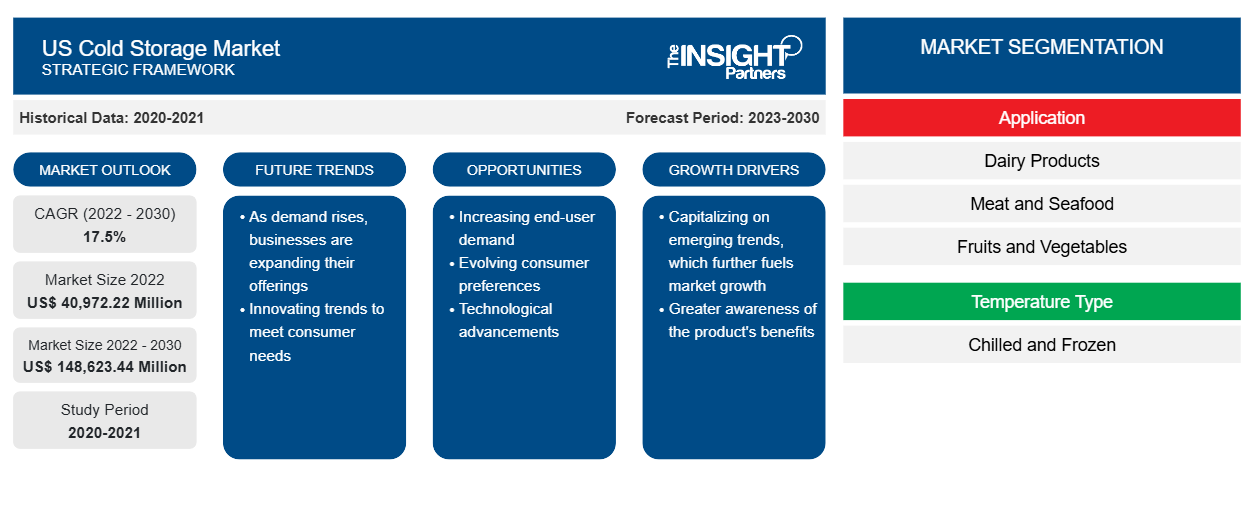

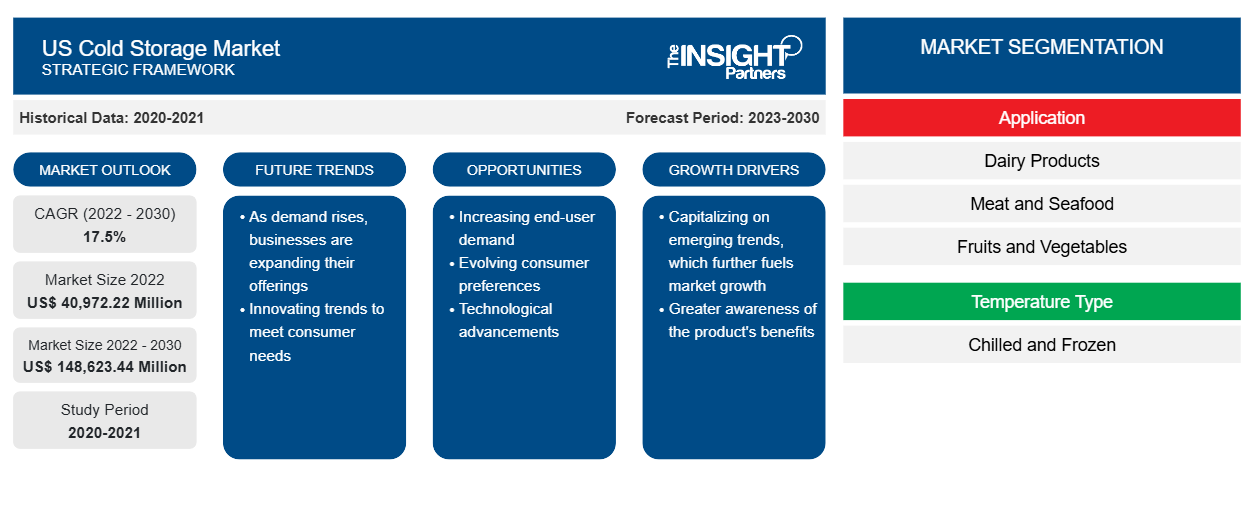

The US cold storage market size was valued at US$ 40,972.22 million in 2022 and is projected to reach US$ 148,623.44 million by 2030; it is expected to register a CAGR of 17.5% during 2022–2030.

