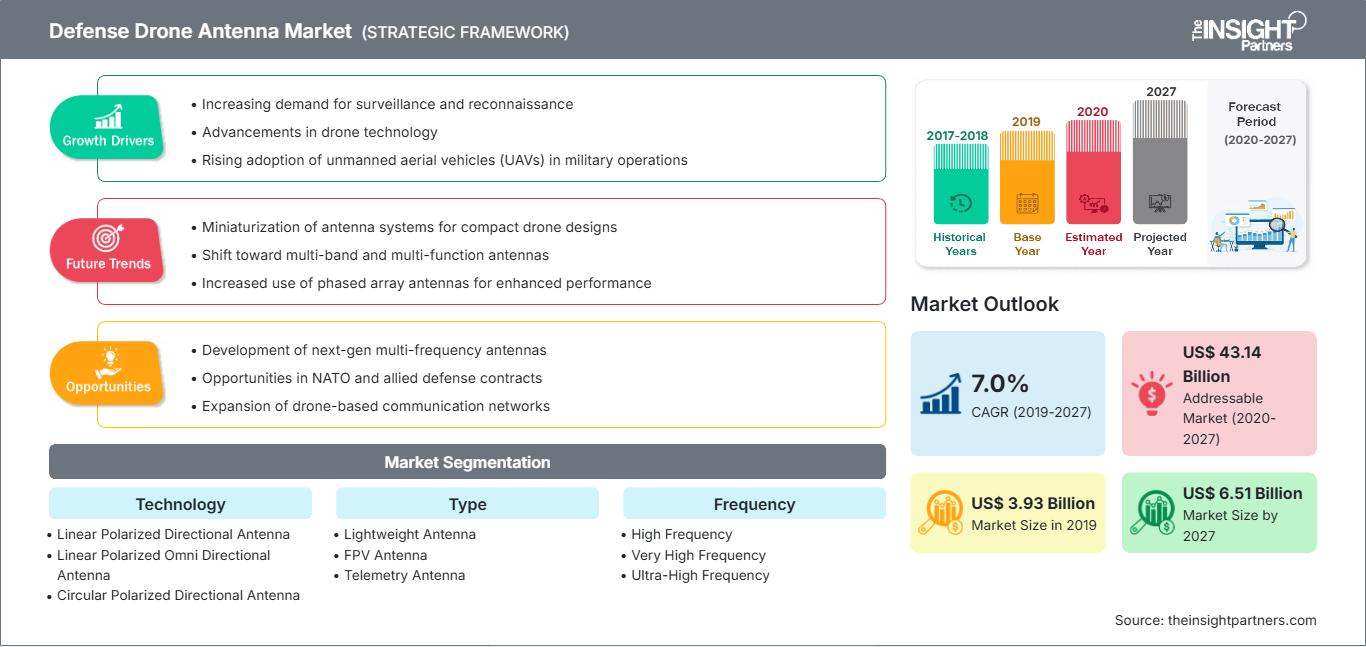

En términos de ingresos, el mercado global de antenas para drones de defensa se valoró en US$ 3.925,61 millones en 2019 y se proyecta que alcance los US$ 6.505,28 millones para 2027; se espera que crezca a una CAGR del 7,0% durante el período de pronóstico de 2020 a 2027.

El mercado de antenas para drones de defensa está segmentado en cinco regiones principales: Norteamérica, Europa, Asia-Pacífico, Oriente Medio y África (MEA) y la región SAM. Norteamérica domina el mercado de vehículos aéreos no tripulados (UAV) militares. Por lo tanto, la demanda de antenas para drones de defensa en la región es alta. Las empresas y el gobierno estadounidense están invirtiendo significativamente en I+D en vehículos aéreos no tripulados (UAV) militares. Además, la colaboración entre gigantes de la industria, junto con el aumento de las inversiones en el desarrollo de UAV tecnológicamente avanzados para diversas aplicaciones militares, aceleraría la demanda de UAV militares en Estados Unidos.

Personalice este informe según sus necesidades

Obtendrá personalización en cualquier informe, sin cargo, incluidas partes de este informe o análisis a nivel de país, paquete de datos de Excel, así como también grandes ofertas y descuentos para empresas emergentes y universidades.

