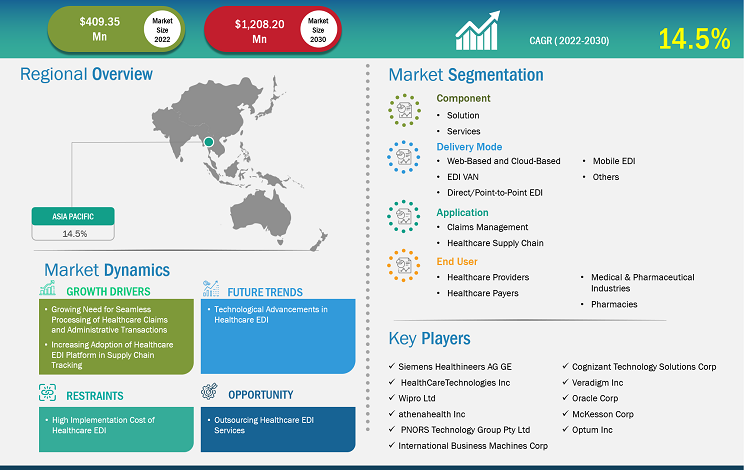

The healthcare EDI market size is expected to grow from US$ 409.35 million in 2022 to US$ 1,208.20 million by 2030; it is estimated to register a CAGR of 14.5% from 2022 to 2030.

Analyst’s ViewPoint

The healthcare EDI market analysis explains market drivers such as the growing need for seamless processing of healthcare claims and administrative transactions, and increasing adoption of healthcare EDI platform in supply chain tracking. Further, technological advancements in healthcare EDI are expected to introduce new trends in the market during 2022–2030. Based on component, the solution segment accounted for a larger share in 2022. Based on delivery mode, the web-based & cloud-based segment dominated the market by accounting maximum share. By application, the claims management segment dominated the market by accounting the maximum share. By end user segment, the healthcare providers segment is likely to account for a considerable share of the healthcare EDI market during 2022–2030.

Electronic data interchange (EDI) in healthcare is a secure way of transmitting data between healthcare institutions, insurers, and patients using established message formats and standards.

Market Insights

Growing Need for Seamless Processing of Healthcare Claims and Administrative Transactions

EDI is a secure way to transfer healthcare data. EDI is regularly utilized by clinics, hospitals, medical practices, and other healthcare companies to transfer medical information. ASC X12, version 5010, is one such example. ASC X12 develops and maintains standards for EDI related to healthcare administrative transactions. Below are a few commonly used ASC X12 transactions frequently adopted in the dental industry.

Commonly Used ASC X12 Transactions in Dental Industry

Transaction Type | Description |

ASC X12 270 | This transaction allows providers to check whether the patient has an insurance coverage. National Dental Electronic Data Interchange Council (NDEDIC) is working to promote high utilization of ASC X12 270/271 within the dental industry. |

ASC X12 271 | This transaction is an electronic response for eligibility inquiry. The responses by the consumers reveal whether the patient has insurance coverage and accordingly offer benefits available to patients. |

ASC X12 275 | The ASC X12 275 is an electronic transaction used for responding to the insurance company's information by sending "ASC X12 277 RFI to the provider. The ASC X12 275 comprises additional data and/or digital images (x-rays, periodontal charts, treatment notes, etc.) to support the healthcare claims. The transaction is not widely used. |

Other ASC X12 | Other transactions comprise ASC X12 276, ASC X12 277, ASC X12 277CA, ASC X12 277U, ASC X12 RFI, ASC X12 837, ASC X12 835, ASC X12 997, ASC X12 999 |

