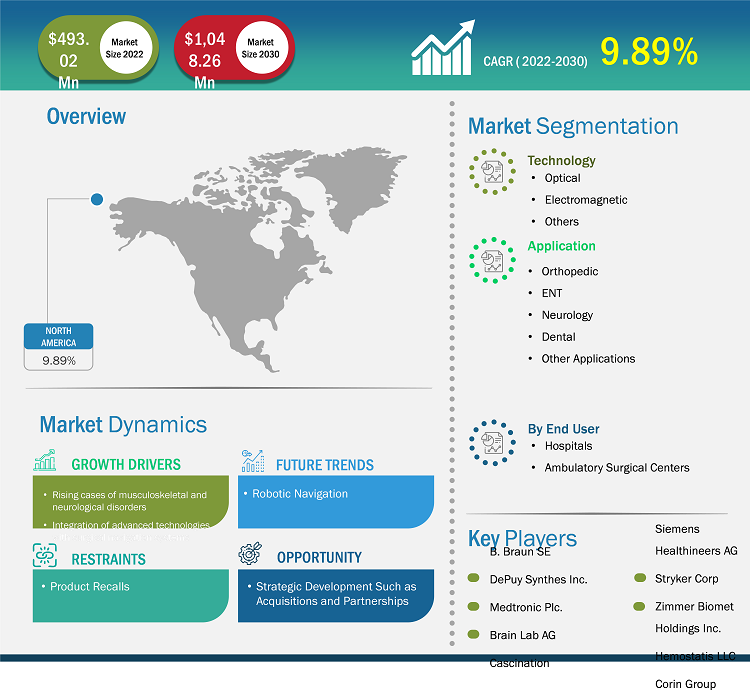

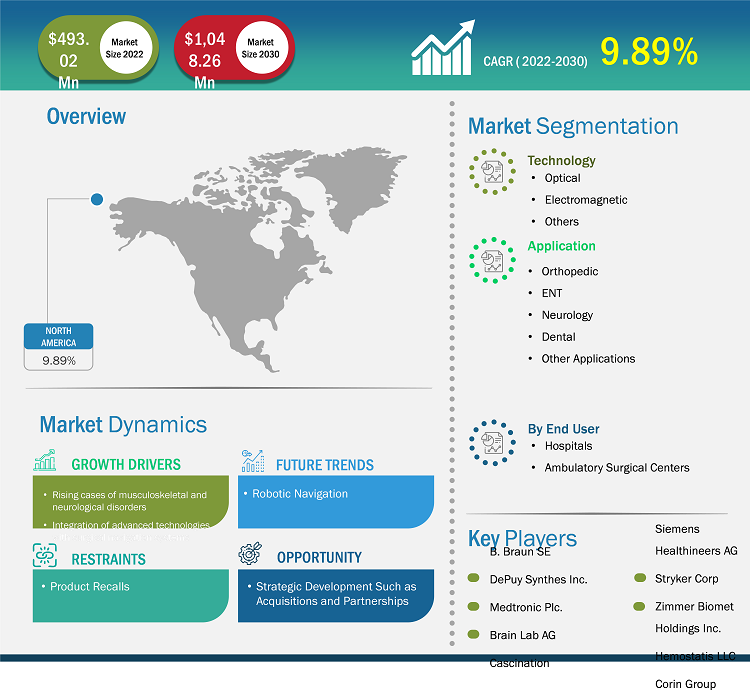

The surgical navigation systems market size is projected to grow from US$ 493.02 million in 2022 to US$ 1,048.26 million by 2030; it is estimated to register a CAGR of 9.89% from 2022 to 2030.

Analyst’s ViewPoint

The North America surgical navigation systems market analysis explains driving factors such as the rising cases of musculoskeletal and neurological disorders, and the integration of advanced technologies with surgical navigation systems. Further, robotic navigation is expected to introduce new trends into the market during 2022–2030. Based on technology, the electromagnetic segment accounted for a larger market share in 2022. Based on application, the orthopedic segment dominated the market by accounting maximum share in 2022. By end user segment, the hospitals segment is likely to account for a considerable share of the surgical navigation systems market during the forecast period.

