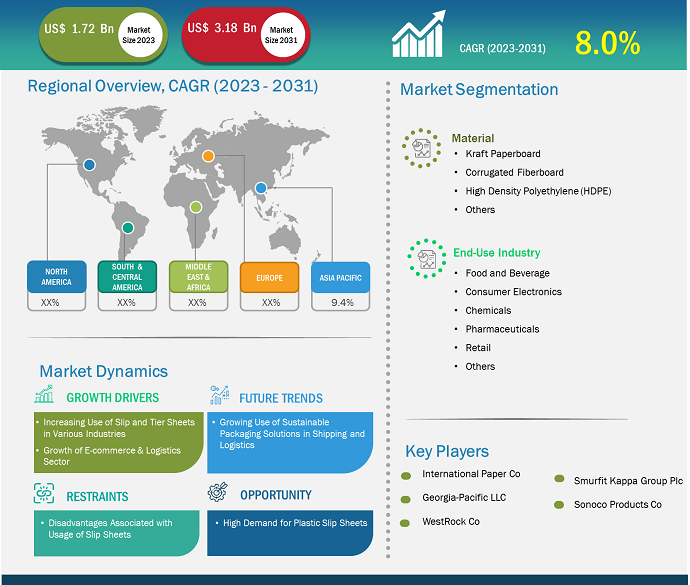

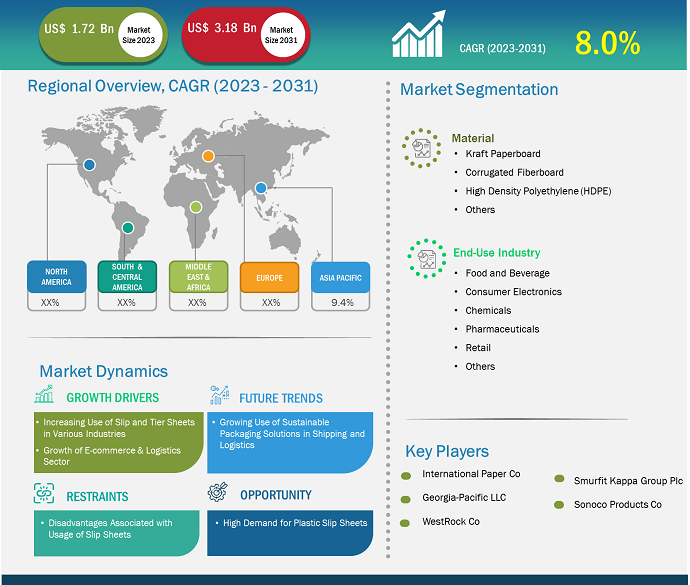

The slip and tier sheet market is expected to grow from US$ 1.72 billion in 2023 to US$ 3.18 billion by 2031; it is estimated to register a CAGR of 8.0% from 2023 to 2031.

Market Insights and Analyst View:

Slip and tier sheets are affordable alternatives to wooden pallets. These sheets occupy less space than wooden pallets and allow for transporting more truckloads, saving companies' logistical expenses. Slip and tier sheets are generally made of kraft paper, corrugated fiberboard, high density polyethylene, and polypropylene. Manufacturers design slip sheets based on the number of lip extensions that connect with the loading device. The two fundamental types of slip sheets are single-lip and multi-lip. The slip sheet made from a corrugated fiberboard consists of two liner surfaces with a corrugated interior bonded with adhesive or glue. Slip sheets manufactured from paperboard have a high base weight and density. They are produced in multiple layers laminated together, and this bonding allows the use of sheets multiple times in different temperature environments. Plastic slip sheets are made from thermoplastic or thermoset polymers. Plastic slip and tier sheets are becoming increasingly popular as they are affordable, have a high strength, are suitable for heavy-duty material handling, and provide strong structural support to the products. Companies offer slip sheets that have specified dimensions of length, width, and thickness. Tier sheets are available in different sizes. Moreover, companies operating in the market provide slip and tier sheets in any custom size.

