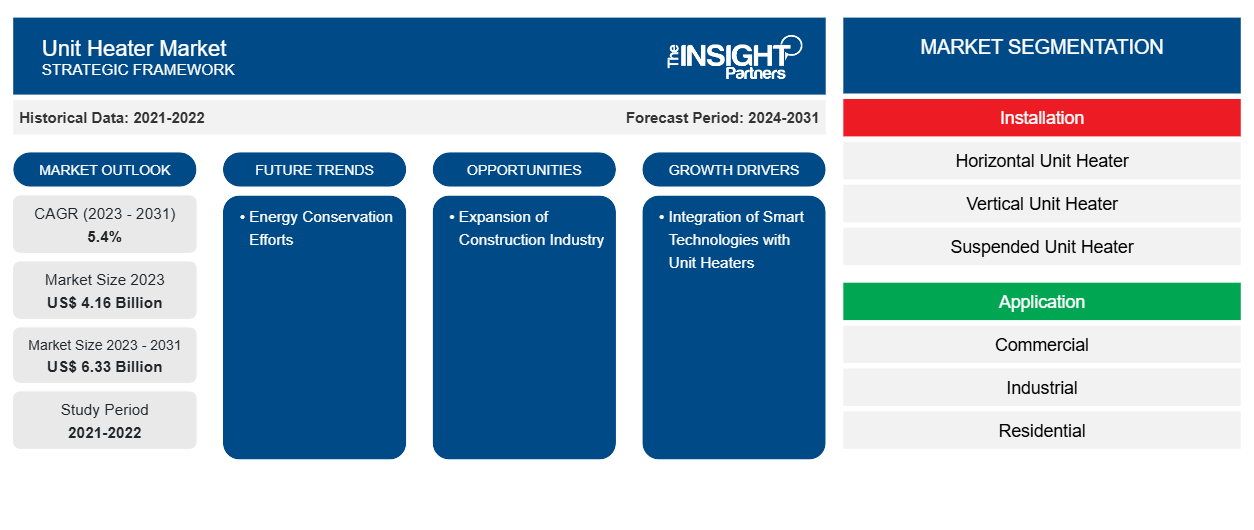

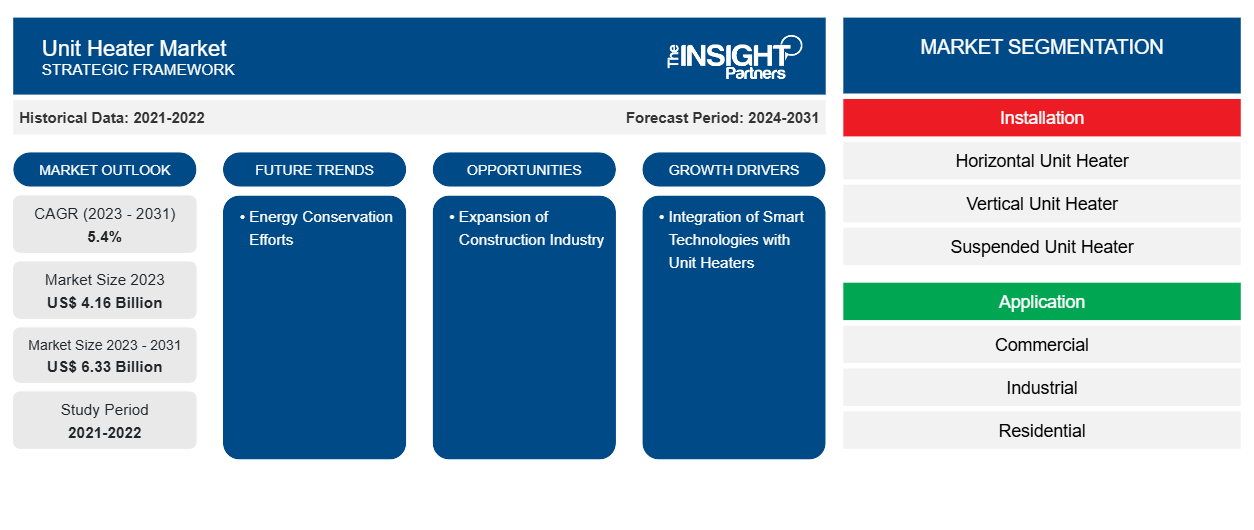

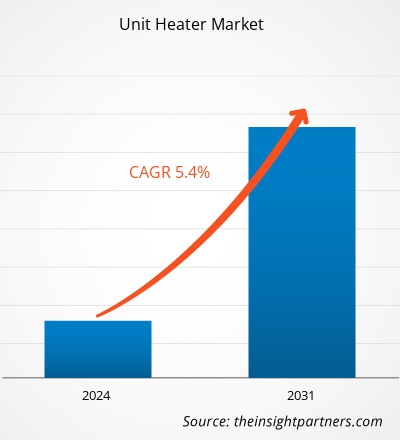

The unit heater market size is projected to reach US$ 6.33 billion by 2031 from US$ 4.16 billion in 2023. The market is expected to register a CAGR of 5.4% during 2023–2031. Energy conservation efforts are likely to remain a key trend in the market.

