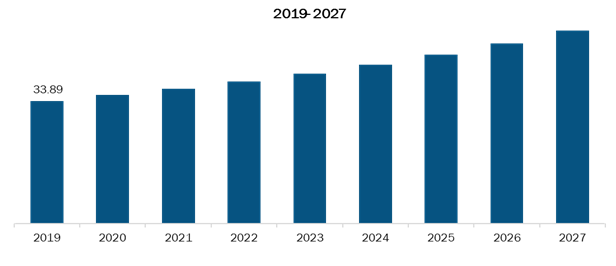

The Asia PacificE. Colii testing market is expected to reach US$ 496.7million by 2027 from US$ 283.2 Mn in 2019; it is estimated to grow at a CAGR of 7.4% from 2020 to 2027.

The key factors driving the growth of E. colitestingare the increasing E. coli testing, growing product innovation, and rising research activities. However, E. colitesting challengesis the major factor hindering the market growth in Asia Pacific.

Escherichia coli (E. coli) are rod-shaped gram-negative bacteria that are generally available in the food, environment, and intestines of warm-blooded animals. The majority of the E. coli strains are typically harmless to humans. Still, some strains recognized to be the reason for serious some medical complications such as gastrointestinal tract infections, cholecystitis, cholangitis, neonatal meningitis, bacteremia, pneumonia, urinary tract infection (UTI) and regularly spread via polluted food or water.

The advancement in the healthcare industry has encouraged various researchers to develop different techniques to identify bacterial presence. The integration of biotechnology in medical devices has resulted in innovative techniques to identify the E. coli. Multiple companies have innovated rapid E. coli test kits that can identify the bacterial presence in a single day. In addition, the rising numbers of start-ups are involved in the development of innovative devices for the detection of E. coli. Moreover, various local and international companies are investing their funds for product innovation and product launches. Hence, such activities in the field of biotechnology are expected to influence the Asia Pacific E. coli Testing market growth during the forecast period.

The Asia Pacific region are developing their healthcare sector at a faster pace. The countries are exploring various new techniques by entering into a collaboration with well-established biotechnology organizations in the developed regions. Countries such as India, and South Korea have increased their investments for the development biotechnology sector. Likewise, in India, the Department of Biotechnology is expected to make the Indian Biotechnology industry worth US$ 100 billion by 2025. Thus, such rising investments in the biotechnology sector are expected to drive growth opportunities for E. coli testing services and facilities in the developing regions. In addition, the regions have rising numbers of biotechnology start-ups contributing to the development of the biotechnology sector. Various start-ups have launched their innovative products and services in the field of biotechnology, which is expected to influence the market growth during the forecast period.

Considering the geographic and economic operations between Asian countries and China, the countries are expected to witness challenge of COVID-19. If this pandemic lasts for a longer time, it may impact the supply of active material and ingredients along with the import and export of biotechnology and biopharmaceuticals. There is also the potential for negative impacts of both a medium- and longer-term nature on R&D and manufacturing activities, and delay on projects. These factors are affecting the growth of the E. coli testing market in the region.

Rest of Asia PacificE. Coli Testing Market,Revenue and Forecast to 2027 (US$ Mn)

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

ASIA PACIFICE. COLITESTING MARKET SEGMENTATION

By Technology

- Monoclonal Antibodies

- Differential Light Scattering

- Molecular Diagnostics

- Immunoassays

- Chromatography

- Flow Cytometry

- Gel Microdroplets

- Diagnostic Imaging

By End-User

- Commercial or Private Labs

- Physician Offices

- Hospitals

- Public Health Labs

- Academic Research Institutes

By Country

- China

- Japan

- India

- South Korea

- Australia

Company Profiles

- bioMerieux SA

- Abbott (Alere Inc.)

- BD

- Thermo Fisher Scientific, Inc.