Growth Drivers and Challenges:

The increasing use of slip and tier sheets in various industries is contributing to the growing slip and tier sheet market size. Slip sheet is a thin and lightweight alternative to wood pallets. Slip sheets are much lighter than pallets; using them for transportation or storage is much easier. It saves more space compared to traditional pallets, allowing users to export more products. Hence, reduced storage space and a lightweight design of slip sheets help reduce transportation costs. Slip sheets also help reduce fuel emissions as they are lighter to transport than wood pallets. They are easily recyclable, eco-friendly, versatile, and can be used in cold and humid environments. There is a high risk of rodent infestations and contamination from wood pallets. However, due to the slip sheet's thinness, rodents fail to occupy the area under it, leading to a cleaner warehouse. Users can easily discard the slip sheet and avoid contamination buildup over time. Also, slip sheets are becoming highly popular as companies realize their potential for return on investment. Thus, the benefits of using slip sheets over pallets are leading to increased product demand across different end-use industries. Further, tier sheets are made from 100% recycled paper. These sheets are available in different sizes that are compatible with all types of pallets. Tier sheets are durable and can also be used in harsh conditions. Owing to the benefits of tier sheets, the usage of such sheets is growing in the packaging of beverage bottles, cans, containers, consumer goods, industrial goods and parts, processed foods, dairy, and dry goods such as salts, grains, and ingredients. The slip and tier sheet market trends include the growing use of sustainable packaging solutions in shipping and logistics.

There are a few disadvantages associated with the usage of slip sheets. Customers need to buy or rent different equipment to handle slip sheets, as standard forklifts will not work. When slip sheets are used as a direct replacement for pallets, there is a need for a push/pull attachment for the lift truck, which is expensive. Also, the safe handling of such attachments requires expertise and proper training. Further, to some extent, slip sheets are not capable of supporting heavy-duty products. The structural support provided by slip sheets is less than that provided by pallets, and they do not support as much weight as pallets. As a result, they are not a suitable option for companies that ship heavy products. In addition, corrugated slip sheets will be weakened if they come in contact with water and dampness and are, therefore, unsuitable for refrigerated supply chains. These disadvantages associated with using slip sheets restrain the global slip and tier sheet market growth.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Slip and Tier Sheet Market: Strategic Insights

Market Size Value in US$ 15,96,288.51 thousand in 2022 Market Size Value by US$ 24,99,318.53 thousand by 2028 Growth rate CAGR of 7.8% from 2022 to 2028 Forecast Period 2022-2028 Base Year 2022

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Slip and Tier Sheet Market: Strategic Insights

| Market Size Value in | US$ 15,96,288.51 thousand in 2022 |

| Market Size Value by | US$ 24,99,318.53 thousand by 2028 |

| Growth rate | CAGR of 7.8% from 2022 to 2028 |

| Forecast Period | 2022-2028 |

| Base Year | 2022 |

Shejal

Have a question?

Shejal will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope:

The "Global Slip and Tier Sheet Market Analysis" has been performed by considering the following segments: material, end-use industry, and geography. Based on material, the market is segmented into kraft paperboard, corrugated fiberboard, high density polyethylene, and others. By end-use industry, the market is segmented into food and beverage, consumer electronics, chemicals, pharmaceuticals, retail, and others. The geographic scope of the slip and tier sheet market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on material, the slip and tier sheet market is segmented into kraft paperboard, corrugated fiberboard, high density polyethylene, and others. Based on material, the kraft paperboard segment is anticipated to hold a significant slip and tier sheet market share by 2031. Kraft paperboard is made waterproof by lining it with either polyethylene or an ecologically friendly bitumen layer. It is cost-effective and lightweight; hence, it is used for protecting and packaging products during transportation. Kraft paperboard sheets protect boxed and bagged bulk products against tears and punctures caused by pallet nails and deck boards. Kraft paperboards are used in many applications, including fast food outlets and the production of point-of-sale displays. Corrugated fiberboard is also one of the major materials in the slip and tier sheet market. A corrugated fiberboard is a sandwich structure formed by gluing one or more sheets of fluted, corrugated materials to one or more flat facings of the liner board. Corrugated fiberboard packaging is versatile, economical, lightweight, robust, recyclable, and dynamic. Corrugated fiberboards are usually used for the packaging of consumer goods. They provide better resistance to compressive forces, higher bending stiffness, and greater moisture resistance. The boards are usually custom-designed to meet specific customer requirements.

Regional Analysis:

Based on geography, the market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the global slip and tier sheet market share. The market in North America accounted for ~US$ 650 million in 2023. The market for slip and tier sheets in North America is mainly driven by their increasing use in different end-use industries. According to the Bureau of Transportation Statistics, transborder freight in North America increased by 24.1% in August 2022 compared to August 2021. The growing transborder freight is one of the major factors driving the slip and tier sheet market in North America. Slip and tier sheets are thin materials consuming significantly less space than pallets and weighing much less than pallets. Thus, transportation companies and manufacturers prefer slip and tier sheets over wooden pellets, which fuels the market growth in the region.

