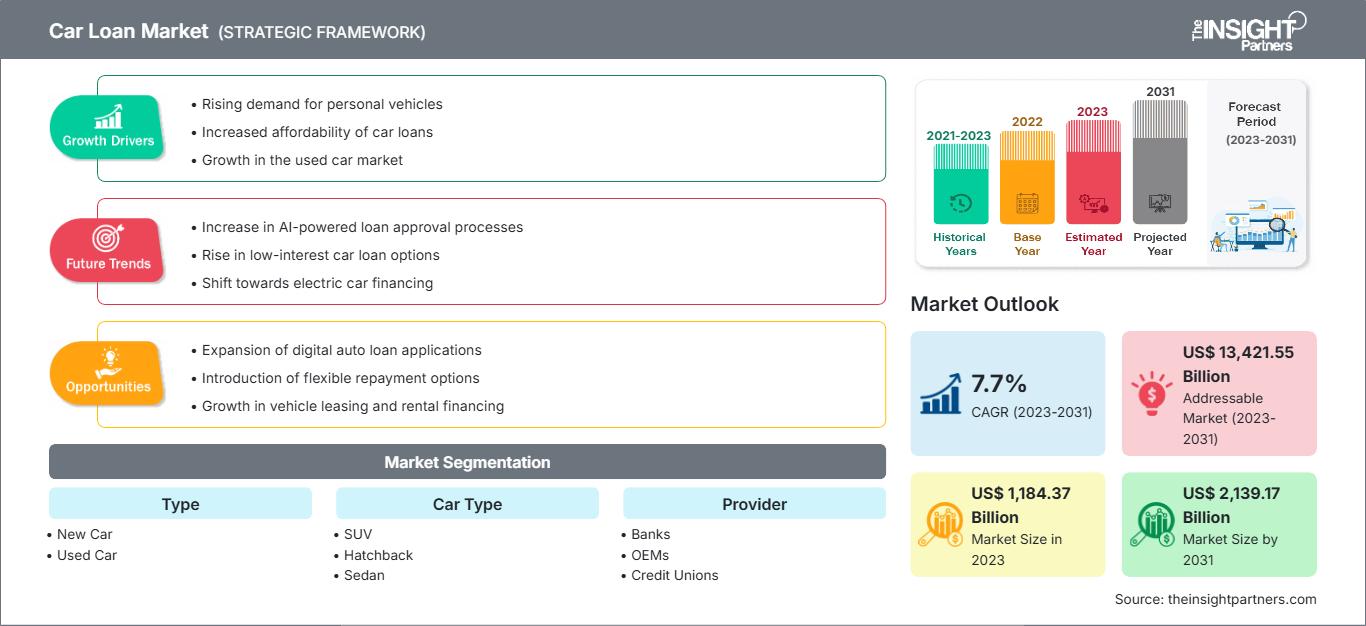

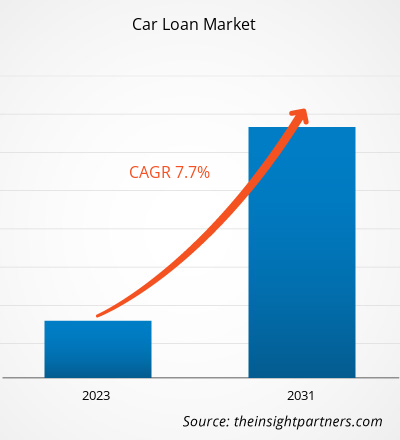

预计汽车贷款市场规模将从2023年的11843.7亿美元增长到2031年的21391.7亿美元,2023年至2031年的复合年增长率(CAGR)预计为7.7%。由于当前的市场趋势及其在预测期内的可预见影响,汽车贷款市场具有增长前景。汽车贷款市场是一个规模庞大且不断扩张的行业。汽车需求增加和可支配收入增长等因素推动了汽车贷款市场的增长。电动汽车的不断推出和车辆的高更换率为汽车贷款市场的增长提供了有利可图的机会。然而,高利率抑制了市场增长。

汽车贷款市场分析

汽车曾是身份的象征,如今却已成为生活必需品。因此,消费者对拥有汽车的需求日益增长,是全球汽车普及的重要因素。疫情后的汽车贷款市场发生了巨大变革。许多发展中国家消费者的可支配收入显著增加,随之而来的是汽车需求的增长,进而带动了汽车贷款需求的激增。传统的人工方式已无法满足如此庞大的贷款需求,数字化正在迅速取代人工方式,将贷款审批时间从数天缩短至数分钟。数字技术的广泛应用,为汽车贷款提供了快捷便利的流程。

汽车贷款行业概览

- 汽车贷款是以汽车本身作为抵押物的担保贷款。贷款机构提供二手车和新车汽车贷款。

- 汽车贷款可以通过信用社、银行和在线贷款机构获得,需要将车辆作为贷款抵押品。

- 汽车贷款是一种融资方式,可以让购车者购买汽车并分期偿还贷款。

- 由于主要市场参与者不断创新贷款产品,预计汽车贷款市场在预测期内将持续增长。

根据您的需求定制此报告

获取免费定制服务汽车贷款市场:战略洞察

-

获取本报告的主要市场趋势。这份免费样品将包含数据分析,内容涵盖市场趋势、估算和预测等。

汽车贷款市场驱动因素

电动汽车的日益普及将为汽车贷款市场带来机遇

- 自2021年起,由于对制造工厂的投资不断增加,电动汽车的需求增长速度加快。电动汽车需求的增长主要归因于低排放汽车需求的不断增长,以及通过补贴和税收减免等方式对零排放汽车日益完善的支持性法规,这些都促使制造商在全球范围内提供电动汽车。

