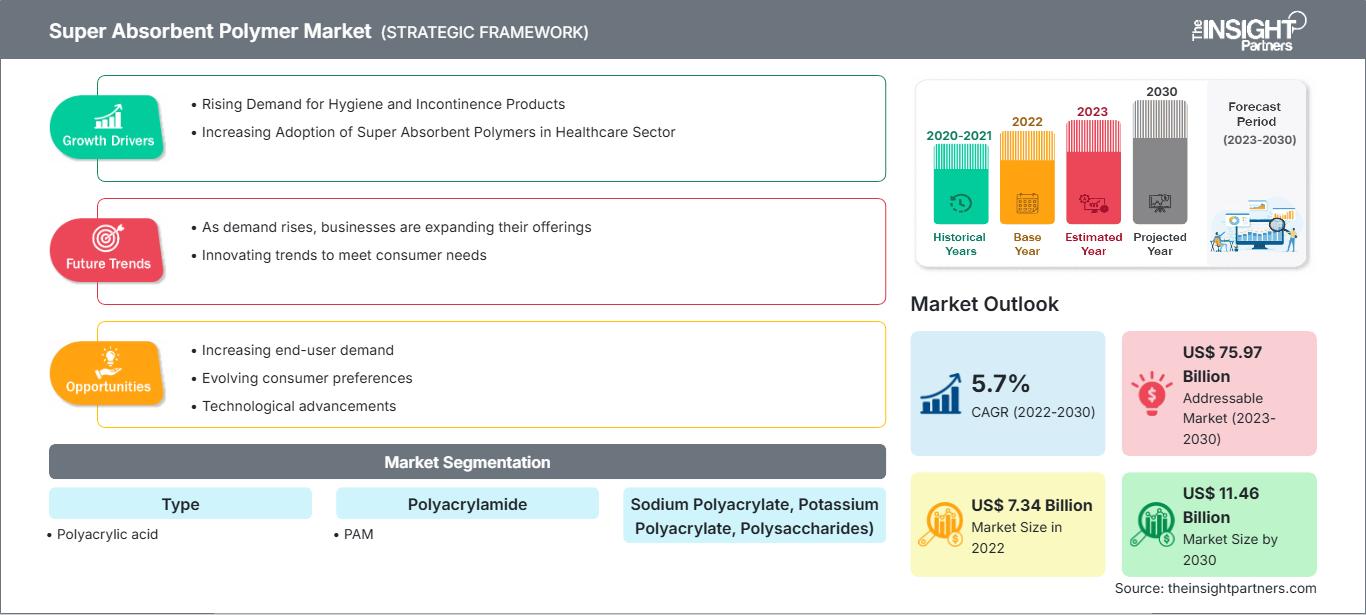

Super Absorbent Polymer Market Key Players and Opportunities by 2030

Super Absorbent Polymer Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Polyacrylic acid (PAA), Polyacrylamide (PAM), Sodium Polyacrylate, Potassium Polyacrylate, Polysaccharides, and Others), Category (Synthetic, and Biobased), and Application (Personal Care, Agriculture, Healthcare, Building and Construction, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Jan 2024

- Report Code : TIPRE00003573

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 265

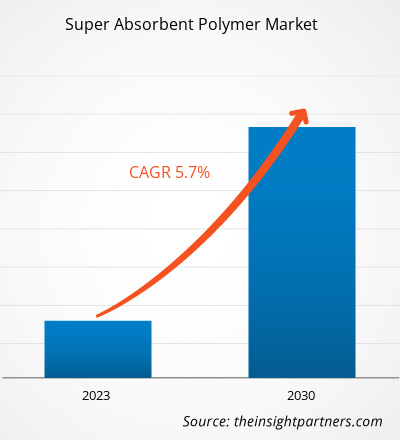

[Research Report] The super absorbent polymer market size was valued at US$ 7,336.14 million in 2022 and is projected to reach US$ 11,456.64 million by 2030; it is anticipated to record a CAGR of 5.7% from 2022 to 2030.

