The Saudi Arabia endoscopy devices market size is projected to grow from US$ 470.79 million in 2022 to US$ 746.18 million by 2030; it is anticipated to record a CAGR of 5.9% from 2022 to 2030.

Market Insights and Analyst View:

An endoscope can be inserted into the openings of the body. For example, during a bronchoscopy, the scope is introduced through natural openings such as mouth, whereas in a sigmoidoscopy, it is inserted through the rectum. The device is used to visually examine internal organs and accordingly diagnose the medical conditions; it is employed in minimally invasive surgical procedures. The device usually comes with a light source. A medical procedure performed using any type of endoscope is called an endoscopy. Key factors driving the Saudi Arabia endoscopy devices market growth include the surging preference for minimally invasive surgeries and the increasing prevalence of cancer. However, risks of infections associated with endoscopic procedures hinder the market growth.

Growth Drivers and Restraints:

The major advantages of minimally invasive surgeries (MIS) over traditional surgical procedures include less post-operative pain, faster recovery, and reduced trauma and pain. Moreover, patients undergoing MIS need hospitalization for a relatively shorter span as minimal cuts or stitches are involved; moreover, patients need not visit the hospital frequently after the procedure. The growing preference for MIS significantly benefits the endoscopy devices market.

According to the article "Endoscopic Transnasal Approach to Petrous Apex," published in May 2022 in Frontiers Journal, endoscopy systems based on MIS methodology are employed to diagnose any disease or infection inside the body. Traditionally, most anatomical sites that are difficult to observe by microscope can be exposed through endoscopic-assisted procedures. Endoscopic devices adjust angles to aid better visibility into the surrounding anatomical structure through the natural human foramen. This can provide surgeons with an open visual field and an operation channel without retraction, significantly improving the overall surgical procedure. Additionally, healthcare providers, including surgeons and gastroenterologists, have increasingly embraced minimally invasive endoscopic techniques, which encourages them to invest in specialized training programs to perform these procedures effectively. For instance, in October 2022, MaxMoreSpine provided full hands-on training on the endoscopic spine surgery technique with the MaxMoreSpine system in Riyadh, Saudi Arabia. Thus, the growing expertise among physicians leads to a broad-scale adoption of minimally invasive endoscopic procedures across different medical specialties, thereby bolstering the demand for advanced endoscopy devices.

An increase in the prevalence of cancer drives the demand for endoscopy devices. These devices are used as vital tools for diagnosis (in biopsies), treatment, and monitoring during cancer treatments. Endoscopy procedures enable the early detection and diagnosis of various types of cancers, including esophageal, pancreatic, colorectal, and stomach cancer. Through the use of endoscopes and imaging technologies, healthcare providers can visualize the internal structures of organs to identify abnormalities, lesions, and early-stage tumors, thereby facilitating timely intervention and improved treatment outcomes.

On the other hand, the risk of infections associated with endoscopic procedures hampers the market growth. Endoscopes are generally compact and closed units operated by a broad spectrum of staff members, including endoscopists, nursing staff, technicians, anesthetists, and hospital attendants; patients awaiting various treatments; and many small and large equipment providers. Patients with a high viral load in their respiratory secretions can contaminate the endoscopic air and fomites with viruses that can survive for longer periods, placing uninfected patients and endoscopy staff at risk. Viral infections can be transmitted from person to person through direct contact or respiratory droplets; the generation of infected aerosols during endoscopy; or contact with contaminated endoscopic devices, accessories, and body fluids. Endoscopic procedures such as gastroscopy, colonoscopy, and endoscopic retrograde cholangiopancreatography are performed daily. Endoscopists work on the gastrointestinal lumen from a close distance; hence, they are exposed to several infections associated with respiratory tracts, oropharynx, and gastrointestinal systems. Along with professionals appointed in endoscopic units, medical staff from other departments are also susceptible to contracting a viral infection.

