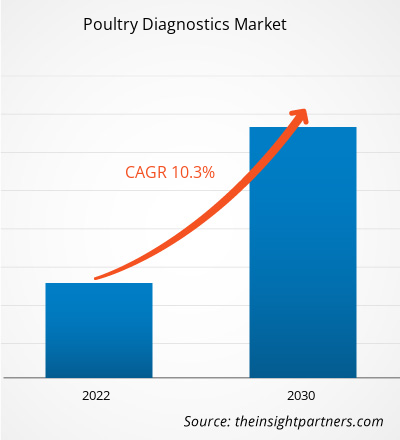

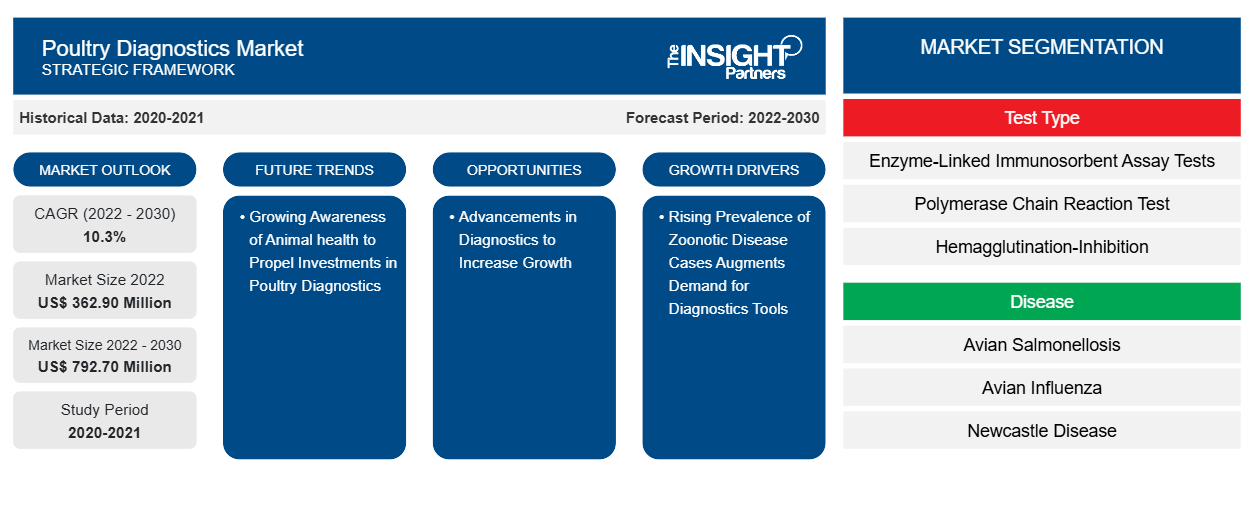

家禽诊断市场规模预计将从 2022 年的 3.629 亿美元增长到 2030 年的 7.927 亿美元;预计 2022 年至 2030 年期间的复合年增长率为 10.3%。农场端家禽诊断平台的日益普及可能仍将是市场的一个主要趋势。

家禽诊断市场分析

在禽科医学中,诊断过程已从关注单个动物转变为评估整个禽群的健康状况。如果禽群满足其遗传潜力且没有临床疾病,则被视为“健康”。农场诊断活动包括常规采样和调查,作为健康控制计划的一部分。国家和国际上采用的特定支原体和沙门氏菌种的控制计划就是重要的例子。人畜共患疾病和禽类疾病日益流行的因素推动了对禽类诊断的需求。此外,市场的新发展也有助于预测期内的市场增长。

家禽诊断市场概况

甲型流感病毒亚型 H9 和 H6 已在家鸡和鹌鹑、野鸡等野禽中建立了谱系,这些动物在亚洲被饲养以供食用。2022 年,中国报告了几种禽流感病毒株,大多属于 H5、H7 或 H9 亚型,经常引起家禽和/或人类的疫情。此外,在印度,马立克氏病 (MD) 是重新出现的家禽疾病之一。尽管 MD 被认为可以通过疫苗接种得到很好的控制,但在疫情爆发期间,接种疫苗的鸡群死亡率为 10-40%。亚太地区市场的增长归因于中东呼吸综合征冠状病毒 (MERS-CoV) 的出现和许多亚洲国家高致病性禽流感 (H5N1) 的传播。禽流感继续造成家禽的重大损失,并对该地区许多国家的人类构成人畜共患威胁。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

家禽诊断市场驱动因素和机遇

家禽诊断技术进步利好市场

近年来,临床微生物实验室诊断工具的扩展极大地影响了家禽医学中的细菌学研究。人们明显倾向于结合分子技术和蛋白质组学,它们可以补充或取代传统的细菌学方法。根据 2022 年 9 月发表在《人工智能前沿》上的一篇文章,在非洲,开发了一种深度卷积神经网络 (CNN) 模型,通过对健康和不健康的粪便图像进行分类来诊断包括球虫病、沙门氏菌和新城疫在内的家禽疾病。该研究得出结论,这种利用深度学习技术的卷积神经网络 (CNN) 模型预计比实验室中的 PCR 诊断测试更便宜,并且在早期检测方面更有效。家禽疾病诊断方面的这种进步促进了家禽诊断市场的增长。

