Swine Diagnostics Market Key Companies and SWOT Analysis by 2030

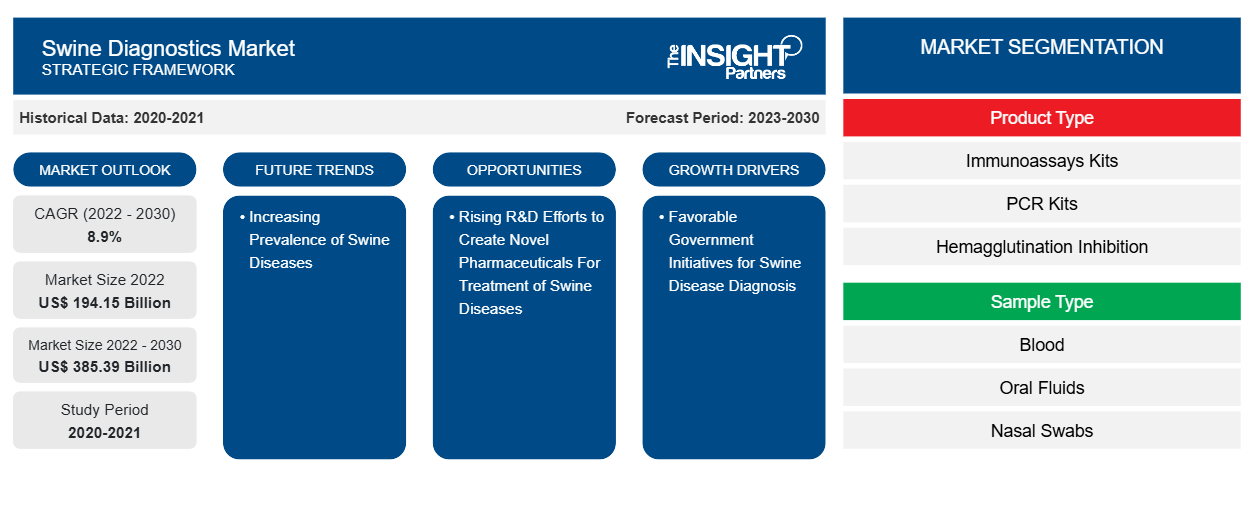

Swine Diagnostics Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Immunoassays Kits, PCR Kits, Hemagglutination Inhibition (HI), and Others], Sample Type (Blood, Oral Fluids, Tissue Samples, Nasal Swabs, and Others), Disease [African Swine Fever (ASF)/Classical Swine Fever (CSF), Porcine Circovirus, Respiratory Diseases, Porcine Epidemic Diarrhea, Swine Dysentery, and Others], End User (Veterinary Hospitals, Veterinary Clinics, and Others), and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPRE00030064

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 183

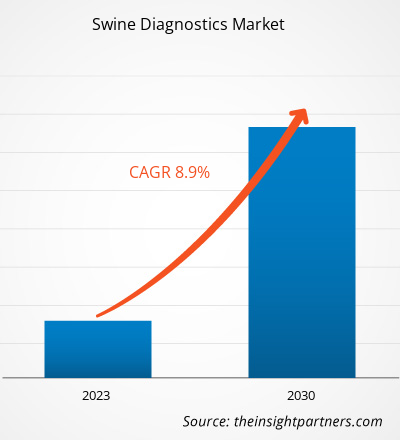

The Swine Diagnostics market size is projected to reach US$ 385.39 billion by 2030 from US$ 194.15 billion in 2022. The market is expected to register a CAGR of 8.9% during 2022–2030. The rising R&D Activities to Create Novel Pharmaceuticals are likely to remain a key trend in the market.

Swine Diagnostics Market Analysis

Swine diagnosis involves understanding the cause of a swine disease. Many swine diseases and conditions have multiple factors, so there may be one or several bacteria and/or viruses involved, as well as factors related to the living conditions of the pigs, such as environmental, nutritional, and management factors. The mounting demand for pork and pork products and the increasing prevalence of swine diseases increase the demand for swine diagnostics. However, the high costs involved in pork health maintenance hinder market growth.

