Aroma Ingredients for Food and Beverages Market Growth and Forecast by 2030

Aroma Ingredients for Food and Beverages Market Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type [Synthetic (Terpenes, Aldehydes, Aliphatic, and Others) and Natural (Essential Oils, Herbal Extracts, Oleoresins, and Others)] and Application (Bakery and Confectionery, Dairy and Frozen Desserts, Beverages, Sweet and Savory Snacks, RTE and RTC Meals, and Others)

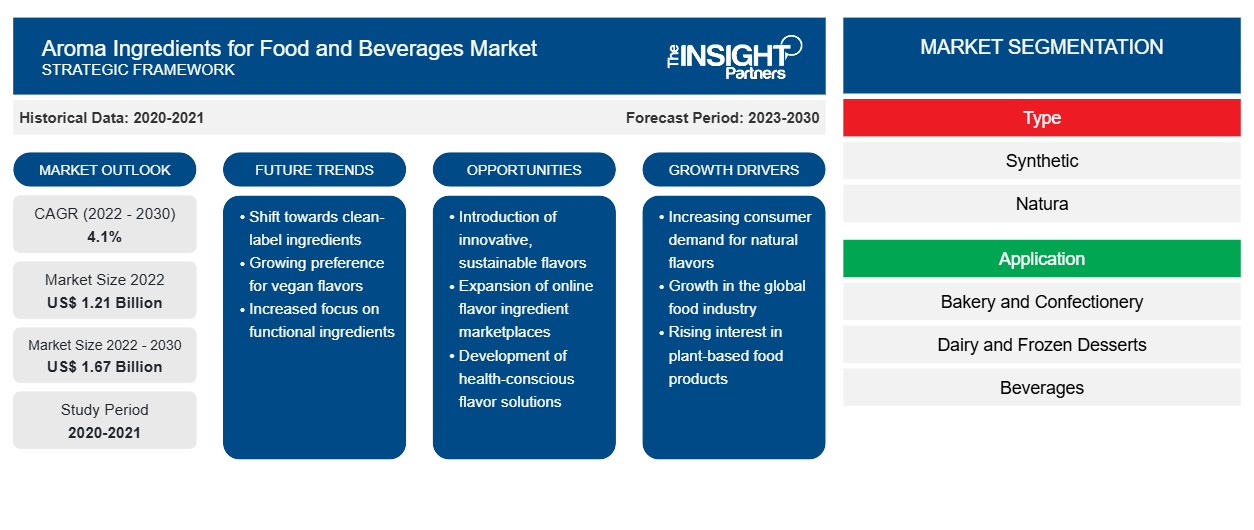

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00038981

- Category : Food and Beverages

- No. of Pages : 200

- Available Report Formats :

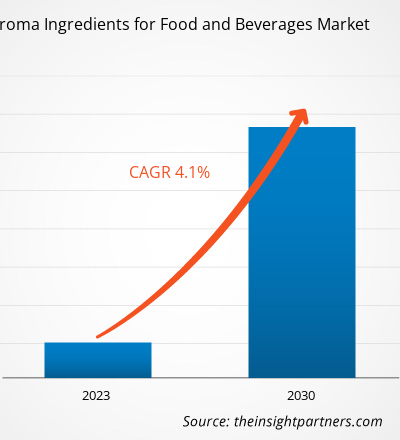

[Research Report] The aroma ingredients for food and beverages market size is projected to grow from US$ 1.21 billion in 2022 to US$ 1.67 billion by 2030; the market is estimated to register a CAGR of 4.1% from 2022 to 2030.

Market Insights and Analyst View:

Aroma ingredients are isolated from naturally sourced ingredients or chemically extracted from petroleum. These ingredients play a crucial role in shaping the flavor and aroma profile of various food and beverage items, ranging from confectionery and savory snacks to alcoholic and non-alcoholic beverages. The growing importance of aroma ingredients in the food & beverages industry and strategic initiatives by key market players are major factors driving the aroma ingredients for the food and beverages market. In addition, the increasing consumer demand for unique and exotic flavor and aroma experiences, as well as advancements in extraction and synthesis techniques, further help in shaping the market landscape. However, the regulatory constraints associated with the use of aroma ingredients in the food and beverages industry hamper the aroma ingredients for food and beverages market growth.

