Temperature Monitoring System Market Growth and Recent Trends by 2028

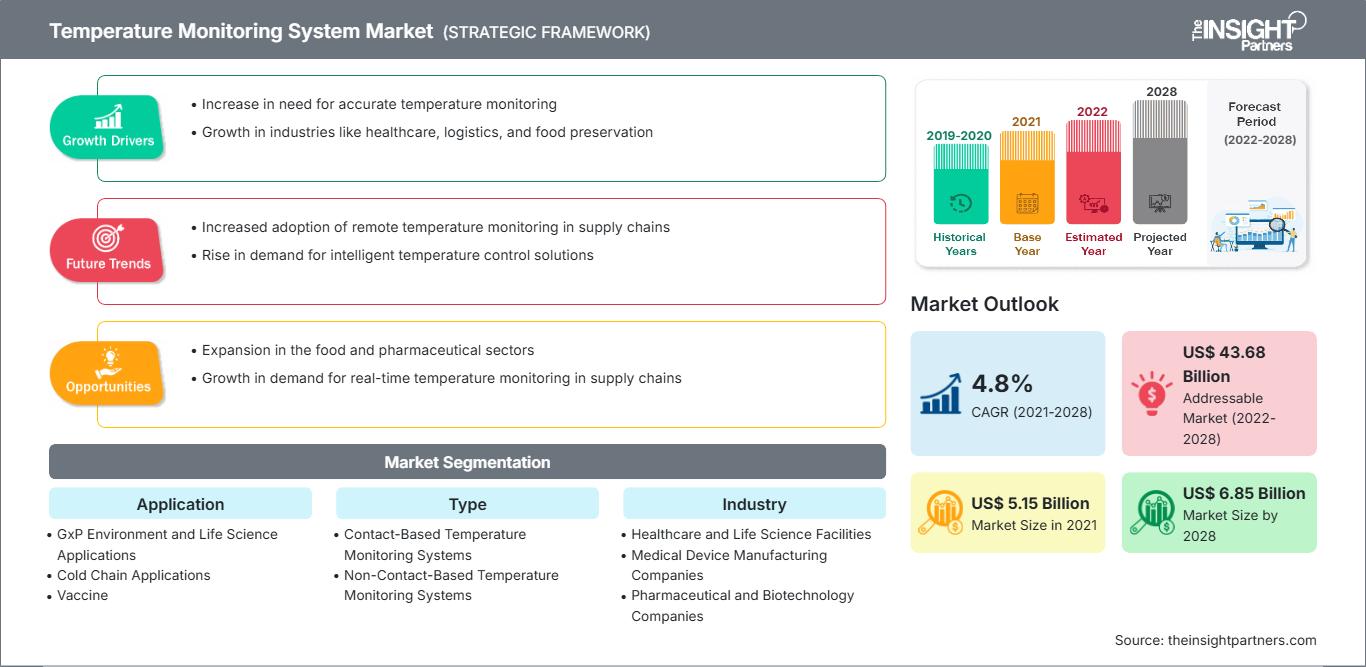

Temperature Monitoring System Market Forecast to 2028 - Analysis By Application (GxP Environment and Life Science Applications, Cold Chain Applications, Vaccine, Semiconductor Manufacturing, Cleanrooms, Data Centers and Equipment Rooms, Museums and Archives, Food and Beverage Manufacturing, Chart Recorder Replacement, and Others), Type (Contact-Based Temperature Monitoring Systems {Conventional Temperature Monitoring System, Temperature Monitoring Strips and Labels, and Wireless Temperature Monitoring System} and Non-Contact-Based Temperature Monitoring Systems {Pyrometer and Infrared Thermometer Market, Thermal Imagers Market, and Fiber Optic Thermometer}), and Industry (Healthcare and Life Science Facilities, Medical Device Manufacturing Companies, Pharmaceutical and Biotechnology Companies, Food and Beverage Product Manufacturers, and Others), and Geography

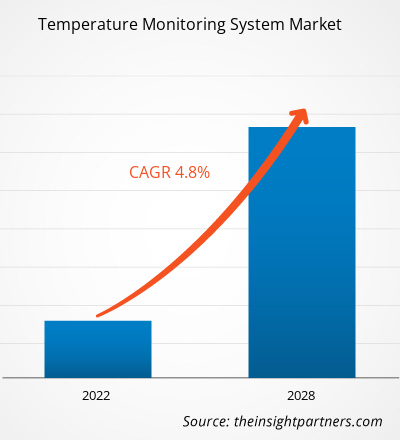

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Feb 2022

- Report Code : TIPRE00004401

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 256

The temperature monitoring system market is expected to grow from US$ 5.15 billion in 2021 to US$ 6.85 billion by 2028; it is estimated to grow at a CAGR 4.8% during 2021 to 2028.

