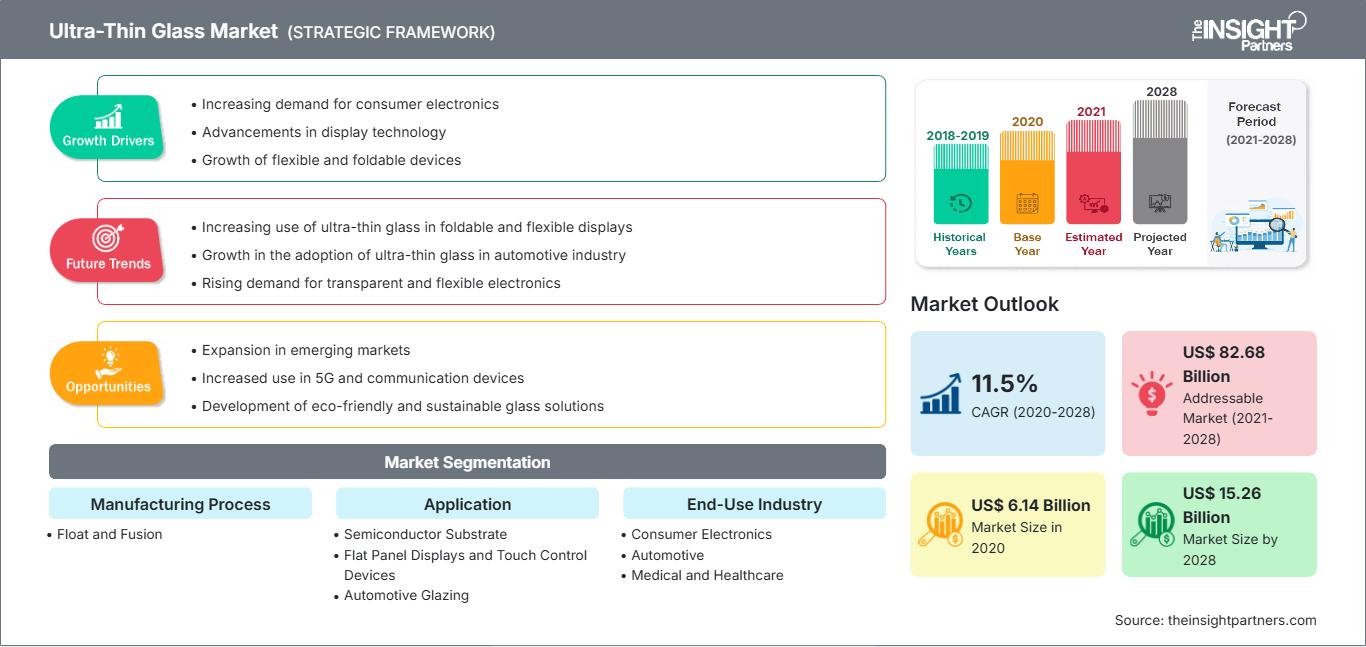

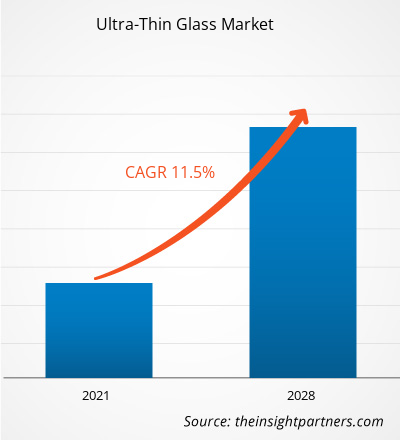

[Forschungsbericht]Der Markt für ultradünnes Glas wurde im Jahr 2020 auf 6.139,56 Millionen US-Dollar geschätzt und soll bis 2028 15.264,74 Millionen US-Dollar erreichen; von 2021 bis 2028 wird ein durchschnittliches jährliches Wachstum von 11,5 % erwartet.

Ultradünnes Glas ist Glas mit einer Dicke von weniger als 1–2 mm.