Source: The Insight Partners Analysis

Additionally, healthcare EDI significantly decreases the time taken to submit and process the claim. For example, not only do EDIs help identify potential mistakes within the claims to be submitted but also assist in processing and providing real-time feedback about the claims submission. For example, the utility of EDI automates manual processes, eliminating paper, printing, physical storage, and cost savings. Also, electronic documents can be processed more quickly as compared to manual processes, ensuring customer needs are met with customer satisfaction. Further, the adoption of EDI in healthcare helps reduce healthcare costs and smooth processes. The adoption of GS1 EDI by Ramsay Healthcare is one such example. Ramsay Healthcare has deployed a full suite of GS1 standards for identifying, capturing, and sharing information that supports interaction with the suppliers. Therefore, the adoption of the GS1 standard suite, Ramsay Healthcare, has increased both the speed and efficiency in purchasing processes that efficiently support operations in hospitals and help ensure continuous delivery of quality healthcare. Procure-to-pay processing costs have been decreased by ~95% per document in Ramsay Healthcare due to the adoption of the GS1 standard suite. Therefore, healthcare efficiency allows healthcare claims to be processed faster through EDI, ultimately driving the market growth.

Future Trend

Technological Advancements in Healthcare EDI

Healthcare organizations deal with vast amount of data every day, starting from patient records and claims to lab results and prescriptions. ~50% of the hospitals in the US have unstructured data, causing a major hindrance in improving the overall healthcare interoperability and connected care initiatives, as per the published report in 2023 by Astera Software. Therefore, technological advancements stand as a reliable solution that can help hospitals overcome challenges associated with hospital-generated data. The Pilotfish’s "ei Console for X12" launched in 2020 is one such example of technological advancement in healthcare EDI. Pilotfish is the only solution that validates healthcare X12 EDI data, translates it, and maps it from any other application by delivering features and modules by reducing minimal complexity. Also, the "eiConsole" for X12 EDI includes an EDI Format Builder that loads a rich data dictionary for EDI transactions, such as field-level documentation and friendly source names. Also, in the eiConsole, the EDI format reader provides automatic prices and reads in X12 transactions.

In September 2022, Prodigo Solutions announced the release of its next-generation EDI platform "Xchange" for healthcare clients that leverage supply chain modernization initiatives and automate transaction processes. This next-generation Xchange has a significantly faster processing time with a small memory footprint to support the ever-increasing volume of EDI documents being transmitted between trading partners. Therefore, with technological advancements in healthcare EDI features, the overall operational efficiency of the healthcare industry is likely to improve, which will promote the market growth during 2022–2030.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Asia Pacific Healthcare Electronic Data Interchange (EDI) Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Asia Pacific Healthcare Electronic Data Interchange (EDI) Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

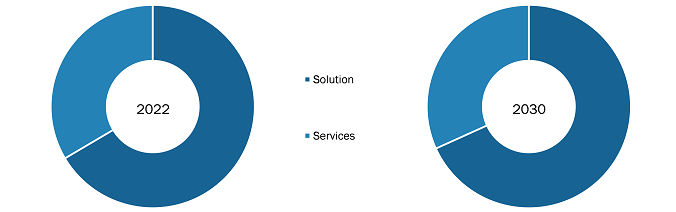

Component-Based Insights

Based on component, the healthcare EDI market is bifurcated into solution and services. The solution segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR of 14.9% in the market during 2022–2030. Electronic data interchange (EDI) solution comprises data conversion in readable formats, interoperability, IT tools, and data security. For example, the current version of the EDI solution includes standardized messaging to enable seamless information exchange within healthcare organizations. Also, top companies such as IBM provide "IBM WebSphere Data Interchange" solutions that support service-oriented architecture (SOA) and business process management (BPM) implementation. Also, the "IBM WebSphere Data Interchange" solution facilitates the creation, deployment, execution, and management of data transformation and related standards-based processing between standard-based EDI formats and internal application data formats. The IBM WebSphere Data Interchange is utilized in multiple industries, including healthcare. The aforementioned factors are responsible for influential growth of the segment growth.