Analyst Perspective:

Cold storage warehouse operators and end users are the main stakeholders operating in the US cold storage market ecosystem. The proper maintenance of processed or refrigerated food helps products remain fresh and last long. The cold storage facility is not only required at the time of product manufacturing and processing but also while packaging. These processes require proper temperature, appropriate storage conditions, and systematic product management. Therefore, storage providers hold a potential share of the US cold storage market. Americold Logistics Inc., Lineage Logistics LLC, United States Cold Storage Inc., Interstate Warehousing Inc., Newcold Cooperatief, Kloosterboer, Arcadia Cold Storage & Logistics, CTW Logistics, Burris Logistics, and VersaCold Logistics Services are among the key cold storage facility providers operating in the market. Food product producers, pharmaceutical companies, supermarkets, hypermarkets, and hospitals are a few major end users of cold storage facilities. The rising number of products, such as canned food products, processed food products, inflammable chemical products, pharmaceutical products, and beverages, are likely to provide new opportunities to the US cold storage market players during the forecast period.

Market Overview:

Cold storage facilities help in ensuring the integrity, freshness, and safety of perishable products. It is an exclusive facility used to store temperature-sensitive goods or products. The rising consumer preference for processed and easy-to-cook canned food boosts the demand for cold storage facilities. In addition, the growing adoption of omnichannel grocery shopping and the proliferation of online shopping are benefitting the US cold storage market globally. Consumers are considering online shopping for groceries as it is safe and helps save time. The booming food & beverages sector, due to growing demand for canned and frozen food products, along with development in the pharmaceutical sector, is also propelling the US cold storage market growth.

The growing emergence of quick commerce services is one of the major trends driving the need for cold storage across third party logistics (3PL) warehouses that are majorly utilized for last-mile delivery across different regions. Therefore, the high adoption of last-mile delivery across the US is likely to drive the demand for cold warehouses in the coming years. Further, the rise in the number of internet users, integration of artificial intelligence (AI) and machine learning (ML) into online grocery delivery mobile applications, and improved user interfaces that offer better product ordering experiences to customers are a few other factors boosting the last-mile delivery (LMD) sector. The LMD sector provides its customers with access to their respective daily needs in a specific short period. A few of the products that are delivered through LMD or quick commerce are beauty and personal care, fruits and vegetables, packed food and beverages, staples, dairy products, and many other daily life products. The importance of cold storage in the LMD sector has become one of the major demanding factors that is generating constant demand for cold storage warehouses across different parts of the US.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Cold Storage Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

US Cold Storage Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Rise in Food Waste is Driving US Cold Storage Market Growth

Cold storage facilities can reduce the share of food product waste, as they play a crucial role in supply chain management. According to The Insight Partners Analysis, more than 2.67 million metric tons of food is wasted every year globally, wherein the US wastes more food than any other country worldwide. More than 54.43 million metric tons of food is wasted across the US annually, which is nearly 325 pounds of food waste per person across the country. Such estimates show that ~40% of the total US food supply gets wasted every year. The proper usage of cold storage facilities can reduce the ratio of food wastage as it can preserve and increase the shelf life of dairy, meat, fish, seafood, and processed food products. Optimal usage of cold storage helps food business entities improve their business management. It can reduce the risk of wasting perishable food items for longer periods and also protect the freshness. Moreover, the US Department of Agriculture (USDA) and the US Environmental Protection Agency (EPA) have set their goals to reduce food waste by half across the country by 2030. The rising concern about food waste and its impact on the environment, food business, and the overall economy is boosting the need for cold storage facilities, which is a major driving factor for the US cold storage market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

In terms of application, the US cold storage market is categorized into dairy, fish, meat and seafood, fruits and vegetables, pharmaceuticals, and processed food. The meat and seafood segment is anticipated to hold a significant US cold storage market share by 2030. The rise in inclination toward processed food and the busy lifestyle of consumers are boosting the requirement for products with a longer shelf life as well as convenient food products, which creates the demand for cold storage facilities. In addition, the growing need for online delivery services and the rising population are boosting the demand for cold storage to store dairy products, meat and seafood, processed foods, and pharmaceutical items, among others.