Surgical navigation systems allow surgeons to precisely track instrument position and assist while performing surgeries. A surgical navigation system comprises a computer workstation and a hardware setup for tracking the position of instruments.

Market Insights

Rising Cases of Musculoskeletal and Neurological Disorders

According to the United States Bone and Joint Initiative 2023 report, musculoskeletal diseases affect more than 50% of people aged 18 and above in the US. Trauma, back pain, and arthritis are the three most common musculoskeletal conditions reported in the country. Also, with the aging of the population, musculoskeletal diseases are becoming a greater burden annually. Osteoarthritis and inflammatory arthritis, including rheumatoid arthritis (RA), gout, psoriatic arthritis, and other conditions, are the most common types of arthritis. As per the United States Bone and Joint Initiative 2023 report, more than 25% of adults have doctor-diagnosed arthritis, and 78 million Americans are estimated to have this disease by 2040. Therefore, there is a high demand for surgical navigation systems intended for orthopedic surgeries. These systems are among the most powerful and enabling tools for surgeons. Surgical navigation systems analyze pre- and post-operative data in multiple versions using augmented reality (AR) to improve clinical outcomes of orthopedic surgeries. For example, visualization systems allow surgeons to take suitable positions during surgeries without excessive exposure to X-ray radiation.

The Information Technology & Innovation Foundation report states mental and neurological disorders, and associated diseases account for the cost burden of more than US$ 1.5 trillion annually to the US government, totaling 8.8% of the national GDP. Additionally, the report reveals that more than 50 million American adults, accounting for 21.8% of the adult population, have experienced events associated with brain disease in the past. Navigation systems for neurological procedures assist in a range of procedures, from intracranial tumor resections to frameless biopsies and from pedicle screw placement to spinal stabilization. For example, in skull openings (small craniotomies), neuronavigation systems display anatomical structures and track the virtual axis of surgical instruments.

Medtronic provides innovative surgical navigation systems and related products for neurosurgery, spinal surgery, and cranial surgery. Its StealthStation S8 Surgical Navigation System comprises an intuitive interface that aids advanced visualization to navigate neurosurgery procedures. The system provides optical and electromagnetic (EM) tracking capabilities with the help of external devices such as microscopes and ultrasound, thus acting as a powerful tool for neurosurgical procedures. Thus, the need for effective surgical treatments for orthopedic and neurosurgery with the rising cases of musculoskeletal and neurological disorders, coupled with innovative product launches by top companies, propels the adoption of surgical navigation systems in North America.

Future Trend

Robotic Navigation

Surgical robotic navigation benefits surgeons by assisting them through the alignment of surgical instruments and screws precisely. The real-time visualization of instrument positioning and imaging compatibility enables great accuracy for surgeons while performing procedures by using navigation systems. Several top companies plan to launch innovative robotic surgical navigation platforms. Globus Medical offers a Multifunctional Robotics+Navigation platform designed to improve surgical accuracy and optimize patient care with the use of robotics and navigation. Axis Spine Center's surgical navigation robot is connected to a camera; the robot can process the view captured by the camera using CT images in real time. The robot can also change position upon patients’ movement to ensure a precise placement of a surgical instrument. Despite developments in robotic surgical navigation, further studies are necessary to determine the efficacy, efficiency, and safety of new combined surgical robotic navigation systems/platforms.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Surgical Navigation Systems Market: Strategic Insights

Market Size Value in US$ 493.02 million in 2022 Market Size Value by US$ 1,048.26 million by 2030 Growth rate CAGR of 9.89% from 2022 to�2030 Forecast Period 2022-2030 Base Year 2022

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

North America Surgical Navigation Systems Market: Strategic Insights

| Market Size Value in | US$ 493.02 million in 2022 |

| Market Size Value by | US$ 1,048.26 million by 2030 |

| Growth rate | CAGR of 9.89% from 2022 to�2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope

Technology-Based Insights

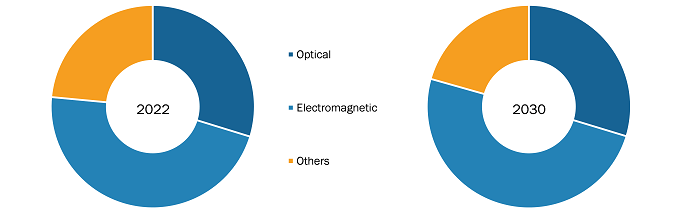

Based on technology, the surgical navigation systems market is segmented into optical, electromagnetic, and others. The electromagnetic segment held the largest market share in 2022, and the same segment is expected to record a significant CAGR during 2022–2030. In electromagnetic tracking systems (EMTs), magnetic fields are generated, sensors are used to detect them, and finally, software is used to process them. In an electromagnetic field of known geometry, the coordinates of the pre-interventional patient scan and the coordinates of the tracking system are registered.

EMTs are used widely in neurosurgery, interventional bronchoscopy, urology, cardiology, and sinonasal cavity surgeries. EMTs utilize fluoroscopy to screen the patient without using ionizing radiation, and it does not expose the patient to any energy fields that are more harmful than ultrasounds.

In July 2021, TT Electronics—a provider of engineered electronics for performance-critical applications—partnered with US-based Radwave Technologies to develop advanced electromagnetic tracking technologies. These companies, in partnership, would focus on introducing a customizable electromagnetic tracking platform with minimally invasive diagnostic and therapeutic devices for use during surgical procedures.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Application-Based Insights

Based on application, the surgical navigation systems market is segmented as orthopedic, ENT, neurology, dental, and other applications. The orthopedic segment held the largest market share in 2022, and the neurology segment is anticipated to register the highest CAGR during 2022–2030. Orthopedic surgery navigation systems or orthopedic surgical robots use a patient's preoperative/intraoperative imaging data to plan the surgical path and then guide doctors through the planned surgical path using the robotic arm's guiding function. The navigation system also captures a joint range of motion, laxity, and kinematics intraoperatively. HipNav is an image-guided surgical navigation system used in hip replacement surgery. With this system, prosthetic components can be measured and guided during total hip replacement surgery (THR). The system consists of a 3-dimensional preoperative planner, a simulator, and an intraoperative surgical navigator. The orthopedic segment is further classified into knee replacement and hip replacement.

According to the American Academy of Orthopaedic Surgeons, nearly 1 million knee and hip replacements are performed every year. An aging population, and an increase in obesity and osteoarthritis would cause that number to rise to 4 million by 2050.

DePuy Synthes offers a technology-assisted VELYS Hip Navigation platform for hip replacement. The surgeons use real-time data to help improve surgical outcomes. Thus, the growing advancement in orthopedic surgery navigation systems boosts the growth of the orthopedic segment of the North America surgical navigation systems market.

End User-Based Insights

In terms of end user, the surgical navigation systems market is categorized into hospitals and ambulatory surgical centers (ASCs). The hospital segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR during 2022–2030.

Surgical navigation systems are routinely used in orthopedic, neurology, and other surgeries to reach the target body site with greater precision. Hospitals are a vital part of the development of health systems. They play an important role in offering support to other healthcare providers. An increasingly large number of hospitals in North America are attaining expertise to use surgical navigation systems for surgeries. With the rising number of surgeries, the use of surgical navigation is expected to rise in hospital settings. Moreover, the rising number of hospitals is expected to continue the dominance of the hospitals segment in the North America surgical navigation market during the forecast period.

Surgical Navigation Systems Market, by Technology – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Regional Analysis

The North America surgical navigation systems market is segmented into the US, Canada, and Mexico. The growing number of surgeries in the US drives the surgical navigation systems market. For instance, the American Academy of Ophthalmology states that ~4 million cataract surgeries are performed each year in the US. Further, at least one cataract develops among half of the US population by the age of 80. Cataract causes vision problems, and it is removed only through the surgery. Similarly, according to the American Academy of Orthopedic Surgeons, ~720,000 knee replacements and 330,000 hip replacements are performed every year in the US.

As per the Canadian Institute for Health Information (CIHI), ~36,000 knee replacements and 12,000 hip replacements were performed in Canada between 2020 and 2022. In June 2022, ClaroNav Inc, a Canadian company, received USFDA approval for Navident, a navigation tool for dental implant surgeries. Thus, an upsurge in the number of surgeries and product approvals in Canada promotes the growth of the North America surgical navigation market.