Delivery Mode-Based Insights

Based on delivery mode, the healthcare EDI market is segmented as web-based & cloud based, EDI value added network (VAN), direct/point-to-point EDI, mobile EDI, and others. The web-based & cloud based segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 15.2% during 2022–2030. Web-based EDI conducts EDI through an internet browser and replicates paper-based documents in the web format. The form comprises fields where the user needs to fill in the information. Once the relevant information is added, it is automatically converted into an EDI message and sent through a secure internet protocol such as File Transfer Protocol Secure (FTPS) and Hyper Text Transport Protocol Secure (HTTPS) or AS2. Web EDI is the simplest form of technology that small and medium-sized enterprises can adopt to create, receive, turn around, and manage electronic documents using a browser.

Likewise, cloud-based EDI solution offers lucrative benefits such as flexibility and scalability, cost-effectiveness, and cloud computing advantage. For example, big healthcare companies such as GE Healthcare is shifting focus from traditional data exchange platform to cloud-based EDI because of improving agility and IT flexibility within the company operations. Also, cloud EDI software provides a combination of technological and business process improvement designed to meet the demands of the organization. From data transformational capabilities to streamlining automation, cloud EDI puts the enterprise in a position to tackle any integration challenges without having to deploy and manage software and hardware.

Application-Based Insights

In terms of application, the healthcare EDI market is categorized into claims management and healthcare supply chain. The claims management segment held a larger market share in 2022 and is anticipated to register the highest CAGR of 14.6% during 2022–2030.

EDI is a standard and routinely used across the healthcare industry, allowing both payers and healthcare professionals to send and receive claims-related information faster, avoiding delays and reducing administrative expenses. The EDI benefits healthcare claims management as follows:

- Electronic claims are automatically checked for HIPAA and payer-specific requirements at the vendor, clearinghouse, and payer levels. Such electronic claims decrease the number of claim rejections, and the same level of automated data generated through EDI cannot be performed on paper claims.

- EDI reduces call timings, obtain information about members, and process claims-related payments through verified authorizations.

For instance, XactAnalysis constantly monitors the data to identify errors, track progress, benchmark performance to reduce claims cost and errors, as well as increases the precision speed of healthcare claims settlements. Additionally, XactAnalysis provides real-time quality assurance and review tools, bulk assignment import, estimates audits, display performance scorecards, assignment network, and many more.

End-User Based Insights

The Asia Pacific healthcare electronic data interchange (EDI) market, by end user, is segmented as healthcare providers, healthcare payers, medical & pharmaceutical industries, and pharmacies. The healthcare providers segment held the largest market share in 2022 and is anticipated to register the highest CAGR of 14.7% during 2022–2030. Healthcare providers require a broad set of tools that drive clinical, financial, and operational success. "Oracle Health" is one such example that strives to streamline clinical and operational workflows to enhance productivity and outcomes across ambulatory clinics and ambulatory surgery centers (ASCs). This is well understood by the following case study, where Children's Minnesota partnered with Oracle Health to maximize efficiency and support quality care. Additionally, Children's Minnesota was able to streamline ready care services or urgent care by utilizing Cerner's new ED LaunchPoint product. The product provided direct visibility to current patient visits and actions as well as a patient summary view with a single click. Further, to support mobility across all patient visit types, "PowerChart Touch" was rolled by Cerner at Children's Minnesota’s primary care. For example, "PowerChart Touch" supports provider mobility on smartphones or tablets, allowing providers to review charts, take photos for easy data/report transfer, and document with in-built dictation software. Such innovative product launches by the providers for efficient and smooth functioning of the healthcare organization promote the overall market growth.