Unit Heater Market Analysis

Top unit heater manufacturers are now developing energy-efficient products to achieve effective heating with reduced maintenance and operational costs, as well as a reduction in emissions. For example, Modine Manufacturing Company has introduced a new unit heater called Affinity. Some of its advanced features include a power exhauster, dual heat exchanger, and separated combustion chamber, all of which reduce CO2 emissions and increase heating efficiency in general. Growing demands for silent operation, functioning of electric heaters linked directly with solar panels, and automatic temperature change through the implementation of sensors are some of the factors driving the global market for unit heaters, while the manufacturers are also coming up with new designs in motors with low-noise fans and integrating thermostats, screen displays, and remote-control options. Moreover, various states in the US are adopting energy efficiency standards for unit heaters, as recommended by the US Department of Energy, thereby promoting the production of energy-efficient unit heaters. Hazloc Heaters has engineered an explosion-proof electric air heater for use in harsh environments and is certified under US and Canadian standards. This provides a spark-resistant fan assembly with quality per AMCA 99-10.

Unit Heater Market Overview

A unit heater is a self-contained heater installed in a commercial, industrial, or residential context to provide focused heating. The heaters are specially designed to effectively create and spread their heat in some square or round area, usually a warehouse, workshop, or garage. Most of them consist of a fan or blower that forces air over a heat exchanger and then discharges heated air into the space. Some of the energy sources used to power unit heaters include electricity, natural gas, or propane. Wall-mount and ceiling-suspended attachments are available for these units to save space. Their compactness and versatility qualify them for a wide range of space heating applications with cost-effective and reliable solutions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Unit Heater Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Unit Heater Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Unit Heater Market Drivers and Opportunities

Integration of Smart Technologies with Unit Heaters

The unit heaters have been designed in different sizes and configurations, whereas the new generation is focused on comfort, ease of operation, automation, and remote control. The new unit heaters have warning indicators fitted with fire-resistant materials and explosion-proof features to guarantee the safety of the users. Some intelligent technologies are being added by the best manufacturers, such as Qubino and Armstrong, into their unit heaters. The heating equipment from Qubino provides convenient scheduling, remote accessibility, energy monitoring, color touchscreen, and sensor capabilities. Other companies, such as Goodman Manufacturing Company, are focusing their attention on incorporating the Internet of Things and Artificial Intelligence into their unit heaters. Amana, a leading manufacturer of heating, ventilation, and air conditioning equipment, is making great efforts to introduce intelligent communication technology in unit heaters that can automate their operations and increase consumer comfort.

Further, smart thermostats, Bluetooth connectivity, Wi-Fi connectivity, and intelligent circuitry are some of the features that will augment demand for smart unit heaters in the coming years. For example, the infusion of AI and machine learning into unit heaters makes them smart to analyze the patterns of use among their consumers in order to find out the optimum time usage, thus avoiding human operation. Therefore, the trend to incorporate smart technologies into unit heaters is driving the growth of the unit heater market.

Expansion of the Construction Industry

The growth in the construction industry is contributing significantly to the demand for unit heaters. The formation of new healthcare centers and hospitals within the European Union will, at large, drive the demand for heating solutions. The rise of new structures brings with it a pressing need for efficient and reliable heating systems, thus opening up a rather profitable opportunity for the unit heater market to be applied in such budding healthcare facilities and hospitals. This trend presents a good opportunity for the unit heater market to meet the rising heating demands of such newly built healthcare infrastructures, which would complement the overall growth of the construction industry and the changing healthcare sector dynamics of the European Union.

Unit Heater Market Report Segmentation Analysis

Key segments that contributed to the derivation of the unit heater market analysis are installation and product type.

- Based on installation, the market is segmented into horizontal unit heater, vertical unit heater, and suspended unit heater. The horizontal unit heater segment held a significant market share in 2023.

- In terms of product type, the market is segmented into gas fired, hydronic, electric, and others. The gas fired segment held a significant market share in 2023.