The Mexican healthcare sector is evolving with a growing focus on offering technologically advanced medical services, the surging incidence of spinal disorders, the rising number of spinal surgeries, and developments in the country's healthcare infrastructure. The cost of spinal surgeries is approximately one-third of that in the US and Canada; as a result, patients in the US and Canada opt to travel to Mexico for treatments. For instance, as per the Medical Tourism Association, the cost of hip replacement in the US is US$ 40,000, whereas in Mexico, it is US$ 12,500. Similarly, the knee replacement cost in the US is US$ 35,000, and in Mexico, it is US$ 10,500. Moreover, a surge in the geriatric population suffering from spinal problems contributes to the growth of the surgical navigation market due to the increasing number of surgeries in Mexico.

Leading North America surgical navigation systems market players profiled in this market study include B. Braun SE; DePuy Synthes Inc; Medtronic Plc; Siemens Healthineers AG; Stryker Corp; Zimmer Biomet Holdings Inc; Brainlab AG; CASCINATION; HEMOSTASIS, LLC; and Corin Group.

- In July 2023, Stryker announced the launch of the "Ortho Q Guidance System" that enables advanced surgical planning, and guidance for hip and knee procedures. The system combines new optical tracking options through a designed, state-of-the-art camera with sophisticated algorithms of the newly launched Ortho Guidance software that delivers surgical planning and guidance capabilities.

- In May 2022, Zimmer Biomet Holdings, Inc received FDA approval clearance for the "Persona OsseoTi Keel Tibia" for cementless knee replacement. The product is the latest addition to the clinically proven Persona Knee System, with a porous version of the Persona anatomic tibia featuring OsseoTi Porous Metal Technology of Zimmer Biomet. This technology uses anatomical data in combination with 3D printing technology to create a structure that directly mimics the architecture of human cancellous or spongy bone.

- In September 2022, Stryker launched the "Q Guidance System" intended for spine applications. This system combines new optical tracking options along with a redesigned, state-of-the-art camera, a sophisticated algorithm, and the newly launched Spine Guidance Software, which together deliver improved surgical planning and navigation capabilities than before.

- In September 2022, B. Braun Medical Inc. (B. Braun) announced the acquisition of the Clik-FIX catheter securement device portfolio from Starboard Medical, Inc. for building a strong and innovative product and program to improve the overall patient experience and outcomes with the peripheral intravenous (IV) therapy.

- In March 2022, Johnson & Johnson MedTech announced that DePuy Synthes announced the acquisition of CUPTIMIZE Hip-Spine Analysis, giving surgeons an easy-to-use tool to understand better and address the impact of abnormal motion between the spine and pelvis for some patients seeking total hip arthroplasty (THA).

Company Profiles

- B. Braun SE

- DePuy Synthes Inc

- Medtronic Plc

- Siemens Healthineers AG

- Stryker Corp

- Zimmer Biomet Holdings Inc

- Brainlab AG

- CASCINATION

- HEMOSTASIS, LLC

- Corin Group

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, Application, End User, and Region

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Siemens Healthineers and Stryker are the top two companies that hold huge market shares in the surgical navigation systems market.

The hospital segment dominated the global surgical navigation systems market and held the largest market share in 2022.

The surgical navigation systems market majorly consists of the players such B. Braun SE; DePuy Synthes Inc; Medtronic Plc; Siemens Healthineers AG; Stryker Corp; Zimmer Biomet Holdings Inc; Brainlab AG; CASCINATION; HEMOSTASIS, LLC; and Corin Group.

The electromagnetic segment held the largest share of the market in the global surgical navigation systems market and held the largest market share in 2022.

The CAGR value of the surgical navigation systems market during the forecasted period of 2020-2030 is 9.89%.

Key factors that are driving the growth of this market are rising cases of musculoskeletal and neurological disorders, and the integration of advanced technologies with surgical navigation systems are expected to boost the market growth for the surgical navigation systems over the years.