Chemische Härtung durch Ionenaustausch wird häufig zur Verstärkung von ultradünnem Glas für Hightech-Anwendungen eingesetzt.Gehärtetes ultradünnes Glas ist kratzfest und bis zu einem Radius von wenigen Millimetern biegbar. Die Eigenschaften von ultradünnem Glas wie Korrosionsbeständigkeit, Transparenz, Flexibilität, hervorragende Gas- und Wasserbarriere und hohe Schlagfestigkeit machen es für verschiedene Anwendungen geeignet, wie z. B. Flachbildschirme und Fahrzeugverglasung. Im Jahr 2020 hatte der asiatisch-pazifische Raum den größten Umsatzanteil am globalen Markt für ultradünnes Glas. China ist der größte Verbraucher von ultradünnem Glas und hat einen Marktanteil von über 50 % im asiatisch-pazifischen Raum. Das Land ist das wichtigste Produktionszentrum für alle Arten von Unterhaltungselektronikprodukten wie Smartphones und LCDs.Die anhaltende COVID-19-Pandemie hat den Status des Chemie- und Werkstoffsektors drastisch verändert und das Wachstum des Marktes für ultradünnes Glas negativ beeinflusst.

Die Umsetzung von Maßnahmen zur Eindämmung der Ausbreitung des neuen Coronavirus hat die Situation verschärft und das Wachstum mehrerer Sektoren negativ beeinflusst. Branchen wie die Automobil- und Unterhaltungselektronik wurden durch die plötzliche Verzerrung der Betriebseffizienz und Störungen der Wertschöpfungsketten aufgrund der plötzlichen Schließung nationaler und internationaler Grenzen negativ beeinflusst. Der Wachstumsrückgang in mehreren Sektoren wirkte sich negativ auf die Nachfrage nach ultradünnem Glas auf dem Weltmarkt aus. Da die Volkswirtschaften jedoch eine Wiederbelebung ihrer Aktivitäten planen, wird die Nachfrage nach ultradünnem Glas in den kommenden Jahren voraussichtlich weltweit steigen. Aufgrund der Pandemie nimmt die Akzeptanz von Telearbeit und Online-Bildung zu. Daher steigt die Nachfrage nach Produkten wie Laptops, Smartphones und anderen Telekommunikationsgeräten. Die steigende Nachfrage nach ultradünnem Glas in verschiedenen Branchen, wie der Automobil- und Unterhaltungselektronik, sowie erhebliche Investitionen namhafter Hersteller dürften das Wachstum des Marktes für ultradünnes Glas im Prognosezeitraum vorantreiben.Passen Sie diesen Bericht Ihren Anforderungen an

Sie erhalten kostenlos Anpassungen an jedem Bericht, einschließlich Teilen dieses Berichts oder einer Analyse auf Länderebene, eines Excel-Datenpakets sowie tolle Angebote und Rabatte für Start-ups und Universitäten.

Markt für ultradünnes Glas: Strategische Einblicke

-

Holen Sie sich die wichtigsten Markttrends aus diesem Bericht.Dieses KOSTENLOSE Beispiel umfasst Datenanalysen, die von Markttrends bis hin zu Schätzungen und Prognosen reichen.

