Data Center Colocation Market Size, Trends, Growth Forecast & Key Players (2025-2031)

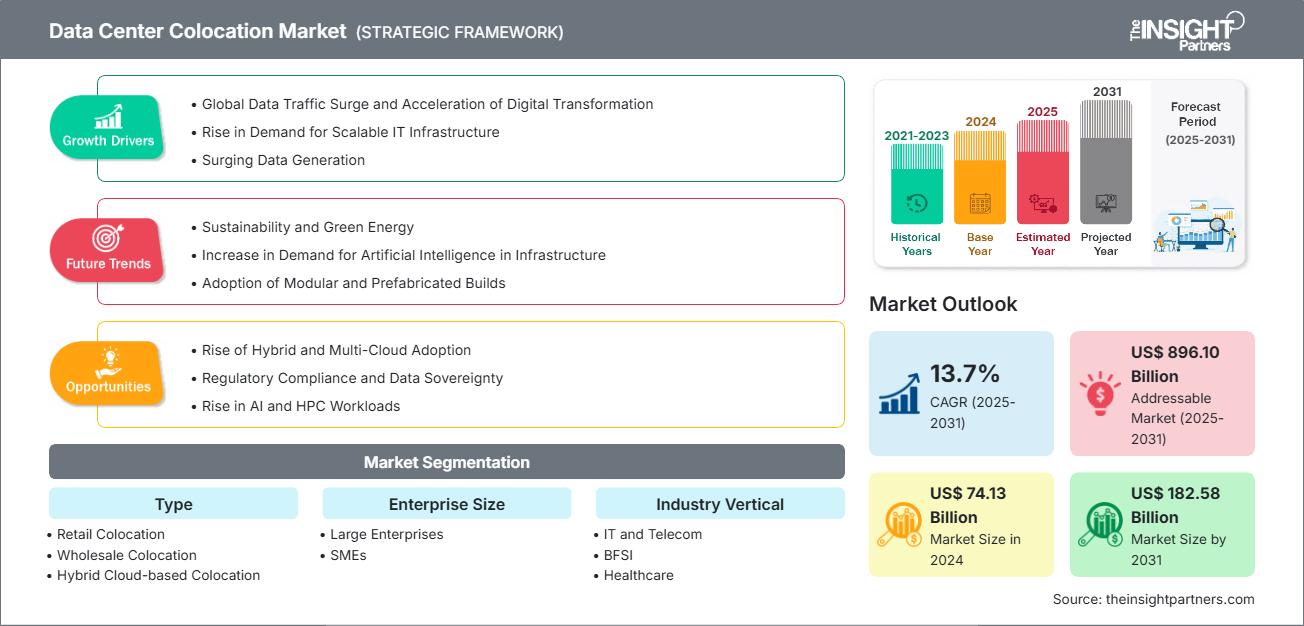

Data Center Colocation Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Retail Colocation, Wholesale Colocation, and Hybrid Cloud-based Colocation), Enterprise Size (Large Enterprises and SMEs), Industry Vertical (IT and Telecom, BFSI, Healthcare, Retail, and Others), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPTE100000210

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 161

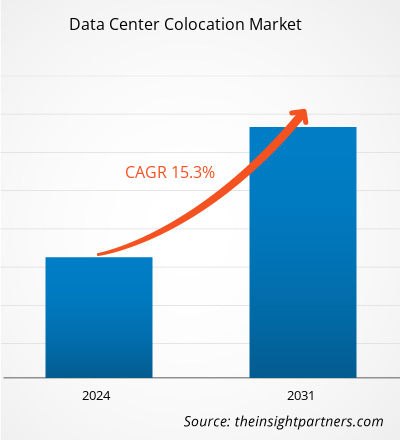

The data center colocation market size was valued at US$ 74.13 billion in 2024 and is projected to reach US$ 182.58 billion by 2031. The market is expected to register a CAGR of 13.7% during 2025–2031.