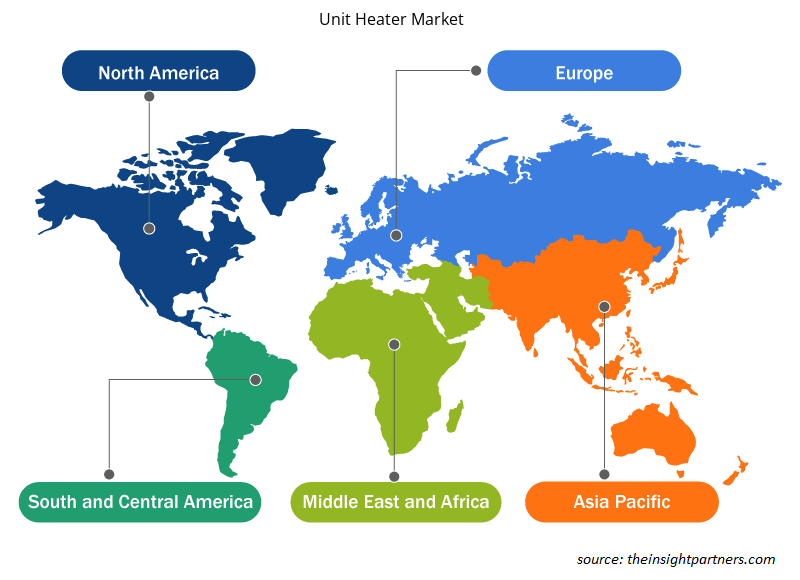

Unit Heater Market Share Analysis by Geography

The geographic scope of the unit heater market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

In Europe, technological advances, high industrialization, well-established infrastructure in construction, and a relatively high standard of living—particularly in Western Europe and the Nordic countries—favor market growth. Further, the cold climates for extended periods in this region contribute to the prominence of unit heaters, thus making it a considerable market for advanced HVAC systems. North America holds a significant share of the unit heater market owing to the large-scale investments made by the commercial sector, further aided by high awareness about energy-efficient heating solutions. Additionally, the Asia Pacific region is anticipated to experience notable traction and attractive growth rates attributed to rapid urbanization, industrialization, and increasing disposable incomes, fostering heightened demand for heating solutions across various sectors.

Unit Heater Market Regional Insights

The regional trends and factors influencing the Unit Heater Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Unit Heater Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Unit Heater Market

Unit Heater Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.16 Billion |

| Market Size by 2031 | US$ 6.33 Billion |

| Global CAGR (2023 - 2031) | 5.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Installation

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

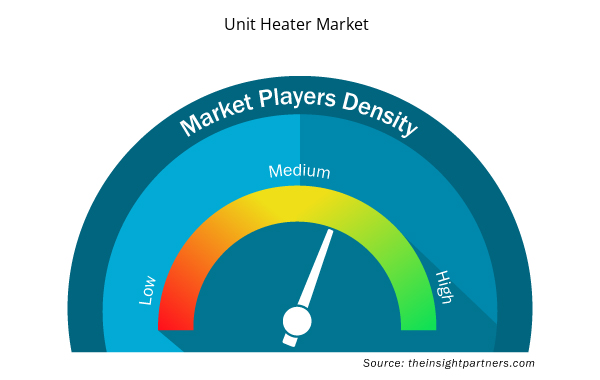

Unit Heater Market Players Density: Understanding Its Impact on Business Dynamics

The Unit Heater Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Unit Heater Market are:

- Airtherm

- Armstrong International Inc.

- Beacon Morris

- Dunham-Bush Limited

- KING ELECTRICAL MFG. CO

- Kroll Energy GmbH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Unit Heater Market top key players overview

Unit Heater Market News and Recent Developments

The unit heater market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the unit heater market are listed below:

- Modine (NYSE: MOD), a leader in innovative heating solutions in the HVAC industry, has announced the launch of the MEW, a new corrosion-resistant electric unit heater that is designed to be used in non-hazardous washdown and corrosive environments. This new unit provides a heating option for use in farming and agriculture, food and beverage production, car wash, oil and gas, petrochemical and dairy industries.

(Source: MODINE MANUFACTURING COMPANY, Company Website, February 2024)

Unit Heater Market Report Coverage and Deliverables

The “Unit Heater Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Unit heater market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Unit heater market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Unit heater market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the unit heater market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pressure Vessel Composite Materials Market

- Animal Genetics Market

- Terahertz Technology Market

- Mail Order Pharmacy Market

- Single Pair Ethernet Market

- Arterial Blood Gas Kits Market

- Asset Integrity Management Market

- Saudi Arabia Drywall Panels Market

- UV Curing System Market

- Vertical Farming Crops Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Installation, Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the unit heater market?

The market is projected to record a CAGR of 5.4% during 2023–2031.

What would be the estimated value of the unit heater market by 2031?

The market is expected to reach a value of US$ 6.33 billion by 2031.

Which are the leading players operating in the unit heater market?

Airtherm, Armstrong International Inc., Beacon Morris, Dunham-Bush Limited, KING ELECTRICAL MFG. CO, Kroll Energy GmbH, Reznor HVAC, Thermon Industries, Inc., Trane, and Turbonics, Inc. are key players in the market.

What are the future trends of the unit heater market?

Energy conservation efforts are a key trend in the market.

What are the driving factors impacting the unit heater market?

Integration of smart technologies with unit heaters is driving the market.

Get Free Sample For

Get Free Sample For