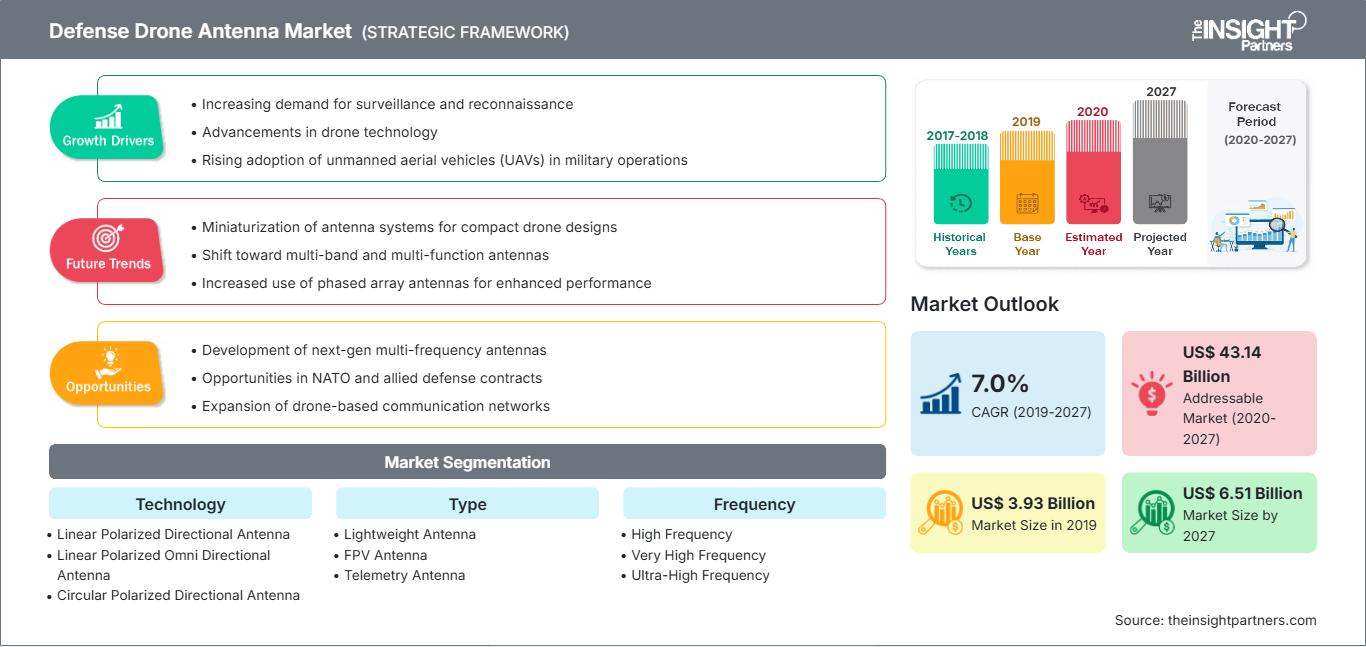

In termini di fatturato, il mercato globale delle antenne per droni da difesa è stato valutato a 3.925,61 milioni di dollari nel 2019 e si prevede che raggiungerà i 6.505,28 milioni di dollari entro il 2027; si prevede una crescita a un CAGR del 7,0% nel periodo di previsione dal 2020 al 2027.

Il mercato delle antenne per droni da difesa è ampiamente segmentato in cinque regioni principali: Nord America, Europa, APAC, MEA e SAM. Il Nord America domina il mercato dei droni militari. Pertanto, la domanda di antenne per droni da difesa da parte della regione è elevata. Gli operatori e il governo degli Stati Uniti stanno investendo in modo significativo in ricerca e sviluppo relativa ai droni militari. Oltre a ciò, le collaborazioni tra i giganti del settore, insieme ai crescenti investimenti nello sviluppo di droni tecnologicamente avanzati a supporto di numerose applicazioni militari, accelereranno la domanda di droni militari negli Stati Uniti.

Personalizza questo rapporto in base alle tue esigenze

Potrai personalizzare gratuitamente qualsiasi rapporto, comprese parti di questo rapporto, o analisi a livello di paese, pacchetto dati Excel, oltre a usufruire di grandi offerte e sconti per start-up e università

Mercato delle antenne per droni da difesa: Approfondimenti strategici

-

Ottieni le principali tendenze chiave del mercato di questo rapporto.Questo campione GRATUITO includerà l'analisi dei dati, che vanno dalle tendenze di mercato alle stime e alle previsioni.

Approfondimenti sul segmento tecnologico

In base alla tecnologia, il segmento delle antenne omnidirezionali a polarizzazione lineare ha dominato il mercato globale delle antenne per droni da difesa nel 2019. Le antenne lineari proiettano un'onda lungo un piano unico, orizzontale o verticale. Questo tipo di polarizzazione facilita la trasmissione di una maggiore energia, poiché l'onda si muove semplicemente in una direzione.

Approfondimenti sul segmento del tipo

In base alla tipologia, il segmento delle antenne leggere ha dominato il mercato globale delle antenne per droni da difesa nel 2019. UAV più piccoli e leggeri vengono utilizzati in modo significativo per applicazioni di intelligence e comunicazione più complesse. Per aumentare la capacità di stazionamento e la persistenza di questi veicoli, vi è una crescente richiesta di antenne più leggere e aerodinamiche.

Approfondimenti sul segmento di frequenza

In base alla frequenza, il segmento delle frequenze ultra-alte ha dominato il mercato globale delle antenne per droni da difesa nel 2019. Le antenne a frequenza ultra-alta (UHF) operano nella gamma di frequenza superiore a 300 MHz. Nello scenario attuale, l'UHF è la banda di frequenza più comunemente utilizzata.

