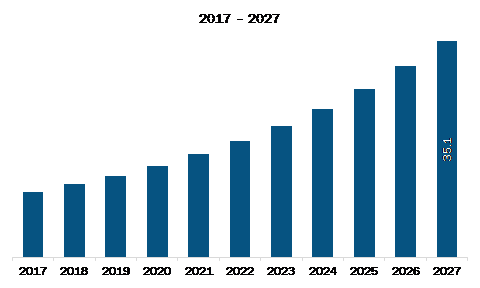

The US data center colocation market is expected to reach US$ 35.10 billion by 2027 from US$ 13.18 billion in 2019. The market is estimated to grow at a CAGR of 13.1% from 2020 to 2027.

On-site management of data center infrastructure requires highly skilled IT employees. It also incurs infrastructure maintenance and server management expenditures. Moreover, constructing a new data center facility needs high initial investments that increase the overall CAPEX of enterprises. Thus, enterprises are becoming more considerate of the CAPEX spent on constructing mission-critical data centers and seeking several methods to improve return on investment (ROI) and reduce cost. The growing focus on reducing the IT costs encourages business owners to explore innovative IT infrastructure options. As a large number of enterprises are shifting their IT infrastructures to the cloud to attain zero downtime and address the need to reduce IT infrastructure expenses, high-power and physical security requirements serve as major elements driving the colocation market. Today, enterprises are switching to data center colocation providers for bandwidth, space, power, and value-added services (VAS), such as internet solutions, interconnection services, and skilled managed IT services depending upon their size and requirement. This, in turn, supports increasing business potential by reducing operational expenditure and thereby maximizes the ability to concentrate on the core business. Thus, growing demand for cost-effective solution from enterprises that saves the cost of cooling and heating and room space requirement as well as the need for IT expertise is propelling the growth of the US data center colocation market.The COVID-19 pandemic situation in the US has forced companies to implement work from home (WFH) process as a contingency for the continuity of the business. As per CBRE's North American Data Center Trends Report 2020, the region’s data center sector was strong in the first half of 2020 because hybrid IT infrastructure is being widely implemented by the organizations to develop remote working capabilities. Data center business have never dealt with a global pandemic Covid-19. Nearly all industries got impacted by the ongoing spread of the virus and are creating potential IT and related business opportunities for data center business.

US Data Center Colocation Market Revenue and Forecast to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

US Data Center Colocation Market Segmentation

US Data Center Colocation Market – By Type

- Single Core

- Twin Core

US Data Center Colocation Market – By Enterprise Size

- SMEs

- Large Enterprises

US Data Center Colocation Market – By Industry

- BFSI

- Telecom & IT

- Healthcare

- Retail

- Others

US Data Center Colocation Market -Companies Mentioned

- Equinix Inc.

- Cyxtera Technologies, Inc.

- Digital Realty Trust LP

- CoreSite Realty Corporation

- CyrusOne, Inc.

- QTS Realty Trust, Inc.

- 365 Data Centers

- UnitedLayer, LLC

- Telehouse

- NTT Communications Corporation

US Data Center Colocation Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 13.18 Billion |

| Market Size by 2027 | US$ 35.10 Billion |

| Global CAGR (2020 - 2027) | 13.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United State

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For