Data Center Colocation Market Analysis

The increasing need for scalable IT infrastructure, global data traffic, and digital transformation, along with rising investments in data centers across various industries, are key factors fueling the demand for data center colocation. Technological advancements, the adoption of hybrid and multi-cloud, and rising regulatory compliance and data sovereignty are expected to create lucrative opportunities in the market during the forecast period. Further, a high focus on sustainability and green energy and an increase in demand for artificial intelligence in infrastructure are expected to generate future growth opportunities in the market.

Data Center Colocation Market Overview

The data center colocation market involves renting space, power, and cooling within a shared facility for housing servers and IT infrastructure. Essentially, it allows businesses to have secure, reliable, and scalable environments without the significant capital investment required to build and maintain their own data centers. The benefits include cost efficiency, enhanced security, improved uptime through redundant systems, and access to high-speed connectivity. Additionally, colocation allows companies to focus on their core competencies while outsourcing physical infrastructure management. The market's growth is driven by factors such as rapid data growth, increasing cloud adoption, demand for disaster recovery solutions, and the need for low-latency connections near end users. Regulatory compliance and data sovereignty concerns also push organizations toward colocation providers who offer certified, compliant facilities. Furthermore, digital transformation across industries fuels demand, making colocation a strategic choice for scalability, flexibility, and operational efficiency in managing IT infrastructure.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONData Center Colocation Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Data Center Colocation Market Drivers and Opportunities

Market Drivers:

- Rising Demand for Scalable IT Infrastructure: The surging demand for scalable IT infrastructure is a fundamental driver for the expanding global data center colocation market. Enterprises, especially in sectors such as financial services, healthcare, software, and telecommunications, are increasingly turning to colocation providers instead of building and operating their data centers. This shift enables organizations to scale rapidly, avoid significant upfront capital expenditure, and convert fixed costs into operational flexibility. A primary driver of this growth is the increase in digital workloads from AI, IoT, edge computing, and cloud-native services that require high-density, resilient infrastructure. According to the Uptime Institute's 2023 Capacity Trends Survey, 64% of enterprise data center operators were expanding their capacity, with an impressive 20% growing at rates exceeding 20% per year. This indicated a strong internal demand for data center resources. In addition, 82% of enterprises anticipated an increased demand for higher power densities. However, over one-third of respondents reported that their current facilities could not support this demand without upgrades. This situation presents a significant opportunity for colocation providers that offer advanced power and cooling infrastructure.

- Global Data Traffic and Digital Transformation Growth: The rapid increase in global data traffic and accelerated digital transformation drive the demand for data center colocation services. Today's enterprises are coping with soaring volumes of data, powered by mobile broadband, video streaming, SaaS, IoT, and enterprise applications, while simultaneously upgrading digital products and services to remain competitive. According to the International Telecommunication Union's Facts and Figures 2024, global mobile broadband traffic surpassed 1 zettabyte in 2023 and is projected to reach 1.3 zettabytes in 2024, while fixed broadband traffic is estimated to hit 6 zettabytes in 2024, up from 5.1 zettabytes in the prior year. The vast amount of data being generated is leading to an unprecedented demand for storage and processing within data centers and their interconnect networks. Traffic growth rates are still strong, with mobile broadband traffic increasing at approximately 19.6% annually and fixed broadband traffic growing at about 15.2% per year.

Market Opportunities:

- Hybrid and Multi-Cloud Adoption: The hybrid and multi-cloud adoption is growing significantly, which highlights a clear role for colocation facilities: serving as neutral, secure, and highly interconnected hubs that interoperate with hyperscale cloud providers. Enterprises require reliable connectivity to multiple clouds, such as AWS, Azure, and Google, for which colocation offers direct on‑ramps and high-performance interconnection services. Moreover, typical clients run a mix of public and private cloud workloads—often retaining up to 81 % of infrastructure on-premises alongside public cloud deployment.