Healthcare EDI Market, by Component – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis

The Asia Pacific healthcare EDI market is segmented into China, India, Japan, South Korea, Australia, and Rest of Asia Pacific. China accounted the largest share of healthcare EDI market. According to the National Institute of Health (NIH) report, China has realized the benefits of adopting electronic data interchange (EDI). For example, data governance systems in the field of healthcare seek to balance and share health data. Also, regulatory need is important as there is a massive amount of health data generated. Therefore, China's Ministry of Health (MOH) has planned to undertake a major project, "the China Golden Health Medical Network Project," in October 2023 to establish a satellite-transmitted nationwide healthcare communication network. The project is set to launch the Golden Health Card, a smart card with an embedded chip to save patient financials and medical information and help patients obtain appropriate healthcare services from hospitals at different geographic locations. Under the same project, the hospitals have started using EDI to communicate with other hospitals, medical resource suppliers, insurance companies, and banks.

The EDI services were first conducted in Beijing hospitals to promote EDI usage in China's healthcare organizations. Beijing was chosen as a research site for the implementation of EDI because it is the capital of China and one of the most industrialized cities. Also, many organizations in Beijing have well-developed IT infrastructure. Therefore, hospitals in Beijing receive more assistance from the government and various industry organizations implement EDI in hospitals. The influx of EDI in Chinese hospitals makes remarkable changes in Level 3 and lower-level hospitals. For example, outpatient registration fees are determined by the healthcare policy in China, and the registration fee difference between Level 3 and lower level hospitals is approx. US$ 0.2. With the difference being so slight, many patients are willing to pay more to go to Level 3 Chinese hospitals with better services. Therefore, Level 1 and Level 2 Chinese hospitals have a fewer outpatient visits, and Level 3 hospitals have long waiting lines. With long waiting lines in Level 3 hospitals, it is more likely to adopt IT infrastructure to maintain competitiveness. However, for low-level hospitals, patient attraction is a critical issue, and they are more likely to invest in marketing rather than IT. Therefore, the implementation of EDI offers both advantages, including IT and marketing, for both Level 3 and low-level hospitals. Thus, such remarkable features provided by the EDI help healthcare system in China dominate the market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The healthcare EDI market majorly consists of the players such Siemens Healthineers AG, GE HealthCare Technologies Inc, Wipro Ltd, athenahealth Inc, PNORS Technology Group Pty Ltd, International Business Machines Corp, Cognizant Technology Solutions Corp, Veradigm Inc, Oracle Corp, McKesson Corp, and Optum Inc.

The healthcare providers segment dominated the healthcare EDI market and held the largest market share in 2022.

Electronic data interchange (EDI) in healthcare is a secure way of transmitting data between healthcare institutions, insurers, and patients using established message formats and standards.

The CAGR value of the healthcare EDI market during the forecasted period of 2020-2030 is 14.5%.

The solution segment held the largest share of the market in the healthcare EDI market and held the largest market share in 2022.

Siemens Healthineers and GE HealthCare Technologies Inc are the top two companies that hold huge market shares in the healthcare EDI market.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

1.2.1 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – by Component

1.2.2 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – by Delivery Mode

1.2.3 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – by Application

1.2.4 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – by End User

1.2.5 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – by Region

2. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Market Landscape

4.1 Overview

4.1.1 Asia Pacific PEST Analysis

5. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market

5.1 Market Drivers

5.1.1 Growing Need for Seamless Processing of Healthcare Claims and Administrative Transactions

5.1.2 Increasing Adoption of Healthcare EDI Platform in Supply Chain Tracking

5.2 Market Restraints

5.2.1 High Implementation Cost of Healthcare EDI

5.3 Market Opportunities

5.3.1 Outsourcing Healthcare EDI Services

5.4 Future Trends

5.4.1 Technological Advancements in Healthcare EDI

5.5 Impact analysis

6. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Regional Analysis

6.1 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Forecast and Analysis

7. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 – by Component

7.1 Overview

7.2 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Component, 2022 & 2030 (%)

7.3 Solution

7.3.1 Overview

7.3.2 Solution: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Services

7.4.1 Overview

7.4.2 Services: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue and Forecasts To 2030– by Delivery Mode

8.1 Overview

8.1.1 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Delivery Mode (2022 and 2030)