Europe is another major contributor, holding more than 30% of the global market share. The Europe slip and tier sheet market is witnessing considerable growth owing to the growth of the logistics industry and the rise in demand for packaging products. According to the European Commission, in 2021, European road freight transport increased strongly by 6.5% compared to 2020. The increased trade activities propel the demand for overall packaging materials across Europe. Moreover, between 2019 and 2021, the average annual demand for pharmaceutical products was the highest for diagnostic testing equipment, medical consumables, medical devices, and protective garments. The significant growth in end-use industries such as pharmaceuticals, agriculture, and retail in Europe is propelling the slip and tier sheet market growth in Europe.

Slip and Tier Sheet Market Report Scope

Industry Developments and Future Opportunities:

The slip and tier sheet market forecast can help stakeholders plan their growth strategies. The following are initiatives taken by the key players operating in the market:

- In September 2023, Sonoco Products Co announced the completion of its acquisition of the remaining equity interest in RTS Packaging, LLC from joint venture partner WestRock and one WestRock paper mill in Chattanooga, Tennessee. This acquisition will further strengthen and expand Sonoco's 100% recycled fiber-based packaging solutions to serve growing consumer wine, spirits, food, beauty, and healthcare markets. With this acquisition, Sonoco adds a network of 15 operations and 1,100 employees in the US, Mexico, and South America.

- In November 2021, Badger Paperboard – a chipboard converting company headquartered in Fredonia, Wisconsin –announced the acquisition of Falcon Packaging in Houston, Texas. The addition of Falcon Packaging's full converting and warehousing facilities in Houston will expand Badger's footprint and production capabilities.

Competitive Landscape and Key Companies:

Fresh Pak Corp, International Paper Co, Georgia-Pacific LLC, Signode Industrial Group LLC, WestRock Co, Dura-Fibre LLC, Smurfit Kappa Group Plc, Crown Paper Converting, Eltete TPM Oy, and Sonoco Products Co are among the prominent players profiled in the slip and tier sheet market report. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations in order to stay competitive in the slip and tier sheet market.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, and End-Use Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Fresh Pak Corp, International Paper Co, Georgia-Pacific LLC, Signode Industrial Group LLC, WestRock Co, Dura-Fibre LLC, Smurfit Kappa Group Plc, Crown Paper Converting, Eltete TPM Oy, and Sonoco Products Co are among the prominent players profiled in the slip and tier sheet market report.

Asia Pacific is estimated to register the fastest CAGR in the global slip and tier sheets market over the forecast period. The Asia Pacific region is one of the major regions for the slip and tier sheet market owing to the growth of the retail, food and beverage, pharmaceuticals, consumer electronics, and many other industries.

In 2023, North America held the largest share of the global slip and tier sheets market. In North America, the market for slip and tier sheets is mainly driven by their increasing use in different end-use industries.

The slip and tier sheet market growth is attributed to the increase in the use of slip and tier sheets in various industries and the growth of the e-commerce & logistics sector.

The food and beverage segment held the largest share of the global slip and tier sheets market in 2023. Slip and tier sheets are mainly used in the food & beverages industry as a replacement for traditional wooden pallets to avoid damage.

1. Introduction

1.1 The Insight Partners Research Report Guidance

1.2 Market Segmentation

2. Executive Summary

2.1 Key Insights

2.2 Market Attractiveness

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Global Slip and Tier Sheets Market Landscape