MARKET ANALYSIS

Super absorbent polymers are materials with the ability to absorb and retain large amounts of liquid relative to their mass. Super absorbent polymers are crucial components in adult diapers, adult incontinence products, and feminine hygiene products. Super absorbent polymers are incorporated into soil to improve water retention. This helps in agriculture by reducing the need for frequent irrigation, particularly in arid regions, and enhancing plant growth. Super absorbent polymers are used in wound care dressings and bandages to absorb and retain exudate from wounds. It can be used in oil drilling processes to control fluid loss and improve the rheological properties of drilling fluids.

GROWTH DRIVERS AND CHALLENGES

Increasing adoption of super absorbent polymers in the healthcare sector and rising demand for hygiene and incontinence products are a few factors boosting the global super absorbent polymer market growth. In the healthcare setting, super absorbent polymers are utilized in various hygiene products such as bed pads and hospital underpads. This helps in managing bodily fluids and maintaining cleanliness in medical facilities. Super absorbent polymers are integrated into advanced wound dressings, which create a gel-like consistency to protect the wound and aid the healing process. Super absorbent polymers are lightweight and comfortable, making them ideal for incorporation into medical textiles and dressings. The adoption of super absorbent polymer in the healthcare sector is attributed to its versatility, performance, benefits, and ability to address critical needs in various applications of the medical sector. It is used as a bandage for diabetic foot ulcers, pressure ulcers, leg venous and arterial ulcers, first and second-degree burns, post-operative wounds, and traumatic wounds. As per the National Pressure Ulcer Advisory Panel, the incidence of pressure ulcers ranges from 0.4–38% in hospitals, from 2.2–23.9% in skilled nursing facilities, and from 0–17% for home health agencies. Thus, these key factors are driving the need for super absorbent polymer, thereby fueling the market growth.

The volatility in raw material prices can act as a deterrent for the super absorbent polymer market. Acrylic acid is the major raw material for super absorbent polymer production, and its price fluctuation significantly impacts the viability and profitability of super absorbent polymer manufacturing. Acrylic acid is primarily produced from propylene, a petroleum derivative. Fluctuation in crude oil prices directly affects propylene and consequently affects the cost of acrylic acid. Environmental regulations and trade restrictions on propylene or acrylic acid can impact production costs and market dynamics. Acrylic acid is used in various industries besides super absorbent polymer production. Increased demand for other applications can strain the supply and lead to price hikes, which pose a challenge to the super absorbent polymer market growth.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSuper Absorbent Polymer Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Super Absorbent Polymer Market Analysis and Forecast to 2030" is a specialized and in-depth study with a significant focus on global market trends and growth opportunities. The report aims to provide an overview of the global market with detailed market segmentation on the basis of type, category, application, and geography. The report provides key statistics on the consumption of super absorbent polymers across the world, along with their demand in major regions and countries. In addition, the report provides a qualitative assessment of various factors affecting super absorbent polymer market performance in major regions and countries. It also includes a comprehensive analysis of the leading players in the super absorbent polymer market and their key strategic developments. Analysis of the market dynamics is also included to help identify the key driving factors, market trends, and lucrative opportunities, which, in turn, aids in identifying the major revenue pockets.

The ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global super absorbent polymer market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global super absorbent polymer market is segmented on the basis of type, category, and application. Based on type, the market is segmented into polyacrylic acid (PAA), polyacrylamide (PAM), sodium polyacrylate, potassium polyacrylate, polysaccharides, and others. The sodium polyacrylate segment accounted for a significant share of the super absorbent polymer market in 2022. PAA can absorb and retain water and swell many times compared to its original volume. It is commonly used in highly absorbent materials such as napkins, paper towels, and disposable diapers. PAM is a majorly used synthetic super absorbent polymer after polyacrylic acid. It has similar water absorbency as compared to polyacrylic acid. Sodium polyacrylate is a super absorbent polymer utilized as an emulsion stabilizer, a hair fixative, a film former, a skin conditioner, and a viscosity agent. It appears as the gel-like crystals in baby diapers, which makes them absorbent. Potassium polyacrylate used as a super absorbent polymer in the agriculture industry leads to better farming results even in poor conditions. It is used as a water-retaining agent and increases the availability of moisture to plants.