8.2 Web-Based & Cloud Based

8.2.1 Overview

8.2.2 Web-Based & Cloud Based: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

8.3 EDI Value Added Networks (VANs)

8.3.1 Overview

8.3.2 EDI Value Added Network (VAN): Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Direct/Point-to-Point EDI

8.4.1 Overview

8.4.2 Direct/Point-to-Point EDI: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Mobile EDI

8.5.1 Overview

8.5.2 Mobile EDI: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue and Forecasts To 2030– by Application

9.1 Overview

9.2 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Application (2022 and 2030)

9.3 Claims Management

9.3.1 Overview

9.3.2 Claims Management: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.3 Claims Submission

9.3.3.1 Claims Submission: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.4 Claims Status

9.3.4.1 Claims Status: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.5 Eligibility Criteria

9.3.5.1 Eligibility Criteria: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.6 Payment Remittance

9.3.6.1 Payment Remittance: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.7 Referral Certification & Authorization

9.3.7.1 Referral Certification & Authorization: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.3.8 Others

9.3.8.1 Others: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

9.4 Healthcare Supply Chain

9.4.1 Overview

9.4.2 Healthcare Supply Chain: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue and Forecasts To 2030– by End User

10.1 Overview

10.2 Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by End User (2022 and 2030)

10.3 Healthcare Providers

10.3.1 Overview

10.3.2 Healthcare Providers: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

10.4 Healthcare Payers

10.4.1 Overview

10.4.2 Healthcare Payers: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

10.5 Medical & Pharmaceutical Industries

10.5.1 Overview

10.5.2 Medical & Pharmaceutical Industries: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

10.6 Pharmacies

10.6.1 Overview

10.6.2 Pharmacies: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market– Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 – Regional Analysis

11.1 Asia Pacific Healthcare EDI Market, Revenue and Forecast To 2030

11.1.1 Overview

11.1.2 Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.1 Asia Pacific: Healthcare EDI Market, by Component

11.1.2.2 Asia Pacific: Healthcare EDI Market, by Delivery Mode

11.1.2.3 Asia Pacific: Healthcare EDI Market, by Application

11.1.2.3.1 Asia Pacific: Healthcare EDI Market, by Claims Management

11.1.2.4 Asia Pacific: Healthcare EDI Market, by End User

11.1.2.5 Asia Pacific: Healthcare EDI Market, by Countries

11.1.2.6 China

11.1.2.6.1 Overview

11.1.2.6.2 China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.6.3 China: Healthcare EDI Market, by Component

11.1.2.6.4 China: Malaria -Healthcare EDI Market, by Delivery Mode

11.1.2.6.5 China: Healthcare EDI Market, by Application

11.1.2.6.5.1 China: Healthcare EDI Market, by Claims Management

11.1.2.6.6 China: Healthcare EDI Market, by End User

11.1.2.7 Japan

11.1.2.7.1 Overview

11.1.2.7.2 Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.7.3 Japan: Healthcare EDI Market, by Component

11.1.2.7.4 Japan: Healthcare EDI Market, by Delivery Mode

11.1.2.7.5 Japan: Healthcare EDI Market, by Application

11.1.2.7.5.1 Japan: Healthcare EDI Market, by Claims Management

11.1.2.7.6 Japan: Healthcare EDI Market, by End User

11.1.2.8 India

11.1.2.8.1 Overview

11.1.2.8.2 India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.8.3 India: Healthcare EDI Market, by Component

11.1.2.8.4 India: Malaria -Healthcare EDI Market, by Delivery Mode

11.1.2.8.5 India: Healthcare EDI Market, by Application

11.1.2.8.5.1 India: Healthcare EDI Market, by Claims Management

11.1.2.8.6 India: Healthcare EDI Market, by End User

11.1.2.9 South Korea

11.1.2.9.1 Overview

11.1.2.9.2 South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.9.3 South Korea: Healthcare EDI Market, by Component