Growth Drivers and Challenges:

Aroma ingredient manufacturers in the food & beverages industry are significantly involved in mergers and acquisitions, collaborations, and other strategic developments to attract consumers and enhance their market position. Increasing demand for aroma ingredients from various food and beverage establishments that produce and sell bakery and confectionery, dairy, frozen desserts, and other items has resulted in key players adopting strategic initiatives to strengthen their market position globally. For instance, in November 2023, BASF SE announced the launch of two new natural aroma ingredients: Isobionics Natural alpha-Bisabolene 98 and Isobionics Natural (-)-alpha-Bisabolol 99. Such product developments are driving the aroma ingredients for the food and beverages market.

Key players in the market are expanding their production facilities and entering into agreements with distributors to strengthen their market position. For instance, in December 2021, Tilley Distribution, Inc. announced the merger with Phoenix Aromas and Essential Oils. The merger will help provide high-quality products to new and existing consumer bases with teams experienced in providing regulatory and technical support. In addition, in July 2021, Symrise AG acquired Canada-based Giraffe Foods Inc., a Canadian producer of customized sauces, dips, dressings, syrups, and beverage concentrates for B2B customers. The acquisition will expand Symrise's Flavor & Nutrition segment in North America, boosting its market position and customer base. Thus, strategic initiatives by key market players fuel the global aroma ingredients for food and beverages market growth.

The production and use of aroma ingredients in various food and beverage applications are regulated by various government agencies. Regulatory bodies such as the Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) impose strict guidelines and standards on the use of aroma ingredients to ensure consumer safety and product quality. For instance, the United Nations Environment Programme has regulated the use of food aromas. This regulation provides for all necessary conditions for the correct, controlled, and safe use of flavorings and aromatic ingredients or aromas in foods. Additionally, the Food and Drug Administration (FDA) imposed a regulation on food aroma that can be used in and on food. Meeting these regulatory requirements comes with extensive testing and documentation processes, which can be time-consuming and cost-intensive for manufacturers. The approval process for aroma ingredients can be lengthy and complex, further hindering innovation and product development within the industry.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAroma Ingredients for Food and Beverages Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The "Global Aroma Ingredients for Food and Beverages Market Analysis to 2030" is a specialized and in-depth study with a major focus on market trends and growth opportunities. The report aims to provide an overview of the market with detailed market segmentation by type and application. The market has witnessed high growth in the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the consumption of aroma ingredients for food and beverages globally. In addition, the global aroma ingredients for food and beverages market report provides a qualitative assessment of various factors affecting the market performance globally. The report also includes a comprehensive analysis of the leading players in the market and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative opportunities that would, in turn, aid in identifying the major revenue pockets.

The aroma ingredients for the food and beverages market forecast are estimated on the basis of various secondary and primary research findings, such as key company publications, association data, and databases. Further, the ecosystem analysis and Porter's five forces analysis provide a 360-degree view of the market, which helps understand the entire supply chain and various factors affecting the market performance.

Segmental Analysis:

The aroma ingredients for the food and beverages market are segmented on the basis of type and application. By type, the market is bifurcated into synthetic and natural. The synthetic segment is further segmented into terpenes, aldehydes, aliphatic, and others. The natural segment is further divided into essential oils, herbal extracts, oleoresins, and others. In 2022, the synthetic segment held the largest aroma ingredients for food and beverages market share. The natural segment is expected to register the highest CAGR from 2022 to 2030. Synthetic aroma ingredients are chemical compounds that mimic natural flavors found in foods and beverages. The surge in the demand for these ingredients in the food & beverages industry can be attributed to several factors. First, synthetic aroma ingredients provide consistency in flavor profile, ensuring that products taste the same every time, regardless of variations in natural ingredients. This consistency is crucial for brand identity and consumer satisfaction. Second, they offer cost-effectiveness compared to natural aroma ingredients, making them more accessible to manufacturers, particularly in large-scale production. Additionally, advancements in flavor science have led to the development of synthetic ingredients that closely replicate natural flavors, satisfying consumer preferences for familiar tastes while offering unique flavor combinations. In conclusion, concerns regarding the stability and availability of natural ingredients and regulatory pressures have further propelled the adoption of synthetic aroma ingredients in the food & beverages industry.