4.1 Overview

4.2 Porter's Five Forces Analysis

4.2.1 Threat of New Entrants:

4.2.2 Bargaining Power of Buyers:

4.2.3 Bargaining Power of Suppliers:

4.2.4 Intensity of Competitive Rivalry:

4.2.5 Threat of Substitutes:

4.3 Ecosystem Analysis

4.3.1 Raw Material Suppliers:

4.3.2 Manufacturers:

4.3.3 Distributors or Suppliers:

4.3.4 End-Use Industries

4.4 List of Vendors in the Value Chain

5. Global Slip and Tier Sheets Market – Key Market Dynamics

5.1 Global Slip and Tier Sheets Market – Key Market Dynamics

5.2 Market Drivers

5.2.1 Increasing Use of Slip and Tier Sheets in Various Industries

5.2.2 Growth of E-commerce & Logistics Sector

5.3 Restraint

5.3.1 Disadvantages Associated with Usage of Slip Sheets

5.4 Opportunity

5.4.1 High Demand for Plastic Slip Sheets

5.5 Future Trend

5.5.1 Growing Use of Sustainable Packaging Solutions in Shipping and Logistics

6. Global Slip and Tier Sheets Market – Global Market Analysis

6.1 Global Slip and Tier Sheets Market Volume (Thousand Units), 2023–2031

6.2 Global Slip and Tier Sheets Market Volume Forecast and Analysis (Thousand Units)

6.3 Global Slip and Tier Sheets Market Revenue (US$ Thousand), 2023–2031

6.4 Global Slip and Tier Sheets Market Forecast and Analysis

7. Global Slip and Tier Sheets Market Volume and Revenue Analysis – by Material

7.1 Kraft Paperboard

7.1.1 Overview

7.1.2 Kraft Paperboard: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

7.1.3 Kraft Paperboard: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

7.2 Corrugated Fiberboard

7.2.1 Overview

7.2.2 Corrugated Fiberboard: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

7.2.3 Corrugated Fiberboard: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

7.3 High Density Polyethylene

7.3.1 Overview

7.3.2 High Density Polyethylene: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

7.3.3 High Density Polyethylene: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

7.4 Others

7.4.1 Overview

7.4.2 Others: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

7.4.3 Others: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8. Global Slip and Tier Sheets Market Revenue Analysis – by End-Use Industry

8.1 Food and Beverage

8.1.1 Overview

8.1.2 Food and Beverage: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8.2 Consumer Electronics

8.2.1 Overview

8.2.2 Consumer Electronics: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8.3 Chemicals

8.3.1 Overview

8.3.2 Chemicals: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8.4 Pharmaceuticals

8.4.1 Overview

8.4.2 Pharmaceuticals: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8.5 Retail

8.5.1 Overview

8.5.2 Retail: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

8.6 Others

8.6.1 Overview

8.6.2 Others: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9. Global Slip and Tier Sheets Market – Geographical Analysis

9.1 Overview

9.2 North America

9.2.1 North America Slip and Tier Sheets Market Overview

9.2.2 North America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

9.2.3 North America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.2.4 North America Slip and Tier Sheets Market Breakdown by Material

9.2.4.1 North America Slip and Tier Sheets Market Volume and Forecast and Analysis – by Material

9.2.4.2 North America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Material

9.2.5 North America Slip and Tier Sheets Market Breakdown by End-use Industry

9.2.5.1 North America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by End-use Industry

9.2.6 North America Slip and Tier Sheets Market Revenue and Forecast and Analysis – by Country

9.2.6.1 North America Slip and Tier Sheets Market Volume and Forecast and Analysis – by Country

9.2.6.2 North America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Country

9.2.6.3 United States Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.2.6.3.1 United States Slip and Tier Sheets Market Breakdown by Material

9.2.6.3.2 United States Slip and Tier Sheets Market Breakdown by End-use Industry

9.2.6.4 Canada Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.2.6.4.1 Canada Slip and Tier Sheets Market Breakdown by Material

9.2.6.4.2 Canada Slip and Tier Sheets Market Breakdown by End-use Industry

9.2.6.5 Mexico Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.2.6.5.1 Mexico Slip and Tier Sheets Market Breakdown by Material

9.2.6.5.2 Mexico Slip and Tier Sheets Market Breakdown by End-use Industry

9.3 Europe

9.3.1 Europe Slip and Tier Sheets Market Overview

9.3.2 Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.3 Europe Slip and Tier Sheets Market Breakdown by Material

9.3.3.1 Europe Slip and Tier Sheets Market Volume and Forecast and Analysis – by Material

9.3.3.2 Europe Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Material

9.3.4 Europe Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.4.1 Europe Slip and Tier Sheets Market Revenue and Forecast and Analysis –by End-use Industry

9.3.5 Europe Slip and Tier Sheets Market Revenue and Forecast and Analysis – by Country

9.3.5.1 Europe Slip and Tier Sheets Market Volume and Forecast and Analysis – by Country

9.3.5.2 Europe Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Country

9.3.5.3 Germany Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.3.1 Germany Slip and Tier Sheets Market Breakdown by Material

9.3.5.3.2 Germany Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.5.4 France Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.4.1 France Slip and Tier Sheets Market Breakdown by Material