11.1.2.9.4 South Korea: Malaria -Healthcare EDI Market, by Delivery Mode

11.1.2.9.5 South Korea: Healthcare EDI Market, by Application

11.1.2.9.5.1 South Korea: Healthcare EDI Market, by Claims Management

11.1.2.9.6 South Korea: Healthcare EDI Market, by End User

11.1.2.10 Australia

11.1.2.10.1 Overview

11.1.2.10.2 Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.10.3 Australia: Healthcare EDI Market, by Component

11.1.2.10.4 Australia: Malaria -Healthcare EDI Market, by Delivery Mode

11.1.2.10.5 Australia: Healthcare EDI Market, by Application

11.1.2.10.5.1 Australia: Healthcare EDI Market, by Claims Management

11.1.2.10.6 Australia: Healthcare EDI Market, by End User

11.1.2.11 Rest of Asia Pacific

11.1.2.11.1 Overview

11.1.2.11.2 Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

11.1.2.11.3 Rest of Asia Pacific: Healthcare EDI Market, by Component

11.1.2.11.4 Rest of Asia Pacific: Malaria -Healthcare EDI Market, by Delivery Mode

11.1.2.11.5 Rest of Asia Pacific: Healthcare EDI Market, by Application

11.1.2.11.5.1 Rest of Asia Pacific: Healthcare EDI Market, by Claims Management

11.1.2.11.6 Rest of Asia Pacific: Healthcare EDI Market, by End User

12. Industry Landscape

12.1 Overview

12.2 Growth Strategies in the Asia Pacific Electronic Data Interchange (EDI) Market

12.3 Organic Developments

12.3.1 Overview

12.1 Inorganic Developments

12.1.1 Overview

13. Company Profiles

13.1 Siemens Healthineers AG

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 GE HealthCare Technologies Inc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Wipro Ltd

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 athenahealth Inc

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 PNORS Technology Group Pty Ltd

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 International Business Machines Corp

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Cognizant Technology Solutions Corp

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Veradigm Inc

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Oracle Corp

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 McKesson Corp

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

13.11 Optum Inc

13.11.1 Key Facts

13.11.2 Business Description

13.11.3 Products and Services

13.11.4 Financial Overview

13.11.5 SWOT Analysis

13.11.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

List of Tables

Table 1. Surgical Navigation Systems Market Segmentation

Table 2. Commonly Used ASC X12 Transactions in Dental Industry

Table 3. Subscription Models to the Organization

Table 4. Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 5. Asia Pacific: Healthcare EDI Market Revenue and Forecast To 2030 (US$ Mn) – Delivery Mode

Table 6. Asia Pacific: Healthcare EDI Market Revenue and Forecast To 2030 (US$ Mn) – Application

Table 7. Asia Pacific: Healthcare EDI Market Revenue and Forecast To 2030 (US$ Mn) – Claims Management

Table 8. Asia Pacific: Healthcare EDI Market Revenue and Forecast To 2030 (US$ Mn) – End User

Table 9. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 10. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 11. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 12. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 13. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 14. Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 15. Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 16. Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 17. Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 18. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 19. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 20. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 21. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 22. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 23. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 24. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 25. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 26. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 27. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 28. GS1 Model for Supply Chain Management in Healthcare in Australia

Table 29. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 30. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 31. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 32. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 33. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 34. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Component

Table 35. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Delivery Mode

Table 36. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Application

Table 37. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – Claims Management

Table 38. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn) – End User

Table 39. Organic Developments Done by Companies

Table 40. Inorganic Developments Done by Companies

Table 41. Glossary of Terms

List of Figures

Figure 1. Asia Pacific Electronic Data Interchange (EDI) Market, by Region

Figure 2. Key Insights

Figure 3. Asia Pacific: PEST Analysis

Figure 4. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market- Key Industry Dynamics

Figure 5. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market: Impact Analysis of Drivers and Restraints