Cold storage for meat and seafood involves inspecting the products at a controlled room temperature between 8°C and 12°C at the time of dispatch, which ranges from approximately 2°C to 4°C. Raw meat ought to be stored between -2°C and 2°C. All carcass meats should be unwrapped and hung so that air can circulate them, ideally at 1°C in a standard fridge and 3°C in a walk-in refrigerator. Seafood, when freshly caught, has a good taste and eating quality, which ultimately deteriorates each day, making it unhealthy for consumption. Seafood is stored in cold storage, maintaining an ideal temperature so that the seafood is conserved and not spoiled for a longer period. Increasing demand for meat and seafood among consumers, a growing number of restaurants, eateries, and food businesses, and rising import-export of perishable products are a few factors boosting the demand for cold storage to keep the procured meat and seafood fresh for longer periods.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

The scope of the US cold storage market report focuses on the US. Growing demand for processed meat and seafood, along with the rising need for pharmaceutical products, is also pushing the requirement for cold storage facilities in the US. The basic requirement of storing seasonal fruits, meat products, and dairy items for a long is fulfilled by proper cold storage facilities. In addition, the appropriate supply chain management of agricultural products, frozen meat and fish, medicine, and drugs has also surged the demand for cold storage facilities in the US.

The growing demand for meat, canned and processed food, and dairy products, owing to the rising population and changing lifestyle, is driving the US cold storage market. Increasing health consciousness and inclination toward vegan food products is also boosting the US cold storage market share. The requirement for cold storage facilities has amplified in recent years as customers are increasingly procuring online frozen food and groceries. The growing demand for frozen food and ready-to-make food products is boosting the demand for proper cold storage facilities in the US. The changing consumer preference toward convenience food, busy lifestyle, and rising awareness for maintaining food value is contributing to the growing US cold storage market size.

Key Player Analysis:

The US cold storage market analysis is carried out by identifying and evaluating key players in the market. Americold Logistics Inc., Lineage Logistics LLC, United States Cold Storage Inc., Interstate Warehousing Inc., Newcold Cooperatief, Kloosterboer, Arcadia Cold Storage & Logistics, CTW Logistics, Burris Logistics, and VersaCold Logistics Services are among the key players covered in the US cold storage market report. The report includes growth prospects in light of current US cold storage market trends and driving factors influencing the market growth.

Recent Developments:

Inorganic strategies such as mergers and acquisitions are highly adopted by companies in the US cold storage market. The companies adopt these strategies to expand their footprint across the world and to meet the growing customer demand. The market players present in the US cold storage market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings. A few recent developments by the key US cold storage market players are listed below:

Year | News |

2021 | Lineage LLC acquired the Kloosterboer Group. Kloosterboer operated eleven facilities in the Netherlands, France, Germany, Canada, and South Africa, with a combined capacity of 6.4 million cubic meters, 790,000 pallet slots, and over 900 employees. |

2023 | Canadian Pacific Kansas City (CPKC) and Americold Realty Trust Inc. established a strategic partnership to co-locate Americold warehouse buildings on the CPKC network. The merger of Americold's North American facility network and cold chain operating style with CPKC's new MMX intermodal service and refrigerated assets created a new and distinct solution in the food supply chain. |

US Cold Storage Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 40,972.22 Million |

| Market Size by 2030 | US$ 148,623.44 Million |

| CAGR (2022 - 2030) | 17.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

|

Frequently Asked Questions

What are reasons behind the US Cold Storage growth?

What are market opportunities for the US Cold Storage market?

What is the future trend for the US Cold Storage market?

Who are the major vendors in the US Cold Storage market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For