Mercado de antenas para drones de defensa: Perspectivas estratégicas

-

Obtenga las principales tendencias clave del mercado de este informe.Esta muestra GRATUITA incluirá análisis de datos, desde tendencias del mercado hasta estimaciones y pronósticos.

Perspectivas del mercado: mercado de antenas para drones de defensa

Creciente interés en las antenas omnidireccionales circulares

Las fuerzas militares utilizan tecnologías no tripuladas para fines como vigilancia, comunicaciones, navegación e inteligencia de señales (SIGINT). Buscan continuamente tecnologías avanzadas para mejorar las capacidades de los vehículos no tripulados. Las antenas omnidireccionales de polarización lineal se encuentran entre las tecnologías preferidas. Sin embargo, la preferencia por las antenas omnidireccionales de polarización circular está creciendo exponencialmente. Los drones militares modernos necesitan moverse o maniobrar constantemente para recopilar mayores volúmenes de información; por lo tanto, a veces requieren vuelos acrobáticos. Las antenas circulares son más pequeñas, lo que ofrece una ventaja adicional para una fácil maniobrabilidad. Además de su menor tamaño, la capacidad de transmitir los datos recopilados en 360° está despertando el interés de las fuerzas de defensa, así como de los fabricantes de drones de defensa. Además, las fuerzas militares exigen una calidad excepcional de datos e imágenes capturados, y estas antenas facilitan la transmisión de imágenes de alta calidad durante el vuelo del dron cerca del objetivo. Estas ventajas de las antenas omnidireccionales circulares contribuyen al crecimiento del mercado de antenas para drones de defensa.

Perspectivas del segmento tecnológico

En cuanto a tecnología, el segmento de antenas omnidireccionales de polarización lineal dominó el mercado global de antenas para drones de defensa en 2019. Las antenas lineales proyectan una onda a lo largo de un único plano, horizontal o vertical. Este tipo de polarización facilita la transmisión de mayor energía, ya que la onda simplemente se mueve en una dirección.

Información sobre segmentos de tipo

En cuanto a tipo, el segmento de antenas ligeras dominó el mercado global de antenas para drones de defensa en 2019. Los UAVs, cada vez más pequeños y ligeros, se utilizan cada vez más para aplicaciones de inteligencia y comunicaciones más complejas. Para aumentar la capacidad de merodeo y la persistencia de estos vehículos, existe una creciente demanda de antenas más ligeras y aerodinámicas.

Información sobre segmentos de frecuencia

En cuanto a frecuencia, el segmento de ultraalta frecuencia dominó el mercado global de antenas para drones de defensa en 2019. Las antenas de ultraalta frecuencia (UHF) operan en un rango de frecuencia superior a 300 MHz. Actualmente, la UHF es la banda de frecuencia más utilizada.

Información sobre segmentos de aplicaciones

En cuanto a la industria, el segmento de comunicaciones dominó el mercado global de antenas para drones de defensa en 2019. Los fabricantes de UAV se esfuerzan continuamente por integrar sistemas de comunicación de vanguardia para facilitar la comunicación del personal militar en la estación base con el UAV. Para integrar los mejores sistemas de comunicación, la necesidad de una antena de comunicación es fundamental. Debido a la importancia de la antena de comunicación en un UAV, se prevé que la demanda de antenas se mantenga alta durante el período de pronóstico.

Los actores del mercado se centran en innovaciones y desarrollos de nuevos productos integrando tecnologías y características avanzadas en sus productos para competir con la competencia.

- En 2020, PPM anunció la apertura de 40 nuevas oficinas en el Reino Unido para expandir su trabajo de ingeniería y diseño, ventas y marketing, servicio al cliente y contabilidad.

- En 2020, Southwest Antennas presentó dos nuevas antenas omnidireccionales para aplicaciones en las bandas UHF e ISM. Son ideales para sistemas de radio tácticos, receptores de video portátiles, sistemas de radio MIMO y MANET, plataformas robóticas no tripuladas y otras aplicaciones. Las nuevas antenas están disponibles con base de resorte sellada Ultra-Flex o base de cuello de cisne flexible.