9.3.5.4.2 France Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.5.5 Italy Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.5.1 Italy Slip and Tier Sheets Market Breakdown by Material

9.3.5.5.2 Italy Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.5.6 United Kingdom Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.6.1 United Kingdom Slip and Tier Sheets Market Breakdown by Material

9.3.5.6.2 United Kingdom Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.5.7 Russia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.7.1 Russia Slip and Tier Sheets Market Breakdown by Material

9.3.5.7.2 Russia Slip and Tier Sheets Market Breakdown by End-use Industry

9.3.5.8 Rest of Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.3.5.8.1 Rest of Europe Slip and Tier Sheets Market Breakdown by Material

9.3.5.8.2 Rest of Europe Slip and Tier Sheets Market Breakdown by End-use Industry

9.4 Asia Pacific

9.4.1 Asia Pacific Slip and Tier Sheets Market Overview

9.4.2 Asia Pacific Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.3 Asia Pacific Slip and Tier Sheets Market Breakdown by Material

9.4.3.1 Asia Pacific Slip and Tier Sheets Market Volume and Forecast and Analysis – by Material

9.4.3.2 Asia Pacific Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Material

9.4.4 Asia Pacific Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.4.1 Asia Pacific Slip and Tier Sheets Market Revenue and Forecast and Analysis –by End-use Industry

9.4.5 Asia Pacific Slip and Tier Sheets Market Revenue and Forecast and Analysis – by Country

9.4.5.1 Asia Pacific Slip and Tier Sheets Market Volume and Forecast and Analysis – by Country

9.4.5.2 Asia Pacific Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Country

9.4.5.3 China Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.3.1 China Slip and Tier Sheets Market Breakdown by Material

9.4.5.3.2 China Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.5.4 Japan Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.4.1 Japan Slip and Tier Sheets Market Breakdown by Material

9.4.5.4.2 Japan Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.5.5 India Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.5.1 India Slip and Tier Sheets Market Breakdown by Material

9.4.5.5.2 India Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.5.6 Australia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.6.1 Australia Slip and Tier Sheets Market Breakdown by Material

9.4.5.6.2 Australia Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.5.7 South Korea Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.7.1 South Korea Slip and Tier Sheets Market Breakdown by Material

9.4.5.7.2 South Korea Slip and Tier Sheets Market Breakdown by End-use Industry

9.4.5.8 Rest of APAC Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.4.5.8.1 Rest of APAC Slip and Tier Sheets Market Breakdown by Material

9.4.5.8.2 Rest of APAC Slip and Tier Sheets Market Breakdown by End-use Industry

9.5 Middle East and Africa

9.5.1 Middle East and Africa Slip and Tier Sheets Market Overview

9.5.2 Middle East and Africa Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

9.5.3 Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.5.4 Middle East and Africa Slip and Tier Sheets Market Breakdown by Material

9.5.4.1 Middle East and Africa Slip and Tier Sheets Market Volume and Forecast and Analysis – by Material

9.5.4.2 Middle East and Africa Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Material

9.5.5 Middle East and Africa Slip and Tier Sheets Market Breakdown by End-use Industry

9.5.5.1 Middle East and Africa Slip and Tier Sheets Market Revenue and Forecast and Analysis –by End-use Industry

9.5.6 Middle East and Africa Slip and Tier Sheets Market Revenue and Forecast and Analysis – by Country

9.5.6.1 Middle East and Africa Slip and Tier Sheets Market Volume and Forecast and Analysis – by Country

9.5.6.2 Middle East and Africa Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Country

9.5.6.3 South Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.5.6.3.1 South Africa Slip and Tier Sheets Market Breakdown by Material

9.5.6.3.2 South Africa Slip and Tier Sheets Market Breakdown by End-use Industry

9.5.6.4 Saudi Arabia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.5.6.4.1 Saudi Arabia Slip and Tier Sheets Market Breakdown by Material

9.5.6.4.2 Saudi Arabia Slip and Tier Sheets Market Breakdown by End-use Industry

9.5.6.5 United Arab Emirates Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.5.6.5.1 United Arab Emirates Slip and Tier Sheets Market Breakdown by Material

9.5.6.5.2 United Arab Emirates Slip and Tier Sheets Market Breakdown by End-use Industry

9.5.6.6 Rest of Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.5.6.6.1 Rest of Middle East and Africa Slip and Tier Sheets Market Breakdown by Material