Approfondimenti sul segmento di applicazione

In base al settore, il segmento delle comunicazioni ha dominato il mercato globale delle antenne per droni da difesa nel 2019. I produttori di UAV stanno costantemente enfatizzando l'integrazione di sistemi di comunicazione all'avanguardia con l'obiettivo di facilitare la comunicazione tra il personale militare presso la stazione base e il drone. Per integrare i migliori sistemi di comunicazione, la necessità di un'antenna di comunicazione è di fondamentale importanza. Considerata l'importanza delle antenne di comunicazione su un UAV, si prevede che la domanda di questo tipo di antenne rimarrà elevata per tutto il periodo di previsione.

Gli operatori del mercato si concentrano su innovazioni e sviluppi di nuovi prodotti integrando tecnologie e funzionalità avanzate nei loro prodotti per competere con la concorrenza.

- Nel 2020, PPM ha annunciato l'apertura di 40 nuovi uffici nel Regno Unito per espandere le proprie attività di ingegneria e progettazione, vendite e marketing, servizio clienti e contabilità.

- Nel 2020, Southwest Antennas ha introdotto due nuove antenne omnidirezionali per applicazioni in banda UHF e ISM. Queste sono ideali per sistemi radio tattici, ricevitori video portatili, sistemi radio MIMO e MANET, piattaforme robotiche senza pilota e altre applicazioni. Le nuove antenne sono disponibili con base a molla sigillata Ultra-Flex o con base a collo d'oca flessibile.

Le tendenze e i fattori regionali che influenzano il mercato delle antenne per droni da difesa durante il periodo di previsione sono stati ampiamente spiegati dagli analisti di The Insight Partners. Questa sezione illustra anche i segmenti e la geografia del mercato delle antenne per droni da difesa in Nord America, Europa, Asia-Pacifico, Medio Oriente e Africa, America meridionale e centrale.

Ambito del rapporto sul mercato delle antenne per droni di difesa

| Attributo del rapporto | Dettagli |

|---|---|

| Dimensioni del mercato in 2019 | US$ 3.93 Billion |

| Dimensioni del mercato per 2027 | US$ 6.51 Billion |

| CAGR globale (2019 - 2027) | 7.0% |

| Dati storici | 2017-2018 |

| Periodo di previsione | 2020-2027 |

| Segmenti coperti |

By Tecnologia

|

| Regioni e paesi coperti |

Nord America

|

| Leader di mercato e profili aziendali chiave |

|

Densità degli operatori del mercato delle antenne per droni di difesa: comprendere il suo impatto sulle dinamiche aziendali

Il mercato delle antenne per droni da difesa è in rapida crescita, trainato dalla crescente domanda degli utenti finali, dovuta a fattori quali l'evoluzione delle preferenze dei consumatori, i progressi tecnologici e una maggiore consapevolezza dei vantaggi del prodotto. Con l'aumento della domanda, le aziende stanno ampliando la propria offerta, innovando per soddisfare le esigenze dei consumatori e sfruttando le tendenze emergenti, alimentando ulteriormente la crescita del mercato.

- Ottieni il Mercato delle antenne per droni da difesa Panoramica dei principali attori chiave

- Antenna direzionale polarizzata lineare

- Antenna omnidirezionale polarizzata lineare

- Antenna direzionale polarizzata circolare

- Antenna omnidirezionale polarizzata circolare

Mercato delle antenne per droni da difesa - Per tipo

- Antenna leggera

- Antenna FPV

- Antenna telemetrica

- Antenna NLOS

- Altro

Mercato delle antenne per droni da difesa - Per frequenza

- Alta frequenza

- Altissima frequenza

- Altissima frequenza

Mercato delle antenne per droni da difesa - Per applicazione

- Sorveglianza

- Navigazione

- Comunicazione

- Telemetria

- Altro

Mercato delle antenne per droni di difesa - Per regione

- Nord America

- Stati Uniti

- Canada

- Messico

- Europa

- Francia

- Germania

- Italia

- Spagna

- Svizzera

- Regno Unito

- Resto d'Europa

- Asia Pacifico (APAC)

- Cina

- India

- Corea del Sud

- Singapore

- Giappone

- Australia

- Resto dell'APAC

- Medio Oriente e Africa (MEA)

- Sudafrica

- Arabia Saudita

- Emirati Arabi Uniti

- Resto del MEA

- Sud America (SAM)

- Brasile

- Resto del SAM

Mercato delle antenne per droni da difesa - Profili aziendali

- Alaris Holdings Ltd.

- Antcom Corporation

- Antenna Research Associates, Inc.

- Cobham Plc

- JEM Engineering

- MP Antenna, LTD

- PPM Systems

- Southwest Antennas, Inc.

- TE Connectivity

- Trimble Inc.

- Analisi storica (2 anni), anno base, previsione (7 anni) con CAGR

- Analisi PEST e SWOT

- Valore/volume delle dimensioni del mercato - Globale, Regionale, Nazionale

- Industria e panorama competitivo

- Set di dati Excel

Report recenti

Rapporti correlati

Testimonianze

Motivo dell'acquisto

- Processo decisionale informato

- Comprensione delle dinamiche di mercato

- Analisi competitiva

- Analisi dei clienti

- Previsioni di mercato

- Mitigazione del rischio

- Pianificazione strategica

- Giustificazione degli investimenti

- Identificazione dei mercati emergenti

- Miglioramento delle strategie di marketing

- Aumento dell'efficienza operativa

- Allineamento alle tendenze normative

Ottieni un campione gratuito per - Mercato delle antenne per droni da difesa

Ottieni un campione gratuito per - Mercato delle antenne per droni da difesa