Contaminated endoscopes have been associated with many outbreaks of device-related nosocomial infections in the past. Although flexible endoscopes can be disinfected, they cannot be sterilized after use. This implies the risk of settlement of biofilm-producing species. Thus, the application of endoscopic devices in various procedures is limited by the risk of infections associated with endoscopic devices.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Saudi Arabia Endoscopy Devices Market: Strategic Insights

Market Size Value in US$ 470.79 million in 2022 Market Size Value by US$ 746.18 million by 2030 Growth rate CAGR of 5.9% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Saudi Arabia Endoscopy Devices Market: Strategic Insights

| Market Size Value in | US$ 470.79 million in 2022 |

| Market Size Value by | US$ 746.18 million by 2030 |

| Growth rate | CAGR of 5.9% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Mrinal

Have a question?

Mrinal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The “Saudi Arabia endoscopy devices market” is segmented on the basis of the product, application, and end user. Based on product, the market is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. In terms of application, the Saudi Arabia endoscopy devices market is segmented into gastroscopy, laparoscopy, arthroscopy, urology endoscopy, bronchoscopy, laryngoscopy, otoscopy, and others. Based on end user, the market is segmented into hospitals, ambulatory surgical centers, and others.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Segmental Analysis:

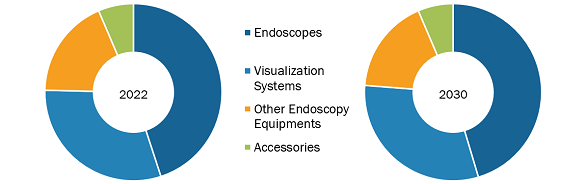

The Saudi Arabia endoscopy devices market, by product, is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. The endoscopes segment held the largest share of the market in 2022, and the visualization systems segment is anticipated to register the highest CAGR in the market during 2022–2030. An endoscope is used in minimally invasive surgeries and can be inserted into the openings of the body. The device is commonly used to visually examine internal organs and accordingly diagnose medical conditions. However, some of these devices are also used for small surgical tasks due to their fine, flexible design, which helps reduce cost, time, and physical trauma that are associated with standard surgical procedures. Most of the endoscopes are similar in construction. The endoscopes are named as per the location of their use. For example, a nephroscope is used for the endoscopy of the kidney, an arthroscopy is used for joints, and a laparoscope for the endoscopy of the abdomen or pelvis. There are various types of endoscopes based on their structure, such as rigid, flexible, capsule, and robot-assisted endoscopes.

Saudi Arabia Endoscopy Devices Market, by Products – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

- Request discounts available for Start-Ups & Universities

Based on application, the Saudi Arabia endoscopy devices market is segmented into gastroscopy, laparoscopy, arthroscopy, urology endoscopy, bronchoscopy, laryngoscopy, otoscopy, and others. The gastroscopy segment held the largest share of the market in 2022. However, the laparoscopy segment is expected to register the highest CAGR in the market from 2022 to 2030. Gastroscopy, also known as upper endoscopy, involves examining the upper gastrointestinal tract—the stomach, esophagus, and duodenum (the beginning part of the small intestine). It is used to diagnose conditions such as ulcers, tumors, inflammation, and gastroesophageal reflux disease (GERD). Laparoscopy, commonly referred to as minimally invasive surgery, involves using a laparoscope to visualize the abdominal or pelvic cavities for diagnostic or surgical purposes. This approach offers reduced incision size, faster recovery, and lower complication risks compared to traditional open surgeries.

Based on end user, the Saudi Arabia endoscopy devices market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest share of the market in 2022, and the same segment is expected to register the highest CAGR in the market from 2022 to 2030. Hospitals encompass a wide spectrum of medical facilities, ranging from community hospitals to large academic medical centers. They serve as major end users of endoscopy devices. The demand for endoscopy devices within hospital settings is driven by factors such as comprehensive care delivery, inpatient and outpatient services, and advanced procedures and interventions.