- Rising Regulatory Compliance and Data Sovereignty: Colocation facilities also reduce compliance risk, streamline regulatory reporting, and support disaster resilience while keeping regional sovereignty intact. In areas with emerging localization laws, such as Brazil, Russia, India, and the EU, enterprises increasingly turn to third-party operators that comply with regulatory and operational governance. As regulatory complexity rises globally, colocation providers are uniquely positioned to deliver the governed, sovereign, and scalable infrastructure enterprises require, making them strategic enablers of compliance and business continuity in the digital age.

Data Center Colocation Market Report Segmentation Analysis

The data center colocation market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Type:

- Retail Colocation: Retail colocation is designed for businesses, startups, and government agencies that require a smaller-scale data center presence. Typically, this refers to deployments involving fewer than 10 colocation racks or cabinets. Retail colocation space can consist of individual racks that are either positioned side-by-side or spread throughout a facility, interconnected via cross-connects rather than enclosed in a private cage. Providers often offer flexible options, including shared colocation space in increments such as 1U, 2U, 3U, or 4U, as well as dedicated locking quarter, half, or full racks. Customers may also opt for multiple locking racks. Services are usually bundled at a flat monthly rate, which depends on the amount of power (e.g., per circuit or kilowatt) included. For example, a provider might offer a full rack with 208V/20A power and a 100 Mbps blended internet connection for a fixed price.

- Wholesale Colocation: Wholesale colocation is tailored to meet the needs of large enterprises, service providers, and government agencies that require significant amounts of space and power. These clients often receive dedicated infrastructure such as a locking private cage, private suite, or even a custom-built data center designed specifically for their requirements. The primary objective of wholesale colocation is to separate a client's IT infrastructure from others in a multi-tenant facility, ensuring enhanced security and control. Unlike retail colocation, wholesale colocation pricing is primarily based on power consumption. Clients typically require at least 500 kW of power, which can vary depending on the project. Providers begin by determining the client's total usable power requirements. For instance, if a client needs 500 kW to operate their off-site IT environment, the provider will assess the power density per rack. If each rack supports 10 kW, the client would be allocated 50 racks.

- Hybrid Cloud-Based Colocation: Hybrid cloud-based data center colocation combines the advantages of traditional colocation with seamless integration to both public and private cloud platforms. This model allows businesses to colocate their critical infrastructure in a secure, high-performance facility while extending workloads to the cloud for enhanced scalability, flexibility, and cost-effectiveness. Colocation providers offer direct cloud connections, low-latency interconnectivity, and managed services that simplify hybrid deployments.

By Enterprise Size:

- SMEs: As SMEs scale operations or expand globally, colocation enables faster market entry by providing a ready-built infrastructure footprint. It also allows SMEs to better manage risk, improve uptime, and focus internal resources on core business innovation rather than data center management.

- Large Enterprises: The global data center colocation market is a critical enabler for large enterprises pursuing digital transformation, hybrid cloud adoption, and global scalability. As organizations seek to reduce capital expenditures and improve infrastructure agility, colocation offers a strategic alternative to owning and operating proprietary data centers. Enterprises leverage wholesale and retail colocation models to host mission-critical workloads in highly secure, redundant, and connected facilities. These environments offer direct access to cloud providers, content delivery networks, financial exchanges, and network carriers, facilitating high-performance computing, real-time data exchange, and edge deployments.

Industry Vertical:

- IT and Telecom

- BFSI

- Healthcare

- Retail

- Others

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The North America data center colocation market is the largest globally, driven by strong IT infrastructure, widespread cloud adoption, and growing digital transformation initiatives. The US and Canada are experiencing a high demand, driven by enterprises seeking scalable, secure, and cost-effective data storage solutions. Hyperscale cloud providers and tech giants continuously expand their colocation facilities to support AI, big data, and IoT workloads. Additionally, the region's regulatory environment, which focuses on data privacy and security, drives the demand for compliant colocation providers.