In terms of category, the market is bifurcated into synthetic and biobased. Furthermore, the synthetic segment held a significant share of the super absorbent polymer market in 2022. Superabsorbent polymers are cross-linked polymer networks constituting water-soluble building blocks. SAPs are generally composed of ionic monomers and are characterized by a low cross-linking density, which results in a large fluid uptake capacity. Biobased super absorbent polymers are manufactured using new technology, which requires much more advancements. Super absorbent polymers based on natural polymers, such as cellulose, starch, and chitosan, have an advantage of degradability as compared to synthetic category super absorbent polymers.

REGIONAL ANALYSIS

The report provides a detailed overview of the global super absorbent polymer market with respect to five major regions—North America, Europe, Asia-Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific accounted for a significant share of the market and was valued at more than US$ 2,500 million in 2022. Asia Pacific is characterized by steady growth in population, growing disposable income of people, and high per capita healthcare expenditure. According to a report published by the US Census Bureau in 2022, the population of Asia reached 4.5 billion in 2020. Super absorbent polymers act as water reservoirs in the soil, absorbing and storing large amounts of water from irrigation and rainfall. Thus, super absorbent polymers for agricultural applications and rising demand for incontinence products are projected to boost the super absorbent polymer market during the forecast period.

The North America is expected to reach more than US$ 2,800 million by 2030. In North America, the utilization of super absorbent polymer is influenced by the rising demand for baby diapers, adult incontinence products, and feminine hygiene products. The emphasis on convenience, comfort, and improved absorbency in personal care products has fueled the demand for high-performance super absorbent polymers. Europe is expected to record a CAGR of ~6% from 2022 to 2030. According to a report by the United Nations Population Fund in 2022, the share of the aged population is anticipated to reach 30% of the total population in Europe by 2050. The aging and geriatric population is most likely to suffer from incontinence and require adult diapers to manage incontinence. Therefore, rising incontinence issues and growing emphasis on the development of bio-based super absorbent polymers are expected to create lucrative opportunities for market growth.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Various initiatives taken by the key players operating in the super absorbent polymer market are listed below:

- In February 2023, Nippon Shokubai Co Ltd obtained ISCC PLUS certification for 19 products, including acrylic acid, superabsorbent polymers, and ethylene oxide. The certification allows the company to manufacture and market certified products using biomass-derived raw materials.

- In September 2022, Sanyo Chemical Industries Ltd declared that its subsidiary, SDP Global Co, created an environmentally friendly super absorbent polymer with plant-based biomass as one of its raw components.

Super Absorbent Polymers (SAP)

Super Absorbent Polymer Market Regional InsightsThe regional trends and factors influencing the Super Absorbent Polymer Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Super Absorbent Polymer Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Super Absorbent Polymer Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.34 Billion |

| Market Size by 2030 | US$ 11.46 Billion |

| Global CAGR (2022 - 2030) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Super Absorbent Polymer Market Players Density: Understanding Its Impact on Business Dynamics

The Super Absorbent Polymer Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Super Absorbent Polymer Market top key players overview

IMPACT OF COVID-19 PANDEMIC/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Before the COVID-19 pandemic, many countries across the globe reported economic growth. The key manufacturers invested in the research and development of super absorbent polymers. They are also focused on the expansion of geographic reach through merger and acquisition strategies to cater to a wide customer base. Manufacturers reported challenges in sourcing raw materials and ingredients from suppliers, thereby impacting the production rate of a super absorbent polymer. Further, production shortfall caused by severe disruptions in supply chains and limited skilled laborers created a demand-supply gap in many regions, particularly Asia Pacific, Europe, and North America. The demand and supply gap were also recorded in the regions mentioned above due to fluctuating demand from the personal care, construction, and healthcare industries.

The sales of super absorbent polymer increased with the resumption of end-use industries. The market began reviving as governments of various countries took significant measures, such as well-coordinated vaccination drives. With the recovery of operations of the personal care, agriculture and construction sectors, the demand for super absorbent polymer has been growing.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Sanyo Chemical Industries Ltd, LG Chem Ltd, BASF SE, Sumitomo Seika Chemicals Co Ltd, Nippon Shokubai Co Ltd, Evonik Industries AG, Chase Corp, Yixing Danson Science and Technology Co Ltd, Songwon Industrial Co. Ltd, and Satellite Chemical Co Ltd. are among the key players operating in the super absorbent polymer market.

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For