Surgical navigation systems allow surgeons to precisely track instrument position and assist while performing surgeries. A surgical navigation system comprises a computer workstation and a hardware setup for tracking the position of instruments.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

1.2.1 North America Surgical Navigation Systems Market – by Technology

1.2.2 North America Surgical Navigation Systems Market – by Application

1.2.3 North America Surgical Navigation Systems Market – by End User

1.2.4 North America Surgical Navigation Systems Market – by Region

2. North America Surgical Navigation Systems Market – Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. North America Surgical Navigation Systems Market – Market Landscape

4.1 Overview

4.1.1 North America PEST Analysis

5. North America Surgical Navigation Systems Market

5.1 Market Drivers

5.1.1 Rising Cases of Musculoskeletal and Neurological Disorders

5.1.2 Integration of Advanced Technology with Surgical Navigation Systems

5.2 Market Restraints

5.2.1 Product Recalls

5.3 Market Opportunities

5.3.1 Strategic Developments Such as Acquisitions and Partnerships

5.4 Future Trends

5.4.1 Robotic Navigation

5.5 Impact analysis

6. North America Surgical Navigation Systems Market – Regional Analysis

6.1 North America Surgical Navigation Systems Market Revenue Forecast and Analysis

7. North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 – by Technology

7.1 Overview

7.2 North America Surgical Navigation Systems Market Revenue Share, by Technology, 2022 & 2030 (%)

7.3 Optical

7.3.1 Overview

7.3.2 Optical: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Electromagnetic

7.4.1 Overview

7.4.2 Electromagnetic: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Others

7.5.1 Overview

7.5.2 Others: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

8. North America Surgical Navigation Systems Market Revenue and Forecasts To 2028– by Application

8.1 Overview

8.2 North America Surgical Navigation Systems Market Revenue Share, by Application (2022 and 2030)

8.3 Orthopedic

8.3.1 Overview

8.3.2 Orthopedic: North America Surgical Navigation Systems Market– Revenue and Forecast to 2030 (US$ Million)

8.3.3 Knee Replacement Procedures

8.3.3.1 Knee Replacement Procedures: North America Surgical Navigation Systems Market– Revenue and Forecast to 2030 (US$ Million)

8.3.4 Hip Replacement Procedures

8.3.4.1 Hip Replacement Procedures: North America Surgical Navigation Systems Market– Revenue and Forecast to 2030 (US$ Million)

8.4 ENT

8.4.1 Overview

8.4.2 ENT: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Neurology

8.5.1 Overview

8.5.2 Neurology: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Dental

8.6.1 Overview

8.6.2 Dental: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Others

8.7.1 Overview

8.7.2 Others: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

9. North America Surgical Navigation Systems Market Revenue and Forecasts To 2028– by End User

9.1 Overview

9.2 North America Surgical Navigation Systems Market Revenue Share, by End User (2022 and 2030)

9.3 Hospitals

9.3.1 Overview

9.3.2 Hospitals: North America Surgical Navigation Systems Market– Revenue and Forecast to 2030 (US$ Million)

9.4 Ambulatory Surgical Centers (ASCs)

9.4.1 Overview

9.4.2 Ambulatory Surgical Centers (ASCs): North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10. North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 – Regional Analysis

10.1 North America: Surgical Navigation Systems Market

10.1.1 Overview

10.1.2 North America: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.3 North America: Surgical Navigation Systems Market, by Technology, 2020–2030 (US$ Million)

10.1.4 North America: Surgical Navigation Systems Market, by Application, 2020–2030 (US$ Million)

10.1.5 North America: Surgical Navigation Systems Market, by Orthopedic, 2020–2030 (US$ Million)

10.1.6 North America: Surgical Navigation Systems Market, by End User, 2020–2030 (US$ Million)

10.1.7 North America: Surgical Navigation Systems Market, by Country, 2022 & 2030 (%)

10.1.7.1 US: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.1.1 US: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.1.2 US: Surgical Navigation Systems Market, by Technology, 2020–2030 (US$ Million)

10.1.7.1.3 US: Surgical Navigation Systems Market, by Application, 2020–2030 (US$ Million)

10.1.7.1.4 US: Surgical Navigation Systems Market, by Orthopedic, 2020–2030 (US$ Million)

10.1.7.1.5 US: Surgical Navigation Systems Market, by End User, 2020–2030 (US$ Million)

10.1.7.2 Canada: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.2.1 Canada: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.2.2 Canada: Surgical Navigation Systems Market, by Technology, 2020–2030 (US$ Million)

