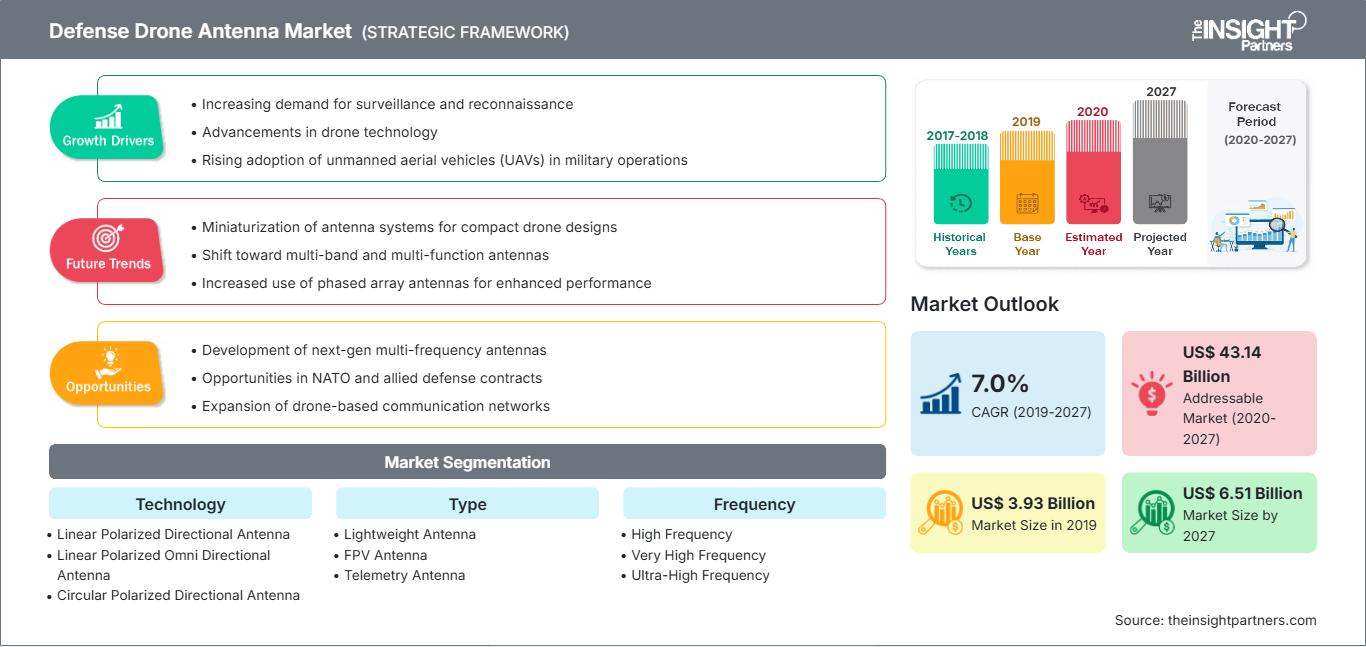

Der globale Markt für Verteidigungsdrohnenantennen wurde im Jahr 2019 auf 3.925,61 Millionen US-Dollar geschätzt und soll bis 2027 voraussichtlich 6.505,28 Millionen US-Dollar erreichen; im Prognosezeitraum von 2020 bis 2027 wird ein CAGR-Wachstum von 7,0 % erwartet.

Der Markt für Verteidigungsdrohnenantennen ist grob in fünf Hauptregionen unterteilt: Nordamerika, Europa, APAC, MEA und SAM. Nordamerika dominiert den Markt für militärische Drohnen. Daher ist die Nachfrage nach Verteidigungsdrohnenantennen aus dieser Region hoch. Die Akteure und die Regierung in den USA investieren erheblich in Forschung und Entwicklung im Zusammenhang mit militärischen Drohnen. Darüber hinaus werden Kooperationen zwischen Branchenriesen sowie steigende Investitionen in die Entwicklung technologisch fortschrittlicher Drohnen zur Unterstützung zahlreicher militärischer Anwendungen die Nachfrage nach militärischen Drohnen in den USA beschleunigen.

Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

Markt für Verteidigungsdrohnenantennen: Strategische Einblicke

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst Datenanalysen, die von Markttrends bis hin zu Schätzungen und Prognosen reichen.

Militärische Streitkräfte nutzen unbemannte Technologien für Zwecke wie Überwachung, Kommunikation, Navigation und Signalaufklärung (SIGINT). Sie sind ständig auf der Suche nach fortschrittlichen Technologien, um die Fähigkeiten unbemannter Fahrzeuge zu verbessern. Linear polarisierte Rundstrahlantennen gehören zu den bevorzugten Antennentechnologien. Die Nachfrage nach zirkular polarisierten Rundstrahlantennen steigt jedoch exponentiell. Moderne Militärdrohnen müssen sich ständig bewegen oder manövrieren, um große Informationsmengen zu erfassen; daher sind manchmal akrobatische Flugmanöver erforderlich. Zirkulare Antennen sind kleiner und bieten dadurch zusätzliche Vorteile hinsichtlich der Manövrierfähigkeit. Neben der geringeren Antennengröße weckt die Möglichkeit, die erfassten Daten in einem Winkel von 360° zu übertragen, das Interesse der Streitkräfte und der Hersteller von Verteidigungsdrohnen. Darüber hinaus verlangen die Streitkräfte eine außergewöhnliche Qualität der erfassten Daten und Bilder, und diese Antennen ermöglichen die Übertragung hochwertiger Bilder während des Drohnenflugs in unmittelbarer Nähe des Ziels. Solche Vorteile kreisförmiger Rundstrahlantennen tragen zum Wachstum des Marktes für Antennen für Verteidigungsdrohnen bei.

Einblicke in das Technologiesegment

Technologischer Hinsicht dominierte das Segment linear polarisierter Rundstrahlantennen 2019 den globalen Markt für Antennen für Verteidigungsdrohnen. Die linearen Antennen projizieren eine Welle entlang einer einzigen Ebene, horizontal oder vertikal. Diese Art der Polarisation ermöglicht die Übertragung von mehr Energie, da sich die Welle einfach in eine Richtung bewegt.

Einblicke in das Typsegment

Typisch betrachtet dominierte das Segment der Leichtantennen 2019 den globalen Markt für Antennen für Verteidigungsdrohnen. Kleinere und leichtere UAVs werden zunehmend für komplexere Geheimdienst- und Kommunikationsanwendungen eingesetzt. Um die Verweildauer und Ausdauer dieser Fahrzeuge zu erhöhen, besteht ein wachsender Bedarf an leichteren, aerodynamischeren Antennen.

Einblicke in das Frequenzsegment

Basierend auf der Frequenz dominierte das Ultrahochfrequenzsegment 2019 den globalen Markt für Antennen für Verteidigungsdrohnen. Die Ultrahochfrequenzantennen (UHF) arbeiten mit einem Frequenzbereich von über 300 MHz. Im aktuellen Szenario ist UHF das am häufigsten verwendete Frequenzband.

Einblicke in das Anwendungssegment

Basierend auf der Branche dominierte das Kommunikationssegment 2019 den globalen Markt für Antennen für Verteidigungsdrohnen. Die UAV-Hersteller legen kontinuierlich Wert auf die Integration modernster Kommunikationssysteme mit dem Ziel, dem Militärpersonal an der Basisstation die Kommunikation mit der UAV zu erleichtern. Um die besten Kommunikationssysteme zu integrieren, ist der Bedarf an Kommunikationsantennen von größter Bedeutung. Aufgrund der Bedeutung von Kommunikationsantennen für Drohnen wird erwartet, dass die Nachfrage nach Antennen während des gesamten Prognosezeitraums hoch bleibt.

Die Marktteilnehmer konzentrieren sich auf Produktinnovationen und -entwicklungen, indem sie fortschrittliche Technologien und Funktionen in ihre Produkte integrieren, um mit der Konkurrenz mithalten zu können.