- Hologic, Inc.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, End User, and Country - Regional Analysis and Market Forecasts by Technology, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Asia Pacific E. coli Testing Market – By Technology

1.3.2 Asia Pacific E. coli Testing Market – By End-User

1.3.3 Asia Pacific E. coli Testing Market – By Country

2. Asia Pacific E. coli Testing Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Asia Pacific E. coli Testing Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 E. coli Testing Market - Asia Pacific PEST Analysis

4.3 Expert Opinion

5. Asia Pacific E. coli Testing Market - Key Market Dynamics

5.1 Key Market Drivers

5.1.1 Increasing E. coli Testing

5.1.2 Growing Product Innovations

5.1.3 Rising Research Activities

5.2 Key Market Restraints

5.2.1 Testing Challenges

5.3 Key Market Opportunities

5.3.1 Growth Opportunities in Developing Regions

5.4 Future Trends

5.4.1 Developments in Biotechnology

5.5 Impact Analysis

6. E. coli Testing Market – Asia Pacific Analysis

6.1 Asia Pacific E. coli Testing Market Revenue Forecasts and Analysis

7. Asia Pacific E. coli Testing Market Analysis – By Technology

7.1 Overview

7.2 Asia Pacific E. coli Testing Market, By Technology 2019-2027 (%)

7.2.1 Asia Pacific E. coli Testing Market Devices Revenue and Forecasts to 2027, By Technology (US$ Mn)

7.3 Monoclonal Antibodies

7.3.1 Overview

7.3.2 Asia Pacific Monoclonal Antibodies Market Revenue and Forecasts to 2027 (US$ Mn)

7.4 Differential Light Scattering

7.4.1 Overview

7.4.2 Asia Pacific Differential Light Scattering Market Revenue and Forecasts to 2027 (US$ Mn)

7.5 Molecular Diagnostics

7.5.1 Overview

7.5.2 Asia Pacific Molecular Diagnostics Market Revenue and Forecasts to 2027 (US$ Mn)

7.6 Immunoassays

7.6.1 Overview

7.6.2 Asia Pacific Immunoassays Market Revenue and Forecasts to 2027 (US$ Mn)

7.7 Chromatography

7.7.1 Overview

7.7.2 Asia Pacific Chromatography Market Revenue and Forecasts to 2027 (US$ Mn)

7.8 Flow Cytometry

7.8.1 Overview

7.8.2 Asia Pacific Flow Cytometry Market Revenue and Forecasts to 2027 (US$ Mn)

7.9 Gel Microdroplets

7.9.1 Overview

7.9.2 Asia Pacific Gel Microdroplets Market Revenue and Forecasts to 2027 (US$ Mn)

7.10 Diagnostic Imaging

7.10.1 Overview

7.10.2 Asia Pacific Diagnostic Imaging Market Revenue and Forecasts to 2027 (US$ Mn)

8. Asia Pacific E. coli Testing Market Analysis – By End-User

8.1 Overview

8.2 Asia Pacific E. coli Testing Market, By Application 2019-2027 (%)

8.2.1 Asia Pacific E. coli Testing Market Revenue and Forecasts to 2027, By End-User (US$ Mn)

8.3 Commercial or Private Labs

8.3.1 Overview

8.3.2 Asia Pacific Commercial or Private Labs Market Revenue and Forecasts to 2027 (US$ Mn)

8.4 Physician Offices

8.4.1 Overview

8.4.2 Asia Pacific Physician Offices Market Revenue and Forecasts to 2027 (US$ Mn)

8.5 Hospitals

8.5.1 Overview

8.5.2 Asia Pacific Hospitals Market Revenue and Forecasts to 2027 (US$ Mn)

8.6 Public Health Labs

8.6.1 Overview

8.6.2 Asia Pacific Public Health Labs Market Revenue and Forecasts to 2027 (US$ Mn)

8.7 Academic Research Institutes

8.7.1 Overview

8.7.2 Asia Pacific Academic Research Institutes Market Revenue and Forecasts to 2027 (US$ Mn)

9. E. coli Testing Market Revenue and Forecasts To 2027 – Geographical Analysis

9.1 Asia Pacific E. coli Testing Market Revenue and Forecasts To 2027

9.1.1 Overview

9.1.2 Asia Pacific: E. coli Testing Market - Revenue and Forecast to 2027 (USD Million)

9.1.3 Asia Pacific: E. coli Testing Market, by Technology, 2018–2027 (USD Million)

9.1.4 Asia Pacific: E. coli Testing Market, by End User, 2018–2027 (USD Million)

9.1.5 Asia Pacific: E. coli Testing Market, by Country, 2019 & 2027 (%)