Country Analysis:

The endoscopy devices market in Saudi Arabia is undergoing significant transformation owing to factors such as developments in healthcare infrastructure, rapidly growing medical tourism, and acceptance and adoption of advanced medical technologies. The private sector with rising investments has been playing an essential role in the Saudi healthcare system. Efforts from this sector help in the timely delivery of healthcare services to numerous patients. The Saudi Vision 2030 program of the government of Saudi Arabia aims to reduce its dependence on the oil & gas sector and diversify its economy by promoting the growth of other sectors, including healthcare. Moreover, with a projected investment of US$ 13.8 billion by 2030 to improve medical facilities, the adoption of advanced surgical equipment and medical devices is likely to increase in the country in the future.

The Saudi Food and Drug Authority (SFDA) plays a pivotal role in regulating medical devices, including endoscopy devices, ensuring adherence to international standards and certifications, thus fostering confidence in the safety and efficacy of endoscopic technologies. Similarly, Saudi Arabia's commitment to enhancing healthcare infrastructure, including efforts such as the construction of state-of-the-art hospitals, specialty clinics, and medical centers, triggers the demand for advanced endoscopy devices that support a wide range of diagnostic and interventional services.

Industry Developments and Future Opportunities:

Various initiatives taken by key players operating in the endoscopy devices market are listed below:

- In October 2023, Olympus Corp announced the launch of the next-generation EVIS X1 endoscopy system in the market. The company had plans to showcase and demonstrate the product during October 22–24, 2023, at the yearly meeting of the American College of Gastroenterology (ACG) in Vancouver, Canada. With the amazing new tools available for GI tract visualization, doctors will be able to make better observations and assist their patients more effectively.

- In October 2023, Olympus announced the release of its EU-ME3 endoscopic ultrasound processing platform. The EU-ME3 meets medical practitioners’ demands for high-quality images during endoscopic ultrasounds. During this fiscal year, the company intends to launch the system in Europe, the Middle East, Africa, sections of Asia, and Oceania.

- In September 2023, Ambu expanded its gastroenterology portfolio with the announcement of the Ambu aScope Gastro Large and Ambu aBox 2, two new larger gastroscopy solutions that will be available in Europe. In addition to being the first gastroscope in the world with a 4.2 mm operating channel, which enables gastroenterologists to achieve strong suction performance during procedures in ICUs and endoscopy units, the Ambu aScope Gastro Large is the first endoscope ever manufactured of bioplastic materials.

- In February 2023, Boston Scientific Corp received FDA approval for its LithoVue Elite Single-Use Digital Flexible Ureteroscope System. It is the first ureteroscope system that can monitor intrarenal pressure in real time during ureteroscopy procedures. The LithoVue Elite system comprises the StoneSmart Connect Console, which has been upgraded to offer superior image quality, control features, and streamlined integration.

- In September 2022, Medtronic plc received US FDA approval for its Nexpowder endoscopic hemostasis system. The hemostasis system is supplied worldwide by Medtronic and is separately developed by NEXTBIOMEDICAL CO., LTD (Korea). The system is incorporated with a catheter with patented powder-coating technology, which uses noncontact, nonthermal, and nontraumatic hemostatic powder sprayed on the component.

Competitive Landscape and Key Companies:

Boston Scientific Corp, Medtronic Plc, Stryker Corp, Johnson & Johnson, Karl Storz SE & Co KG, Olympus Corp, Ambu AS, Conmed Corp, B Braun SE, and PENTAX Medical are among the prominent players operating in the Saudi Arabia endoscopy devices market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Based on application, the Saudi Arabia endoscopy devices market is segmented into gastroscopy, laparoscopy, arthroscopy, urology endoscopy, bronchoscopy, laryngoscopy, otoscopy, and others. The gastroscopy segment held the largest share of the market in 2022. However, the laparoscopy segment is expected to register the highest CAGR in the market from 2022 to 2030.

Based on end user, the Saudi Arabia endoscopy devices market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment held the largest share of the market in 2022 and the same segment is expected to register the highest CAGR in the market from 2022 to 2030.

The endoscopy devices market was valued at US$ 470.79 million in 2022.

The endoscopy devices market is expected to be valued at US$ 746.18 million in 2030.

An endoscope is a medical equipment that includes a light. It is used to examine the interior of a body cavity or organ. For example, during a bronchoscopy, the scope is introduced through a natural opening, such as the mouth, or the rectum for a sigmoidoscopy. A medical procedure using any type of endoscope is called an endoscopy.