Swine Diagnostics Market Overview

According to the Agricultural 2018–2027 report by the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO), a few of the main contributors to global meat production include the US, China, India, Mexico, the Russian Federation, Argentina, and Turkey. The People's Republic of China is the major meat producer in the world. According to Our World in Data 2021 statistics, ~352.13 million tons of meat was produced worldwide in 2021. The swine diagnostics market is expected to benefit from the growing demand for pork worldwide. As per the European Commission, Europe is the world's second-largest pork producer (after China), and it is the biggest exporter of pork and pork products. For high-quality meat, animals must be inspected on a regular basis. The expanding consumption of pork and pork products increases the demand for the swine diagnostic testing market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONSwine Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Swine Diagnostics Market Drivers and Opportunities

Mounting Prevalence of Swine Diseases to Favor Market

As per this article published by the Food and Agriculture Organization (FAO) of the United Nations in July 2023, African swine fever (ASF) is a growing disease that affects pigs with 100% fatality rate in Asia & Pacific. According to the World Organization for Animal Health (WOAH), in 2021, more than 100 million cases of swine diseases were reported worldwide. African swine fever, porcine reproductive and respiratory syndrome (PRRS), swine influenza and enzootic pneumonia of pigs were the most common diseases in pigs. Additionally, in the US, according to the Office International des Epizooties (OIE), an estimated 70% of pig herds are infected with Porcine reproductive and respiratory syndrome. The disease is also common in other parts of the world, including Europe, Asia, and South America. Thus, the increasing prevalence of various swine diseases boosts the swine diagnostic market worldwide.

Favorable Government Initiatives Brings Growth Opportunities

In December 2020, the Animal and Plant Health Inspection Service (APHIS) of the United States Department of Agriculture (USDA) granted US$ 14.4 million to 76 projects from the National Animal Health Laboratory Network (NAHLN), focused on enhancing the early diagnosis of animal diseases and improving emergency response abilities of veterinary diagnostic laboratories. The projects also focus on the improvement of ASF and classical swine fever diagnostic testing.

Swine Diagnostics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the swine diagnostics market analysis are product, end user, and distribution channel.

- The swine diagnostics market is segmented based on product type into immunoassay kits, PCR kits, hemagglutination inhibition, and others. The immunoassay kits segment held a significant share market share in 2022.

- By disease, the market is segmented into African swine fever/classical swine fever, porcine circovirus, porcine epidemic diarrhea, respiratory diseases, swine dysentery, and others. The African swine fever/classical swine fever segment held the largest market share in 2022.

- By sample type, the market is segmented into blood, oral fluids, tissue samples, nasal swabs and others. The blood segment held the largest share of the market in 2022.

- By end users, the market is segmented into veterinary hospitals, veterinary clinics, and other end users. The veterinary hospitals segment held the largest share of the market in 2022.

Swine Diagnostics Market Share Analysis by Geography

The geographic scope of the Swine Diagnostics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. Asia Pacific is expected to grow with the highest CAGR in the coming years.

The Swine Diagnostics market in North America is analyzed based on the three major countries: the US, Canada, and Mexico. The US is projected to have the largest share of the North America swine diagnostics market in 2022. The growth of the market in the country is attributed to the increasing investments by government and private companies to develop new diagnostics tests for ASF and the high demand for diagnostics kits for swine diseases. In February 2023, the Animal and Plant Health Inspection Service (APHIS) of the USDA purchased ASF and foot-and-mouth disease (FMD) diagnostic test kits for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB). Therefore, such actions by the US government to procure diagnostics kits in large volumes support the swine diagnostics market growth.

Swine Diagnostics

Swine Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 194.15 Billion |

| Market Size by 2030 | US$ 385.39 Billion |

| Global CAGR (2022 - 2030) | 8.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Swine Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Swine Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Swine Diagnostics Market News and Recent Developments

TheSwine Diagnostics market is evaluated by gathering qualitative and quantitative data from primary and secondary research, which includes essential corporate publications, association data, and databases. A few of the developments in the Swine Diagnostics market are listed below:

- Ringbio participated in the (DLP Expo Africa 2023). Ringbio displayed its products and solutions, including a range of rapid test kits for detecting diseases and infections in swine, at the Dairy, Livestock, and Poultry Technology Exhibition Africa 2023, which was held at Kenyatta International Convention Centre, Kenya. (Source: Ringbio, Press Release, June 2023).

- IDEXX Laboratories, Inc. announced the launch of a new rapid digital cytology service, IDEXX Digital Cytology. The rapid digital test and service digitally connects with over 100 veterinary clinics across the world and provides them with cytology interpretations within 2 hours. In addition, company IDEXX’s proprietary VetConnect PLUS software will provide service 24*7. (Source: IDEXX Laboratories, Inc, Press Release, January 2020).

Swine Diagnostics Market Report Coverage and Deliverables

The “Swine Diagnostics Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Swine Diagnostics market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Swine Diagnostics market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Swine Diagnostics market analysis covering key market trends, global and regional framework, significant players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Swine Diagnostics market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For