9.1.6 China: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.6.1 China: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.6.2 China: E. coli Testing Market, by Technology, 2018–2027 (USD Million)

9.1.6.3 China: E. coli Testing Market, by End User, 2018–2027 (USD Million)

9.1.7 Japan: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.7.1 Japan: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.7.2 Japan: E. coli Testing Market, by Technology, 2018–2027 (USD Million)

9.1.7.3 Japan: E. coli Testing Market, by End User, 2018–2027 (USD Million)

9.1.8 India: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.8.1 India: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.8.2 India: E. coli Testing Market, by Technology, 2018–2027 (USD Million)

9.1.8.3 India: E. coli Testing Market, by End User, 2018–2027 (USD Million)

9.1.9 South Korea: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.9.1 South Korea: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.9.2 South Korea: E. coli Testing Market, by Technology, 2018–2027 (USD Million)

9.1.9.3 South Korea: E. coli Testing Market, by End User , 2018–2027 (USD Million)

9.1.10 Australia: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.10.1 Australia: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

9.1.10.2 Australia: E. coli Testing Market, by Technology , 2018–2027 (USD Million)

9.1.10.3 Australia: E. coli Testing Market, by End User, 2018–2027 (USD Million)

10. Impact Of COVID-19 Pandemic on Asia Pacific E. coli Testing Market

10.1 Asia Pacific: Impact Assessment of COVID-19 Pandemic

11. COMPANY PROFILES

11.1 bioMerieux SA

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Abbott

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 BD

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 THERMO FISHER SCIENTIFIC INC.

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Hologic, Inc.

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

12. Appendix

12.1 Glossary of Terms

LIST OF TABLES

Table 1. Asia Pacific E. coli Testing Market Revenue and Forecasts To 2027, By Technology (US$ Mn)

Table 2. Asia Pacific E. coli Testing Market Revenue and Forecasts To 2027, By End-User (US$ Mn)

Table 3. Asia Pacific E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 4. Asia Pacific E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 5. China E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 6. China E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 7. Japan E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 8. Japan E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 9. India E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 10. India E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 11. South Korea E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 12. South Korea E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 13. Australia E. coli Testing Market, by Technology – Revenue and Forecast to 2027 (USD Million)

Table 14. Australia E. coli Testing Market, by End User– Revenue and Forecast to 2027 (USD Million)

Table 15. Glossary of Terms, E. Coli Testing Market

LIST OF FIGURES

Figure 1. E. coli Testing Market Segmentation

Figure 2. Asia Pacific E. coli Testing Market Overview

Figure 3. Monoclonal Antibodies Segment Held Largest Share of E. coli Testing Market

Figure 4. China is Expected to Show Remarkable Growth During the Forecast Period

Figure 5. Asia Pacific E. coli Testing Market - Leading Country Markets (US$ Mn)

Figure 6. E. coli Testing Market - Asia Pacific PEST Analysis

Figure 7. E. coli Testing Market Impact Analysis of Driver and Restraints

Figure 8. Asia Pacific E. coli Testing market – Revenue Forecasts and Analysis – 2019- 2027