9.5.6.6.2 Rest of Middle East and Africa Slip and Tier Sheets Market Breakdown by End-use Industry

9.6 South and Central America

9.6.1 South and Central America Slip and Tier Sheets Market Overview

9.6.2 South and Central America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

9.6.3 South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.6.4 South and Central America Slip and Tier Sheets Market Breakdown by Material

9.6.4.1 South and Central America Slip and Tier Sheets Market Volume and Forecast and Analysis – by Material

9.6.4.2 South and Central America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Material

9.6.5 South and Central America Slip and Tier Sheets Market Breakdown by End-use Industry

9.6.5.1 South and Central America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by End-use Industry

9.6.6 South and Central America Slip and Tier Sheets Market Revenue and Forecast and Analysis – by Country

9.6.6.1 South and Central America Slip and Tier Sheets Market Volume and Forecast and Analysis – by Country

9.6.6.2 South and Central America Slip and Tier Sheets Market Revenue and Forecast and Analysis –by Country

9.6.6.3 Brazil Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.6.6.3.1 Brazil Slip and Tier Sheets Market Breakdown by Material

9.6.6.3.2 Brazil Slip and Tier Sheets Market Breakdown by End-use Industry

9.6.6.4 Argentina Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.6.6.4.1 Argentina Slip and Tier Sheets Market Breakdown by Material

9.6.6.4.2 Argentina Slip and Tier Sheets Market Breakdown by End-use Industry

9.6.6.5 Rest of South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

9.6.6.5.1 Rest of South and Central America Slip and Tier Sheets Market Breakdown by Material

9.6.6.5.2 Rest of South and Central America Slip and Tier Sheets Market Breakdown by End-use Industry

10. Competitive Landscape

10.1 Heat Map Analysis by Key Players

10.2 Company Positioning & Concentration

11. Industry Landscape

11.1 Overview

11.2 Market Initiative

12. Company Profiles

12.1 Fresh Pak Corp

12.1.1 Key Facts

12.1.2 Business Description

12.1.3 Products and Services

12.1.4 Financial Overview

12.1.5 SWOT Analysis

12.1.6 Key Developments

12.2 International Paper Co

12.2.1 Key Facts

12.2.2 Business Description

12.2.3 Products and Services

12.2.4 Financial Overview

12.2.5 SWOT Analysis

12.2.6 Key Developments

12.3 Georgia-Pacific LLC

12.3.1 Key Facts

12.3.2 Business Description

12.3.3 Products and Services

12.3.4 Financial Overview

12.3.5 SWOT Analysis

12.3.6 Key Developments

12.4 Signode Industrial Group LLC

12.4.1 1Key Facts

12.4.2 Business Description

12.4.3 Products and Services

12.4.4 Financial Overview

12.4.5 SWOT Analysis

12.4.6 Key Developments

12.5 WestRock Co

12.5.1 Key Facts

12.5.2 Business Description

12.5.3 Products and Services

12.5.4 Financial Overview

12.5.5 SWOT Analysis

12.5.6 Key Developments

12.6 Dura-Fibre LLC

12.6.1 Key Facts

12.6.2 Business Description

12.6.3 Products and Services

12.6.4 Financial Overview

12.6.5 SWOT Analysis

12.6.6 Key Developments

12.7 Smurfit Kappa Group Plc

12.7.1 Key Facts

12.7.2 Business Description

12.7.3 Products and Services

12.7.4 Financial Overview

12.7.5 SWOT Analysis

12.7.6 Key Developments

12.8 Crown Paper Converting

12.8.1 Key Facts

12.8.2 Business Description

12.8.3 Products and Services

12.8.4 Financial Overview

12.8.5 SWOT Analysis

12.8.6 Key Developments

12.9 Eltete TPM Oy

12.9.1 Key Facts

12.9.2 Business Description

12.9.3 Products and Services

12.9.4 Financial Overview

12.9.5 SWOT Analysis

12.9.6 Key Developments

12.10 Sonoco Products Co

12.10.1 Key Facts

12.10.2 Business Description

12.10.3 Products and Services

12.10.4 Financial Overview

12.10.5 SWOT Analysis

12.10.6 Key Developments

13. Appendix

13.1 About The Insight Partners

List of Tables

Table 1. Global Slip and Tier Sheets Market Segmentation

Table 2. Global Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Table 3. Global Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Table 4. Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 5. Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 6. Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 7. North America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 8. North America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 9. North America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Country

Table 10. North America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Country