Figure 6. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue Forecast and Analysis – 2021–2030

Figure 7. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Component, 2022 & 2030 (%)

Figure 8. Solution: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Services: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Delivery Mode (2022 and 2030)

Figure 11. Web-Based & Cloud Based: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. EDI Value Added Network (VAN): Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 13. Direct/Point-to-Point EDI: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Mobile EDI: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Others: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by Application (2022 and 2030)

Figure 17. Claims Management: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Claims Submission: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Claims Status: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Eligibility Criteria: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Payment Remittance: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Referral Certification & Authorization: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Others: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Healthcare Supply Chain: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Asia Pacific Healthcare Electronic Data Interchange (EDI) Market Revenue Share, by End User (2022 and 2030)

Figure 26. Healthcare Providers: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Healthcare Payers: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Medical & Pharmaceutical Industries: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Pharmacies: Asia Pacific Healthcare Electronic Data Interchange (EDI) Market – Revenue and Forecast to 2030 (US$ Million)

Figure 30. Healthcare EDI Market, 2022 ($Mn)

Figure 31. Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 32. Asia Pacific: Healthcare EDI Market, By Key Countries, 2022 And 2030 (%)

Figure 33. China: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 34. Japan: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 35. India: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 36. South Korea: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 37. Australia: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 38. Rest of Asia Pacific: Healthcare EDI Market Revenue and Forecast to 2030 (US$ Mn)

Figure 39. Growth Strategies in the Asia Pacific Electronic Data Interchange (EDI) Market

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Nov 2023

Emergency Response Software Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Incident Lifecycle (Before the Incident, During the Incident, and After the Incident), Deployment (Cloud and On-premises), Application (Disaster Management, Incident Management, Risk Management, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Nov 2023

AI in Automotive Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Nov 2023

AI in Healthcare Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Nov 2023

AI in BFSI Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Nov 2023

AI in IT and Telecom Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On-Premises ), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Nov 2023

Public Safety Solutions Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, and Services), Hardware Type (Imaging and Video Hardware, Mobile and Wearable Devices, Connectivity and Edge Hardware, Sensors and Telemetry Devices, In-Vehicle Computing Hardware, Medical Devices (EMS-Focused), and Others), Software Type (Cloud-Based Public Safety Platforms, Analytics and AI Software, Video and Imaging Software, Responder Mobile Applications, In-Vehicle Software (Mobile Apps), and Others), Imaging And Video Hardware Type (Dash Cameras, Thermal Cameras, and In Cab Cameras), Mobile And Wearable Devices Type (Body-Worn Cameras, Rugged Smartphones, and Handheld Radios), Connectivity And Edge Hardware Type (LTE or 5G Routers, Vehicle Gateways and Edge Computing Devices), Sensors And Telemetry Devices Type (GPS Sensors, Accelerometers, Crash Sensors, and Environmental Sensors), In-vehicle Computing Hardware (Mobile Data Terminals, Rugged Laptops, and Vehicle Mounted Tablets), Medical Devices Type (Cardiac Monitors, Connected Defibrillators and Pulse Oximeters), Vehicle Type (Patrol Cars, Ambulances, Fire Trucks, Specialized Emergency Vehicles, and Others), End User (Law Enforcement or Police, Medical Emergency, Fire, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Nov 2023

Data Center Air Cooling Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cooling Type (Room-Based Cooling, Row-Based Cooling, and Rack-Based Cooling), Data Center Type (Hyperscale Data Center, Colocation Data Center, Wholesale Data Center, and Enterprise Data Center), Industry Vertical (IT and Telecom, BFSI, Healthcare, Manufacturing, Government and Defense, Media and Entertainment, Retail, Energy, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Nov 2023

Infrastructure Security Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Organization Size (Large Enterprises and SMEs), Industry Vertical (BFSI, IT and Telecom, Government, Healthcare, Manufacturing, Retail and Ecommerce, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For