Die Unterhaltungselektronikbranche boomt aufgrund der zunehmenden Nutzung elektronischer Geräte wie Smartphones, Laptops, Fernseher und anderer Elektronikprodukte. Unterhaltungselektronik ist in der technologisch geprägten Welt zu einer Notwendigkeit geworden. Menschen aller Generationen sind in irgendeiner Form auf ihre Smartphones, Smartwatches und Laptops angewiesen. Mit der wachsenden Unterhaltungselektronikbranche konzentrieren sich die Hersteller kontinuierlich auf die Bereitstellung fortschrittlicher und qualitativ hochwertiger Produkte. Ultradünnes Glas spielt in der Unterhaltungselektronikbranche eine wichtige Rolle. Es wird in Touch- und Displaypanels, Sensoren und Kamerasystemen verwendet. Verschiedene Eigenschaften von ultradünnem Glas wie Korrosionsbeständigkeit, Transparenz, Flexibilität und Gasbarrierefähigkeit machen es für zahlreiche Anwendungen in der Unterhaltungselektronikbranche geeignet. China dominiert die Unterhaltungselektronikbranche. Das Land ist einer der führenden Hersteller von Flachbildschirmen. Es gibt eine schnell steigende Nachfrage nach chinesischen Smartphones, Fitnesstrackern, Fernsehern und anderen elektronischen Gütern, was den Herstellern von ultradünnem Glas lukrative Möglichkeiten bietet. China hat den Bau neuer Infrastruktur verstärkt. Die Entwicklung künstlicher Intelligenz, des industriellen Internets und des Internets der Dinge wurde vorangetrieben. Zudem wurde die Kommerzialisierung von 5G beschleunigt, was die elektronische Informationsproduktion in eine neue Entwicklungsphase führt und die High-End-Entwicklung verwandter Branchen weiter fördert. Laut World Population Review gibt es in China 1,6 Milliarden und in Indien 1,28 Milliarden Handynutzer. Im Jahr 2018 verkaufte Apple rund 22,5 Millionen Smartwatches. Diese Zahl ist gegenüber 2017 gestiegen, da das Unternehmen 2017 17,7 Millionen Einheiten verkaufte. Im Jahr 2018 lieferte Fitbit rund 5,5 Millionen Smartwatches aus, Samsung hingegen rund 5,3 Millionen. Somit treibt die schnell wachsende Unterhaltungselektronikbranche die Nachfrage nach ultradünnem Glas voran

Einblicke in die Endverbraucherbranche

Das Segment Unterhaltungselektronik hatte 2020 den größten Anteil am globalen Markt für ultradünnes Glas. Ultradünnes Glas wird häufig zur Herstellung elektronischer Produkte wie Flachbildschirmen und Touchscreens für verschiedene Geräte wie LCDs, OLEDs, Smartphones und tragbare Geräte verwendet. Mit der weltweit wachsenden Nachfrage nach innovativen und technologisch fortschrittlichen elektronischen Produkten wird die Nachfrage nach ultradünnem Glas in den kommenden Jahren voraussichtlich stark ansteigen.

Einblicke in den Herstellungsprozess

Nach Herstellungsverfahren dominierte das Fusionssegment den Markt für ultradünnes Glas im Jahr 2020 gemessen am Umsatz. Das Fusionsverfahren, oft auch als Overflow-Downdraw-Methode bezeichnet, wird häufig zur Herstellung flacher ultradünner Gläser für Anzeigetafeln verwendet. Corning war das erste Unternehmen, das Spezialglas herstellte, das in der Luft schwebte – ein wesentliches Merkmal des Fusionsverfahrens. Glas kommt nicht mit geschmolzenem Metall in Berührung, was ein grundlegender Vorteil des Schmelzverfahrens gegenüber dem Floatglasverfahren ist.

Einige der wichtigsten Marktteilnehmer auf dem Markt für ultradünnes Glas sind Corning Incorporated; AGC Inc.; Nippon Electric Glass Co., Ltd.; SCHOTT AG; Central Glass Co., Ltd.; CSG Holding Co., Ltd.; Emerge Glass; Nippon Sheet Glass Co., Ltd.; Xinyi Glass Holdings Limited; und Luoyang Glass Co., Ltd. Wichtige Marktteilnehmer verfolgen Strategien wie Fusionen und Übernahmen sowie Produkteinführungen, um ihre geografische Präsenz und Kundenbasis zu erweitern.

Markt für ultradünnes Glas

Die Analysten von The Insight Partners haben die regionalen Trends und Faktoren, die den Markt für ultradünnes Glas im Prognosezeitraum beeinflussen, ausführlich erläutert. In diesem Abschnitt werden auch die Marktsegmente und die geografische Verteilung von ultradünnem Glas in Nordamerika, Europa, im asiatisch-pazifischen Raum, im Nahen Osten und Afrika sowie in Süd- und Mittelamerika erörtert.Umfang des Marktberichts über ultradünnes Glas

| Berichtsattribut | Einzelheiten |

|---|---|

| Marktgröße in 2020 | US$ 6.14 Billion |

| Marktgröße nach 2028 | US$ 15.26 Billion |

| Globale CAGR (2020 - 2028) | 11.5% |

| Historische Daten | 2018-2019 |

| Prognosezeitraum | 2021-2028 |

| Abgedeckte Segmente |

By Herstellungsverfahren

|

| Abgedeckte Regionen und Länder |

Nordamerika

|

| Marktführer und wichtige Unternehmensprofile |

|

Dichte der Marktteilnehmer für ultradünnes Glas: Verständnis ihrer Auswirkungen auf die Geschäftsdynamik