Table 11. United States Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 12. United States Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 13. United States Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 14. Canada Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 15. Canada Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 16. Canada Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 17. Mexico Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 18. Mexico Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 19. Mexico Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 20. Europe Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 21. Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 22. Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 23. Europe Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Country

Table 24. Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Country

Table 25. Germany Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 26. Germany Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 27. Germany Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 28. France Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 29. France Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 30. France Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 31. Italy Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 32. Italy Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 33. Italy Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 34. United Kingdom Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 35. United Kingdom Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 36. United Kingdom Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 37. Russia Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 38. Russia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 39. Russia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 40. Rest of Europe Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 41. Rest of Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 42. Rest of Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 43. Asia Pacific Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 44. Asia Pacific Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 45. Asia Pacific Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 46. Asia Pacific Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Country

Table 47. Asia Pacific Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Country

Table 48. China Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 49. China Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 50. China Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 51. Japan Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 52. Japan Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 53. Japan Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 54. India Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 55. India Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 56. India Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 57. Australia Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 58. Australia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 59. Australia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 60. South Korea Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 61. South Korea Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 62. South Korea Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 63. Rest of APAC Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 64. Rest of APAC Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 65. Rest of APAC Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 66. Middle East and Africa Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 67. Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 68. Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 69. Middle East and Africa Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Country

Table 70. Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Country

Table 71. South Africa Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 72. South Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 73. South Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 74. Saudi Arabia Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 75. Saudi Arabia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 76. Saudi Arabia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 77. United Arab Emirates Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 78. United Arab Emirates Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 79. United Arab Emirates Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 80. Rest of Middle East and Africa Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 81. Rest of Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 82. Rest of Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 83. South and Central America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Material

Table 84. South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 85. South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 86. South and Central America Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units) – by Country

Table 87. South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Country

Table 88. Brazil Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 89. Brazil Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 90. Brazil Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 91. Argentina Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 92. Argentina Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 93. Argentina Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 94. Rest of South and Central America Slip and Tier Sheets Market –Volume and Forecast to 2031 (Thousand Units) – by Material

Table 95. Rest of South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Table 96. Rest of South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by End-use Industry

Table 97. Heat Map Analysis by Key Players

List of Figures

Figure 1. Global Slip and Tier Sheets Market Segmentation, by Geography

Figure 2. Global Slip and Tier Sheets Market – Porter's Analysis

Figure 3. Ecosystem Analysis: Global Slip and Tier Sheet Market

Figure 4. Comparative Cost Analysis Using Plastic Slip Sheets Vs. Wood Pallets

Figure 5. Global Slip and Tier Sheet Market: Impact Analysis of Drivers and Restraints

Figure 6. Global Slip and Tier Sheets Market Volume (Thousand Units), 2023–2031

Figure 7. Global Slip and Tier Sheets Market Revenue (US$ Thousand), 2023–2031

Figure 8. Global Slip and Tier Sheets Market Share (%) – Material, 2023 and 2031

Figure 9. Kraft Paperboard: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 10. Kraft Paperboard: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 11. Corrugated Fiberboard: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 12. Corrugated Fiberboard: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 13. High Density Polyethylene: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 14. High Density Polyethylene: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 15. Others: Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 16. Others: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 17. Global Slip and Tier Sheets Market Share (%) – End-Use Industry, 2023 and 2031

Figure 18. Food and Beverage: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 19. Consumer Electronics: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 20. Chemicals: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 21. Pharmaceuticals: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 22. Retail: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 23. Others: Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 24. Global Slip and Tier Sheets Market Breakdown by Region, 2023 and 2031 (%)

Figure 25. North America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 26. North America Slip and Tier Sheets Market Breakdown by Material (2023 and 2031)

Figure 27. North America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand) – by Material

Figure 28. North America Slip and Tier Sheets Market Breakdown by End-use Industry (2023 and 2031)

Figure 29. North America Slip and Tier Sheets Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 30. United States Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 31. Canada Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 32. Mexico Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 33. Europe Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 34. Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 35. Europe Slip and Tier Sheets Market Breakdown by Material (2023 and 2031)

Figure 36. Europe Slip and Tier Sheets Market Breakdown by End-use Industry (2023 and 2031)

Figure 37. Europe Slip and Tier Sheets Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 38. Germany Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 39. France Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 40. Italy Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 41. United Kingdom Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 42. Russia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 43. Rest of Europe Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 44. Asia Pacific Slip and Tier Sheets Market – Volume and Forecast to 2031 (Thousand Units)

Figure 45. Asia Pacific Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 46. Asia Pacific Slip and Tier Sheets Market Breakdown by Material (2023 and 2031)