10.1.7.2.3 Canada: Surgical Navigation Systems Market, by Application, 2020–2030 (US$ Million)

10.1.7.2.4 Canada: Surgical Navigation Systems Market, by Orthopedic, 2020–2030 (US$ Million)

10.1.7.2.5 Canada: Surgical Navigation Systems Market, by End User, 2020–2030 (US$ Million)

10.1.7.3 Mexico: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.3.1 Mexico: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

10.1.7.3.2 Mexico: Surgical Navigation Systems Market, by Technology, 2020–2030 (US$ Million)

10.1.7.3.3 Mexico: Surgical Navigation Systems Market, by Application, 2020–2030 (US$ Million)

10.1.7.3.4 Mexico: Surgical Navigation Systems Market, by Orthopedic, 2020–2030 (US$ Million)

10.1.7.3.5 Mexico: Surgical Navigation Systems Market, by End User, 2020–2030 (US$ Million)

11. North America Surgical Navigation Systems Market – Industry Landscape

11.1 Overview

11.2 Growth Strategies in the North America Surgical Navigation Systems Market

11.3 Organic Developments

11.3.1 Overview

11.4 Inorganic Developments

11.4.1 Overview

12. Company Profiles

12.1 B. Braun SE

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 DePuy Synthes Inc

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Medtronic Plc

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Siemens Healthineers AG

12.4.1 Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 Stryker Corp

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Zimmer Biomet Holdings Inc

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Brainlab AG

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 CASCINATION

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 HEMOSTASIS, LLC

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Corin Group

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

13.2 Glossary of Terms

LIST OF TABLES

Table 1. North America Surgical Navigation Systems Market Revenue Share, by Technology – Revenue and Forecast to 2030 (US$ Million)

Table 2. Technology

Table 3. North America Surgical Navigation Systems Market Revenue Share, by Application– Revenue and Forecast to 2030 (US$ Million)

Table 4. Application

Table 5. North America Surgical Navigation Systems Market Revenue Share, by Orthopedic – Revenue and Forecast to 2030 (US$ Million)

Table 6. Orthopedic Application

Table 7. North America Surgical Navigation Systems Market Revenue Share, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 8. US Surgical Navigation Systems Market, by Technology – Revenue and Forecast to 2030 (US$ Million)

Table 9. Technology

Table 10. US Surgical Navigation Systems Market, by Application– Revenue and Forecast to 2030 (US$ Million)

Table 11. Application

Table 12. US Surgical Navigation Systems Market, by Orthopedic – Revenue and Forecast to 2030 (US$ Million)

Table 13. Orthopedic Application

Table 14. US Surgical Navigation Systems Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 15. End User

Table 16. Canada Surgical Navigation Systems Market Revenue Share, by Technology – Revenue and Forecast to 2030 (US$ Million)

Table 17. Technology

Table 18. Canada Surgical Navigation Systems Market Revenue Share, by Application– Revenue and Forecast to 2030 (US$ Million)

Table 19. Application

Table 20. Canada Surgical Navigation Systems Market Revenue Share, by Orthopedic – Revenue and Forecast to 2030 (US$ Million)

Table 21. Orthopedic Application

Table 22. Canada Surgical Navigation Systems Market Revenue Share, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 23. End User

Table 24. Mexico Surgical Navigation Systems Market, by Technology – Revenue and Forecast to 2030 (US$ Million)

Table 25. Technology

Table 26. Mexico Surgical Navigation Systems Market, by Application– Revenue and Forecast to 2030 (US$ Million)

Table 27. Application

Table 28. Mexico Surgical Navigation Systems Market, by Orthopedic – Revenue and Forecast to 2030 (US$ Million)

Table 29. Orthopedic Application

Table 30. Mexico Surgical Navigation Systems Market, by End User – Revenue and Forecast to 2030 (US$ Million)