A temperature monitoring system controls and regulates the temperature of a particular environment. A temperature monitoring system has become an essential part of hospitals, clinics, food businesses, and other industries in recent years. With a temperature monitoring system, a person can easily track, control, and regulate the products’ temperature in a specific environment. A temperature monitoring system makes sure that temperature-dependent products stay safe when they are being transported from one place to another. The temperature monitoring system market is segmented on the basis of application, type, industries, and geography. The market, by geography, is broadly segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South and Central America. The report offers in-depth insights into the temperature monitoring system market, emphasizing parameters such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of leading market players.Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONTemperature Monitoring System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Stringent Regulations Governing Food & Beverage and Pharmaceutical Industries Contributes Significantly to Temperature Monitoring System Market Growth

Temperature-related issues impact the pharmaceutical sector dearly. Maintaining the potency of medications and vaccines is more difficult due to compliance, legal regulations, and environmental conditions. According to National Center for Biotechnology Information (NCBI), a shipment of Intralipid % IV fat emulsion, 100 mL bags (Baxter International, Inc.) was inappropriately exposed to subfreezing temperatures—outside the declared permitted storage range—on its route to a distribution site in August 2017. About two months later, the manufacturer voluntarily recalled this parenteral nutrition product and advised patients to discard their supply. An effective temperature monitoring system that indicates system inconsistencies is required to avoid such instances. Stringent regulatory requirements and guidelines in the pharmaceutical industry like GMP Pharma, GDP, 21 CFR part 11, GDP Pharma, and others are expected to drive the growth of temperature monitoring system market over the forecast period.Temperature-sensitive pharmaceuticals pass through numerous stages and inspections before arriving at their final destinations, making them vulnerable to various environmental conditions such as temperature, light, humidity, and cleanliness while in storage and transit. As a result, it is critical to get appropriate equipment and procedures to monitor their temperature frequently to ensure that product quality is not affected. Molecules studied during the pre-clinical phase, or tested during clinical trials, such as pharmaceutical products (medicines, vaccines, etc.) in production then storage phase, must be monitored in real-time as part of the pharmaceutical cold-chain monitoring process.

Temperature monitoring is an essential part of pharmaceutical quality control. Temperature is monitored using various technologies, alerting the system to any irregularities. Regulatory requirements apply to businesses that aim to conduct research, manufacture, store, transport, or sell pharmaceutical items. Each country's laws and regulations are unique. They commonly include national or international governance such as the EU (in Europe), FDA (in the US), or Swissmedic (in Switzerland), all authorized by the International Council for Harmonization of Technical Needs for Pharmaceuticals for Human utilization (ICH).

In addition to official regulations, some critical associations are issuing guidance documents supporting and detailing the regulations and their application in specific situations. Some of the most influential organizations relevant to the pharmaceutical supply chain industry are the United States Pharmacopeia (USP), International Society for Pharmaceutical Engineering (ISPE), Parental Drug Association (PDA), and the World Health Organization (WHO). Therefore, the regulatory framework is a living organism that changes almost daily with new laws and new guidance documents being published.

Food and beverages need to be produced and stored at specific temperatures to maintain their quality. Maintaining a proper temperature is required to protect perishable food items stored in refrigerators or freezers. Food that is not appropriately stored can get spoiled or contaminated. Many facilities are employing food temperature monitoring system. These systems assure continuous monitoring of food and beverages. They immediately alert a user to act fast and avoid financial losses when food inventory is at risk.