Der Markt für ultradünnes Glas wächst rasant. Die steigende Nachfrage der Endverbraucher ist auf Faktoren wie veränderte Verbraucherpräferenzen, technologische Fortschritte und ein stärkeres Bewusstsein für die Produktvorteile zurückzuführen. Mit der steigenden Nachfrage erweitern Unternehmen ihr Angebot, entwickeln Innovationen, um den Bedürfnissen der Verbraucher gerecht zu werden, und nutzen neue Trends, was das Marktwachstum weiter ankurbelt.

- Holen Sie sich die Markt für ultradünnes Glas Übersicht der wichtigsten Akteure

- Progressive Trends in der Ultradünnglasindustrie, um Akteuren bei der Entwicklung effektiver langfristiger Strategien zu helfen

- Geschäftswachstumsstrategien von Unternehmen zur Sicherung des Wachstums in entwickelten und sich entwickelnden Märkten

- Quantitative Analyse des globalen Ultradünnglasmarktes von 2019 bis 2028

- Schätzung der Nachfrage nach Ultradünnglas in verschiedenen Branchen

- Porter-Analyse zur Veranschaulichung der Wirksamkeit von Käufern und Lieferanten, die in der Branche tätig sind, um das Marktwachstum vorherzusagen

- Jüngste Entwicklungen zum Verständnis des Wettbewerbsmarktszenarios und der Nachfrage nach Ultradünnglas

- Markttrends und -aussichten in Verbindung mit Faktoren, die das Wachstum des Ultradünnglasmarktes vorantreiben und hemmen

- Verständnis der Strategien, die das kommerzielle Interesse im Hinblick auf das Wachstum des globalen Ultradünnglasmarktes untermauern, zur Unterstützung des Entscheidungsprozesses

- Größe des Ultradünnglasmarktes an verschiedenen Marktknotenpunkten

- Detaillierte Übersicht und Segmentierung des globalen Markt für ultradünnes Glas sowie seine Branchendynamik

- Marktgröße für ultradünnes Glas in verschiedenen Regionen mit vielversprechenden Wachstumschancen

Markt für ultradünnes Glas nach Herstellungsverfahren

- Float

- Fusion

Markt für ultradünnes Glas nach Anwendung

- Halbleitersubstrat

- Flachbildschirme und Touch-Control-Geräte

- Automobilverglasung

- Sonstige

Markt für ultradünnes Glas nach Endverbrauchsbranche

- Unterhaltungselektronik

- Automobil

- Medizin und Gesundheitswesen

- Sonstige

Firmenprofile

- Corning Incorporated

- AGC Inc.

- Nippon Electric Glass Co., Ltd.

- SCHOTT AG

- Central Glass Co., Ltd.

- CSG Holding Co., Ltd.

- Emerge Glass

- Nippon Sheet Glass Co., Ltd

- Xinyi Glass Holdings Limited

- Luoyang Glass Co., Ltd

- Historische Analyse (2 Jahre), Basisjahr, Prognose (7 Jahre) mit CAGR

- PEST- und SWOT-Analyse

- Marktgröße Wert/Volumen – Global, Regional, Land

- Branchen- und Wettbewerbslandschaft

- Excel-Datensatz

Aktuelle Berichte

Verwandte Berichte

Erfahrungsberichte

Grund zum Kauf

- Fundierte Entscheidungsfindung

- Marktdynamik verstehen

- Wettbewerbsanalyse

- Kundeneinblicke

- Marktprognosen

- Risikominimierung

- Strategische Planung

- Investitionsbegründung

- Identifizierung neuer Märkte

- Verbesserung von Marketingstrategien

- Steigerung der Betriebseffizienz

- Anpassung an regulatorische Trends

Kostenlose Probe anfordern für - Markt für ultradünnes Glas

Kostenlose Probe anfordern für - Markt für ultradünnes Glas