政府举措带来增长机遇

家禽养殖是发展中国家农民的重要收入来源。家禽业面临着与免疫、健康和生产相关的挑战,包括保持消费者信心、产品质量和安全以及疾病管理。食源性疾病和人畜共患疾病与家禽密切相关,并带来重大挑战。控制和消灭这些病原体是该行业面临的主要挑战。此外,解决与食用高抗生素残留食品有关的公共卫生问题也是一个关键问题。为了克服这些挑战,多部门合作和惠及小规模家禽饲养者的政府政策至关重要。成功的控制将改善数百万农村家庭的生计、营养和性别平等。根据兽医和畜牧业服务 (V&AHS) 在 2024 年发表的一篇文章,方案 1 旨在为牲畜提供必要的动物卫生设施和临床援助,通过正确的诊断、大规模免疫和提供合理的治疗来控制和遏制动物疾病。与简单的诊断相比,此类政府支持家禽养殖诊断的计划和举措将为家禽生产商提供一系列市场机会。

家禽诊断市场报告细分分析

有助于家禽诊断市场分析的关键部分是测试类型和疾病。

- 根据检测类型,家禽诊断市场可细分为酶联免疫吸附试验 (ELISA) 检测、聚合酶链反应 (PCR) 检测、血凝抑制 (HI) 检测等。ELISA 检测细分市场在 2023 年占据最大市场份额。

- 根据疾病,市场细分为禽沙门氏菌病、禽流感、新城疫、禽支原体病、传染性支气管炎等。禽流感细分市场在 2022 年占据了最大的市场份额。

家禽诊断市场份额按地区分析

家禽诊断市场报告的地理范围主要分为五个地区:北美、亚太、欧洲、中东和非洲、南美和中美。

北美拥有下一代测序市场的最大市场份额。北美家禽诊断市场基于美国、加拿大和墨西哥进行分析。预计美国将在 2023 年主导北美家禽诊断市场。根据联合国粮食及农业组织 (UNFAO) 发布的统计数据,2022 年北美鸡蛋和母鸡产量有所增加。政府正在考虑对家禽进行大规模疫苗接种运动。截至 2022 年 7 月 5 日,美国农业部 (USDA) 表示,美国 36 个州有 4009 万只鸟感染了高致病性禽流感 (HPAI)。

因此,北美市场的增长是由于该地区家禽疾病爆发率的上升和对家禽衍生产品的需求的增加。

家禽诊断市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响家禽诊断市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的家禽诊断市场细分和地理位置。

- 获取家禽诊断市场的区域特定数据

家禽诊断市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2022 年市场规模 | 3.629亿美元 |

| 2030 年市场规模 | 7.927亿美元 |

| 全球复合年增长率(2022 - 2030 年) | 10.3% |

| 史料 | 2020-2021 |

| 预测期 | 2022-2030 |

| 涵盖的领域 |

按测试类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

家禽诊断市场参与者密度:了解其对业务动态的影响

家禽诊断市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在家禽诊断市场运营的主要公司有:

- 赛默飞世尔科技公司

- Idexx 实验室公司

- 凯杰公司

- 欧陆科技

- 兽医教育培训中心

- 勃林格殷格翰国际有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解家禽诊断市场的主要参与者概况

家禽诊断市场新闻和最新发展

家禽诊断市场通过收集来自一手和二手研究的定性和定量数据进行评估,其中包括重要的公司出版物、协会数据和数据库。以下列出了家禽诊断市场的一些发展情况:

- IDEXX Laboratories, Inc. USA 与 Haychem Bangladesh Limited(斯里兰卡 Hayleys Agriculture Holdings Limited 的子公司)合作。此次合作旨在扩大 IDEXX 在孟加拉国的产品供应,并增加兽医疫苗接种和诊断。(来源:Hayleys Agriculture Holdings Limited,新闻稿,2023 年)

- Qiagen NV 宣布美国 FDA 批准“therascreen PDGFRA RGQ PCR 试剂盒(therascreen PDGFRA kit)”。新产品旨在帮助临床医生识别胃肠道间质瘤(GIST)患者,用于治疗“AYVAKIT(avapritinib)”(来源:QIAGEN,新闻稿,2023 年)

家禽诊断市场报告覆盖范围和交付成果

“家禽诊断市场规模和预测(2020-2030 年)”报告对以下领域进行了详细的市场分析:

- 家禽诊断市场规模及全球、区域和国家层面所有主要细分市场的预测

- 家禽诊断市场趋势以及市场动态,如驱动因素、限制因素和关键机遇

- 详细的 PEST/波特五力分析和 SWOT 分析

- 家禽诊断市场分析涵盖主要市场趋势、全球和区域框架、重要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者以及家禽诊断市场的最新发展

- 详细的公司简介

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 家禽诊断市场

获取免费样品 - 家禽诊断市场