Food suppliers and production facilities must comply with the Food Safety Modernization Act (FSMA) regulations for temperature monitoring. Breaching of the regulations can result in heavy penalties and even imprisonment. According to the FSMA, temperatures must be monitored and recorded throughout the processing, shipping, and distribution processes. Companies can use data logging capabilities in food monitoring systems to assist them in complying with these standards. Users can use these systems to ensure that everything is kept at the proper temperature. Users can also obtain temperature data records at any moment to confirm compliance with food safety regulations. Thus, stringent regulations governing food & beverages and pharmaceutical industries are expected to fuel the use of temperature monitoring system market.

Application-Based Insights

Based on application, the global temperature monitoring systems market is segmented into in GxP environment and life science applications, cold chain applications, vaccine, semiconductor manufacturing, cleanrooms, data centers and equipment rooms, museums and archives, food and beverage manufacturing, chart recorder replacement, and others. In 2021, the GxP environment and life science segment held the largest share of the global market. However, the vaccine segment is expected to register the highest CAGR during 2021–2028. Pharmaceutical companies worldwide adhere to GxP guidelines designed to provide consumers with safe products. These are the steps to build an efficient pharmaceutical quality system that will provide sound management and quality and risk management. Such a factor is expected to drive the segment growth during the forecast period.Type-Based Insights

Based on type, the temperature monitoring systems market is segmented into contact-based temperature monitoring systems and non-contact-based temperature monitoring systems. The contact-based temperature monitoring systems segment held the largest market share in 2021. However, the non-contract-based temperature monitoring systems segment is expected to hold a significant market share during the forecast period.

Industries -Based Insights

Based on industries, the temperature monitoring systems market is segmented into healthcare and life science facilities, medical device manufacturing companies, pharmaceutical and biotechnology companies, food and beverage product manufacturers, others. The healthcare and life science facilities segment held the largest market share in 2021. However, the pharmaceutical and biotechnology companies’ segment is expected to hold a significant market share during the forecast period.Product launches, and mergers and acquisitions are highly adopted strategies by the global temperature monitoring systems market players. A few of the recent key market developments are listed below: In December 2021, Monnit launched its new ALTA Wireless Motion+ Sensor which combines sensing components to measure motion and occupancy, ambient temperature, and relative humidity (RH) in a wide variety of facilities. As states and communities set into effect reopening plans during the COVID-19 pandemic, non-contact temperature monitoring devices may be used as part of an initial check at entry points to detect and screen people.

Temperature monitoring systems and non-contact infrared thermometers, which are non-contact temperature assessment devices, may be used to measure a person's temperature. An elevated temperature is one parameter to identify a person who may have contracted the COVID-19 infection, although an infected person may be contagious without a high temperature or other easily detectable symptoms. Thus, increased adoption of temperature monitoring systems by the pharmaceutical and biotechnology companies, healthcare and life science facilities has resulted in profits, and the outbreak of COVID-19 has shown a positive impact on market growth.

Temperature Monitoring System Market Regional Insights

The regional trends and factors influencing the Temperature Monitoring System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Temperature Monitoring System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Temperature Monitoring System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 5.15 Billion |

| Market Size by 2028 | US$ 6.85 Billion |

| Global CAGR (2021 - 2028) | 4.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Temperature Monitoring System Market Players Density: Understanding Its Impact on Business Dynamics

The Temperature Monitoring System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Temperature Monitoring System Market top key players overview

Temperature Monitoring Systems – Market Segmentation

The temperature monitoring system market is segmented on the basis of application, type, industries and geography. Based on application, the market is segmented into GxP environment and life science applications, cold chain applications, vaccine, semiconductor manufacturing, cleanrooms, data centers and equipment rooms, museums and archives, food and beverage manufacturing, chart recorder replacement, and others. Based on type, the temperature monitoring system market is bifucated into contact-based temperature monitoring system and non-contact temperature monitoring system. Based on industries, the temperature monitoring system market is segmented into healthcare and life science facilities, medical device manufacturing companies, pharmaceutical and biotechnology companies, food and beverage product manufacturers, and others. Geographically, the temperature monitoring system market is segmented into North America (the US, Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia Pacific), the Middle East & Africa (the UAE, Saudi Arabia, Africa, and Rest of Middle East & Africa), and South and Central America (Brazil, Argentina, and Rest of South and Central America). Vaisala, Monnit Corporation, SensoScientific Inc., E-control System Inc., CenTrak, 3M, ABB, Deltatrak, Emerson Electric Co., and Honeywell International Inc. are among the leading companies operating in the temperature monitoring system market.Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For