- 根据《全球电动汽车展望》报告,2021年电动汽车(包括纯电动汽车和插电式混合动力汽车)销量增长至创纪录的660万辆。该报告还指出,2021年中国电动汽车销量显著增长至330万辆,约占全球总销量的一半。欧洲电动汽车销量也强劲增长,增幅达65%,达到230万辆;美国电动汽车销量在2021年翻了一番,达到63万辆。

- Bajaj Auto宣布投资4000万美元在印度建设电动汽车工厂,年产能为50万辆电动汽车。

- 因此,电动汽车产量的不断增长为汽车贷款市场的增长提供了有利可图的机会。

汽车贷款市场报告细分分析

- 根据类型,汽车贷款市场分为新车贷款和二手车贷款。预计到2023年,新车贷款市场将占据相当大的份额。

- 由于消费者可支配收入的增加和生活水平的提高,消费者对汽车贷款的需求不断增长,预计新车细分市场在预测期内也将保持最高的复合年增长率。

汽车贷款市场份额地域分析

汽车贷款市场主要分为五大区域:北美、欧洲、亚太、中东和非洲以及南美。亚太地区正经历快速增长,预计将占据相当大的汽车贷款市场份额。该地区显著的经济发展、不断增长的人口以及对风险管理和保险政策日益增长的重视,都促进了该地区市场的增长。对电动汽车日益增长的需求进一步推动了汽车贷款的需求。根据国际可再生能源机构的报告,到2025年,东南亚道路上行驶的车辆中约有20%将是电动汽车,其中包括5900万辆两轮和三轮车以及890万辆四轮汽车。此外,印尼政府于2021年4月设定了目标,力争到2025年,电动汽车的产量占国内汽车总产量的20%,约合40万辆。

汽车贷款市场区域洞察

The Insight Partners 的分析师对预测期内影响汽车贷款市场的区域趋势和因素进行了详尽的阐述。本节还探讨了北美、欧洲、亚太、中东和非洲以及南美和中美洲等地区的汽车贷款市场细分和地域分布。

汽车贷款市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023年市场规模 | 11843.7亿美元 |

| 到2031年市场规模 | 21391.7亿美元 |

| 全球复合年增长率(2023-2031年) | 7.7% |

| 史料 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

按类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

汽车贷款市场参与者密度:了解其对业务动态的影响

汽车贷款市场正快速增长,这主要得益于终端用户需求的不断增长,而终端用户需求的增长又源于消费者偏好的转变、技术的进步以及消费者对产品优势认知的提高。随着需求的上升,企业不断拓展产品和服务,持续创新以满足消费者需求,并把握新兴趋势,这些都进一步推动了市场增长。

- 获取汽车贷款市场主要参与者概览

本次“汽车贷款市场分析”基于贷款类型、汽车类型、贷款机构和地域进行。按贷款类型划分,市场分为新车和二手车。按汽车类型划分,汽车贷款市场分为SUV、掀背车和轿车。按贷款机构划分,市场分为银行、汽车制造商、信用社和其他机构。按地域划分,市场分为北美、欧洲、亚太、中东和非洲以及南美。

汽车贷款市场新闻及最新动态

在汽车贷款市场,企业会采取并购等有机增长和无机增长战略。以下列举了近期一些重要的市场动态:

- 2023年5月,印度领先的私营银行HDFC银行宣布在印度北部地区启动大型“汽车贷款促销活动”。哈里亚纳邦、喜马偕尔邦和昌迪加尔的300多家银行分支机构将与领先的汽车品牌和区域经销商合作,举办此次大规模贷款活动。

[资料来源:HDFC银行,公司网站]

- 2023 年 5 月,二手车经销商双日株式会社收购了二手车批发零售企业 Albert Automotive Holdings Pty Ltd,以扩大其在国内外市场的业务范围。

[来源:双日株式会社,公司网站]

- 2021年8月,塔塔汽车与Sundaram Finance合作,为购买其旗下各类乘用车的客户提供专属优惠。根据与塔塔汽车的合作协议,Sundaram Finance同意为新款“Forever”系列车型提供6年期贷款,并可实现100%融资,且首付金额极低。

[来源:塔塔汽车公司官网]

汽车贷款市场报告涵盖范围及内容

汽车贷款市场预测是基于各种二手和一手研究成果估算的,例如主要公司出版物、协会数据和数据库。市场报告《汽车贷款市场规模及预测(2021-2031)》对市场进行了详细分析,涵盖以下领域:

- 涵盖范围内所有主要市场细分领域的全球、区域和国家层面的市场规模和预测。

- 市场动态,例如驱动因素、制约因素和关键机遇。

- 未来主要趋势。

- 详细的PEST和SWOT分析

- 全球及区域市场分析,涵盖关键市场趋势、主要参与者、法规及近期市场发展动态。

- 行业格局和竞争分析,包括市场集中度、热力图分析、主要参与者和最新发展。

- 公司详细简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 汽车贷款市场

获取免费样品 - 汽车贷款市场