Figure 9. Asia Pacific E. coli Testing Market, by technology 2019 & 2027 (%)

Figure 10. Asia Pacific Monoclonal Antibodies Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 11. Asia Pacific Differential Light Scattering Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 12. Asia Pacific Molecular Diagnostics Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 13. Asia Pacific Immunoassays Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 14. Asia Pacific Chromatography Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 15. Asia Pacific Flow Cytometry Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 16. Asia Pacific Gel Microdroplets Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 17. Asia Pacific Diagnostic Imaging Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 18. Asia Pacific E. coli Testing Market, by Application 2019 & 2027 (%)

Figure 19. Asia Pacific Commercial or Private Labs Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 20. Asia Pacific Physician Offices Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 21. Asia Pacific Hospitals Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 22. Asia Pacific Public Health Labs Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 23. Asia Pacific Academic Research Institutes Market Revenue and Forecasts to 2027 (US$ Mn)

Figure 24. Asia Pacific: E. coli Testing Market, by Key Country – Revenue (2019) (USD Million)

Figure 25. Asia Pacific E. coli Testing Market Revenue and Forecast to 2027 (USD Million)

Figure 26. China: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

Figure 27. Japan: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

Figure 28. India: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

Figure 29. South Korea: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

Figure 30. Australia: E. coli Testing Market – Revenue and Forecast to 2027 (USD Million)

Figure 31. Impact of COVID-19 Pandemic in Asia Pacific Country Markets

The List of Companies - Asia Pacific E. coli Testing Market

- bioMerieux SA

- Abbott (Alere Inc.)

- BD

- Thermo Fisher Scientific, Inc.

- Hologic, Inc.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Asia Pacific E. coli Testing Market

Jul 2020

Corn and Wheat-Based Feed Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Corn-Based (Corn Gluten Meal, Corn Gluten Feed, and Other Corn-Based Feed) and Wheat-Based (Wheat Gluten, Wheat Bran, and Other Wheat-Based Feed)], Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others), and Geography

Jul 2020

Icing and Frosting Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Icing and Frosting), Category (Gluten-Free and Conventional), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others), and Geography

Jul 2020

Fermented Flavor and Fragrance Ingredients Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Fruity, Floral, Woody, Blends, and Others), Application (Food and Beverages, Personal Care Products, Cosmetics, and Others), and Geography

Jul 2020

Aroma Ingredients for Food and Beverages Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Synthetic (Terpenes, Aldehydes, Aliphatic, and Others) and Natural (Essential Oils, Herbal Extracts, Oleoresins, and Others)] and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Sweet and Savory Snacks, RTE and RTC Meals, and Others)

Jul 2020

High-End Rum Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (White, Dark, and Gold), Category (Super Premium, Ultra-Premium, and Prestige & Prestige Plus), Nature (Plain and Flavored), and Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others)

Jul 2020

Edible Oils and Fats Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Oil (Soybean Oil, Sunflower Oil, Palm Oil, Canola Oil/Rapeseed Oil, and Others) and Fats (Butter, Margarine, Palm Oil Based Shortening, and Vegetable Oil Based Shortening, and Others)] and Application [Food and Beverages (Bakery and Confectionery, Dairy and Frozen Desserts, RTE and RTC Meals, Snacks, and Others), Animal Nutrition, and Pharmaceuticals and Nutraceuticals]

Jul 2020

Flavor Masking Agents for Food and Beverages Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Sweet, Salt, Fat, Bitter, and Others) and Application (Bakery and Confectionery; Dairy and Frozen Desserts; Beverages; Meat, Poultry, and Seafood; Meat Substitutes; Dairy Alternatives; RTE and RTC Meals; and Others)

Jul 2020

Chicken Powder Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Low-Fat and Conventional) and Application [Food & Beverages (RTE and RTC Meals; Soups, Sauces, and Dressings; Savory Snacks; Noodles and Pastas; and Others), Dietary Supplements, Pet Food, and Animal Feed]