Table 31. End User

Table 32. Organic Developments Done by Companies

Table 33. Inorganic Developments Done by Companies

Table 34. Glossary of Terms

LIST OF FIGURES

Figure 1. Surgical Navigation Systems Market Segmentation

Figure 2. North America Surgical Navigation Systems Market, by Region

Figure 3. Key Insights

Figure 4. North America: PEST Analysis

Figure 5. North America Surgical Navigation Systems Market- Key Industry Dynamics

Figure 6. North America Surgical Navigation Systems Market: Impact Analysis of Drivers and Restraints

Figure 7. North America Surgical Navigation Systems Market – Revenue Forecast and Analysis – 2020–2030

Figure 8. North America Surgical Navigation Systems Market Revenue Share, by Technology, 2022 & 2030 (%)

Figure 9. Optical: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Electromagnetic: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Others: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. North America Surgical Navigation Systems Market Revenue Share, by Application (2022 and 2030)

Figure 13. Orthopedic: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Knee Replacement Procedures: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Hip Replacement Procedures: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. ENT: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Neurology: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Dental: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Others: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. North America Surgical Navigation Systems Market Revenue Share, by End User (2022 and 2030)

Figure 21. Hospitals: North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 22. Ambulatory Surgical Centers (ASCs): North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. North America: Surgical Navigation Systems Market Revenue Share, by Key Region – Revenue (2022) (US$ Million)

Figure 24. North America Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. North America: Surgical Navigation Systems Market, by Country, 2022 & 2030 (%)

Figure 26. US: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 27. Canada: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 28. Mexico: Surgical Navigation Systems Market – Revenue and Forecast to 2030 (US$ Million)

Figure 29. Growth Strategies in the North America Surgical Navigation Systems Market

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Oct 2023

Emergency Response Software Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Incident Lifecycle (Before the Incident, During the Incident, and After the Incident), Deployment (Cloud and On-premises), Application (Disaster Management, Incident Management, Risk Management, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Oct 2023

AI in Automotive Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Oct 2023

AI in Healthcare Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Oct 2023

AI in BFSI Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware and Services), Deployment (Cloud and On Premises), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Oct 2023

AI in IT and Telecom Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Software, Hardware, and Services), Deployment (Cloud and On-Premises ), Organization Size (Large Enterprises and SMEs), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America)

Oct 2023

Public Safety Solutions Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software, and Services), Hardware Type (Imaging and Video Hardware, Mobile and Wearable Devices, Connectivity and Edge Hardware, Sensors and Telemetry Devices, In-Vehicle Computing Hardware, Medical Devices (EMS-Focused), and Others), Software Type (Cloud-Based Public Safety Platforms, Analytics and AI Software, Video and Imaging Software, Responder Mobile Applications, In-Vehicle Software (Mobile Apps), and Others), Imaging And Video Hardware Type (Dash Cameras, Thermal Cameras, and In Cab Cameras), Mobile And Wearable Devices Type (Body-Worn Cameras, Rugged Smartphones, and Handheld Radios), Connectivity And Edge Hardware Type (LTE or 5G Routers, Vehicle Gateways and Edge Computing Devices), Sensors And Telemetry Devices Type (GPS Sensors, Accelerometers, Crash Sensors, and Environmental Sensors), In-vehicle Computing Hardware (Mobile Data Terminals, Rugged Laptops, and Vehicle Mounted Tablets), Medical Devices Type (Cardiac Monitors, Connected Defibrillators and Pulse Oximeters), Vehicle Type (Patrol Cars, Ambulances, Fire Trucks, Specialized Emergency Vehicles, and Others), End User (Law Enforcement or Police, Medical Emergency, Fire, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Oct 2023

Data Center Air Cooling Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Cooling Type (Room-Based Cooling, Row-Based Cooling, and Rack-Based Cooling), Data Center Type (Hyperscale Data Center, Colocation Data Center, Wholesale Data Center, and Enterprise Data Center), Industry Vertical (IT and Telecom, BFSI, Healthcare, Manufacturing, Government and Defense, Media and Entertainment, Retail, Energy, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Oct 2023

Infrastructure Security Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component (Solution and Services), Organization Size (Large Enterprises and SMEs), Industry Vertical (BFSI, IT and Telecom, Government, Healthcare, Manufacturing, Retail and Ecommerce, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For