Data Center Colocation Market Regional Insights

The regional trends and factors influencing the Data Center Colocation Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Data Center Colocation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Data Center Colocation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 74.13 Billion |

| Market Size by 2031 | US$ 182.58 Billion |

| Global CAGR (2025 - 2031) | 13.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Data Center Colocation Market Players Density: Understanding Its Impact on Business Dynamics

The Data Center Colocation Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Data Center Colocation Market top key players overview

Data Center Colocation Market Share Analysis by Geography

Asia Pacific shows rapid growth in the data center colocation market, driven by booming digital economies, urbanization, and increasing internet penetration. Numerous countries, including China, India, Japan, Australia, and Singapore, are prominent markets due to the rising enterprise cloud adoption and expanding e-commerce, gaming, and social media sectors. The region faces challenges such as power availability and land scarcity, which boost the demand for efficient colocation services offering scalable capacity. Government initiatives promoting smart cities and digital infrastructure also stimulate the market. Additionally, Asia Pacific's geopolitical complexities and data sovereignty concerns prompt businesses to colocate data locally. Rapid innovation in edge computing and 5G deployment further accelerates the demand for colocation to support latency-sensitive applications.

The data center colocation market grows differently in each region owing to digital transformation, technological advancements, and industrial expansion. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a major share of the global data center colocation market

-

Key Drivers:

- Rapid growth of cloud services drives demand for scalable colocation facilities

- Businesses modernizing their IT infrastructure increase need for secure, flexible data centers

- Proximity to end users requires more distributed colocation sites

- Trends: Increasing integration of AI and machine learning workloads in data centers for advanced analytics

2. Europe

- Market Share: Substantial share

-

Key Drivers:

- Drives demand for localized, compliant data center facilities

- Emphasis on energy-efficient, green colocation centers

- Expansion of hyperscalers increasing demand for colocation capacity

- Trends: Rising investments in renewable energy-powered data centers to meet ESG goals

3. Asia Pacific

- Market Share: Fastest-growing region with a rising market share every year

-

Key Drivers:

- Expanding user base boosts demand for data hosting and cloud services

- Large-scale digital infrastructure projects require robust colocation support

- Increasing data traffic necessitates scalable colocation

- Trends: Emergence of modular and containerized data centers for faster deployment

4. South and Central America

- Market Share: Growing market with steady progress

-

Key Drivers:

- Growing cloud adoption and digital economy to accelerate need for colocation to support digital services

- Government investments in ICT infrastructure to develop smart cities and digital transformation

- Limited local data center infrastructure to drive outsourcing to colocation providers

- Trends: Increasing partnerships between local governments and global colocation providers to expand infrastructure

5. Middle East and Africa

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Increasing internet and mobile access leading to higher data traffic and colocation demand

- Economic growth and IT modernization driving companies to outsource in order to improve cost efficiency and scalability

- Data sovereignty for compliance with regulations through local data storage

- Trends: Growing demand for hybrid cloud and multicloud strategies influencing colocation market dynamics

Data Center Colocation Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition:

Competition is strong due to the presence of established players such as CoreSite Realty Corporation, CyrusOne Inc, Iron Mountain Inc, Digital Realty Trust Inc, Equinix Inc, Telehouse, NTT Data Corp, International Business Machines Corp, Rittal GmbH & Co KG, and ATandT.This high level of competition urges companies to stand out by offering:

- High-performance infrastructure and connectivity solutions (e.g., low-latency interconnects, direct on-ramps to hyperscale cloud platforms, and high bandwidth capacity)

- Edge and hybrid colocation services (support for distributed infrastructure with seamless integration between centralized data centers, edge sites, and multi-cloud environments)

- Sustainability and energy-efficient operations [green certifications, renewable energy sourcing, and advanced power usage effectiveness (PUE) metrics]

- Compliance-focused security frameworks (adherence to global regulatory standards such as GDPR, HIPAA, ISO 27001, and SOC 2)

- Scalable and modular infrastructure design (support for rapid customer expansion with flexible power and space provisioning)

- AI and automation for operational optimization (predictive maintenance, automated capacity planning, and smart monitoring systems)

Opportunities and Strategic Moves

- Strategic partnerships with cloud service providers, content delivery networks (CDNs), and edge computing vendors are becoming critical to enhance service offerings, drive low-latency delivery, and support hybrid and multi-cloud architectures.