Figure 47. Asia Pacific Slip and Tier Sheets Market Breakdown by End-use Industry (2023 and 2031)

Figure 48. Asia Pacific Slip and Tier Sheets Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 49. China Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 50. Japan Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 51. India Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 52. Australia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 53. South Korea Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 54. Rest of APAC Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 55. Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 56. Middle East and Africa Slip and Tier Sheets Market Breakdown by Material (2023 and 2031)

Figure 57. Middle East and Africa Slip and Tier Sheets Market Breakdown by End-use Industry (2023 and 2031)

Figure 58. Middle East and Africa Slip and Tier Sheets Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 59. South Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 60. Saudi Arabia Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 61. United Arab Emirates Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 62. Rest of Middle East and Africa Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 63. South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 64. South and Central America Slip and Tier Sheets Market Breakdown by Material (2023 and 2031)

Figure 65. South and Central America Slip and Tier Sheets Market Breakdown by End-use Industry (2023 and 2031)

Figure 66. South and Central America Slip and Tier Sheets Market Breakdown by Key Countries, 2023 and 2031 (%)

Figure 67. Brazil Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 68. Argentina Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 69. Rest of South and Central America Slip and Tier Sheets Market – Revenue and Forecast to 2031 (US$ Thousand)

Figure 70. Company Positioning & Concentration

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely - analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You'll receive access to the report within 4-6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we'll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we're happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you're considering, and we'll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report's scope, methodology, customization options, or which license suits you best, we're here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we'll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we'll ensure the issue is resolved quickly so you can access your report without interruption.

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

May 2024

Rhamnolipids Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Mono-rhamnolipids and Di-rhamnolipids), Application [Daily Chemicals (Laundry Detergents, Dishwashers, Surface Cleaners, and Others), Personal Care and Cosmetics, Agriculture, Food, Pharmaceuticals, Oilfield and Petroleum, Environmental Protection, and Others] and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

May 2024

Europe Spray Marking Paints Market

Size and Forecast (2021 - 2035), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Propellant Type [LPG, Dimethyl Ether (DME), and Others], By Technology (Solvent-Based, Water-Based, and Others), By Application [Construction (Geodesy and Topography in Building and Construction, Railway Marking, Landscaped/Agricultural/Military Site Marking, and Others), Forestry [Tree Marking, Log Marking, Plank Marking, and Others], Line Marking (Information Marking and Signaling, Parking Spaces, Safety Marking and Signage, and Space Delimitation), Packaging, and Others], and Country

May 2024

Adhesives Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Resin Type (Epoxy, Polyurethane, Acrylic, and Others), By End-Use Industry (Automotive, Aerospace, Paper and Packaging, Building and Construction, Electrical and Electronics, Medical, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America)

May 2024

Ester for Synthetic and Bio-Based Lubricants Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Ester Type [Monoesters, Diesters, Polyol Esters (Trimethylolpropane Esters, Pentaerythritol Esters, Neopentyl Glycol Esters, Trimethylol Ethane Esters, and Dipentaerythritol Esters), Trimellitate Esters, Complex Esters, and Others], Lubricant Type (Synthetic Lubricants and Biobased Lubricants), Application [Engine Oil (MCO, PCMO, HDEO, and Other Engines), Compressor Oil, (Refrigeration, Air Compressors, Natural Gas Compressors, and Others Compressors), Hydraulic Fluids, Gear Oil, Transmission Oil, Coolants, and Others], and End Use [Automotive (Conventional Vehicles and Electric Vehicles), Textile, Marine, Mining and Metallurgy, Aviation, Energy and Power, and Others]

May 2024

Synthetic Ester Lubricants for the Telecommunications Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, and Grease), End Use (Data Centers, Telecommunication Infrastructure, and Others), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America

May 2024

Synthetic Ester Lubricants for Electrical and Electronics Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Metalworking Fluids, and Others) and End Use (General Air Conditioners, Automotive Air Conditioners, Refrigerators, and Others)

May 2024

Synthetic Ester Lubricants for Construction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (Construction Machinery, Concrete and Construction Tools, Wire Ropes and Chains, and Others)

May 2024

Synthetic Ester Lubricants for Energy and Power Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Engine Oil, Hydraulic Oil, Gear Oil, Transformer Oil, Immersion Cooling Fluids, Refrigeration Oil, Grease, Turbine Oil, Metalworking Fluids, and Others) and End Use (River Dam, Offshore Wind Power, Energy Storage Systems, and Others)

Get Free Sample For

Get Free Sample For