The Saudi Arabia endoscopy devices market, by product, is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. The endoscopes segment held the largest share of the market in 2022, and visualization systems is anticipated to register the highest CAGR in the market during 2022-2030.

Factors such as the surging preference for minimally invasive surgeries and increasing prevalence of cancer propel market growth.

The endoscopy devices market majorly consists of the players, including Boston Scientific Corp, Medtronic Plc, Stryker Corp, Johnson & Johnson, Karl Storz SE & Co KG, Olympus Corp, Ambu AS, Conmed Corp, B Braun SE, and PENTAX Medical.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Saudi Arabia Endoscopy Devices Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 Saudi Arabia PEST Analysis

5. Saudi Arabia Endoscopy Devices Market - Key Industry Dynamics

5.1 Market Drivers

5.1.1 Surging Preference for Minimally Invasive Surgeries

5.1.2 Increasing Prevalence of Cancer

5.2 Market Restraints

5.2.1 Risks of Infections Associated with Endoscopic Procedures

5.3 Market Opportunities

5.3.1 Expanding Range of Applications with Technological Advancements

5.4 Future Trends

5.4.1 Use of Artificial Intelligence in Gastroenterology

5.5 Impact Analysis:

6. Global and Saudi Arabia Endoscopy Devices Market – Global and Saudi Arabia Market Analysis

6.1 Global Endoscopy Devices Market Revenue (US$ Mn), 2022 – 2030

6.2 Saudi Arabia Endoscopy Devices Market Revenue (US$ Mn), 2022 – 2030

7. Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 – by Product

7.1 Overview

7.2 Saudi Arabia Endoscopy Devices Market Revenue Share, by Product 2022 & 2030 (%)

7.3 Endoscopes

7.3.1 Overview

7.3.2 Endoscopes: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.3.2.1 Endoscopes: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.4 Visualization Systems

7.4.1 Overview

7.4.2 Visualization Systems: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.4.2.1 Visualization Systems: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.5 Accessories

7.5.1 Overview

7.5.2 Accessories: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.5.2.1 Accessories: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.6 Other Endoscopy Devices

7.6.1 Overview

7.6.2 Other Endoscopy Devices: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

7.6.2.1 Other Endoscopy Devices: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8. Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 – by Application