Análisis regional del mercado de antenas para drones de defensa

Los analistas de The Insight Partners han explicado detalladamente las tendencias regionales y los factores que influyen en el mercado de antenas para drones de defensa durante el período de pronóstico. Esta sección también analiza los segmentos y la geografía del mercado de antenas para drones de defensa en América del Norte, Europa, Asia Pacífico, Oriente Medio y África, y América del Sur y Central.

Alcance del informe de mercado de antenas para drones de defensa

| Atributo del informe | Detalles |

|---|---|

| Tamaño del mercado en 2019 | US$ 3.93 mil millones |

| Tamaño del mercado en 2027 | 6.510 millones de dólares estadounidenses |

| CAGR global (2019-2027) | 7.0% |

| Datos históricos | 2017-2018 |

| Período de pronóstico | 2020-2027 |

| Segmentos cubiertos |

Por tecnología

|

| Regiones y países cubiertos |

América del norte

|

| Líderes del mercado y perfiles de empresas clave |

|

Densidad de actores del mercado de antenas para drones de defensa: comprensión de su impacto en la dinámica empresarial

El mercado de antenas para drones de defensa está creciendo rápidamente, impulsado por la creciente demanda de los usuarios finales debido a factores como la evolución de las preferencias de los consumidores, los avances tecnológicos y un mayor conocimiento de las ventajas del producto. A medida que aumenta la demanda, las empresas amplían su oferta, innovan para satisfacer las necesidades de los consumidores y aprovechan las tendencias emergentes, lo que impulsa aún más el crecimiento del mercado.

- Obtenga una descripción general de los principales actores clave del mercado de antenas para drones de defensa

El mercado global de antenas para drones de defensa se ha segmentado de la siguiente manera:

Mercado de antenas para drones de defensa: por tecnología

- Antena direccional polarizada lineal

- Antena omnidireccional polarizada lineal

- Antena direccional polarizada circular

- Antena omnidireccional polarizada circular

Mercado de antenas para drones de defensa: por tipo

- Antena ligera

- Antena FPV

- Antena de telemetría

- Antena NLOS

- Otros

Mercado de antenas para drones de defensa: por frecuencia

- Frecuencia alta

- Muy alta frecuencia

- Frecuencia ultraalta

Mercado de antenas para drones de defensa: por aplicación

- Vigilancia

- Navegación

- Comunicación

- Telemetría

- Otros

Mercado de antenas para drones de defensa: por región

-

América del norte

- A NOSOTROS

- Canadá

- México

-

Europa

- Francia

- Alemania

- Italia

- España

- Suiza

- Reino Unido

- Resto de Europa

-

Asia Pacífico (APAC)

- Porcelana

- India

- Corea del Sur

- Singapur

- Japón

- Australia

- Resto de APAC

-

Oriente Medio y África (MEA)

- Sudáfrica

- Arabia Saudita

- Emiratos Árabes Unidos

- Resto de MEA

-

América del Sur (SAM)

- Brasil

- Resto de SAM

Mercado de antenas para drones de defensa: perfiles de empresas

- Alaris Holdings Ltd.

- Corporación Antcom

- Asociados de investigación de antenas, Inc.

- Cobham Plc

- Ingeniería JEM

- Antena MP, LTD

- Sistemas PPM

- Antenas del suroeste, Inc.

- Conectividad TE

- Trimble Inc.

- Análisis histórico (2 años), año base, pronóstico (7 años) con CAGR

- Análisis PEST y FODA

- Tamaño del mercado, valor/volumen: global, regional y nacional

- Industria y panorama competitivo

- Conjunto de datos de Excel

Informes recientes

Informes relacionados

Testimonios

Razón para comprar

- Toma de decisiones informada

- Comprensión de la dinámica del mercado

- Análisis competitivo

- Información sobre clientes

- Pronósticos del mercado

- Mitigación de riesgos

- Planificación estratégica

- Justificación de la inversión

- Identificación de mercados emergentes

- Mejora de las estrategias de marketing

- Impulso de la eficiencia operativa

- Alineación con las tendencias regulatorias

Obtenga una muestra gratuita para - Mercado de antenas para drones de defensa

Obtenga una muestra gratuita para - Mercado de antenas para drones de defensa