Regional Analysis:

The market scope focuses on five key regions—North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. Asia Pacific accounted for the largest aroma ingredients for food and beverages market share in 2022, with a market value of ~US$ 425 million. Europe accounted for the second largest share followed by North America.

In Europe, the growing demand for aroma ingredients can be attributed to the region's rich culinary traditions and increasing preference for premium and artisanal products. There is a strong cultural appreciation for culinary traditions and cuisine across Europe. Consumers in Europe value high-quality ingredients and authentic flavors, thereby driving the demand for aroma ingredients that enhance the sensory experience. This emphasis on gourmet excellence has led to a growing market for premium aroma ingredients sourced from natural and sustainable sources, catering to the discerning tastes of European consumers. Additionally, the increasing interest in healthier and more natural food options in Europe contributes to the market growth. European consumers have been embracing organic and plant-based diets, often incorporating ingredients with strong or unfamiliar tastes and fragrances, such as certain vegetables, grains, and legumes; to make these health-conscious choices more appealing, food manufacturers use aroma ingredients to mitigate any overpowering or objectionable flavors and fragrances, ensuring that products maintain wide consumer acceptance while adhering to natural and clean-label trends. This demand aligns with the broader European food quality, taste, and an awareness of sensory experience, all contributing to the adoption of aroma ingredients for food and beverages in the region.

In North America, the aroma ingredients for the food and beverages market are attributed to rising sales of convenience and packaged food products, the well-established food industry, and surging consumer preference for functional beverages. Aroma ingredients play a vital role in these products to enhance the overall aroma of the products, making them more appealing to the consumers. The growing consumer preference for natural and clean-label products has further contributed to market growth. As awareness of health and wellness continues to rise, consumers are increasingly seeking out products with natural aroma ingredients. This has led food and beverage manufacturers to incorporate aroma ingredients derived from natural sources such as fruits, herbs, and spices to meet consumer demand. In addition, the aroma ingredients for food and beverages market trends toward premiumization in the food & beverages sector have contributed to the increased demand.

Aroma Ingredients for Food and Beverages Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.21 Billion |

| Market Size by 2030 | US$ 1.67 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aroma Ingredients for Food and Beverages Market Players Density: Understanding Its Impact on Business Dynamics

The Aroma Ingredients for Food and Beverages Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Industry Developments and Future Opportunities:

As per press releases, a few of the initiatives taken by key players operating in the aroma ingredients for food and beverages market are listed below:

- In March 2023, BASF SE announced its investment in a new plant in Zhanjiang, China, and menthol and linalool downstream plants in Ludwigshafen, Germany. This investment will expand and diversify BASF’s aroma ingredient value chain footprint in Germany and Malaysia and support customers’ growth opportunities.

Competitive Landscape and Key Companies:

International Flavors & Fragrances Inc, Sensient Technologies Corp, T Hasegawa Co Ltd, BASF SE, V Mane Fils Sas, Symrise AG, Firmenich International SA, Archer-Daniels-Midland Co, Kerry Group Plc, and Berje Inc are among the key players profiled in the aroma ingredients for food and beverages market report. The global market players focus on providing high-quality products to fulfill customer demand.

Frequently Asked Questions

Further, the preference for natural aroma ingredients extends beyond health considerations to encompass sensory experience and flavor authenticity. Natural aroma ingredients possess complex and nuanced flavor profiles that synthetic ingredients cannot replicate, providing a more authentic and satisfying culinary experience. The prominent players in the market are investing in developing natural aroma ingredients. For instance, in September 2022, Axxence Aromatic GmbH and the Dutch research institute Wageningen Plant Research, part of Wageningen University & Research, announced the long-term strategic research and development collaboration to develop natural ingredients.

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For