8.1 Overview

8.2 Saudi Arabia Endoscopy Devices Market Revenue Share, by Application 2022 & 2030 (%)

8.3 Gastroscopy

8.3.1 Overview

8.3.2 Gastroscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.4 Laparoscopy

8.4.1 Overview

8.4.2 Laparoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.5 Arthroscopy

8.5.1 Overview

8.5.2 Arthroscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.6 Otoscopy

8.6.1 Overview

8.6.2 Otoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.7 Urology Endoscopy

8.7.1 Overview

8.7.2 Urology Endoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.8 Bronchoscopy

8.8.1 Overview

8.8.2 Bronchoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.9 Laryngoscopy

8.9.1 Overview

8.9.2 Laryngoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

8.10 Others

8.10.1 Overview

8.10.2 Others: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

9. Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 – by End User

9.1 Overview

9.2 Saudi Arabia Endoscopy Devices Market Revenue Share, by End User 2022 & 2030 (%)

9.3 Hospitals

9.3.1 Overview

9.3.2 Hospitals: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

9.4 Ambulatory Surgical Centers

9.4.1 Overview

9.4.2 Ambulatory Surgical Centers: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

9.5 Others

9.5.1 Overview

9.5.2 Others: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

10. Endoscopy Devices Market Industry Landscape

10.1 Overview

10.2 Growth Strategies in the Endoscopy Devices Market

10.3 Inorganic Growth Strategies

10.3.1 Overview

10.4 Organic Growth Strategies

10.4.1 Overview

11. Company Profiles

11.1 Boston Scientific Corp

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Medtronic Plc

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Stryker Corp

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Johnson & Johnson

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Karl Storz SE & Co KG

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Olympus Corp

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Ambu AS

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Conmed Corp

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 B Braun SE

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 PENTAX Medical

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About Us

12.2 Glossary of Terms

List of Tables

Table 1. Saudi Arabia Endoscopy Devices Market Segmentation

Table 2. Recent Inorganic Growth Strategies in the Endoscopy Devices Market

Table 3. Recent Organic Growth Strategies in the Endoscopy Devices Market

Table 4. Glossary of Terms, Saudi Arabia Endoscopy Devices Market

List of Figures

Figure 1. Saudi Arabia PEST Analysis

Figure 2. Saudi Arabia Endoscopy Devices Market - Key Industry Dynamics

Figure 3. Impact Analysis of Drivers and Restraints

Figure 4. Global Endoscopy Devices Market Revenue (US$ Mn), 2020 – 2030

Figure 5. Global Endoscopy Devices Market Revenue, Geography (US$ Mn), 2022 – 2030

Figure 6. Saudi Arabia Endoscopy Devices Market Revenue (US$ Mn), 2020 – 2030

Figure 7. Saudi Arabia Endoscopy Devices Market Revenue Share, by Product 2022 & 2030 (%)

Figure 8. Endoscopes: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 9. Visualization Systems: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 10. Accessories: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 11. Other Endoscopy Devices: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 12. Saudi Arabia Endoscopy Devices Market Revenue Share, by Application 2022 & 2030 (%)

Figure 13. Gastroscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 14. Laparoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 15. Arthroscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 16. Otoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 17. Urology Endoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 18. Bronchoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 19. Laryngoscopy: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 20. Others: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 21. Saudi Arabia Endoscopy Devices Market Revenue Share, by End User 2022 & 2030 (%)

Figure 22. Hospitals: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 23. Ambulatory Surgical Centers: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 24. Others: Saudi Arabia Endoscopy Devices Market – Revenue and Forecast to 2030 (US$ Million)

Figure 25. Growth Strategies in the Endoscopy Devices Market

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Dec 2023

MRI-guided Focused Ultrasound Therapy Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Breast Cancer, Prostate Cancer, Liver Cancer, Pancreatic Cancer, Breast Lifting and Aesthetic Application, Nipple and Areola Preservation, Post Surgical Applications, and Others), End User (Healthcare Facilities, Diagnostic Imaging Centers, and Research Centers), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Gene Therapy CDMO Market

Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Service Type (Drug Development and Manufacturing, Testing and Regulatory Services, and Other Service Types), End User (Pharmaceutical Companies, Biopharmaceutical Companies, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

RT-PCR Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Reagents & Consumables, Instruments, and Software & Services), Application (Research Application, Clinical Application, and Forensic Application), End user (Hospitals and Diagnostic Centers, Pharmaceutical and Biotechnology Companies, Research Laboratories and Academic Institutes, Forensic Laboratories, and Clinical Research Organizations)

Dec 2023

dPCR Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Reagents & Consumables, Instruments, and Software & Services), Application (Research Application, Clinical Application, and Forensic Application), End user (Hospitals and Diagnostic Centers, Pharmaceutical and Biotechnology Companies, Research Laboratories and Academic Institutes, Forensic Laboratories, and Clinical Research Organizations)

Dec 2023

Oscillometry Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Device and Accessories), Technology (Impulse Oscillometry, Forced Oscillation Technique, and Hybrid Oscillometry Devices), Application (Asthma, COPD, and Others), End User (Hospitals, Diagnostic Laboratories, and Others)

Dec 2023

Prenatal Testing Services Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Diagnostic Type (Noninvasive and Invasive), Disease (Aneuploidy, Microdeletions, Structural Chromosomal Abnormalities, and Others), End User (Hospitals, Diagnostic Laboratories, Specialty Clinics, and Other End Users), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Dec 2023

Joint Resurfacing Devices Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Knee, Hip, Shoulder, Ankle, and Others), Material (Metal, Ceramic, and Others), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America)

Dec 2023

Embolization Plugs Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application (Neurology, Peripheral Vascular Disease, Oncology, Urology, and Others), End User (Hospital, Ambulatory Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

Get Free Sample For

Get Free Sample For