- Im Jahr 2020 kündigte PPM die Eröffnung von 40 neuen Niederlassungen in Großbritannien an, um die Bereiche Entwicklung und Design, Vertrieb und Marketing, Kundenservice und Buchhaltung auszubauen.

- Im Jahr 2020 stellte Southwest Antennas zwei neue Rundstrahlantennen für den Einsatz im UHF- und ISM-Band vor. Diese eignen sich ideal für taktische Funksysteme, tragbare Videoempfänger, MIMO- und MANET-Funksysteme, unbemannte Roboterplattformen und andere Anwendungen. Die neuen Antennen sind entweder mit einem abgedichteten Ultra-Flex-Federsockel oder einem flexiblen Schwanenhalssockel erhältlich.

Markt für Antennen für Verteidigungsdrohnen

Die Analysten von The Insight Partners haben die regionalen Trends und Faktoren, die den Markt für Antennen für Verteidigungsdrohnen im Prognosezeitraum beeinflussen, ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die geografische Lage in Nordamerika, Europa, dem asiatisch-pazifischen Raum, dem Nahen Osten und Afrika sowie Süd- und Mittelamerika erörtert.Umfang des Marktberichts über Antennen für Verteidigungsdrohnen

| Berichtsattribut | Einzelheiten |

|---|---|

| Marktgröße in 2019 | US$ 3.93 Billion |

| Marktgröße nach 2027 | US$ 6.51 Billion |

| Globale CAGR (2019 - 2027) | 7.0% |

| Historische Daten | 2017-2018 |

| Prognosezeitraum | 2020-2027 |

| Abgedeckte Segmente |

By Technologie

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für Antennen für Verteidigungsdrohnen: Verständnis ihrer Auswirkungen auf die Geschäftsdynamik

Der Markt für Antennen für Verteidigungsdrohnen wächst rasant. Dies wird durch die steigende Nachfrage der Endnutzer aufgrund veränderter Verbraucherpräferenzen, technologischer Fortschritte und eines stärkeren Bewusstseins für die Produktvorteile vorangetrieben. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um den Bedürfnissen der Verbraucher gerecht zu werden, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

- Holen Sie sich die Markt für Verteidigungsdrohnenantennen Übersicht der wichtigsten Akteure

- Linear polarisierte Richtantenne

- Linear polarisierte Rundstrahlantenne

- Zirkular polarisierte Richtantenne

- Zirkular polarisierte Rundstrahlantenne

Markt für Antennen für Verteidigungsdrohnen – nach Typ

- Leichtbauantenne

- FPV-Antenne

- Telemetrieantenne

- NLOS-Antenne

- Sonstige

Markt für Antennen für Verteidigungsdrohnen – nach Frequenz

- Hohe Frequenz

- Sehr hohe Frequenz

- Ultrahohe Frequenz

Markt für Antennen für Verteidigungsdrohnen – nach Frequenz Nach Anwendung

- Überwachung

- Navigation

- Kommunikation

- Telemetrie

- Sonstige

Markt für Antennen für Verteidigungsdrohnen – nach Region

- Nordamerika

- USA

- Kanada

- Mexiko

- Europa

- Frankreich

- Deutschland

- Italien

- Spanien

- Schweiz

- Großbritannien

- Restliches Europa

- Asien-Pazifik (APAC)

- China

- Indien

- Südkorea

- Singapur

- Japan

- Australien

- Restliches APAC

- Naher Osten und Afrika (MEA)

- Südafrika

- Saudi-Arabien

- VAE

- Rest von MEA

- Südamerika (SAM)

- Brasilien

- Rest von SAM

Markt für Verteidigungsdrohnenantennen – Unternehmensprofile

- Alaris Holdings Ltd.

- Antcom Corporation

- Antenna Research Associates, Inc.

- Cobham Plc

- JEM Engineering

- MP Antenna, LTD

- PPM Systems

- Southwest Antennas, Inc.

- TE Connectivity

- Trimble Inc.

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für Verteidigungsdrohnenantennen

Kostenlose Probe anfordern für - Markt für Verteidigungsdrohnenantennen