- Rising demand for edge data centers and micro colocation facilities is opening new growth frontiers, especially in support of IoT, 5G deployments, and latency-sensitive applications across various verticals.

- Geographic expansion into Tier 2 and Tier 3 cities across North America, Asia Pacific, and Africa presents strong growth opportunities, driven by increasing digitalization, e-commerce growth, and favorable regulatory environments.

- Increased investment in green data centers and sustainability initiatives is enabling colocation providers to attract environmentally conscious enterprises, meet ESG goals, and comply with stricter energy efficiency regulations.

- Integration of advanced infrastructure management tools, Data Center Infrastructure Management (DCIM), and AI-powered monitoring systems is improving operational efficiency, enabling predictive maintenance, and optimizing power and cooling usage.

Major Companies operating in the data center colocation market are:

- CoreSite Realty Corporation (US)

- CyrusOne Inc (US)

- Iron Mountain Inc (US)

- Digital Realty Trust Inc (US)

- Equinix Inc (US)

- Telehouse (US)

- NTT Data Corp (Japan)

- International Business Machines Corp (US)

- Rittal GmbH & Co KG (Germany)

- AT&T (US)

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Dell Inc

- Hewlett-Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Vertiv Group Corp.

- Eaton Corp Plc

- Schneider Electric SE

- Cannon Technologies Ltd

- PCX Holding LLC

- Delta Electronics, Inc.

- Johnson Controls

- ABB Ltd

- STULZ GMBH

- IE Corp.

- EDGE MISSION CRITICAL SYSTEMS, LLC

- ZTE Corporation

- CommScope

- Amazon Web Services, Inc.

Data Center Colocation Market News and Recent Developments

- CyrusOne Announced Partnership with E.ON In June 2025, CyrusOne, a leading global data center owner, developer, and operator specializing in delivering sophisticated digital infrastructure solutions worldwide, and E.ON, one of Europe's largest energy companies and a leader in energy networks, energy infrastructure solutions and energy sales, announced they had entered into a Preferred Partnership agreement to design and deliver local power generation solutions for data centers.

- Iron Mountain Takes Ownership of Indian Data Center Firm Webwerks In April 2025, Iron Mountain announced the expansion of its Amsterdam data center campus. An additional 10MW of capacity will be added to AMS-1, bringing the data center closer to its maximum buildout of 60MW. It presently offers 22.7MW capacity with 17,000 sqm (183,000 sq ft) of space. AMS-1 is located on a 23-acre site in Haarlem, a city west of Amsterdam.

- Digital Realty and Bersama Digital Infrastructure Asia (BDIA) Announced Formation of Digital Realty Bersama In March 2025, Digital Realty (NYSE:DLR), the largest global provider of cloud- and carrier-neutral data center, colocation, and interconnection solutions, and Bersama Digital Infrastructure Asia (BDIA), a leading Southeast Asian digital infrastructure platform, announced the formation of Digital Realty Bersama, a 50-50 joint venture (JV) to develop and operate data centers across Indonesia. The JV extends PlatformDIGITAL into the dynamic Indonesian market, directly supporting the acceleration and growth of its digital economy, which is driven by the country's young and digitally savvy population.

Data Center Colocation Market Report Coverage and Deliverables

The " Data Center Colocation Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Data center colocation market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Data center colocation market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Data center colocation market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the data center colocation market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For